Australia technology: Taking care of business

Investors are quietly leveraging subtle advantages in the Australian enterprise software space to create global leaders. The market will not remain an overlooked goldmine for long

When Australia's Bailador Technology Investments set up shop in 2010, B2B software-as-a-service (SaaS) didn't feature in the firm's mission statement. Now it represents 90% of the portfolio.

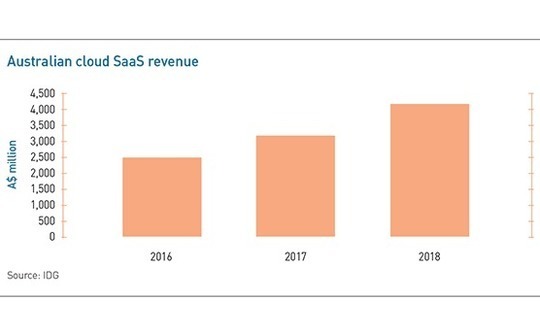

This evolution captures how enterprise services has become Australia's key growth sector in recent years and arguably the only reliable path to achieving scale in technology-focused business models. According to IT researcher IDC Australia, revenue generated by SaaS companies locally grew about 60% between 2016 and 2018 to A$4 billion ($2.6 billion) despite significant lingering tendencies to stick with legacy systems.

The largest company in Bailador's portfolio, hospitality services platform Siteminder, offers a timely case in point following a A$100 million round led by BlackRock last month at a valuation of A$1.1 billion. Siteminder generates A$100 million in annual revenue, up from A$5 million in 2012, but the key point is that 80% of this growth is due to international business. The company has joined a growing class of globally significant Australian SaaS players.

"Compared to 5-10 years ago, there's a much heavier bias toward B2B models, and most of the companies we sit down with have a plan that includes addressing global markets," says Paul Wilson, a co-founder at Bailador. "They're thinking much bigger than they used to think. They've seen the success of some of the big players. They've seen how you can go global. Some remain headquartered here, some have moved to various other parts of the world, and some are hybrids. We've watched this phenomenon develop."

Siteminder reflects the Australian B2B story on a number of levels. It grew an enterprise-facing business model through a consumer-style user adoption strategy, a method pioneered by the country's tech poster child Atlassian. Furthermore, it has done so with a mix of local and international private equity and venture capital funding, including significant later-stage backing from the US. Much of the business is now handled out of a new office in Dallas and plans are increasingly angling toward Asia, but an Australian identity persists.

Familiar territory

The idea that Australia is particularly well placed for globalizing B2B software businesses is connected to its familiarity with the much larger markets of the UK and US in terms of language and business culture. Companies can exploit the advantages of a smaller market such as more accessible public markets and lower competition before making a relatively seamless jump to a larger playing field. US and UK connections are also said to have afforded the country a disproportionately deep talent base for its size.

Moreover, few overseas jurisdictions are as comfortable to US investors from a legal, political, and regulatory perspective. Notable entrants include Accel-KKR, Battery Ventures, TA Associates, and Francisco Partners, which helped crack the market for private equity by investing an early version of accounting services player MYOB in 2004. KKR Australia completed a $2 billion buyout of MYOB last year. VCs typically start with checks of $20 million.

But achieving success in the competitive US landscape is a tall order, even with local support. Xero, a New Zealand-founded competitor of MYOB backed by TCV, for example, has had significant success across Australasia and moderate traction in the UK but a disappointing experience in the US. More generally, Australian B2B forays overseas are likely to be hindered by their strong focus on marketplaces, which, as winner-take-most business models, often entail insurmountable challenges around dislodging local incumbents.

Much of the enthusiasm for B2B plays in terms of international expansion stems from the notion that Australia is too small for consumer models to achieve the necessary critical mass. Large customer bases transacting at small dollar amounts per customer are harder to manage overseas, even with language and cultural advantages. Meanwhile, the fact that Australian companies are relatively dependent on foreign capital is seen as a plus in the sense that it instils global savvy earlier in development.

Going global with B2B has its limits, however, in instances where products have too much of a country-specific regulatory overlay. UK private equity firm HG Capital offers a case in point as a pan-European investor with a strong B2B focus whose portfolio companies are mostly constrained to a single country or a tightly defined subregion. Australian companies showing how to break this mould include Ascender, which has grown from a domestic focus to a footprint of 31 countries in four years by focusing on relatively borderless payroll software.

At the same time, there may be missed opportunities in the rush to go global. For Potentia Capital, a Sydney-based investor in Ascender that is reportedly helping the company prepare a A$500 million IPO, there is plenty of upside in the domestic-facing middle market. The GP, founded by ex-MYOB CEO Tim Reed and former Francisco executive Andrew Gray, estimates there was A$80 billion worth of private sector tech M&A in Australia during 2010-2019, about A$30 billion of which targeted companies with valuations of A$30-300 million.

"We definitely look at overseas expansion if it makes sense, especially in Asia, but that's not the only path to success. Companies like Seek, Realestate.com, and Carsales.com have proven that while you're not going to have trillion-dollar companies like in the US, you can have a great, large business just supplying the local market in Australia," says Gray, who is also executive chairman at Ascender. "If you are looking at international growth, one thing you need to think about is the high level of competition in the US."

Taking it slow

Potentia reached a first close of A$180 million on its debut fund last year and has about A$300 million overall, including earlier co-investments. About half of this has been deployed, with four enterprise software companies backed in the past 12 months. Among them are local leaders in payments infrastructure, mine planning, business compliance, and education. For established, revenue-generating companies such as these – on a slower track than B2B start-ups – there is also the argument that focusing on the home market before branching overseas is a more tactically sound approach.

Seek, the local human resources champion, took this approach, building up a defensible local presence before going cross-border with a measured, almost exclusively inorganic expansion approach. Ronnie Fink, a managing director of corporate development at Seek, notes that this process can be difficult in Asia versus the West due to a relative lack of willingness among businesses to pay for SaaS products. However, macro forces behind a global boom in HR services have created a growth story that cuts across every industry and market.

"There has been a profound shift in the last 30 years from people having jobs for life to the average tenure being around two years, or even less in some markets," Fink explains. "The cost of attracting, retaining, and replacing employees has therefore become enormous, which means culture and engagement are increasingly important areas of investment. As a result, more and more businesses, especially cloud-based services, are coming out with scalable mechanisms to address these problems."

Seek is also an active start-up investor in this space, having backed HR platform Employment Hero and workplace training specialist Go1 alongside a mix of local and international PE and VC investors. Go1 was targeted in part because of its niche strategy, which entails little incumbent competition in foreign markets. Investors will need to consider similar criteria as the segment heats up. AVCJ has records of 11 Australian HR start-ups receiving PE and VC funding in the past two years, led by Culture Amp, which has raised $158 million to date.

"What we look for in SaaS are tools that are used by many employees rather than just small pockets of the organization or HR team," Fink adds. "Solutions that are pervasive and part of people's daily routines such as Slack and other communications devices have the most potential. In sub-categories such as benefits programs, where usage among employees can be very low, systems may be less integrated into an organization, and therefore businesses may not be as attractive in terms of higher churn and lower lifetime value."

Replicable formula?

Most of the deal targeting techniques at play in Australia boil down to dissections of what made the first crop of winners work. The emphasis is therefore on large addressable markets – which is not always as evident in enterprise as consumer – stickiness with users, a high level of intellectual property value, recurring revenue, problem-solving merits, and the bottom-up marketing ploys popularized by Atlassian. This is the model where a product is "bought, not sold" by individual professionals, who recommend it to colleagues.

More specifically, companies in this vein will feature a light sales team approach, a strong focus on digital marketing, search engine optimization, word of mouth, and viral features built into the software. Most of Australia's B2B leaders have used this formula or variations thereof. SafetyCulture, a compliance software provider tipped to be among the next local unicorns, is a standout example, having attracted 12,000 international monthly users in its early days with only an eight-strong team in the far-flung outpost of Townsville, Queensland.

WiseTech Global, an Australia-founded shipping industry software provider which has since relocated its headquarters to the US, has added a novel twist to the concept by opting for a chief growth officer instead of a chief marketing officer. The roughly A$6 billion company, backed by the likes of Fidelity International before listing publicly in Australia in 2017, sees sales as more a matter of incremental growth in the utilization rates of its expanding platform than a transactional, team-driven process of hitting up potential new customers.

Perhaps the highest profile exponent of the bottom-up strategy in recent months is graphic design SaaS player Canva, which raised $85 million in October at a valuation of $3.2 million. The company's latest plans include a pure enterprise product, which will be sold to some extent via a traditional sales team approach, but some 80% of its revenue still comes from individual designer subscriptions. US ambitions have recently come into focus with an investment from Silicon Valley veteran Mary Meeker's Bond Capital.

"I don't think you need to have this dichotomy of consumer-facing and B2B – that's old school thinking and I just don't think the categories are relevant anymore," says Rick Baker, a co-founder at Blackbird Ventures, an investor in Canva, Culture Amp, and SafetyCulture. "Modern companies that are doing really well have learnt to blur that line to their advantage. B2B is a term we don't even use in the office anymore. Everyone here talks about SaaS and the difference between bottom-up selling and enterprise selling."

Blackbird has made enterprise SaaS a core part of its thesis, with about 60% of its portfolio now in the space. At the highest level, this can be taken as a signal that modern software's encroachment into every industry has finally delivered Australia an onramp to the global business-building big time. But investors must also consider the effects of the increase in competition that will follow the renaissance. That means not only bringing more to the table in terms of value-add but knowing how to approach the opportunity in a differentiated way.

"One of the things we look at when we're examining businesses of this type is whether they are a platform that can really play well with lots of other companies within that particular ecosystem and become a central hub," says Bailador's Wilson. "That really enhances the ability for it to get very large, whereas, software that serves a certain niche may have to integrate with a more major platform or even sell to that platform. Those companies can still be lucrative, but I'm not sure you'll see them go on to be multi-billion-dollar leaders."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.