Australia PE spinouts: Into the unknown

Australia has seen plenty of spinouts in recent years, with outcomes ranging from a $2 billion first-time fund to deal-by-deal strategies. Is local LP support essential in getting wider traction?

Call it the 12-year itch. After more than a decade of working for global or pan-regional firms, successful private equity investors are often consumed by the urge to strike out on their own. They are at the peak of their deal-making powers, with the networks to source transactions and the experience to manage them. Why continue answering to a far-flung investment committee and sharing economics with a broad group of colleagues when you can work for yourself?

"Working for one of these firms is a really hard slog as your responsibilities increase and you travel more. People usually only last 10-15 years at a senior level," says one Australia-based manager who spun out from a larger group. "I lost my appetite for it. I wanted to run an Australian business."

Simon Moore and Ben Gray both chose this path in 2015, with Moore vacating his position as The Carlyle Group's country head after a 10-year stint with the firm and Gray starting the clock on his exit from TPG Capital – where he latterly served as co-managing partner for Asia – having spent 14 years in harness. They now run Colinton Capital and BGH Capital, respectively. Brett Sutton recently ended his 15-year career with Affinity Equity Partners and is expected to follow suit.

This is not a purely Australian phenomenon. For example, there have been three high-profile China spinouts in the last four years, leading to the creation of DCP Capital Partners, Centurium Capital, and Nexus Point Capital. The founders previously spent an average of 12 years at KKR, Warburg Pincus, and MBK Partners. Like Moore and Gray, mid-40s tends to be the sweet spot.

Nonetheless, leaving the comforts and infrastructure of an established firm to start from scratch presents multiple challenges, any of which could stop a fundraise before it has started. And in Australia, spinouts are perhaps harder than anywhere else given the importance attached to the support of a local LP base that isn't necessarily keen on private equity.

"There has to be substance to the team, I don't want to see a marriage of convenience between two people who worked together twice on deals when they were associates. If there's more than one person, you need substance. An attributable track record is also important, some evidence that you did deals in your previous shop," says Eric Marchand, a principal and head of Asia Pacific private equity at Unigestion. "Also, because it's Australia, if you don't have local support that would ring alarm bells. It doesn't make sense that the local ecosystem wouldn't back you."

Fits and starts

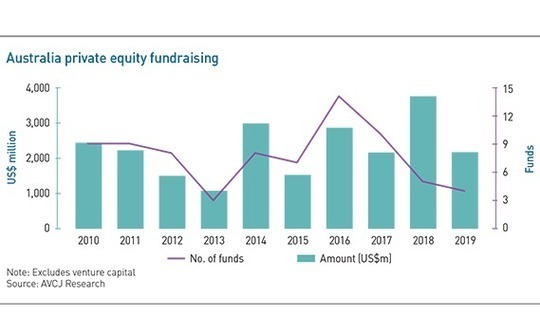

Consolidation within the Australian GP community over the last decade – driven by a combination of internal failures and declining support from local superannuation funds – has prompted various teams to splinter off. While many foreign LPs viewed the changing dynamics as healthy, they worried that these groups would work their way back from deal-by-deal strategies to raise blind pool funds, inflating the market once again. This may prove to be the case, but there is little evidence of it so far.

Should Sutton choose to launch his own firm – there has been no official comment on the matter – few industry participants doubt he would be able to raise money. Comparisons are drawn between his track record and that of Gray at TPG. In Australian terms, though, BGH is an outlier. The firm, established by Gray in conjunction with fellow TPG alumnus Simon Harle and ex-Macquarie Capital executive Robin Bishop, closed its debut fund at A$2.6 billion ($2 billion) in mid-2018. Most of the capital comes from overseas, with AustralianSuper the only significant domestic participant.

Adamantem Capital, established by former Pacific Equity Partners dealmakers Anthony Kerwick and Rob Koczkar, is the next-largest spinout, having raised A$600 million in 2018. Then there's Odyssey Private Equity, set up by several ex-CHAMP Ventures executives, which raised A$275 million in 2017. Potentia Capital, established by Andrew Gray on leaving Archer Capital, and Colinton are both still in the market, having achieved first closes last year.

While she accepts that First State Super has been a first mover in the domestic market, Jenny Newmarch, the superfund's private equity portfolio manager, believes that the increasing willingness of LPs globally to back first-time managers – to the point that in some cases there is no real process, just a first and final close – is catching on in Australia. The more pertinent question is how much capital is available to commit.

"After us and one or two others, it does fall away in terms of check sizes people can write and their ability to be a meaningful cornerstone. That doesn't mean they aren't willing to back first-time funds, just that they might not be able to offer enough fundraising traction," Newmarch says. "However, that is changing. The superfunds I interact with are playing catchup with the market, writing larger checks and increasing their strategic allocations."

Finding a niche

Managers that secure anchor commitments can still take time to raise the outstanding capital. Those that don't get early backing often rely on deal-by-deal fundraising to build momentum. Potentia is said to have warehoused deal-by-deal investments and used them to seed the fund. Colinton continues to team up with institutional players on certain transactions, with AustralianSuper and MLC Private Equity among its collaborators.

Moving into the lower middle market, a host of investors are active on a deal-by-deal basis, securing capital from the high net worth market that tends to be resistant to blind pool funds. Arcadia Capital is a recently established example, having been founded two years ago by Leigh Oliver and Sam Walker, whose resumes include stints at KKR, Carlyle, and Macquarie Group.

The firm, which targets businesses with enterprise valuations of A$20-100 million, likes deal-by-deal appeals because of the flexibility it allows. Oliver recalls watching KKR's special situations team structure investments with downside protection, contracted cash and non-cash returns, and blended IRRs in the low 20% range, while he bid returns down past 20% to stay competitive on billion-dollar buyouts. Operating outside the constraints of an equity fund mandate seemed attractive.

Arcadia relies on an investor base that in many cases has tried to go direct but found the experience challenging and time-consuming. They begin to appreciate the value brought by an independent fund manager, which leads to more passive co-investment strategies and – perhaps – ultimately fund commitments. Asked whether he would raise a blind pool if the opportunity presented itself, Oliver claims to be in two minds.

"If you get to a point where you have a good track record and there is sufficient demand to raise a fund, the idea of taking management fees on committed funds is appealing, but there is also a lot of appeal in the flexibility of deal-by-deal," he says. "I don't know yet is the answer."

Several spinouts have arrived at their current strategies, structures and fund sizes through choice rather than necessity. While Gray always envisaged BGH as a fleet-footed version of TPG, able to compete for A$10 billion buyouts and A$100 million roll-ups, Moore deliberately positioned himself far from Carlyle's space. Adrian McKenzie, previously Australia head at CVC Capital Partners and now leading Five V Capital, raised A$250 million for its third fund through family office channels last year and is said to have little desire to try the institutional market.

Regardless of the motivations, anyone looking to achieve the scale required to attract institutional capital must overcome several key obstacles. First, can you market the fund using your track record from your previous firm? While BGH reached an agreement with TPG – it gave up a small stake in the GP in return for access to Gray and Harle's track record – this is the exception rather than rule. Legal disputes over what can and cannot be used in marketing are rare, but not unprecedented. Even if it is clear which deals an individual worked on, some LPs draw comfort from seeing the full audit trail.

Negotiating separation terms is never easy, not least because it is not in a private equity firm's interests to encourage spinouts. An Australian manager recounts leaving one deal-by-deal shop for another and getting tied up in discussions for six months as they reached a resolution over how to divide up the management fees from existing holdings, based in part on who had brought which investors into transactions. He was unable to look at any new opportunities during this period.

Second, are you willing to make upfront investments in your team and back office capabilities? Deal-by-deal investors can flex up and down in terms of staff according to their needs, but a blind pool fundraise is facilitated when there is a team and infrastructure in place that LPs can conduct due diligence on, rather than offer advice on how a firm should ready itself for institutional capital.

Third, are you able to provide a sizeable GP contribution to the debut fund? Much like investments in the team, a spinout manager is expected to demonstrate commitment to the cause by putting his money where his mouth is. Most have the means to do this to some extent – although, unlike the US, it isn't possible to get a leverage facility against a GP contribution in Australia – and any indication of hesitance could raise concerns.

"In general, we would like first-time managers that have a meaningful share of their fund and a meaningful net worth exposed to the success of the fund," says Newmarch of First State Super. "It is one of the strongest messages when pitching, that you are putting in a lot of money yourself. If 1% is meaningful relative to what the group has generated in the past, that wouldn't take the fund off the table, but we would ask questions as to why they haven't generated more wealth in the past."

Room for negotiation

It remains to be seen whether spinout managers will consistently get traction with local LPs. A longstanding argument over whether private equity is worth its relatively high management expense ratio divided the institutional investor community, with some withdrawing from the asset class while a hard core of supports remained. Steve Byrom, a former head of PE at Future Fund who now runs an institutional advisory firm, notes it would be a shame if smaller managers were unable to rely on local investors, but the structure of the superfund system may count against them.

"There is enough opportunity in the mid-market for people to go and raise funds," he says. "The question is who are their backers, where are they getting the capital from, and what form does it take? Australia is a gatekeeper market and some LPs aren't going to do things unless advised to do them. It can be hard to get gatekeepers to think a spin-out is a good idea."

There is evidence of local GPs seeking compromise solutions to address fee concerns. These include discounts for commitments that are large or come in early, a shift in emphasis from management fees to carried interest, offering more zero-fee co-investment, and opting for smaller funds with shorter investment periods. However, this works to the assumption that superfunds want to back these managers in the first place. Unless accompanied by strong team and a compelling and differentiated story, fee breaks amount to little.

While a lack of local support doesn't kill off a fundraise – many foreign institutional investors understand the dynamics in Australia – there is an abundance of product globally as well as an abundance of capital. Overseas LPs warn that it is difficult to persuade investment committees to reengage with a strategy once there's a sense that it is too risky or time-consuming. In short, don't give people a reason to say no.

"Australian institutions make up 60% of our investor base, and the 40% that are international took a reasonable amount of comfort from the fact that significant Australian investors have supported us," says Anthony Kerwick, a managing director at Adamantem.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.