GP profile: CPE Capital

CHAMP Private Equity became CPE Capital earlier this year, following a leadership transition. The Australian GP has also refined its middle market investment strategy, emphasizing functional expertise

Jeremy Stevenson's tenure as general counsel and head of human resources at Accolade Wines ended in 2016, two years before CHAMP Private Equity sold the Australia-based business to The Carlyle Group. But his ties to private equity were not severed. Stevenson had impressed John Haddock, CHAMP's CEO, during his six years with Accolade. When the GP decided to appoint an in-house legal affairs specialist, he was a logical recruit.

Stevenson was the first of five functional experts brought in by CHAMP as part of efforts to become nimbler in executing investments and more efficient in managing them. They ease the burden on the 14-strong deal team across key areas – the other experts cover capital raising, accounting and finance, data analytics, and commercial due diligence – and allow them to focus on identifying new opportunities and develop investment theses.

"We are trying to make our analysis and decision making better and faster. We also want to enable the deal team to focus on sourcing more deals and not spend all their time on accounting and legal calls," says Haddock. "On any one transaction, there are seven or eight people involved from the outset, not just a couple of deal guys. This has made our process more inclusive, bringing in a wider range of ideas and opinions."

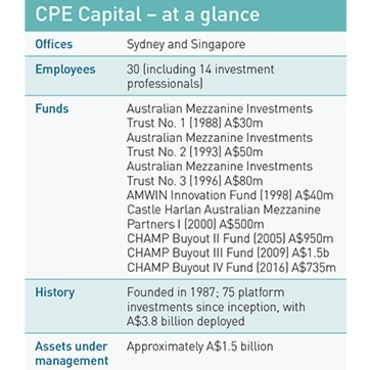

This redistribution of resources is already making an impact. CHAMP claims to have been the most active private equity firm in Australia's middle market over the past 18 months, making six primary investments, three primary disposals, and six bolt-on acquisitions. Its current fund – which closed at A$735 million ($502 million) in 2017 and is now almost fully deployed – has a net IRR of more than 30% and a 0.7x distributions to paid-in (DPI).

While numerous global private equity firms have layered functional expertise on top of their sector coverage, CHAMP's approach is thought to be unique in Australia's middle market. It may turn out to be one of the defining characteristics of the firm's third iteration. Earlier this year, the completion of the transition to CHAMP 3.0 – which included a transfer of ownership to Haddock and his team – was punctuated by a rebranding: CHAMP Private Equity is now known as CPE Capital.

Early start

The firm's first iteration began in 1987 when Bill Ferris and Joe Skrzynski established Australian Mezzanine Investments (AMIL). They raised A$30 million for their debut fund, securing LP commitments from four local superannuation funds, and proceeded to make investments in the A$1.5-4 million range with a staff of three. The strategy ran all the way from early-stage deals to management buyouts, reflecting the nascent state of private equity in Australia.

By the mid-1990s, the industry was gaining momentum with GPs raising funds of up to A$150 million. AMIL then took it to another level by accumulating A$500 million for CHAMP I Trust. This jump in size was partly a product of increased international interest. AMIL had entered its second iteration by forming a joint venture with US-based Castle Harlan, which brought with it access to overseas LPs. A more focused mid-market buyout strategy also emerged.

"We had to convince ourselves and our investors that if we raised a fund of that size then demand for capital would follow. It was a pioneering phase during which we drummed up demand by encouraging intermediaries, consultants and bankers," Ferris said in 2012, for an interview that marked the 25th anniversary of both CHAMP and AVCJ.

When CPE launched its fifth fund in November, Ferris and Skrzynski held no financial or operational interest in the GP, though they remain senior advisors and will participate as LPs. The relationships with Castle Harlan and CHAMP Ventures, a small buyout affiliate now in winddown mode, have also ended. Succession planning in private equity is often fraught with difficulties, and Australia is no exception, but Haddock credits Ferris and Skrzynski for enabling a smooth transition.

"They gave me the support and also the room to drive the investment program and make the key decisions," he observes. "Leadership transitions for all firms are different and they reflect the individual personalities and dynamics. But to make a transition work, you need the founders and the next leadership to want to do it. Bill and Joe realized that if they stepped back in when it was convenient for them it would create challenges. They have been very good in that respect."

At the same time, Haddock acknowledges that it is hard to specify a date when a succession is complete. There were inevitably questions from LPs as to whether he had the necessary attributes to evolve from deal guy into leader, but these can only really be answered by racking up milestones: exiting the founders from all levels of ownership and doing it in an amicable way; refreshing the strategy in increments; raising and deploying a fund and then generating attractive returns.

In the middle

One notable strategic tweak is a step down in fund size. Fund IV launched with a target of A$1 billion before closing at A$735 million. The successor, which is currently being raised, is expected to end up in the A$800-900 million range. CPE will continue to focus on businesses across a variety of sectors with enterprise valuations of A$100-750 million.

"The space we operate, and where we intend to stay, is mid-market for Australian PE," says Cameron Buchanan, a managing director with the firm. "We see ourselves as generalist, opportunistic and flexible. We want to look at all the deals in the market in our size range and then we have a filtering process to come up with three to four new investment opportunities every year."

There are three broad deal types: full buyouts, partnership transactions where the founder is willing to give up control but retains a minority interest, and growth capital arrangements where the ownership is 50-50 and the capital drives expansion rather than going to existing shareholders. The latter two types have become more prominent in recent years. Companies often require investment in their corporate infrastructure, which involves bringing in additional management talent so that the founder is no longer performing multiple roles. Functional expertise is therefore valuable.

"At Accolade, we had a legal team of six at one point. A lot of the companies we acquire now don't have an internal lawyer – they haven't needed one because of their size or because they don't have a large range of legal risks that justify having a lawyer on staff. I often work with the CEO or CFO to help them build out that capability," says Stevenson.

For instance, when CPE acquired Jaybro, a supplier of signage, fencing and other consumables to civil infrastructure and construction contractors, in 2017 there was no in-house legal resource. However, a few regulatory issues emerged, prompting Stevenson to conduct a full legal risk review and help the company hire a lawyer. Another portfolio company was involved in litigation, so Stevenson sat alongside the CEO through that process.

He doesn't serve as a company's internal lawyer, more as a gray hair who offers advice on legal risks without the hourly billing. Stevenson simultaneously works with the deal team on new investments and bolt-on acquisitions, providing guidance wherever there is a touchpoint with the law. Cost savings come through the selection of external law firms, the timing of their appointment, and the specificity of their remit.

First, a top Sydney-based M&A lawyer might not be required for a bolt-on in Western Australia. Second, whoever is hired doesn't need to move until due diligence is completed. Third, setting up scopes correctly, assembling panels of legal and accounting advisors, and standardizing terms cuts down on the amount of time and money devoted to a process. On top of that, in-house legal input can lead to cleaner deal structures, faster turnaround times, and better engagement with vendors.

"We still use external service providers but having that managed by an expert makes a big difference. For example, Jeremy can make sure the scope on a legal due diligence process is right for the company we are looking at," adds Buchanan. "In addition, there have been cases in which certainty and speed of execution were more important to the vendor than price and we have been able to move quickly. This applies to competitive processes and bilateral conversations."

While there are internal lawyers at other Australian private equity firms who touch on elements of transactions, Stevenson believes he is the only one as deeply embedded alongside the investment team. He does not sit on the investment committee, but meetings are widely attended and there are plenty of opportunities to contribute. And not just on legal matters.

"My perspective is welcome on non-legal issues," he explains. "Good decision making comes from a diversity of perspective. The functional team members come at issues and problems from a different perspective and we think that drives better outcomes for our investors because we are making better decisions," he says.

Differentiated deals

The hope is this plurality of views enables CPE to uncover investment opportunities that others do not see. Marand Precision Engineering might be a case in point, with CPE becoming the first Australian private equity firm to attain significant local defense sector exposure when it acquired the company earlier this year. Marand is a global supplier for Lockheed Martin's F-35 Joint Strike Fighter program and has also worked with the likes of BAE Systems and Boeing. It is the anchor asset of defense and aerospace platform that now includes Levett Engineering.

"We could see a strong base of earnings and we wanted to use Marand as a base for a larger Australian advanced manufacturing platform, focused on defense," Buchanan says. "There is broad political and community support towards increased defense spending, and a commitment to having product produced onshore. We started off looking at an individual company, and as we got into it and did the work, we looked at what else we could bring to the table through organic growth opportunities and bolt-on acquisitions."

It is one of three partnership deals in Fund IV, sitting alongside four control buyouts and three growth capital transactions. There are fewer commodities-related investments, with Haddock admitting that the firm has learned lessons from underestimating the cyclicality angle or capital intensity in certain deals. While CPE remains sector agnostic, international exposure is a consistent theme across the portfolio. Three of the Fund IV investees have most of their operations or earnings outside Australia and New Zealand.

It is not a new phenomenon. One in three of all the companies CPE has backed in the past 20 years fit this profile, more than any other domestic GP. There are historical reasons for the high offshore exposure – notably the Castle Harlan connection and opening of a Singapore office in 2008 – but Haddock wants it to remain as much part of the firm's future as it is of its past. For all the benefits that come from 32 years of history, CPE must find ways to stay relevant in an evolving market.

"Nothing has been worked to a great long-term strategy – I'm not sure anyone can set out where they want to be in 10 years given how things are changing so much. You need to know who you are and what the firm is, but you can't stand still," says Haddock. "We are running at a net return of 21% per annum for 32 years. When I look at that history, it helps me focus on managing towards our 40th anniversary."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.