New Frontier Group: Another kind of platform

Led by two former executives with The Blackstone Group in Asia, New Frontier Group has so far looked beyond traditional PE funding channels as it builds large-scale Chinese healthcare platforms

Before the end of the year, shareholders in New Frontier Corporation (NFC) – a US-listed special purpose acquisition company (SPAC) – will be asked to vote on the $1.3 billion purchase of one of China's leading private hospital operators. Investors including TPG Capital and Boyu Capital are set to make full exits at nearly three times the valuation of the business when it was privatized in 2014, but the most eye-catching participant in the deal is arguably New Frontier Group (NFG).

The company – which is NFC's parent – has risen from a Hong Kong logistics start-up incubator to operator of what is intended to be one of China's largest listed integrated healthcare services companies in the space of three years. Moreover, this has been achieved in a private market context, but without a reliance on typical private equity fundraising channels.

"We never intended NFG to be an investment firm, although that is effectively what we've ended up doing," says Carl Wu, CEO and co-founder of NFG. "When we first started, it was structured as an operating company and the original model was to be a company builder. We raised private capital from investors to create and build companies. And when we started Boxful, we had no idea we would be building a healthcare platform."

Boxful was Wu's first entrepreneurial project after nearly a decade with The Blackstone Group. He launched the self-storage and logistics services business with serial entrepreneur Norman Cheung. They went on to become two of the three co-founders of NFG alongside Antony Leung, group chairman and CEO of Nan Fung Group, who previously served as chairman of Greater China at Blackstone and before that as financial secretary of Hong Kong.

Internet to healthcare

Wu compares NFG to a large private SPAC in that it has raised funding from high net worth individuals and family offices as working capital to support expansion. Unlike a PE fund, there are no assets under management, no drawdowns, and no management fees. It is a balance sheet business. Boxful raised three rounds of funding, diluting the founders from 100% to 55% because the balance sheet was small in the early years.

As Boxful grew, became financially sustainable and entered markets beyond Hong Kong, the NFG team started looking at other platform-based concepts. They settled on online-to-offline local services and established HelloToby, a Hong Kong and Taiwan-based equivalent to China's Meituan-Dianping and 58 Daojia. Having helped consumers connect with beauticians, teachers, handymen, and personal trainers, home healthcare was a logical next step.

"We were taking all these services into the home, so why not do it for healthcare as well? We decided to do it in Shanghai as well as Hong Kong because the market is bigger," Wu explains. "It was more of an internet project, but as we built out the business, we realized that with healthcare you can't just be an internet company – you can do hospitals, clinics, and other things."

YD Care started off as a home healthcare provider and then became an operator of senior care facilities. From there, NFG expanded horizontally, opening rehabilitation clinics for the elderly and pediatric segments and training centers for healthcare professionals. Core healthcare services followed, including a licensed doctor group, a precision medicine business, oncology centers, and hospitals that focus on acute conditions. The company's healthcare operations now span 10 cities, with seven hospitals, 40 outpatient centers, more than 3,000 licensed beds, and 1,800 employees.

The hospital asset NFC plans to buy, United Family Healthcare (UFH), was one of several assets considered by the SPAC. These structures cannot be set up with predetermined targets; rather, they typically have 24 months to complete an acquisition under a broad remit. The sponsor receives 20% of the shares once a SPAC lists, but they only hold value if there is an acquisition. The sponsor must also underwrite all the listing, deal sourcing and execution costs.

However, UFH represented a good fit with NFG's existing healthcare portfolio, bringing additional scale and brand equity to its core segment coverage. While negotiations were ongoing, NFG also acquired a facility in Shenzhen from China Resources Group that it plans to turn into a general hospital. This will become part of the UFH business – wrapped into the NFC platform alongside other core healthcare assets.

UFH, which was set up more than 20 years ago, has 700 licensed beds across six hospitals – with two more under construction – and 14 clinics. Revenue is set to reach RMB2.5 billion ($355 million) in 2019. TPG and Fosun Pharma took ownership of the business through a $461 million privatization in 2014. They worked alongside Roberta Lipson, the founder and CEO of UFH, who will retain her position under NFG.

"We've reached a critical mass in terms of brand, footprint and maturity of the management team. We've at an inflection point where I can see that acceleration in growth becoming a reality. We are extending our hub-and-spoke model in tier-one and tier-1.5 cities where we already have a presence and targeting some new geographies. We are also offering more in-depth services," Lipson says.

Evolving landscape

UFH has evolved in step with China's broader private healthcare industry. Initially known as the Beijing-based maternity hospital of choice for expatriates and Chinese families taking their first step into private healthcare, the company has broadened its scope of services and geographical footprint as local demand has burgeoned. Lipson notes that it's not unusual for UFH to cater to four generations of the same family.

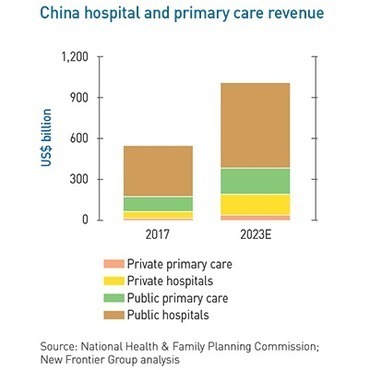

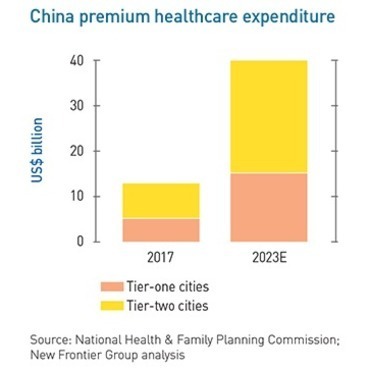

Hospital and primary care services revenue in China is expected to reach $1 trillion in 2023, up from $544 billion in 2017, with the private sector share growing from 12% to 19%, according to NFG. Meanwhile, premium healthcare expenditure – by expatriates, locally insured patients, and out-of-pocket spending by affluent households – is set to rise from $13 billion to $40 billion. These growth projections have attracted a lot of PE capital into the space, which may help UFH's M&A ambitions.

"M&A could be part of the process, but it doesn't have to be," Wu observes. "Many private equity-owned assets may not have the same IPO story as us and we can capitalize on that. We are on the lookout for potential acquisitions that are synergistic and accretive to our overall strategy.

"There are people who were real estate and when that went out of style, they got into healthcare, but they didn't realize that running a hospital is not just building a building. There are some potential targets of that nature or maybe groups that are struggling due to lack of scale and we can help because we have the brand and the supporting infrastructure," Lipson says.

While TPG and Boyu are making full exits, Fosun and UFH management, including Lipson, will roll over a portion of their equity. The proceeds from NFC's IPO were $478 million and there is $300 million in debt funding. UFC has also secured $711 million in equity commitments from third-party investors and will contribute $90 million in cash from its trust account. This will leave $180 million on NFC's balance sheet.

The third-party investors include Nan Fung Group, Vivo Capital, Yunqi Capital, Morgan Stanley Investment Management, Juno Capital Management, Agricultural Bank of China International, and China Cinda Asset Management. Property developers such as Shimao Group, Hysan Group and Shui On Group and entrepreneurs like Jason Jiang of Focus Media and Thomas Lau of Sogo owner Lifestyle International Holdings are also involved.

The list includes hedge funds, which are classic SPAC investors. Each unit in a SPAC offering typically comprises one ordinary share and one warrant. Hedge funds like the structure because they can stay invested if they like the target company or they can redeem once a business combination happens, recovering their principal plus interest and some upside on the warrants. They are usually replaced by long-only mutual funds. However, NFC claims its investor base is more strategic.

"When we first started, it was high net worth individuals, then family offices, and then more strategic investors such as conglomerates. With the SPAC, our investor base will become a lot more diverse – affiliates of big technology companies in China, large family offices, real estate companies, professional investment firms, financial institutions and asset management companies, as well as hedge funds and mutual funds," says Wu. "It is not the typical LP base. Having said that, it could change. We are generally open-minded and flexible."

Difficult to define?

NFG's website describes the firm as owner and manager of a "strategically diverse but thematically focused asset portfolio," that relies on a variety of vehicles across PE, credit, real assets, and fund-of-funds. New economy is the broad focus, and this has taken it into healthcare, internet services, artificial intelligence, big data, education, and financial services. NFG has a series of internal – and undisclosed – valuations for assets that contribute to an overall net asset value.

Asked if the firm has a five-year growth plan, Wu demurs, saying the business is more a combination of its original entrepreneurial spirit and a long-term secular view on investment opportunities. When NFG entered the healthcare space, he didn't expect to have a portfolio of post-acute specialist hospitals with 3,000 beds within two years. And there's an acknowledgment that the firm could look very different two years from now, given its willingness to "take risks and build things."

The platform approach is not unlike those pursued by traditional PE firms, whereby they build up assets and domain expertise in a certain segment and then it is the platform rather than the fund that makes bolt-on acquisitions. At the same time, Wu believes NFG holds an advantage over private equity through the flexibility and permanency of its funding structures – although it remains to be seen whether the firm can consistently raise capital at the same scale.

NFG's flexibility is partly manifested in the breadth of investment structures it can accommodate, from equity to debt to real assets. The firm regards its acquisition from China Resources as a real estate rather than a healthcare deal, because there was no existing hospital on site. In addition, NFG is under no obligation to make investments every year, it is more like opportunistic M&A, and it maintains a lean team. A handful of people are employed at the holding company level, with greater emphasis placed on hiring within the different operating entities.

Permanent capital is also becoming more prevalent in mainstream private equity, and while NFG's structures differ from the norm, the motivations are much the same: being able to hold assets that require significant development for longer than the typical four or five-year span.

"We started our business with permanent capital – there are liquidity events, but people subscribe to our shares and essentially these are permanent capital vehicles. Then we did a SPAC, which accommodates investors who want to participate in the short term as well as those who are willing to hold for a long time," Wu says. "Healthcare is not a short-term business. With home health, you go through at least two years of painful growth followed by a period of stabilization. These companies are profitable now, but we aren't quite there yet."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.