PE & QSR: Dining disrupted

With ubiquitous delivery services, ordering apps that learn user preferences, and intelligent inventory management, technology is changing China’s restaurant industry. Operators are in a race to stay relevant

Luckin Coffee is on course to become China's largest coffee shop chain. Founded in early 2018, the company had 2,963 outlets as of June, most of them small-scale premises designed for collection of orders made via app. The goal is to reach 4,500 by the end of the year, supplanting Starbucks as number one by number of cups sold and number of stores.

Rapid expansion comes at significant cost. Revenue came to RMB909.1 million ($132 million) in the second quarter, up from RMB551.8 million for the previous three months; operating expenses rose from RMB1 billion to RMB1.6 billion. However, costs at a percentage of revenue dropped, the continuation of a trend the company attributes to increased economies of scale and technology-driven operations.

Technology drives the Luckin business model in several respects. First, the company's mobile app covers the entire purchase process, creating a cashier-less environment. Second, the app enables continuous customer engagement. Luckin tracks who they are, what they buy and where they come from, and can turn this knowledge into targeted marketing efforts that reduce customer acquisition costs. Third, technology delivers backend efficiencies through better inventory and staff management.

To some, Luckin represents a transformative force in new retail and a case study in how food and beverage operators can leverage data analytics and artificial intelligence (AI) to boost their bottom line. To others, technology simply adds gloss to an unsustainable narrative.

"Luckin's technology story? I buy one-quarter of that," says Chris Tay, an experienced food and beverage operator in China who now leads consumer-focused LTCV Investments Holdings. "AI is still a story in F&B. You can use technology to deliver more targeted marketing, but this isn't new. KFC and McDonald's can do the same thing. Where is the proprietary technology? Everyone uses the Amazon story to justify their business model and explain why they aren't profit-making."

Age of aggregators

However, technology is, without doubt, transforming fast dining. No operator of scale can exist without an app, a digital marketing strategy, and some kind of order-tracking system – the question is how do they interact with the plethora of third-party logistics providers that have democratized the industry, making it as easy for small-scale players to reach consumers as it is for international brands.

Martin Mok, a partner at EQT, identifies digitization as one of the most important considerations for master franchisors, alongside the arrangement with the brand owner, recruiting a team that can execute a store rollout, and achieving consistency on food quality. EQT owns China F&B Group, holder of the franchise rights to Dairy Queen and Papa John's Pizza in eastern, central and southern China.

"We used to have our own call center and distribution teams, but now we rely on external aggregator platforms. You must be able to leverage those channels, while streamlining your in-house resources," Mok explains. "You need digital DNA in the management team, so they know how to cooperate and promote on aggregator platforms, whether that's buying rankings, location-based preferences, or limited time offers. Advertising on these platforms doesn't always recoup the investment cost, so you must be selective, knowing the demand elasticity curve in each location."

Meituan completed 2.1 billion food delivery orders during the three months ended June, generating RMB12.8 billion in revenue. Across all segments, the platform boasts 422 million transacting users and 5.9 million merchants. Alibaba's local services business boasts 245 million users and revenue for the second quarter was RMB6.8 billion. Both companies continue to subsidize drivers and diners as they battle for market share, but they are an integral part of the new normal for restaurant operators.

Meituan and Ele.me do not share individual user data with customers; rather, they provide aggregated numbers to facilitate targeted advertising on their platforms. Restaurant operators take orders, collect user data, and run loyalty programs through their own apps, offering customer insights on the front-end even if they rely on Meituan and Ele.me to handle deliveries. When CITIC Capital, CITIC Group and The Carlyle Group became the master franchisor for McDonald's in China and Hong Kong in 2017, the business was trailing on both fronts.

"Before we came in, they had started working with Meituan and Ele.me and we helped to bring in a WeChat mini-app," says D.J. Luo, a managing director at CITIC Capital. "We encouraged McDonald's to work closely with Tencent, which is a shareholder in CITIC Capital, and it took no more than three months to launch the app. We now have more than 100 million users, and it's a channel we control."

Playing catchup

McDonald's was playing catchup with Yum Brands – owner of KFC and Pizza Hut – which had spun out its China business into a separate listed entity 12 months earlier. As of September, the KFC and Pizza Hut loyalty programs had 200 million and 65 million members, respectively. The McDonald's membership is nearly 100 million.

The scale of Yum's loyalty program is the result of an aggressive pursuit of digital and delivery strategies. Nearly half of all orders were placed via app in 2018 – a super app that covers everything from pre-ordering to e-gifting – 86% were settled through digital payment, and program members were responsible for 47% of overall sales. Delivery accounts for 20% of sales, although the volume of delivery sales has grown 3x in the last four years.

There is still a huge amount of white space to be tapped. McDonald's processes 1.3 billion transactions a year and knows very little about most of those customers, who are predominantly walk-ins. Most industry participants agree that the depth of data on individual customers is thin.

Even if Luckin has yet to fully realize the technology-enabled model that it champions, AI appears to be the future through personalized menus and special offers, intelligent sales forecasting and store management, and dynamic delivery routing. What remains to be seen is to what extent brand equity is driven by technology – helping operators provide a higher level of service – or disrupted by it.

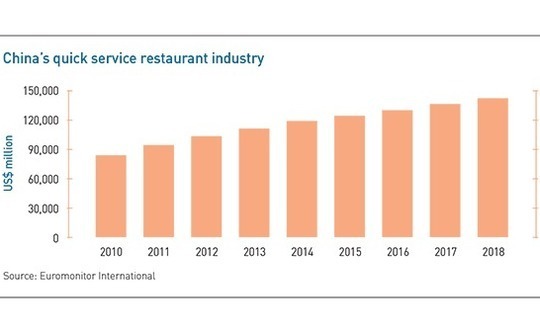

Mobile ordering and delivery have led to an increase in dining options as restaurant chains with few consumer-facing storefronts, or perhaps none whatsoever, can build a broader customer base. While delivery is becoming more prevalent, it still makes up a relatively small percentage of the overall quick-service restaurant (QSR) industry. On top of that, concerns over food safety in China push consumers towards recognized brands. But independent dark kitchens are gaining traction – and in some cases VC backing – across the region.

"Ubiquitous home delivery of any kind of food you want, made in dark kitchens located anywhere, perhaps to the same quality standards and delivered faster than you can deliver it, that's a real game-changer for the industry," says Nick Bloy, a managing partner at Navis Capital Partners, which has past and existing exposure to QSR chains. "We haven't seen the full impact of home delivery on QSR and casual dining. The economics of yesterday do not predict the economics of tomorrow."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.