3Q analysis: Exit angst

Unrest plays havoc with Hong Kong liquidity events as Asia exits stumble; one large renminbi fund does not represent a panacea; consumer products come to the fore as investment stabilizes

1) Exits: The waiting game

The Executive Center (TEC) is one of the more obvious private equity casualties of unrest in Hong Kong. Ten of the company's 130 serviced office premises region-wide are based in the territory, but it accounts for 30% of EBITDA. Even though local business is said to have been robust in July and August, PE owners HPEF Capital Partners and CVC Capital Partners suspended the sale process in mid-September.

For others, look no further than the Hong Kong Stock Exchange. Spurred by listing reforms that opened the door to Chinese technology offerings, there were 11 private equity-backed IPOs between July and September of 2018, followed by seven, four and eight, respectively, in the subsequent three quarters. The four in the first quarter were among the six largest offerings in the region for that period, including the top two.

The $5.4 billion in proceeds from four IPOs with financial sponsors during July-September 2019 is more than the three previous quarters combined, yet weakness still lurks behind the headline number. Budweiser Brewing, the Asian division of unit of beer giant AB InBev, took the spoils, raising $4.9 billion. However, it only counts as PE thanks to GIC Private's pre-IPO investment and the total is about half what the company sought before aborting the process in July.

Budweiser continues a trend of large offerings failing to gain traction in Hong Kong, following the postponement of logistics player ESR's IPO in June. This came shortly after the Hong Kong protests – which were triggered by now-withdrawn extradition legislation but have grown to encompass a variety of grievances – grew in scale. It is no coincidence that the eight PE-backed IPOs in the second quarter priced in May or early June.

Budweiser was responsible for over half of the $9.2 billion raised through IPOs over the past three months – exclude it from consideration and the total is lower than for the previous quarter, although the number of offerings surpassed 40 for the first time this year.

China's technology innovation board, known as the Star Market, made the difference. A total of 25 companies were chosen to make what turned out to be a volatile debut in late July, posting an average gain of 140% on the first day of trading before falling back the next day. According to AVCJ Research's records, approximately 10 PE or VC-backed businesses now trade on the exchange. It is intended to be start-up friendly with a streamlined approvals system, approval for weighted voting rights, and an acceptance of pre-profit businesses, though high financial benchmarks must be met.

Hong Kong's travails were partly to blame as the Hang Seng Index became the worst performer of Asia's major market indices in the third quarter, losing 8.6% in value. Most others flatlined, contributing to an abysmal period for block trades and sell-downs by financial sponsors. The $88 million raised is the lowest quarterly total in seven years.

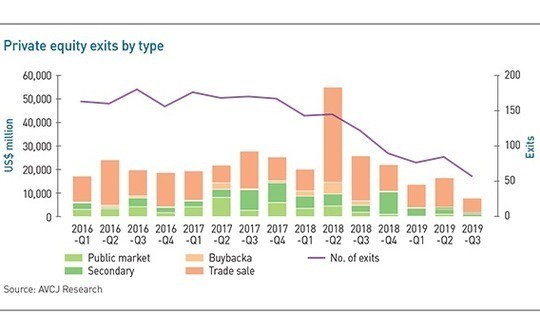

The picture was equally bleak for overall exits, which came in at $7.8 billion, also a seven-year low. There were around 60 transactions – down from more than 80, and proceeds of $16.4 billion, in the preceding three-month period. The number of public market sales fell by more than half, but the real damage was done by the drop off in trade sales: $6.2 billion from around 40 transactions, compared to averages of $16 billion and 68 over the previous eight quarters.

Only three trade sales surpassed $500 million, led by KKR's $2.2 billion exit of Kokusai Electric, a semiconductor-focused thin-film manufacturing business acquired from Hitachi 18 months earlier.

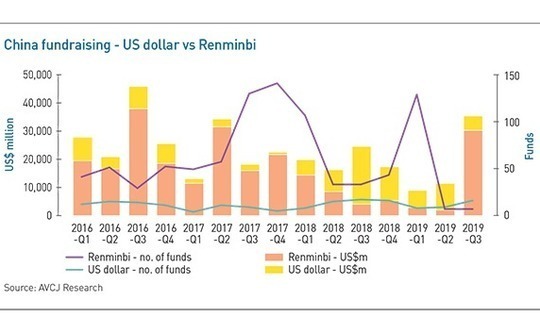

Beware the false promise of a single renminbi-denominated fund. Commitments to local currency vehicles have been sluggish ever since the Chinese government curbed participation in the space by financial institutions in April of last year. A nadir came in the second quarter of 2019 when a mere seven funds achieved incremental or final closes to raise $2 billion. The market hadn't been so low since it was effectively shuttered by regulatory fiat in 2013.

What a difference three months makes. Just over $30 billion surged into renminbi funds between July and September, more than the previous five quarters combined. This propelled region-wide fundraising to $41.2 billion, a marked improvement on the $16 billion accumulated during the previous three months.

But there was no change in the number of closes by renminbi vehicles – still a desultory seven – and therein lies the problem. A total of RMB200 billion ($29.1 billion) went into the second iteration of the National Integrated Circuit (IC) Industry Investment Fund, which is managed by state-controlled Sino IC Capital. This does not signal a fundraising revival, more promulgation of government policy.

Nor should the IC Fund be confused with the guidance funds launched by assorted municipal and provincial authorities to stimulate inbound investment. It exists to drive a central government agenda, backing IC chip designers and manufacturers as well as upstream suppliers of equipment and materials and downstream packagers. China imported $312 billion worth of ICs in 2018 – more than any other product type in value terms – but Beijing wants domestic sources to fulfill 40% of demand by 2020 and 70% by 2025.

The IC Fund – the first iteration of which closed at RMB140 billion in 2014 – is supposed to help turn this dream into reality. Government agencies, state-owned enterprises and the odd private partner may continue pumping in money until it does. Few renminbi funds have this much strategic impetus.

Remove the IC Fund from consideration and the Asia fundraising total falls back to $12.1 billion. Exclude the second-largest close from the period as well, India's National Investment & Infrastructure Fund, which also has strong government ties, and it sinks to $7.6 billion. The number of incremental and final closes was just 65 – the figure could rise in due course should evidence of previously undisclosed activity emerge – down from approximately 90 in the second quarter. The average for the eight quarters before that is 200.

CITIC Capital raised the most money among independent managers, closing its latest China buyout fund at $2.8 billion. However, the story of the quarter is arguably spin-outs. Xiang He Capital, Joy Capital, XVC, and Sky9 Capital, each one founded within the last three years by executives who established themselves in China with other GPs or strategic players, achieved final closes on VC funds. A91 Partners and Avataar Venture Partners did the same in India.

Between 2011 and 2014, technology was Asia's most active sector for private equity investment in five out of 16 quarters. Since the start of 2015, it has led the way in 15 out of 19 quarters. A large-scale transportation or infrastructure deal is usually required to upend what has become the natural order. The July-September period was no different – technology has come top for 10 quarters in a row – but there was some change in the lower ranks.

Consumer products and services claimed a place in the top two for the first time in a decade; the $3.5 billion deployed has never been bettered on a quarterly basis. This underlines the relative scarcity of consumer brands in Asia that are both valuable and accessible to private equity. There is usually a reasonable number of deals – 35 per quarter over the past two years – but they tend to be small scale.

Indeed, two larger transactions, both spinouts from multinationals, accounted for the 90% of the sector total. KKR secured Australian biscuit brand Arnott's as part of a portfolio of Asian assets from US-listed Campbell Soup for $2.2 billion. This was followed by GIC Private's $1 billion investment in the Asian division of brewing giant AB InBev ahead of its IPO.

These were two out of six $1 billion-dollar-plus transactions in the third quarter as PE investment in the region came to $32.5 billion. While activity has yet to recover from the blip triggered by public market uncertainty towards the end of 2018, it appears to be moving in the right direction. The $29.8 billion total for the second quarter was the lowest in over four years.

It is notable that Chinese technology transactions accounted for just four of the 25 largest announced during the past three months. This is half the total in each of the two previous quarters. AVCJ Research has records of just three investments of $300 million or more in what might be described as a return to pre-2018 levels. The overall amount deployed in the space – across VC and growth strategies – was $5.1 billion, down from $5.4 billion the previous three months. The quarterly average for 2018 was around $14 billion.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.