Women in VC: Crashing the gates

VC firms are increasingly serious about identifying and elevating prospective female talent, but the industry’s culture has a long way to go before women can feel truly valued and contribute their best work

When a serial entrepreneur with years of technology and marketing experience and a string of successful exits from Asian technology companies joins a start-up board, they don't usually expect the founder to second-guess their expertise, let alone their personal lives. But Jennifer Cheng, a co-founder of NewChic Capital, has learned that such situations are distressingly common for female investors.

One confrontation with a male entrepreneur stands out for as particularly shocking – the founder not only disrespected Cheng's business advice but openly questioned her judgment about her own medical needs.

"I told him I needed to go to a doctor's appointment quite urgently, because I was having a high-risk pregnancy. He said, ‘Well, I'm sure it's not as important as what we're doing now,'" Cheng recalls. "And I replied, ‘No, it's more important than what you're doing, and I don't want to be involved with your company if you don't realize that. My well-being and my baby's life are much more important than whatever round you're trying to close.'"

This incident is an extreme case, but it demonstrates the constant headwinds that women can face when trying to build a career in the traditionally male-dominated world of venture capital. Circumstances are improving for female investment professionals as VC leaders increasingly recognize the value provided by a wider range of voices, but without sustained commitments by all stakeholders, women will continue to struggle to prove they deserve a place in a hostile world.

A common refrain among female investment professionals is a feeling of isolation: being caught in an industry made by and for men, with little understanding of the talents that women can bring to a team, or allowance for when their needs differ from those of the men at the firm.

Among the few

These reports are not surprising given female representation in the senior ranks of PE and VC firms is much lower than in most other industries. According to the International Finance Corporation (IFC), women accounted for just 10% of leadership roles at GPs in developed markets last year, compared to 11% in emerging markets. Two-thirds of emerging market firms had all-male senior investment teams; only 15% were gender-balanced, defined as women constituting 30-70% of the team.

This disparity has real consequences for female entrepreneurs: businesses led by women accounted for just 8% of PE and VC deals in emerging markets last year and 7% of capital invested. Moreover, the median funding received by female-led companies was significantly lower than among those headed by men.

Industry participants see a direct connection between the scarcity of women in leadership roles and women entrepreneurs' difficulty receiving funding. Old-fashioned sexism can play a role here: Luo Mingxiong, the founder of Beijing-based early stage firm Jingbei Investment, gave a speech just two years ago in which he said the GP does not invest in companies headed by female CEOs because "what else do women do better than men except give birth?" But a more common case is when investors decide to pass on a deal because they lack the experience to see the need the company is filling.

"When I was an entrepreneur, it seemed like 99% of the investment teams that I pitched to were all male," says Carman Chan, who founded and exited three early education-focused technology start-ups before launching Hong Kong-based Click Ventures in 2015. "But when we tried to explain the concept behind the business, these investors couldn't fully understand it, because when it comes to raising younger kids, men are usually not as involved as women."

This kind of soft bias can be extremely frustrating for women entrepreneurs. While active discrimination can be argued against, it is much harder to explain to male investors that their views of the world are incorrect, or at least incomplete. As a result, start-ups solving problems faced by men are often viewed as having universal appeal. By contrast, almost every female investor has stories of start-ups targeting women's issues that were seen as niche opportunities and overlooked for investment, contributing to the invisibility of female entrepreneurs in the market.

In defense of the status quo, one might argue that the job of a VC firm is not to pursue social benefits like female empowerment, but to secure a return on investment for LPs. While this view may be true in isolation, expanding views of corporate social responsibility may lead to increasing pressure on GPs to step up their efforts to promote positive change in the world.

"You're seeing a rise in people moving away from the doctrine that the sole purpose of a business is to get your shareholders an increase on investment," says Erika Cheung, co-founder of Hong Kong-based accelerator Betatron. "People are increasingly saying that we work in a world that's far more dynamic than that – we can't just focus on ROI [return on investment], because this has consequences for the lives that people lead, for the environment, and for society as a whole."

Money matters

Beyond the altruistic value of increasing female representation, there are clear benefits to such a strategy from a business perspective. According to the IFC study, emerging market VC funds with gender-balanced leadership teams achieved a median IRR of 15%, outperforming male or female-dominated funds by more than 4.5% and beating median emerging market venture capital returns by 3.9%.

Even the most conservative of investors must take note of such a glaring performance gap, and industry participants expect more firms to respond by increasing the number of women in leadership positions. This could accelerate a trend already underway in the VC world, as GPs reevaluate their policies toward inclusion following accusations of sexual harassment against 500 Startups founder Dave McClure, as well as Ellen Pao's lawsuit against Kleiner Perkins alleging a hostile work environment.

"There's been a huge focus, starting in California, on venture capital and the lack of women, both on the allocation of capital side as well as among the recipients of capital," says Shruti Chandrasekhar, head of IFC's office of gender parity for venture capital and private equity. "And we've seen a lot of effort across the industry; even very old world, all white, all male venture capital firms in California have added female partners over the last few years."

In some cases, the desire to tap previously unnoticed opportunities has led investors to totally rethink the investment process. Village Capital, a US-based early stage investor, has developed a peer-selection model over the past 10 years in which the firm selects a cohort of 10 to 12 start-ups each year and has the founders evaluate each other's businesses across a range of metrics. The top two companies receive seed investments of $50,000-100,000 from Village and its co-investors.

Village's founders specifically created this model as a way to overcome their own biases, and requirements for gender and ethnic diversity are built into the process – at least 40% of every cohort must be companies founded by women, for example. This requirement has naturally led to a diverse investment team as well, since the team selects each year's participants.

Village has touted the success of its model not just in building a diverse portfolio, but also in identifying potential high performing start-ups, particularly among female-led companies. Its peers have taken note as well, with other GPs increasingly participating in the seed rounds and sometimes asking to invest in the finalists for a year before the cohort has even been selected.

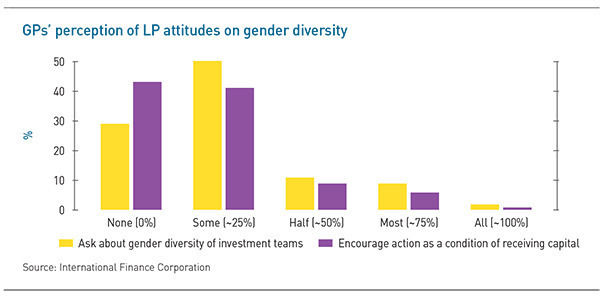

While this kind of firm-level effort can help to move the needle, industry participants say concerted action from LPs would be a real game-changer. It has yet to emerge, to the disappointment of some fund managers. "It's a bit surprising to me that LPs haven't been more vocal about insisting on diversity at the partner level in venture firms, because it's a better business decision," says Allie Burns, CEO of Village. "Obviously it also needs to come from the most senior people in venture themselves, but I think you'd probably see results change pretty quickly if LPs were pushing for it."

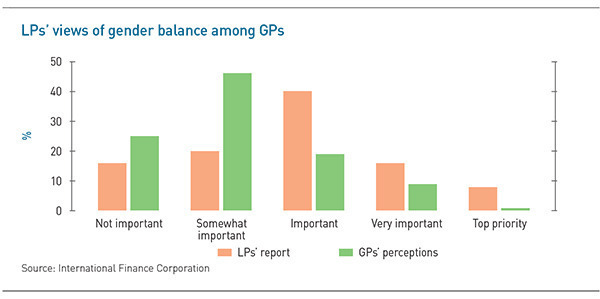

LPs might be surprised to hear that they aren't pushing for representation at venture firms, because in their view they have been: 64% of LPs reported last year that they viewed gender balance as important, very important, or a top priority, according to IFC. But the perception among GPs is significantly different: more than 70% of firms reported that their LPs viewed gender balance as either not important or somewhat important and the vast majority said that less than a quarter of their LPs had encouraged them to improve their gender representation.

This disconnect suggests either that LPs could improve their messaging around gender balance, or that they don't actually value this topic as highly as they think they do. Even without clear conditions, investment professionals believe the representation of women in VC is likely to increase in coming years, due to the growing awareness of the benefits brought by diversity.

Unconscious bias

Some friction is bound to accompany this growth, and female VC professionals will still have to fight against longstanding assumptions about women's roles in the family and the workplace.

"As women we have to explain ourselves more. My single friends have to explain what they will do when they find a boyfriend and need to make time for family," says NewChic's Cheng. "Nobody asks my husband who's taking care of the kids when he's on a business trip. It's like asking someone who makes breakfast in the mornings – of course you take care of your family, and you find time to do self-care."

Women in VC must also confront the impression that they are subordinate to others, even as a founder or partner of a firm. Cheng says that entrepreneurs often assume she has to pass investment decisions to a male colleague. On occasion, founders have asked if her husband needs to approve a deal, though NewChic's first fund consists entirely of the money she earned from her previous start-up exits.

Women trying to work their way up in traditional firms may face the additional challenge of proving that they are committed to their careers and to their employers in a way that is often taken for granted among men. These extra stumbling blocks are a major factor in keeping women from rising to the position where their talents would seem to suit them.

"There can be some hesitation, especially in East Asian countries where women are expected to place more importance on their family life and face questions about how they will be able to balance their life and work in a more demanding leadership position," says Rosalind Tan, a vice president at Singapore-based Expara Ventures. "Women may unconsciously fear taking the next step in their careers, especially if they feel like they are inferior to their male counterparts."

A silver lining identified by some industry participants is that, in running this gauntlet, women can demonstrate their ability to face a formidable challenge without flinching. This should serve them well in their professional lives – particularly if they can gain allies among those who have gone before.

"It's so difficult in our industry to elevate female voices, so if a female makes it to a certain level, they have to have received a lot of training," says Click Ventures' Chan. "Because they need to try much harder to get heard, they need to be more resilient than their male peers. I sometimes find that the female junior employees I hire work much harder than men."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.