Macro and diversity: All hands on deck

As women participate in economies across Asia in larger numbers, investors must consider how this impacts their target markets. Gender-balanced portfolios will no longer be a nice-to-have

Reshaping the global economy by gradually balancing power between traditional haves and have-nots is a concept that investors in Asia understand well. Now, the region's unprecedented macro rise is increasingly recognized as a trend juxtaposed against an even greater socioeconomic shift.

It is difficult to exaggerate the scope of the opportunity. Half of the population in every market anywhere has been systematically marginalized from the workforce since the beginning of recorded history. As the social and business norms responsible for this imbalance are corrected in the years to come, the investment industry – and indeed entire countries – will either catch the tailwinds of the zeitgeist or become uncompetitive.

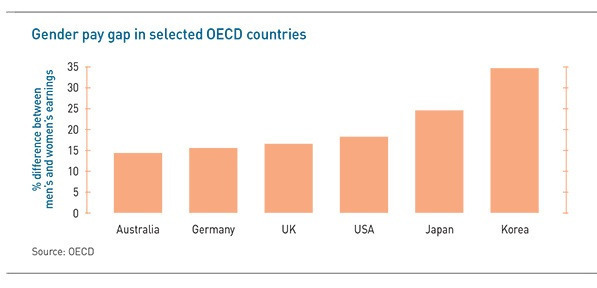

About 7.5% of annual global GDP, or $6 trillion, is lost due to gender discrimination issues such as unequal pay and access to the business world, according to the Organization for Economic & Development (OECD). Asia suffers from the most serious pay gaps among advanced economies, with women in Korea and Japan respectively earning 35% and 25% less than local men.

The Asian Development Bank has found that women in the region are 70% less likely to be in the workforce versus women in the West, and that closing the gender gap could generate a 30% increase in per-capita incomes on average. Most of the relevant countries are graphed as dumbbell-shaped economies, with powerful conglomerates at the top, masses of mom-and-pop operators at the bottom, and relatively negligible girth in the growth-critical small to medium-sized enterprise (SME) sector.

Men and women are already filling this SME space, but it's an informal part of the economy with little access to traditional forms of collateral or the necessary infrastructure to scale up. Women-led businesses are at a heightened disadvantage because of poorer access to finance, including risk and growth capital. But the macro upside tied to evening this playing field benefits from a virtuous cycle: economically empowered women produce better educated children, reinforcing long-term GDP growth.

Private market investors can play an important role in delivering this upside by prioritizing gender equality. As with environmental, social and governance (ESG) protocols, the policy will come to be recognized not only as an ethics consideration but also as industry best practice. Reporting on specific gender issues will likewise be a means of driving efficiency rather than a drain on resources.

Consumption power

Perhaps the most concrete argument for championing female participation is the changing nature of consumer markets. As income levels tick higher, women are expected to control 75% of discretionary spending globally by 2028 compared to about 55% today, according to EY. This is particularly relevant to fast-growing regions like Asia as well as sectors where understanding the customer base is a strategic imperative.

"A lot of people see gender issues as all about being nice and fair, but it comes down to hard economic facts. It's really money we're leaving on the table and a way to drive growth," says Julie Teigland, a managing partner at EY who heads the firm's global gender equality platform. "If you want to have businesses that are close to your consumers, you better have enough women in there because they're the ones who will hold the spending power in the future. Don't do it just because it's the right thing to do – do it because it makes economic sense."

Unlike ESG, there will be more cultural baggage to deal with. For example, 97% of venture funding is channeled into start-ups led by men, according to research by US-based Babson College, which focuses on entrepreneurship education. This figure points to a relative lack of women as potential investment targets, but the severity of the imbalance suggests there also remains a sexist perception that men are inherently less risky as first-time entrepreneurs than women.

Much of the issue here is that women are underrepresented in the investment industry itself, which leads to mainstream fund managers being insufficiently oriented to women-related themes. Specialization is seen as private equity's way of getting things jumpstarted, but traction has been minimal to date. The Wharton School at the University of Pennsylvania estimated that total fundraising for gender-lens strategies amounted to only $2.2 billion globally as of end-2018, and that this sum was overwhelmingly composed of early-stage, first-time venture funds.

So far, LPs showing the most interest are still those that have traditionally prioritized ESG and economy-building at the national level, including the likes of the International Finance Corporation. But even emerging market investors such as US-headquartered private equity firm SEAF have struggled to get support for women-focused platforms from their usual development finance backers.

SEAF is targeting this space with a generalist yet gender-conscious fund seeking $100 million, as well as a strictly women-only vehicle backed by the Australian government that aims to invest up to six start-ups in Southeast Asia. The firm classifies 75 of its roughly 400 impact investments to date as part of its women's economic empowerment agenda, including four deals closed under the Southeast Asian fund.

"One of the biggest questions for LPs looking at this space is whether there is enough [deal] pipeline," says Jennifer Buckley, a senior managing director at SEAF and head of its Women's Opportunity Fund. "As a discussion point, it's on everyone's radar, but the money isn't moving. They want to do it, but on the other hand, it means backing first-time managers, which they don't want to do. We need to get these first-time managers off the ground and ensure they're successful. The Fund IIs will be different story."

In addition to track records, second vintages will bring data, the key ingredient to illuminating a correlation between gender diversity and better performance. This suggests that the countdown to achieving real momentum will be measured in fund horizon timeframes. But there is reason to believe an acceleration of the process is underway.

Going mainstream

Industry participants have unanimously told AVCJ that the level of awareness is either at or nearing critical mass. Basic expressions such as "women-led" that were not part of industry lexicon in the recent past have now migrated from think-tanks to the commercial sphere. As a result, demand for gender-based investment strategy is growing outside the traditional impact space.

Goldman Sachs has recently clarified this point through Launch with GS, a $500 million program dedicated to investing women-led companies and fund managers, with a focus on later-stage growth equity. More than $100 million in balance sheet capital has been deployed so far, with a Chinese pediatrics business among the Asia-based recipients.

"In our first year, we have heard from over 5,000 entrepreneurs, investors, non-profits and thought-leaders interested in being involved," says Jemma Wolfe, a vice president at Goldman who leads Launch with GS. "It's clear that we've struck a chord with the community, and the response has been very encouraging."

Asia is expected to be a driving force in the process of shifting sentiment, although it remains behind the curve in a number of key metrics. Most fundamentally, this is because the region's relative frontier status – including less cemented private equity and venture capital cultures – is seen as a springboard for more progressive policies. The idea is further supported by observations that the least developed economies are likely to be among the most active in gender-lens investment.

SEAF's Buckley notes that Southeast Asia, despite having some of the shortest track records in the region, is seeing some of the most progress globally. Although this is partly attributable to enthusiastic support from Australia, local imperatives to scramble economic resources cannot be discounted. Historically isolated Myanmar offers a poignant case in point with grassroots initiatives such as the Professional Women's Network and the Myanmar Women Entrepreneurs Association.

"In the past few years, we've seen ESG become mainstream. You can't ignore it now – you have to be accountable," says Josephine Price, co-founder of Myanmar-based Anthem Asia. "I think gender diversity will become mainstream in the same way, but it's going to take a long time because the money has to ask for it. Eventually, LPs are going to demand diversity statistics, and managers across the industry are going to have to explain why they have no women in their portfolios."

Anthem Asia reached a first close of $34.5 million on its debut fund last year with support from development banks that cited interest in the gender-lens approach. Investments to date include Thalun International School, which was founded by two women who also happen to run one of the largest advertising agencies in the country. But in Myanmar, as in Asia as a whole, social conservatism is expected to remain a significant impediment.

"There are a number of hidden things that you don't see unless you're on the ground," says Price. "There may not be a law controlling women, but it's still a very paternalistic society, which makes it harder for women to operate and raise money. A women entrepreneur may not get support from her father while her brother would. She can't easily meet up with the guys and brainstorm ideas. It's a bit like the US in the 1950s."

China advantage

China is seen as an early mover in this regard, especially in venture capital. Despite concerns about sexism, there is an underlying sense of practicality that has precipitated global leadership in some areas of women-focused investing. Government data suggest as much as 55% of internet companies in the country could be founded by women, a claim that has attracted some skepticism but is likely rooted in at least some significant traction on the issue. In the US, by contrast, only 12% of VC funding was estimated to go toward start-ups with at least one female founder last year

Virginia Tan, founder of Teja Ventures, a Beijing-based firm that focuses on women-led businesses and leveraging women as a demographic, explains this offset as a case of some investors recognizing a growing market while others do not.

"What I'm seeing in the West, because VC is so male dominated, certain types of ideas like mother-and-baby marketplaces or other types of consumption geared toward women are being ignored," Tan says, acknowledging exceptions such as US women's consumer goods player Honest, which has raised $500 million. "What I see in China is that the best founders, male or female, are going to get funded because the market opportunity is so huge. VC is a much less entrenched industry than in the West, so things are more open."

This is where LP concerns around pipeline tend to resurface, however. Women are at a disadvantage when starting new-economy businesses because they tend to have less tech-oriented educations and backgrounds, which in turn makes it difficult to assemble attractive teams. The notion that digital education will increasingly be viewed as a fundamental human right may lead to some reversal on this issue, but all expectations are that the process will play out slowly.

More immediately relevant to investors is the idea that tech is often an area plagued by talent shortages, which leaves less room for discrimination where skills are available. Meanwhile, online business models have proven effective in expanding options for traditionally denied female workforces by creating more flexibility around job locations and hours.

Examples of success on this front include DoctHERS, a telemedicine start-up founded by three women doctors in Pakistan who wanted to circumvent local cultural norms that could have prevented them from working outside the home after marriage. The company has received backing from the likes of Gray Matters Capital and Development Innovation Ventures, a unit of the US Agency for International Development (USAID).

"While South Asia has far to go toward achieving gender equality, it has made the most rapid progress on closing its gender gap of any world region over the past decade," says a USAID spokesperson, flagging a number of in-house initiatives to address the issue. "Investors can improve women's empowerment through both women-targeted funds, as well as generalist funds that employ one or more gender lenses. We believe that investors would see higher returns by using multiple and broader lenses throughout their processes."

Counterintuitive bets

Naturally, what constitutes gender-smart investing will depend on jurisdiction, but perhaps less intuitively, the effort could be more of an uphill climb in developed markets. Japan, for example, saw women's employment reach 50% for the first time in five decades last year as a local labor shortage began to bite. By comparison, 80% of Vietnamese women are employed. Teikoku Databank estimates women represented a dismal 7.8% of Japan's corporate presidents in 2018, a weak improvement on 5.5% in 1998.

The situation implies that Japan-focused investors have less opportunity to build gender-balanced portfolios, even if they formalize the strategy. Statistically, this difficult to refute, but it does open the door for best-practice improvements in male-dominated portfolio companies. As a result, private equity firms such as Tokyo-based Phronesis Partners have begun tackling gender imbalance like a back-office operational fix.

"We see opportunities in the companies that have not achieved diversity yet because they have potential to grow more by empowering women – or anyone who has been undervalued in the old working culture," says Yoko Sugita, a partner at Phronesis. "Bringing more diversity to the workplace can be a part of value-add strategies, by introducing talented female professionals and helping companies to create a good work environment."

Company-level improvements may do little to change the macro picture around gender equality in calculable terms, but it will enhance results, which will in turn trigger the ultimate deciding factor of increased awareness. If gender-balanced portfolio construction proves to be successful, it will lead to much-needed policy changes both in the private and public domains, regardless of geography.

In addition to measures to close the funding gap for women-founded and women-led businesses, these changes will have to address cultural barriers to women in advanced technologies, perhaps through digital literacy initiatives targeting both the current and future workforces

At the same time, regulatory requirements may be needed to ensure that women-led businesses are receiving a certain minimum of public supply chain spending. EY's Teigland says this figure could meaningfully start as low as 10%.

"Asia has a huge opportunity to act aggressively on this," says Teigland. "The economies are growing faster in Asia, so it might not be the thing the region wants to tackle first, to be honest. But the more they can ensure they are gender-balanced, the closer companies will be to their customer bases. That will lead not only to more successful businesses, but also to broader economic growth."

SIDEBAR: Performance review

Even after the numbers are all added up, some things still don't make sense. Investors needn't look far for statistical demonstrations that gender diversity produces results at the firm, portfolio, and company level. But the pattern recognition powers of even the most seasoned veterans in the industry have failed to connect the dots.

Companies said to be in the top-quartile for gender diversity on executive teams were 21% more likely to achieve above-average profits, according to McKinsey & Company. Meanwhile, the International Finance Corporation has found that gender-balanced portfolio companies grow in valuation 5.5% more per year than less diversified peers.

"The evidence is clear that gender equality is crucial for achieving sustainable development and also a power driver of financial returns," says Jennifer Chien, an associate director at Impact Investment Exchange (IIX). "Yet women and women-focused small to medium-sized enterprises continue to be excluded from markets due to entrenched structural barriers that fail to recognize the value of women."

IIX is hoping to change this narrative through projects like its IIX Growth Fund, which is targeting $25 million for equity investments in South and Southeast Asia that follow a broad interpretation of the gender-lens remit. This includes investing in women entrepreneurs but also initiatives that benefit underserved women or those trapped in subsistence living.

Deal targeting therefore often leans toward high-impact or financial inclusion-oriented enterprises such as businesses that improve women's access to sustainable agriculture or clean energy. However, these priorities belie a far more comprehensive opportunity set, including sectors where women are already prevalent in the workforce and therefore more likely to benefit.

In the case of developing Asia, education, healthcare, and most segments related to the food industry fit this profile, as do services that address the unmet needs of working women, often childcare. The essential step here is to recognize women simultaneously as an undervalued source of talent, a layered demographic that presents varying opportunities and challenges across markets, and a resource for better connecting with an increasingly female-controlled consumer economy.

At more granular levels, gender-lens investing encompasses myriad mother-and-baby categories and women-focused niches of existing models. For example, growing demand for women-only ride-hailing apps due to issues such as harassment by drivers has coincided with trends around increased discretionary spending among women. Early movers include Australia's Shebah, Pakistan's SheKab, Indonesia's LadyJek, and India's Taxshe.

As interest in the gender-lens approach increases, Asia will face challenges related to a relative lack of region-specific data on the correlation between diversity and performance. But this is also where PE investors in the region may play their most critical role. In private portfolios, active shareholders are better positioned to ask for reporting on a wider range of disclosures while working with companies on using data to develop diversity-related improvement plans.

Public companies restricted by regulatory issues and broader ownership structures may have a difficult time benefiting from this type of access. If owners of private companies and the underlying management are open to having data shared with researchers on an aggregated and uniform basis, it could result in significant improvements to the quality of analysis – and thereby accelerate the adoption of gender-lens methodologies.

"We must dive deeper into local ecosystems to discover how women experience barriers along their journey to empowerment, to enable more stakeholders to participate in the transformation of gender norms, and to activate opportunities for women to achieve economic and social independence," says Chien. "In order to concretely tie investment dollars to advancements in gender equality in diverse contexts – from Japan to India – it is important to conduct assessments that can contextualize the impact being generated."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.