US-India cross-border: Taking the leap

US-India cross-border deals present a tempting opportunity for Indian GPs, but managing investments in another market requires careful use of resources and a level of commitment that not all firms can match

When ChrysCapital acquired a majority stake in California-based GeBBS Healthcare Services last year, it represented a rare move. While the Indian GP had backed a handful of US companies in the past, GeBBS, a provider of enterprise software for the healthcare sector, is one of only two such companies currently in its portfolio.

But where others see outliers, ChrysCapital sees an established pattern. For some industries, the firm feels, the question of an Indian or a US base has become a distinction without a difference.

"If I were to white label these companies, didn't tell you where they were headquartered and just shared the financials, you wouldn't be able to tell me which company is based in India and which is based in the US," says Gaurav Ahuja, a managing director at ChrysCapital. "The businesses they are running are exactly the same: they're selling to US customers and delivering out of India."

The growing synergy between the US and India has prompted ChrysCapital and a number of its peers in the Indian PE and venture capital landscape to deepen their engagement with America. However, opinions vary widely on the optimal approach, which is seen as a function both of a firm's size and its sector focus. GPs looking to increase their exposure must ensure that strategies play to their strengths.

For many Indian managers, the question of what constitutes a US investment can be tricky. In some sectors it is increasingly common for companies to have a split identity – operating an official headquarters in the US while maintaining most of their operations in India.

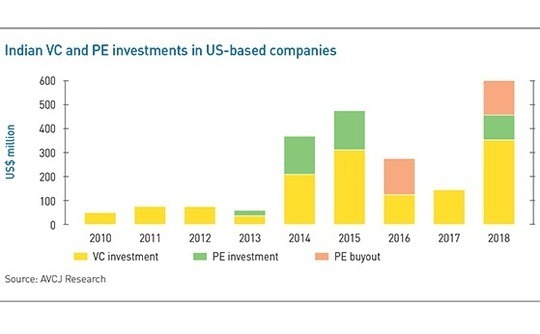

Many of the 164 investments by Indian GPs in US companies recorded by AVCJ Research from 2010-2018 fit this profile. Among the exceptions is Everstone Group's 2016 acquisition of customer relationship management solutions provider CustomerContactChannels (C3), the only US-founded company currently backed by the firm.

"This scenario has played out for the last couple of decades – you have IT services businesses based in India and Silicon Valley, or Indian companies targeting the generic pharmaceuticals market in the US," says Sanjay Gujral, COO at Everstone. "We are not trying to recreate anything; our approach is about finding businesses where we can add incremental value beyond what they are currently doing."

ChrysCapital is one of Everstone's few peers to pursue buyouts of US-based companies. It too prefers to stick to what it knows – companies developing software aimed at US-based enterprise customers. Its first US investment was in Ephinay, a finance and accounting BPO start-up headquartered in North Carolina to which it committed $10 million in 2003. But the firm sees its 2015 investment in digital engagement services provider LiquidHub as the real start of its US strategy that led to the acquisitions of GeBBS and IT consulting firm Infogain.

"At that time the question was, what is our edge in dealing with a US-based management team? Are we going to be able to connect with and influence the team, and how do we maintain the balance between the US and India?" says ChrysCapital's Ahuja. "We learned through the LiquidHub experience that it's possible to do that, and once we did it successfully with LiquidHub we realized that there are a lot of companies with similar potential that we can target as well."

Investing in US-based companies can be financially attractive as well, providing opportunities for leveraged financing and dividend recaps that are not available in India. Portfolio companies with revenues in US dollars can also insulate a portfolio from rupee depreciation and local economic cycles.

Buyout to venture

While ChrysCapital and Everstone recognize the opportunity presented by US companies, in practice both firms' exposure to the market remains limited, with just three current investments between them. This still puts them in the lead among Indian growth capital and buyout-focused GPs, the majority of which have no US exposure; Tata Capital, PremjiInvest, and Aion have made just a handful of growth equity commitments to US companies since 2010.

The dynamic is somewhat more active on the VC side, which has accounted for the majority of deals in every year since 2010 and the greatest share of the capital committed in every year except 2016, the year of the C3 transaction. IT and artificial intelligence companies dominate this field, reflecting both the number of Silicon Valley businesses founded by Indian entrepreneurs and the growing phenomenon of India-based start-ups relocating to the US.

The latter group is well-represented in the portfolio of Iron Pillar Capital Management, a VC firm that has backed several Indian start-ups that went on to establish a US presence, including customer management software developer Servify and pharmaceutical developer Vyome Therapeutics. Iron Pillar expects to see a wave of Indian companies that can compete with and beat rivals from developed markets.

"Vyome is not getting ready for an IPO next year because its making medicines cheaper – its going for an IPO because it invented the first antibiotic for acne in the last 50 years, which no US company has been able to achieve," says Anand Prasanna, co-founder of Iron Pillar. "There's real innovation coming out of these companies."

VCs targeting this kind of opportunity may find themselves pulled into greater involvement in the US market to support entrepreneurs facing a major geographic transition with little experience. By their nature, companies developing products for enterprise customers will need even more support in such situations than those appealing directly to consumers.

"If a consumer-focused company has raised $100 million then you could argue that you don't have to handhold them, because that capital is going to go a long way," says Sanjay Nath, a managing partner at Blume Ventures. "With enterprise, you have to help with business development, introductions, and partnerships."

Both Blume and Iron Pillar have established a significant presence in the US – Iron Pillar opened an office in Silicon Valley where co-founder Mohanjit Jolly is based, while Blume operates Arka Venture Labs, a partnership with two US venture firms targeting US-based companies with an India connection. They are also members of the Draper Venture Network (DVN), providing their portfolio companies access to a global network for collaboration and support.

This willingness to participate on the ground in the US is unusual among India's homegrown VC investors. While most GPs acknowledge the market opportunity, the majority lack the resources to operate in multiple markets at once. Only those that cannot drive value any other way can justify the ongoing expense.

"VC is still a very local business, and it will continue to be. I think that for Indian VC firms to have senior people sitting in the US wouldn't be an optimal use of people's time," says Manish Kheterpal, a managing partner at Waterbridge Ventures. "At the end of the day, if the teams or founders are situated in India, that's where investors should be as well."

A local office

Everstone is also an outlier in this regard among Indian growth and buyout investors, having established a New York office last year. Though the focus of the US team is investor relations, one of its objectives is finding targets for cross-border investments. Suresh Vaswani, a recently hired senior director and former executive at Wipro, Dell, and IBM, is expected to drive such deals as he splits his time between the US and India.

By contrast, many of Everstone's peers, like their VC counterparts, see a full-time US office as a drain on resources that is hard to justify. Everstone can support a US presence because its multiple strategies offer meaningful scale, but other investors must ration their time more carefully. ChrysCapital, for example, sees the Infogain and GeBBS management teams when they visit their India branches, and it visits the US regularly for board meetings, when it can also examine potential investees.

This model of engagement may be enough for firms with limited US exposure, though it could also reinforce those limitations by making it harder to source deals. However, firms that have made cross-border investments a key part of their thesis will be better served committing themselves fully – and may find launching a new office easier than they expected.

"When we decided to come to the US, we didn't have to build anything from scratch. I could readily hire a partner in Silicon Valley who is from India and understands the US market," says Iron Pillar's Prasanna. "There are enough India-origin people in the top US firms that I think more and more of these partners will end up joining Indian GPs or starting their own firms."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.