Greater Bay Area: Promise keepers

The Greater Bay Area initiative plans to speed up regional integration in the Pearl River Delta, with Hong Kong set to be a major beneficiary. Questions remain about the government’s ability to follow through

Ever since the return of Hong Kong and Macau to China, residents of these regions have primarily seen the pledge of "one country, two systems" in political terms. But the slogan is as much an economic promise as a legal framework: that the two former colonies can leverage their history, global positioning and privileged status within the parent country to deliver economic benefits to all three that could never be achieved separately.

Putting this aspiration into practice is one of the primary goals of the Guangdong-Hong Kong-Macau Greater Bay Area (GBA), an initiative 10 years in gestation that aims to weld the disparate systems of the cities in the Pearl River Delta into an economic powerhouse. The enterprise took a major step earlier this year with the release of the first outline development plan by China's State Council, spelling out a vision for the region and the role of each of its core cities.

Investors have responded to the development plan with enthusiasm, particularly with regards to the role of Hong Kong, where the financial sector is seen as central to the broader region's success. While questions remain about practical aspects of implementation – and there are concerns in some quarters about the underlying political motivations – investment professionals say the government's commitment to development is a sign that the region still holds great promise.

"There is no guarantee, but even before the GBA initiative was announced, this was the fastest-growing economic region in China," says William Shen, CEO of CRE Alliance, a joint venture between China Resources Enterprise and Great Wall Asset Management. "I'm not betting on GBA because of this new initiative. My feeling is that this has always been the land of opportunity in China, and with this policy it can be even better."

Strategically significant

The GBA – a region that includes Hong Kong, Macau, Shenzhen, Guangzhou, and seven other cities but not, as one might expect, a bay – has been a vital player in China's economy for decades. With a total land area of just 56,000 square kilometers, it is smaller than both the Yangtze River Delta and the so-called JJJ district of Beijing, Tianjin, and Hebei. Yet the GBA's economic output of $27 million per square kilometer far outstrips the other two areas.

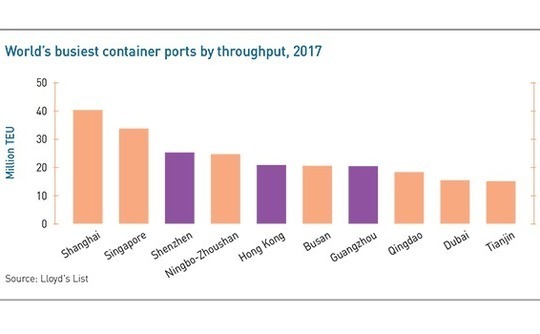

The region is also a window to the broader world. According to maritime research firm Lloyd's List, the GBA is home to three of the world's 10 busiest container ports – Hong Kong, Shenzhen, and Guangzhou – handling nearly 70 million 20-foot equivalent units (TEU) in 2017. If considered as a single port the region would have handled over 50% more cargo than Shanghai, the world's leading port that year.

"Hong Kong has undergone massive integration with the Chinese economy, such as the relocation of factories in the 1980s and the implementation of the Closer Economic Partnership Arrangement (CEPA) since 2003," says Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis. "The difference is that the concept of the Greater Bay Area exists in a universe of global digitization and higher technological production ability than the past."

Initially proposed in 2009, the GBA was intended to provide a blueprint for the region and its jumble of jurisdictions to work together for the benefit of all, but details remained scarce on how this was to be accomplished. The outline development plan goes some way toward addressing questions about implementation.

As outlined by the region's municipal governments, the GBA comprises four core cities: Shenzhen, Guangzhou, Hong Kong, and Macau. Each has a function within the larger cluster – Shenzhen leads the nation in technology and innovation, Guangzhou is a manufacturing giant and export hub, and Macau provides both a global tourist center and a useful link to the Portuguese-speaking world.

Massive investments in infrastructure, such as the recently completed Hong Kong-Zhuhai-Macau Bridge, are planned to help the cities realize their potential. Hong Kong, as a well-established financial hub with an independent legal and regulatory system, is seen as the ideal avenue for attracting foreign capital for this and the central government's other ambitious investment projects.

"One of the clear objectives of the project is the connectivity of GBA to international markets, and particularly enabling the One Belt One Road strategy," says Stanley Lah, China M&A transaction services leader at Deloitte. "With all the development, there's going to be a lot of investments going into the GBA, and Hong Kong is obviously the place to be for foreign investors hoping to get into this region."

Private equity is expected to see significant benefits as the initiative accelerates existing growth trends driven by an increasingly prosperous middle class. CRE's Shen identifies education as a key investment area, due to the region's lack of public schools, along with consumer products with a regional focus.

"There are a lot of regional milk players, but I wouldn't feel comfortable buying into the story of them going national or being in a position to challenge Mengniu or Yili," he adds, naming China's two largest dairy providers. "But there are other verticals within dairy that are growing, such as yogurt, and because of the refrigeration issue many of these businesses are regional."

Technology paradise?

Despite the importance of finance in the development plan, Hong Kong's role is not limited to the region's bank. The goal is to build a technology and innovation ecosystem on par with San Francisco Bay and Tokyo Bay Area, and Hong Kong has a part to play here as well: the development outline calls for increased investment in the territory's early-stage tech ecosystem, as well as support for its R&D centers and integration of Hong Kong into the national innovation system.

Building technology hubs by government fiat has a spotty history in China and globally, but VC investors in the region say Hong Kong's high-quality educational system and global exposure provides a strong foundation for the development plans. "GBA is a very top-down approach, but that's really about the physical connectivity," says David Chang, a managing partner at Hong Kong's MindWorks Ventures. "Now with the infrastructure, information and cultural flow will be better."

Chang co-founded MindWorks in 2013 with the express purpose of leveraging GBA's impact on technology. He says the idea that infrastructural connectivity will precipitate the required cultural momentum is already being demonstrated. In 2018, this traction included Hong Kong overtaking the US as the largest IPO market globally. More recently, the territory has become a magnet for regional entrepreneurs eager to avoid issues related to US-China tensions by lowering their mainland profiles.

"We're seeing a huge upturn – even within our portfolio companies – of founders moving headquarters outside of China but still within flying distance of their regional offices," Chang says. "Last year, when the trade war kicked off, we saw a trickle setting up in Hong Kong. In the last 3-4 months, it's been a boom."

According to InvestHK, the number of start-ups in Hong Kong increased 146% during the four years to 2018 to 2,625, and the number of "workstation" facilities for start-ups climbed 387% during the five years to 2018 to 79. As accelerator and incubator ecosystems continue to mature around GBA, they are expected to contribute to the cultural ingredients of innovation.

Other GBA policies required to deepen the talent pool will include measures that make regional boundaries more porous as well as tax relief and rental subsidies for technologists. Market-driven proof-cases that inspire entrepreneurs will also be necessary, however, especially in parts of the region with shallower reputations for technology.

Hong Kong's most direct path for laying such groundwork is probably financial technology, which has already produced at least one homegrown unicorn in WeLab. TNG Fintech is said to be approaching a $1 billion valuation, while Australia-founded fintech player AirWallex – already a unicorn – has relocated to the city.

"We are definitely seeing a very particular move on the fintech side, and it's not just financial services per se, it incorporates so many other areas," says Jayne Chan, head of InvestHK's start-up ecosystem unit Startmeup, adding that Hong Kong fintech companies targeting GBA tend to see more opportunities in B2B than B2C. "There's a convergence. Even when we're talking about hardware, there's often a fintech component now."

WeLab is a clear example of Hong Kong's fintech potential. It is one of eight recipients of a local virtual banking license, which allows financial institutions to operate branchless savings and loan businesses. K.C. Chan, the chairman of WeLab Virtual Bank and Hong Kong's former financial services secretary, recently told a Hong Kong Venture Capital & Private Equity Association forum that Hong Kong can be a base for sophisticated finance veterans experimenting with different approaches to technology.

"People say Hong Kong is behind the mainland on fintech, which is not disputed. But fintech is not just about payments – fintech should be about bringing innovation to financial services and making financial services accessible to consumers," Chan said.

Other segments set to thrive under GBA include artificial intelligence, internet-of-things and related hardware, health tech, smart manufacturing, and logistics. As existing sub-regional specializations in these industries intensify, a value chain that geographically contextualizes the lifespan of a company is also expected to emerge.

"Hong Kong can focus on the earlier stage of the innovation process while Shenzhen – where entrepreneurs know their market and are good at commercializing research outcomes – can take care of the latter stages," says Lap Man, co-founder of Beyond Ventures, a Hong Kong-based firm that invests exclusively in local tech start-ups.

For investors that cast a broader net, GBA is less about internal efficiencies and more about expanded deal flow and growth options. Click Ventures, for example, a Hong Kong VC that invests globally, sees the concept largely as a new expansion market for its portfolio. This view contends that issues around talent immigration, currency and tax policy have never been hands-down deal-breakers in the region, but as they are streamlined, an operational theater of global significance will take shape.

Cautious optimism

Although the GBA presents tantalizing opportunities, enthusiasm should be tempered with caution. The long-term success will depend in large part on the government's ability to deliver, and investors point to a checkered history. Some Chinese development projects have performed beyond all expectations. Others, like the Qianhai economic zone that was meant to enable freer travel of renminbi between Hong Kong and the mainland, have fizzled.

"The pilot zones are good for experimenting with different systems, but they haven't been very effective in challenging the existing system so far," says Natixis' Garcia Herrero. "For example, Qianhai has a pilot program to adopt some of Hong Kong's legal procedures, but it can't replace the confidence in the rule of law in Hong Kong."

Garcia Herrero also warns that the GBA development is not happening in a vacuum. With China-US trade tensions looming, US policymakers could decide that Hong Kong's integration with the broader region represents a danger to their interests. This is not a theoretical concern. A US government commission warned last year that Beijing's "encroachments" on Hong Kong's political system could provide grounds to reassess the territory's status as a separate customs area from the mainland.

For the investment community, the biggest question is whether the commitment for such a major undertaking can be sustained. The GBA initiative is the work of multiple governments, and a change in administration at any level could destroy the relationships that will be needed to maintain forward momentum. However, industry observers believe the participants understand the importance of the current economic shift and are committed to staying the course.

"Even 10 years ago the state was still the majority of the Chinese economy; today the private sector is taking over," says Frankie Fang, co-founder and managing partner of Starquest Capital. "What is actually driving the economy right now, from an application perspective, is the new business models devised by people brought up in the 1990s, and the government is determined to support that. So I believe that this initiative is very much real."

SIDEBAR: VC - Transition curve

If the Greater Bay Area (GBA) plan succeeds in blurring the boundaries that separate southern China's special administrative regions from the mainland, it could spark a major start-up migration. The thinking here is that many mainland entrepreneurs are stifled by the digital monopolies created by the likes of Alibaba Group and Tencent Holdings and looking for somewhere to grow their ideas.

Enthusiasm around the trend could lead to company valuations spiking in certain instances, but the general expectation is that the process of ecosystem creation in a context of increased cross-border activity will generate sufficient competition to keep the froth in check. The question remains, however, where the best entries will emerge and what will be the best strategy to address them.

"If you're a VC, you want to invest in a company that has the greatest market potential, and in Hong Kong, fintech and logistics are the two areas where you have the best market outlook," says Hugh Chow, CEO at ASTRI, a Hong Kong-based innovation agency. "There are many emerging industries beyond fintech and logistics where VC investors can explore success."

ASTRI, the Applied Science & Technology Research Institute, is tasked with enhancing Hong Kong's competitiveness in technology and has participated directly in GBA strategy through an advisory committee focused on the semiconductor industry. It sees GBA less as a Silicon Valley-style project and more as comprehensive market creation. Not only are industries being strengthened through technology and administrative integration, so are the targeted consumer bases.

Chow, who founded a VC firm in Canada called Pool Global Partners, cites Hong Kong's strengths in intellectual property protection, rule of law, proximity to manufacturing hubs, top-ranked universities, and direct access to both mainland and overseas markets as its core advantages. The catch is that those supports have been around a long time. For GBA to break new ground, it will have to make good on its promise to find new roads to commercialization.

"GBA works in both the supply and demand sides of the market, so you get huge B2B and B2C opportunities, just by the sheer size and population of the area," Chow says. "That's really the key strength of GBA, even before you factor in any of the government support. If we can fully mechanize our potential in the transportation, logistics, financial, and manufacturing industries, GBA could rival any region in the world – we just have to execute it well."

SIDEBAR: Fundraising - Keen partners

Government guidance funds can be elusive creatures when it comes to actual committed capital, but when the Greater Bay Area Homeland Development Fund was announced last December, HK$100 billion ($12.8 billion) was the number readily cited. It represents a profound commitment to the Greater Bay Area (GBA) initiative and Hong Kong's ambitions to become a fundraising hub for the area.

"There will be more of these funds to boost the Greater Bay Area, definitely," says Guo Sun Lee, a partner with King & Wood Mallesons, who advised two investors that backed the vehicle. "They will use this fund as a wave breaker to get more people in."

The GBA blueprint makes several references to fundraising, largely in the context of broader financial integration between Hong Kong and the mainland and enabling institutions and individuals in each territory to invest in the other. It proposes supporting Hong Kong institutional investors in raising renminbi-denominated funds as well as participating in domestic funds to be deployed in the GBA. Steps would be taken to facilitate such investment, especially in the technology sector, and help portfolio companies pursue IPOs in Hong Kong.

It is long on policy and short on detail. But the Homeland Development Fund's profile suggests a willingness to invest in the initiative. Shareholders in the management entity – and therefore likely sizeable contributors to the fund – include the offshore investment arms of China Construction Bank (CCB) and Bank of China, conglomerates China Resources Group and China Merchants Group, and China Taiping Insurance. A former CEO of CCB International heads the fund manager. Several LPs are said to have agreed commitments with minimal negotiation on terms.

If it does trigger a wave of GBA-focused fundraising driven by mainland financial institutions, Hong Kong hopes to play an anchor role on the US dollar side – as is also the case with the Belt and Road initiative. GBA features prominently when industry participants make the case for an onshore system that can accommodate every aspect of a PE investment structure. With Hong Kong's new limited partnership ordinance still in progress, the Homeland Development Fund is domiciled in the Cayman Islands.

"If you look at the Greater Bay Area and link it with One Belt One Road, we think that Hong Kong has the benefit of being the ideal channel for US dollar investors," says John Levack, chairman of the Hong Kong Private Equity & Venture Capital Association's (HKVCA) technical committee. "Investors are looking for a place where they can create funds and have good laws that give them protection in a Western commercial way, and that is Hong Kong's real strength."

Steps are also being taken to create a fertile fundraising environment on the renminbi side. Guangzhou and Zhuhai, both of which fall within the GBA's geographic remit, recently introduced qualified foreign limited partnership (QFLP) programs through which offshore capital can be channeled into onshore renminbi vehicles. QFLP was originally rolled out in Shanghai in 2011 and then three years later, the Qianhai economic zone in Shenzhen launched its own program, offering greater flexibility. Guangzhou and Zhu are said to have copied the Qianhai model and further dialed up the flexibility.

"Shanghai has detailed requirements regarding the minimum registered capital of QFLP funds and also the first capital contribution ratio, the currency of the capital, and terms of the contribution," says Candy Tang, a partner with Fangda Partners. "Guangzhou has no detailed restrictions in some areas and minimum requirements in others. It has also adopted preferential treatment – such as tax incentives – to encourage investment."

What Guangzhou cannot do, it appears, is allow QFLP funds to be treated as pure renminbi funds. Even if a foreign investor establishes a wholly foreign-owned enterprise (WFOE) or a joint venture so the vehicle qualifies for a local business license, regulators will still look through the structure to the entities behind it. As such, the bureaucracy that slows down approvals for foreign investments – and the restrictions on participation in certain sectors – still applies.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.