1Q analysis: China malaise

First quarter analysis: China uncertainty hits PE investment; public market instability holds back IPOs; distress strategies underpin India fundraising as commitments to China-focused managers plummet

1) Investment: Predictably tough times

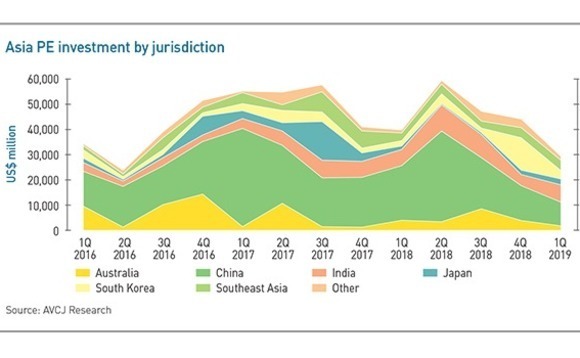

This is the quarter that everyone saw coming. As public markets plummeted towards the end of 2018, a record high between March and April of last year soon became a three-year low in January-March. The total recorded by AVCJ Research may yet be revised upwards, but for now it stands at $29.1 billion, the lowest since the second quarter of 2016.

China is the key actor in this drop-off in activity. Investors deployed $91 billion in 2018, the second-highest annual total on record, but they increasingly held back as the year progressed. Growth was already slowing as a result of monetary tightening. Trade tensions with the US served to accelerate a decline in consumer and investor sentiment that contributed to a 25% fall in the Shanghai Composite Index over the course of the year.

Numerous PE firms have told AVCJ that they expect a renewed burst of investment in 2019, following a muted 2018, but they must find the right moment – and price point – to reengage. That clearly didn't come in the first three months of the year. As the Shanghai index regained 30% in value, PE and VC investment came to $9.3 billion, the lowest quarterly total in four years.

China accounted for just three of the 20 largest deals in the final three months of 2018, a low contribution by historical standards. The first three months of 2019 were little better. China was responsible for five of the top 20 and four of those were technology deals. Don't be deceived, though. Commitments to late-stage tech fell by more than half during the quarter to $3.4 billion. There were just three rounds of $200 million or more, down from 10 in October-December 2018.

Chehaoduo, Horizon Robotics, and Danke Apartment – the three largest China deals from the first quarter – are relatively mature players in car trading, artificial intelligence, and apartment rental, respectively. Investors are less willing to back start-ups outside of this perceived top-tier.

Chehaoduo, which received $1.5 billion from SoftBank Vision Fund, also represents the largest single deal from the quarter. Had the transaction fallen within 2018, it would have barely made the top 20. The quarter was notable for Go-Jek and Grab continuing their one-upmanship in Southeast Asia's transportation space: within days of the former announcing it had raised $1 billion in the first phase of a Series F round, the latter revealed that Vision Fund had contributed $1.46 billion to its Series H.

The Blackstone Group also secured its first PE buyout in Japan with agreements to acquire Ayumi Pharmaceutical Corporation from Unison Capital for around $1 billion as well as medical information site operator M3. This meant that Japan posted an uptick in activity on the previous quarter, which capped a year that promised much but delivered little in terms of large-cap deal flow.

The only other major market to post an increase in investment over the first three months was India. The $6.9 billion in announced transactions was a return to form for a market that only delivered $4.4 billion in October-December 2018. The quarterly average for the past two years is $6.9 billion compared to $3.6 billion for the two years before that.

The numbers appear to confirm that India is becoming more of a target for pan-regional and global players. It was responsible for seven of the 20 largest deals in the quarter, including two by The Carlyle Group that underline the breadth of the opportunity. The PE firm made what is likely its largest-ever bet on the country with the acquisition of a minority stake in SBI Life for $653 million. This was followed by participation in a $415 million round for e-commerce logistics player Delhivery.

2) Exits: IPO logjam

Six months ago, Bitmain was being primed for the world's largest IPO in the crypto space, with a reported target of up to $3 billion. At the end of March, the company – China's second-largest designer of fabless chips, which are used for cryptocurrency mining – abandoned its plan to list. Bitmain's fortunes are tied to bitcoin prices. Revenue grew nearly tenfold to $2.5 billion in 2017 as the cryptocurrency rose from $1,000 to $18,400. It has since collapsed to $3,907.

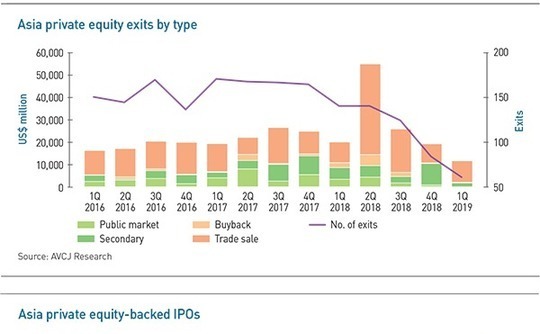

While Bitmain is in part a victim of extenuating circumstances, it is the latest in a line of PE and VC-backed companies that are struggling to get traction with IPOs. Even as Asian public markets staged a recovery in the first quarter of 2019, the number of offerings – 21 – is the lowest in six years.

Chinese online movie ticketing business Maoyan Entertainment led the way with a $287.1 million Hong Kong IPO, but this was well short of the $1 billion it was reportedly seeking. The company's $2.16 billion market capitalization on listing is lower than the $3 billion valuation Tencent Holdings paid at the time of its most recent investment in 2017.

Tencent is also a backer of online marketing specialist Weimob, another of the four Hong Kong offerings that made up four of the top six region-wide. Much like Tencent Music last December, it appears that backing from a Chinese internet giant helps get an IPO off the ground, but it's no longer a strong enough seal of approval to whip up retail investor demand.

China's 11 IPOs represented an improvement on the previous quarter, largely thanks to the Shenzhen bourse spluttering back into life after six months of inactivity by financial sponsors. However, Japan and Korea saw fewer offerings, while India didn't have any at all.

Private equity exits came to $11.7 billion, the lowest three-month total since the start of 2015, and less than half the quarterly average for the previous two years. Deal volume was even more troubling. The number of exits hasn't fallen below 70 since the fallout from the global financial crisis, but Asia saw a significant drop off in trade sale and sponsor-to-sponsor activity in January-March.

This lethargic environment can be linked to uncertainty over valuations. Should public markets stabilize over the coming months, retail investors will likely become more receptive to new offerings and strategic buyers might be confident enough to climb down from the fence. For technology companies, though, it remains to be seen whether valuation expectations will be met.

3) Fundraising: India up, others down

From Bain Capital Credit and Brookfield Asset Management to Värde Partners and J.C. Flowers, foreign investors are piling into India's distressed asset space. They are interested in tapping restructuring opportunities expected to arise from the $200 billion in non-performing assets (NPAs) sitting on the balance sheets of the country's banks. It is hoped the introduction of a new bankruptcy code will facilitate recovery efforts.

The typical mode of entry is through a partnership with a local operator and announcements of these joint ventures usually come with no more than a vague allusion to how much capital might be deployed. However, when Abu Dhabi Investment Authority (ADIA) joined the party in March, it wrote a check. The Middle East-based group has made an anchor commitment of $500 million to a special situations fund launched in conjunction with Kotak Private Equity.

To put that in context, fundraising for all India-focused distress vehicles has only ever exceeded $500 million twice on an annual basis. With Edelweiss Alternative Asset Advisors closing its latest stressed assets fund at INR92 billion ($1.3 billion) – up from $77 million for the previous vintage – the total for the first three months of 2019 alone was $1.9 billion.

Commitments to India-focused private equity funds across all strategies hit $2.9 billion as ChrysCapital Partners and Matrix Partners India both closed their latest vehicles. As was the case with PE investment, India was alone in seeing more activity on a quarter-on-quarter basis. Capital raised for the region came to $16.5 billion – the first time the total has dropped below $20 billion since 2014. The quarterly average for the previous two years is $35 billion.

Only three private equity firms achieved closes above the $1 billion mark: Edelweiss, TPG Capital, and Boyu Capital. TPG's $4.6 billion pan-regional fund is notable for being the largest tender-plus-staple completed in Asia as Lexington Partners led a $1 billion deal that involved the acquisition of positions in two earlier TPG funds as well as a commitment to the new vehicle. Meanwhile, the $3.6 billion raised by Boyu for its fourth fund stands out because China fundraising has been so challenged.

Boyu accounts for nearly half of the $7.3 billion accumulated for deployment in China between January and March, down from $17.1 billion in the previous quarter. The renminbi space is clearly a contributing factor. Even though the number of local currency funds achieving final or partial closes surpassed 100 for the first time in a year, the total of $1.3 billion represents a six-year low. There is as yet no sign of the mega government guidance funds that previously skewed headline numbers making a comeback.

The other area of weakness was venture capital. Asia VC fundraising had been enjoying a bull run, rising from $6.2 billion to $8.3 billion to $10.9 billion to $11.8 billion over the four quarters of 2018. It sank to $3 billion in the first three months of this year. China's contribution was $1.9 billion, down from $5.4 billion in October-December 2018. Blue chip managers have no problem winning LP support; for those further down the food chain, it is becoming ever harder.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.