GP profile: Allegro Funds

The first 15 years of Australia’s Allegro Funds have been marked by a series of changes both to the firm and its market. Adapting to meet them has proven to be one of the turnaround specialist’s greatest strengths

The last few years have been difficult for Australia's Endeavour College of Natural Health. Following its divestment by struggling Vocation in 2015, the alternative medicine education provider ended up in the care of Study Group along with several other assets once owned by its former parent.

Study Group had little interest in Endeavour – seen as a sideline to its primary education business – and was looking to offload it. But finding a buyer proved to be hard: the company's previous owners had fully integrated it into their operations and there were no independent capabilities across management, finance, human resources, or sales and marketing.

This was exactly the kind of challenge that Allegro Funds looks for. The turnaround specialist acquired Endeavour from Study Group for an undisclosed amount in October 2018 and immediately went to work giving the company both a leadership and a sense of purpose that befit its 43-year history.

"The whole backend has been rebuilt on a standalone basis across nearly every functional capability, and we recruited and onboarded an entire senior leadership team in less than four months," says Fay Bou, a managing director at Allegro who serves on Endeavour's board. "We've also gotten the culture on a positive momentum that people can believe in. That's often the hardest job in our space – you have to get people to believe and join you in building a better business."

This emphasis on the importance of belief is telling, in light of the twists and turns that have characterized Allegro's own history. The firm and its founders have often needed to fall back on their confidence in the potential of the firm and Australia's turnaround space: first as consultants without a fund of their own, and then through successive phases as a replacement manager, a deal-by-deal investor, and now as a proven GP with its second standalone vehicle.

Allegro has managed not only to weather these trials but to find in them new opportunities for growth. Veterans at the firm see this characteristic as crucial to its ongoing development. "There's always been a bit of a street fighter about Allegro, because of having to fight to the next mandate and evolve, rather than just having the benefit of a fund straight away," says Albert Farrant, who worked as a managing director at Allegro from 2005-2016 and currently serves on the firm's investment committee.

A taxing turnaround

The story began in 2004, when Chester Moynihan looked up Adrian Loader with a plan for a new GP. Moynihan, a 13-year veteran of private equity with Permira Advisors and Gresham Private Equity, saw an opening in the Australia market for a firm that could go beyond passive growth equity investments and actively reshape struggling companies. He believed that Loader, who had worked on turnaround and restructuring deals across Asia for Arthur Andersen, would be an ideal partner.

The co-founders knew their firm, Quay Capital (later changed to avoid confusion with fund-of-funds Quay Partners), would face an uphill climb convincing LPs to back an unproven strategy. For the first few years of its existence Allegro primarily functioned as a consultancy firm, advising on restructuring deals and looking for opportunities to prove its worth as an investor – for instance, by taking equity stakes as compensation rather than cash.

The first real break came in 2008, when Macquarie, which Allegro had approached as a potential investor in its first fund, suggested that the founders take over the A$300 million ($213 million) ABN AMRO Capital Australia Fund II on behalf of the vehicle's LPs. Investors had lost faith in the previous GP's ability to rescue the troubled fund, and they were impressed with the experience of Allegro's leaders.

Moynihan and Loader knew the opportunity to prove themselves was too good to pass up, but they could see that recovery would be a tricky proposition. The displaced GP had little interest in helping with the transition, and the portfolio was heavily leveraged across the board – a fact that proved even more inconvenient with the advent of the global financial crisis.

"We stepped into a much worse situation than we had been led to believe, and then a week later Lehman Brothers went down and things became even worse," says Loader. "Nearly every single investment we had either was bankrupt or was about to be, and the fund had very limited access to capital because it was almost fully deployed."

Bringing a fund back from the brink of insolvency is difficult for any GP, but Allegro faced the additional challenge of having to salvage a portfolio it had no hand in constructing. Not only had the previous GP invested according to a strategy that was now unworkable given the stress in the global economy; Allegro also had no opportunity to develop an understanding of the businesses that it would have normally gained prior to the original investment.

"Due diligence is often where you really deeply learn the business. If you're taking over from someone else, you can read their reports, but you're never going to hit the ground running to the extent that you do if you bought it from the outset," says Farrant. "So we had to make some pretty quick decisions with imperfect information. Some were right, and some turned out to be wrong."

Despite these headaches, the team attacked the opportunity, promising LPs to set aside other business lines and focus on recovering value from the portfolio until 2010. The firm eventually managed to generate an IRR of 25% for LPs in the vehicle (renamed Allegro Fund I).

Highlights from this era include Discovery Parks, an operator of holiday sites that was established in 2004 with three locations and by 2008 had grown, via mergers, to 40 parks. This aggressive expansion strategy had left the company highly leveraged. With tourism dropping off due to the financial crisis, Discovery was barely meeting its interest payments and appeared destined for receivership.

Allegro spent two years heavily engaged in negotiations with Discovery's creditors to extend its facilities, while selling underperforming parks to pay down debt and cutting expenses at head office. Following these measures the firm renegotiated the debt agreements, and in 2010 it led a consortium of investors to recapitalize Discovery.

Having achieved stability, Allegro concentrated on putting the business on a more sustainable long-term footing. A new pricing system and an online booking platform were introduced, while Discovery's focus shifted from the accumulation of assets to effectively managing existing parks. The business returned to profitability, delivering an IRR of 38% to participants in the 2010 recapitalization. Allegro exited most of its stake to SunSuper in 2014 at a valuation of A$240 million, and it retains a minority holding today.

One to watch

The success of Discovery Parks and other investments from the first fund helped establish Allegro as a name to watch in the turnaround space. The next phase was to demonstrate its ability to source investments, so starting in 2010 the GP began raising capital to invest on a deal-by-deal basis. These transactions – which participating in the takeover of radiology business I-Med in 2011 at the invitation of creditors – showed LPs that Allegro was a well-rounded PE player. The firm closed its first standalone fund in 2014 at A$180 million.

"It effectively took us six years to raise a committed fund, but in each of those years we got better and better, and if you look at us now I think we are a quantum leap beyond where we were in 2014," says Loader. "There was probably some sense in the LPs waiting and watching."

With Allegro Fund II, the GP shifted gears once again, moving away from the lean, generalist approach that had characterized the firm in its deal-by-deal phase. A small team of professionals with broad capabilities had been ideal for a business without a stable source of fees, but the luxury of a long-term pool of capital meant it could fill out its roster with specialized talent.

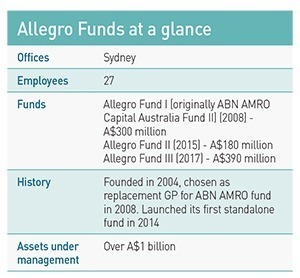

Allegro's operational team now numbers eight people, nearly a third of the GP's total strength of 27. Their talents range from managers capable of stepping into portfolio companies as a CEO to specialized personnel who can take over entire departments as and when needed. The firm has particularly focused on building a stable of dedicated CFOs who can step in immediately to fix portfolio companies that are in dire financial straits upon acquisition.

"In the US there are a lot of highly capable CFOs in every sector and in every region, and when you buy a portfolio company you can rest assured you'll be able to find a CFO," says Bou. "In Australia it's a lot more challenging, and we struggled for many years to recruit for that role when we bought businesses, because every day counts in this space."

Allegro continues to build out its operational capabilities, seeking people who can fill the most common gaps at its investees. Information technology specialists are the most pressing need, along with professionals who can help with digital marketing and human resources. The team is also expected to grow beyond working with portfolio companies post-acquisition. Allegro's leaders see a role for these professionals in the initial assessment of potential investees and determining whether there is an opportunity for Allegro to improve them.

"The biggest question during due diligence is, can we clearly identify what levers we need to pull in order to drive value?" says Moynihan. "That becomes our investment thesis, which then becomes our value creation plan. And our due diligence is centered on making sure there are valid levers that can translate into tangible uplift in value, be that in EBITDA or strategic positioning."

Rising competition

Operational expertise is one of the chief ways that Allegro plans to retain its competitive edge in Australia's turnaround space. The firm currently sees few direct competitors interested in playing in its sphere of deep distress (meaning businesses either currently in receivership or in danger of it) to moderate distress (companies that are strong at core but in need of capital and operational improvements). But it believes rivals are bound to emerge as the strategy becomes proven and investors' appetite for exposure rises.

One developing set of competitors consists of global credit funds that have become increasingly interested in Australia in recent years. However, Allegro sees a credible challenge from these players as a long way off. For one thing, the type of products offered by these investors are geared toward credit, making them less attractive for already overleveraged businesses; for another, they don't offer the deep engagement that companies can find with Allegro.

"It does increase the amount of liquidity in the market, which can take some deal flow away from people like us," Loader says. "But I think our value proposition is very different, because we have a large deal team and a large operating partner team, and our focus is on how we can create a better business and drive value for us and our partners. That's not something that a credit fund with a small office can do in Australia."

As the industry continues to evolve, Allegro expects to adapt along with it, though changes may occur at a slower pace than in the last decade. While the turnaround market is still young, Allegro has proven its ability and found an effective strategy that needs no drastic alterations beyond fine-tuning.

The most important element in the firm's tool kit remains a confidence in the inherent strengths of its portfolio companies and in its own ability to bring those strengths to the fore. Moynihan sees Great Southern Rail – a government-backed transport company that Allegro acquired in 2015 and made a partial exit from two years later after transforming it into a high-end tourist experience – as a prime example of the need for faith.

"We always ask ourselves what we need to believe, and in that case, we had to believe that people would pay up for a unique experience," he says. "A lot of people walked away from the business because it was too hard – it's a government funded business with big fixed costs, and when you take the government funding away the business loses money. So it was a big leap of faith to go from weaning it off of government funding to standing alone as a full fare-paying, revenue-generating business."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.