Australia cross-border: Fool me once

Asian markets continue to represent an attractive destination for Australian PE-backed companies, but investors will need to show increasingly skeptical buyers that their cross-border plans have borne fruit

KKR's A$400 million ($283 million) investment in Australia's GenesisCare last year had an element of déjà vu. On acquiring the GP's interest in the cancer and cardiac care services provider in 2016, China Resources Group and Macquarie Capital stressed the potential for growing the business into China. This bullishness was based on rising demand for quality healthcare in the world's most populous country and the recently struck free trade agreement between Australia and China.

When KKR returned to take another minority stake two years later, those promises had apparently yet to materialize. China expansion was still on the agenda, but some market observers were struck by the fact that the investors had taken such a big leap – the 2016 deal valued GenesisCare at A$1.7 billion – for a thesis that was nowhere close to being proven.

"You had KKR making money on the premise that they're expanding the business into China, before they'd ever opened a site in China or come close to it," says James Viles, a partner at Bain & Company in Sydney. "They were being prepaid in Chinese value that didn't exist, and two years later it still doesn't exist. So it's quite hard to execute these strategies in reality."

Cross-border expansion, particularly in Asia, is part of the toolkit for many Australia-focused GPs – whether domestic, regional, or global – because companies that can demonstrate an ability to succeed in foreign markets are seen as significantly more attractive to potential buyers. But questions remain about the best way to execute such strategies, particularly for local firms that lack extensive overseas connections. Taking advantage of the Asia opportunity will increasingly require demonstrating a real capacity to conduct business in foreign markets and a firm plan to push further.

Healthy options

For private equity players investing in Australian companies, entering Asia is often a matter of both opportunity and necessity. Opportunity because of their proximity to Asia and the good reputation Australian brands enjoy in the region; necessity because Australia's small population means it is easy for a company to max out the local growth story relatively early in its life.

"Our focus is on businesses with revenues of A$20-250 million, and for some sectors the domestic market is sufficient," says Jeremy Samuel, a founder and managing director of Anacacia Capital. "But for most sectors that means you need an international angle. I think we're fortunate that Australia's a very open economy, and that makes it a good space to be."

While this thesis makes sense on paper, carrying it out is often a challenge for a homegrown company. Raising growth capital through a public offering brings expectations from shareholders for short-term profits, which can be incompatible with the kind of long-term investment required to build up overseas operating capacity. Private equity firms, with their eyes on a longer-term return, are considered more patient and therefore more attractive for a growing business.

"I'd say nine out of 10 information memorandums that cross my desk have international expansion as a growth opportunity," says Patrick Verlaine, a partner at Crescent Capital Partners. "Clearly it's a lot easier to say that than to actually implement and achieve it, but there's no doubt that if it's a real proposition it does attract a premium from a valuation perspective."

Healthcare has been a particularly fruitful sector for cross-border value-add in Australia. There are plentiful companies in the medical services and pharmaceuticals industries, and Australia's high education levels mean they have their pick of qualified personnel. With demand for high-quality medical care growing in Asia's developing markets, companies able to satisfy this need can tap into a fantastic opportunity.

Novotech is a prime example of how the strategy can work. Mercury Capital acquired the clinical trials provider in 2013 with an eye to developing its operations in Asia. The company already had a limited presence in the region, but Mercury pushed it to expand, reasoning that the more people it had on the ground, the more responsive, sophisticated, and comprehensive its services could be for its clients.

"If you are across several markets in Asia, you can give a trial sponsor multiple options. You also have wider access to patient populations and can run trials quickly," says Chris Criddle, a partner at Mercury. "This is important to biotech because the faster they get through the phases, the better their chance of getting funding, and Asia is the fastest to enroll market globally."

By the time of Novotech's acquisition by TPG Capital in 2017 at an enterprise valuation of A$392 million, the company had more than 300 employees in 14 offices across nine jurisdictions in Asia. It had also begun to win business from biotech companies in South Korea, Taiwan, and mainland China. Mercury saw the transaction as a win-win: the GP realized a 15.7x return on its investment, and Novotech gained a backer with greater resources that could contribute to the further development of its overseas presence.

Other exits have followed this model. In 2017 Quadrant Private Equity sold cancer care provider Icon Group to a consortium comprising QIC, Goldman Sachs, and Pagoda Investment. It was a similar story to GenesisCare, though in this case Asia expansion was already underway at the time of sale, with facilities operating or under construction in Singapore and China.

Beyond healthcare, several PE-backed consumer brands have pursued cross-border expansion. Swimwear manufacturer Seafolly, which is owned by L Catterton, sought to leverage Australia's unique cultural image of fitness and active lifestyles to attract Asian middle-class consumers. Meanwhile, in the food and beverage space, Anacacia took baby food maker Rafferty's Garden and chilled foods products Yumi's Quality Foods into North Asia and Southeast Asia. Exits came in 2013 and 2018.

In theory, the outbound thesis works for any area in which Australia has a strong global reputation. Crescent found this to be the case with mining. It acquired GroundProbe, a mining services technology provider, in 2010 and grew the company's global operations to include China, Indonesia, and India, along with Russia and several markets in South America. Orica bought the business in 2017 for A$205 million.

Local strengths

Regional or global GPs would seem to have the advantage over domestic firms when it comes to delivering on this strategy, as by their nature they tend to have on-the-ground networks in overseas markets that their domestic peers lack. As a result, Australian GPs tend to focus their investments and operating enhancements on the key areas where their local roots give them an edge over others.

"There are the usual risks, including execution of an expansion strategy with offshore management teams, unfamiliar foreign jurisdictions and local business practices, and an inability to be on the ground constantly," says Chris Hadley, executive chairman of Quadrant. "But we can mitigate this with highly qualified local management teams and often a direct report to the senior leadership team in the local operating environments."

The cross-border skills developed in the Australian PE community will probably be tested in the future, as several factors are expected to combine and create headwinds in the space, particularly regarding Asian growth. Overseas expansion is expected to remain a vital part of the value-add process in Australian PE, but GPs will have to put in more effort to see a satisfactory return.

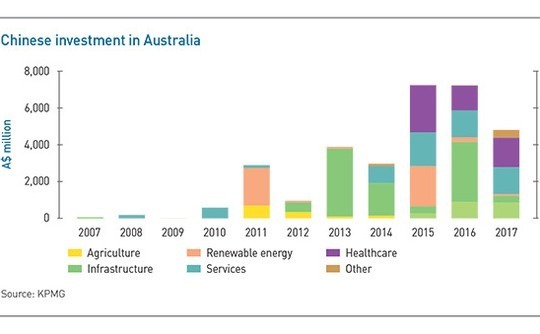

Likely obstacles include a pullback in the Chinese capital that has fueled some of the largest exits, especially in the healthcare sector. While restrictions on Chinese outbound investment are one possible reason for this expected decline, more important is the history of oversized deals that may begin to catch up with investors in coming years.

Luye Medical Group's acquisition of Healthe Care from Archer Capital in 2015 makes up the trio of significant China-related trade sales alongside GenesisCare and Icon. However, the transaction is cited as an example of a "dumb deal," concluded without enough attention paid to the differing difficulty of opening and operating hospitals in China and Australia.

Investors are concerned that Chinese buyers that have piled into Australian healthcare companies, on the assumption that bringing their business into Asia will be easy, will get discouraged by the difficulty and slow or even stop their investments in the country. The loss of this significant revenue stream could mean that GPs must wait longer to realize their investments or settle for less attractive terms.

This is less of a concern for non-healthcare sectors, where Chinese capital has been less of a factor and deals have tended to be smaller. But here too, GPs feel that potential buyers are increasingly willing to pay a premium for companies that have demonstrated a real ability to operate overseas, rather than a theoretical future potential.

"We can all sit around a board table and say a product should sell in China or the US or UK, and in many cases we may right," says Simon Feiglin, a managing partner at The Riverside Company. "But if you can show a buyer that you are already in those countries, and these are the margins you're generating there, then I don't think anybody would debate that's a fundamentally more valuable business than one that has the same revenue and EBITDA, but it's all still in Australia."

The golden mean

For GPs looking to execute a cross-border play, then, the challenge is to hit the sweet spot between beginning an expansion play and reaching full maturity. Investors define these conditions differently, but common elements include a significant portion of revenue being generated overseas – sometimes up to half, depending on the business – and the ability of local teams to operate independently of the parent company in Australia, responding to local market conditions as needed.

Domestic and regional or global firms tend to approach this issue differently as well. For firms based in Australia, the most effective means of driving improvements through local management and finding the right people to supplement the team, while overseas firms focus more on the benefits they can bring in the target market. In both cases, however, the goal is to leave the business poised for further growth with the future owners.

"When we're exiting a business, the key is to be able to show to the next set of shareholders that there's a bright future ahead," says Anacacia's Samuel. "You haven't sold it at maximum maturity, and you've left a lot of growth for the next buyer. And you've also got to demonstrate that you've developed the infrastructure within the group in order for it to achieve that."

There may still be openings for companies to sell on a theoretical cross-border expansion. Allied Pinnacle, a baked goods and flour manufacturer built by Pacific Equity Partners over the last four years, is currently subject to a trade sale process with Japanese and Chinese food producers said to be among the interested parties. If the deal is successful, Asian consumer demand for Australian food products will likely have played a significant role.

"We recently did a survey of Chinese consumers for a baked goods company, and when we asked them who makes the best cakes and pastries in the world, they said Australia – more than twice as many as those who said France," explains Viles of Bain & Company. "There's still this massive attraction to Australian fresh products, and you'll probably see food businesses benefiting from that."

But such cases could well become increasingly rare in the future, as buyers of all types become more sophisticated and look for solid proof that private equity-backed companies have a shot at competing with their overseas peers. GPs that hope to take advantage of these opportunities will have to be prepared to go big or go home.

"You can get value for proof of concept, but you get more value for successful execution. It's a question of who's bearing the risk," says Riverside's Feiglin. "We take the view that, rather than dipping your toe in the water, jump in and make it happen. That's where you're going to create a truly valuable business that is more than just an Australian business."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.