Hong Kong tax: Playing catch-up

Hong Kong is introducing various initiatives intended to encourage private equity firms to bring more of their operations onshore. A failure to act may see Singapore emerge as Asia’s jurisdiction of choice

More than 230,000 people are employed in Hong Kong across banking, financing, legal services, and accounting, auditing and tax consulting. This work generated over $140 billion in business receipts in 2017, according to government statistics. Why, then, do so many private equity managers jump on the ferry to Macau when they want to get business done? And why are there concerns that in the long term these managers will make Singapore their permanent destination?

The answer is simple: tax. The issues behind it form a complex knot that ties together domestic policy, international pressure on offshore financial centers, and the inconveniences PE firms are willing to endure to deliver economic efficiency and regulatory certainty in their deal-making.

One strand will shortly unravel itself. Legislation is about to be passed that should allow managers to conduct more activity in Hong Kong without fear of one investment making an entire fund liable for local taxation. But the roundabout way the territory has arrived at this point – plus a track record of issuing guidelines that wipe out any benefits PE industry players hoped to obtain – suggests the onward journey will not be completely smooth.

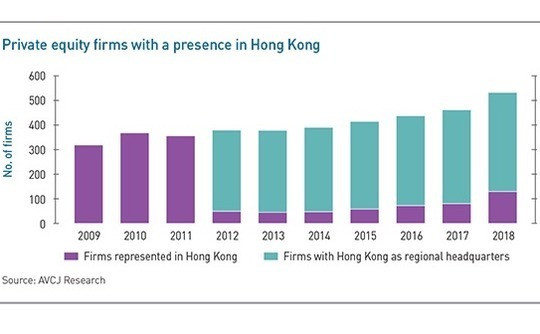

"The amount of capital advised on in Hong Kong is four times larger than Singapore. We also have a very good pool of professionals, stronger than Singapore because there is more activity and depth to the market," says John Levack, chairman of the Hong Kong Private Equity & Venture Capital Association's (HKVCA) technical committee. "But many of those professionals are mobile and will seek to be located close to the fund management teams, if these teams move."

While incumbents may decide to stay put, despite their frustrations, new GPs could take a different view. "Our investment committee is in Hong Kong and then we have a secondary committee offshore to approve every single deal. It's a waste of time and money," says an executive with a pan-regional GP. "Would we move to Singapore? Probably not. We have a lot of staff in Hong Kong and the senior people have families here. But if we were setting up on day one now, there would be a lot more debate about whether we base ourselves in Singapore or Hong Kong."

Revised, again

The industry achieved a breakthrough in 2015 when Hong Kong included PE in a tax exemption so that funds domiciled offshore don't have to set up structures designed to avoid triggering permanent establishment from a taxation perspective. However, practice notes issued two years later made it unworkable, prompting most firms to rely on the traditional approach where the fund and fund management entity – as well as the key decision making – are offshore.

One of the primary concerns was tainting. The Inland Revenue Department's (IRD) guidance decreed that a fund would not qualify for the exemption if a single investment had exposure to Hong Kong real estate or entities with local business operations that exceed 10% of the value of the target. To put that in perspective, a PE firm could find its entire fund is liable for local tax because a company in which it holds a minority interest has bought a property in Hong Kong.

The new legislation removes the tainting provision. If an investment breaches the 10% real estate threshold, the fund will only be taxed on profits arising from that deal. For companies with Hong Kong business operations, the exemption lapses if the holding period is less than two years, with exceptions made for minority investments and for situations where at least half of a company's assets are more than three years old.

These changes are attached to a broader amendment intended to create a unified exemption regime. No fund need fear triggering permanent establishment in Hong Kong, regardless of structure, the location of central management and control, size, or purpose.

It is ironic that the reforms were not driven by private equity per se. Rather, the EU said in late 2017 that it may have to classify Hong Kong as a harmful tax regime. By having an exemption that applied to offshore funds only, the territory is excluding resident taxpayers from taking advantage of preferential tax treatment – a practice known as ringfencing. Hong Kong escaped inclusion on the list by promising to remove the double standard by the end of 2018.

"There was a total lack of interest in the commercial uselessness of the legislation. The IRD basically said, ‘We don't care about your concerns, we have to protect Hong Kong's tax base,'" observes one source familiar with negotiations between private equity industry representatives and the Hong Kong authorities. "Then the EU threatens to blacklist Hong Kong and suddenly everyone is hurrying around."

Others are less inflammatory, describing the timing of the EU's intervention as helpful rather than a catalyst for change. An assortment of interested parties has been lobbying the government for several years over its funds regime and the unified exemption is seen as these efforts finally bearing fruit.

"There has been a shift in the current administration towards looking at new ideas, so that Hong Kong remains competitive as an international financial center," says Darren Bowdern, a partner in the Hong Kong tax practice at KPMG. "Given global corporate tax rates have all trended downwards, I don't think a relatively low tax rate regime is enough to attract foreign investment. The administration has realized we need to be doing more to ensure our regime is fit for purpose."

One aspect of the negotiations that proved encouraging involved the minimum holding period after which investments with Hong Kong exposure qualify for the exemption. The IRD's original position was five years. The HKVCA argued this would result in most investments becoming taxable, presented data supporting the case, and suggested two years. There was some surprise when the regulator acquiesced.

Goodbye Macau?

The near-term impact of the reforms should be a simplification of private equity operating models. While global firms normally have sufficient resources in other markets that they can route fund decision-making through other markets, smaller managers often face more difficulties as they seek to avoid triggering permanent establishment in Hong Kong. This translates into additional costs borne by the GP.

A second investment committee that sits offshore is one option, but some managers still get the ferry to Macau, rubber stamp a deal, and then come back to Hong Kong. That could mean a round trip journey for every investment committee meeting and board meeting. In addition, they need to appoint offshore directors, typically in the Cayman Islands. For a firm managing four funds, each of which requires two offshore directors, the wage bill alone could run to $200,000 a year, according to some estimates.

"It is administratively cumbersome to go to different places to approve and execute the transaction documents" says Anthony Lau, a tax partner at Deloitte. "The unified exemption regime can simplify the model and mitigate the tax risks in other jurisdictions. If a fund has investments in different countries, overseas tax authorities may ask where the investment decisions are made, and whether meetings are held locally in those overseas jurisdictions. It is easier to answer those questions if you have a hub in Hong Kong."

That said, most private equity firms are currently taking a cautious approach. "Once the law passes we have to wait for an updated interpretation notice from the IRD and then we will be able to see what we can and cannot do," says Adam Williams, a partner in the financial services tax practice at EY. Clients are interested in the reforms but reluctant to test them until they are quite sure that they work.

There are also numerous areas in which industry participants believe improvements could be made. Notably, private debt and credit funds are still unable to take advantage of the exemption, so have no choice but to continue operating offshore. The IRD excluded them by ruling that interest payments do not count as profit from qualifying transactions because assets are not being bought or sold.

Other issues aren't necessarily directly related to the exemption, rather the creation of an environment in which private equity investors can operate with a greater degree of comfort and certainty. They include the treatment of carried interest, a clearer licensing regime for managers, alterations to the thresholds above which Hong Kong resident LPs become liable for local taxation even when the funds they back are exempt, and more double taxation agreements (DTAs), especially with other Asian jurisdictions.

However, DTA access could be complicated by limitations on the activities of special purpose vehicles (SPVs) that sit below the fund and serve as conduits for investments. The legislation states that SPVs can only qualify for the exemption if their sole purpose is to hold and administer investments. It is intended to discourage the round-tripping of money purely to take advantage of DTA benefits, but the byproduct could be that no SPV can prove enough local substance to access the DTA network.

"The narrow scope of the definition might make it hard for an SPV to qualify as a tax resident. A tax residence certificate is often a ‘prerequisite' for treaty benefits to apply. In China, for example, if you don't have a certificate issued by the other treaty partner, you don't have a starting point for treaty claims," notes Lau of Deloitte. This effectively means that a 10% withholding tax is paid on the profits of any investment in China; the China-Hong Kong DTA would reduce it to 5%.

Not every jurisdiction is so strict. Several tax advisors claim that demonstrating commercial substance in Hong Kong – convincing tax authorities in the country where an investment target is based that a structure does not exist for tax avoidance purposes on the basis that meaningful activity happens in the territory – can be enough to access a DTA.

Bring it onshore

Nevertheless, the most robust case a manager could make that it is not treaty shopping would be to locate as many layers as possible of its investment structure in Hong Kong. The Organization for Economic Cooperation & Development's (OECD) position is clearly that DTA benefits should not be awarded where a legal domicile is not backed up by central management and control.

"If you have your main management team in Hong Kong, you have your legal entities here, and you are managing the fund from here, it will be easier to get treaty benefits," says HKVCA's Levack. "The trend globally is that more activity has to be put into real centers of management, making it harder to obtain benefits for artificial constructs. Hong Kong has a great opportunity to benefit from this: if it doesn't get it right, people will go elsewhere."

The unified exemption regime gives private equity firms a reason not to leave, but Singapore's system is still several years ahead of Hong Kong. Structures for onshore and offshore managed funds have been in place for more than a decade, the tax exemption is tried and tested, and the DTA network is extensive. Local substance comes at a cost – a minimum expenditure of S$200,000 ($147,000) per year at every level of the structure – but some investors are willing to pay for the certainty of treatment.

This year the Singapore Variable Capital Company (VCC) will be introduced, allowing private equity firms to domicile their fund locally and thereby bring every part of the fund management and investment process onshore. Hong Kong is working on a limited partnership structure of its own, but ease of use depends as much on regulatory attitudes as availability.

"The Monetary Authority of Singapore (MAS) is extremely commercial in nature. They are very open to reinventing these schemes, so they meet current industry standards and norms," says Mriganko Mukherjee, a partner with EY's financial services tax team in Singapore. "You can go to the MAS, explain where the industry is going, and they make sure the Ministry of Finance and the Inland Revenue Authority understand why these changes are being proposed. By and large, they make them happen."

There are a few examples of private equity firms shifting their operations from Hong Kong to Singapore, but most movement is at the margins. The dynamic is captured well by one fund manager who describes the impact of a decision to establish an onshore fund structure in Singapore: The firm's fund administrator added headcount in Singapore, because those vehicles require local administration, and so fees it once paid in Hong Kong are now paid in Singapore. Some global firms, while retaining Hong Kong offices, are said to be structuring their operations so they have enough substance to take advantage of Singapore.

This does not necessarily mean there is significant interest in redomiciling the topmost fund entity to Singapore. US institutional investors still prefer Cayman and GPs are reluctant to rock the boat. "Fund houses that are already in business want to raise money and the message to LPs is we will do the same again but better," says Andrew Read, a partner and head of Asia at fund administrator Langham Hall. "You don't want to put something on the table that investors will ask questions about."

However, administrators and tax advisors claim they are seeing Cayman vehicles – either as master or feeder funds – being used to pool capital that is deployed through Singapore structures. LPs can draw comfort from having their legal agreements with GPs defined under Cayman law, while fund managers have Singapore-based platforms that offer substance and DTA network access.

Beyond Cayman

It could be argued this arrangement points to a future that is not dominated by Cayman. Compliance issues in Europe are already prompting investors to insist on using Luxembourg rather than Cayman and that is being felt in Asia as well, with Luxembourg structures feeding into Singapore funds. Questions have been asked for years as to what it might take for a critical mass of Asia-focused GPs might run everything through a jurisdiction within the region. Industry participants are getting closer to issuing definitive answers.

"If you asked me today where I would set up a pan-Asian fund, I would lean towards Singapore rather than Cayman," says Jayesh Peswani, a director for relationship management at fund administrator AlterDomus. "If you asked me in a couple of years, it depends. Singapore has done a good job on substance and ensuring that operations sit in Singapore – if the real central management and control are there, you are likely to want to have a Singapore fund. Hong Kong is going to have to try and replicate that, and it has made a decent start."

If this progress is sustained, the pay-off could be substantial. Just as Hong Kong is well-positioned to serve as a staging post for investment entering China, it is the logical conduit for Chinese money moving offshore. The territory has already benefited in this respect from the Belt & Road initiative and there could be more to come from mainland asset managers, especially if there isn't an existing international LP base agitating for Cayman.

What regulators and other stakeholders cannot afford to do is stand still. "Hong Kong has great growth prospects, but we have to grab the opportunity," says Florence Yip, Greater China private equity tax leader at PwC. "We can't just wait for it to happen."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.