Portfolio: QIC and North Australian Pastoral

Addressing Chinese demand was central to QIC’s acquisition of cattle breeder North Australian Pastoral, but the company has repositioned itself in response to changing patterns of consumption in global beef markets

For most consumers, the beef supply chain has historically inspired little curiosity. Provided the meat is high-quality, free of disease, and bears a reasonable price, the path that it took from the pasture to the supermarket shelf is typically seen as somebody else's problem.

But Phillip Cummins, CEO of North Australian Pastoral Company (NAP), believes this is about to change. Thanks to generations of educational work by environmental activists, consumers are showing a growing concern about the ecological impact of the agribusinesses that dominate global food supply, and that interest is likely to impact their future buying choices.

"A piece of steak is no longer just a piece of steak," says Cummins. "Where does it come from? How was it produced? What carbon was involved in the production, and did that beef contribute to deforestation? Producers who can control these factors can play into the de-commoditization of beef, and Australia is probably best placed among all the regions of the world to do so."

NAP's early recognition of the importance of sustainable production played a key role in the Queensland-based cattle breeder's acquisition in 2016 by QIC, and these themes have become even more important amid ongoing shifts in global demand. As environmentally friendly practices have become more of a consumer priority, the investor is helping NAP stand out among the world's beef producers.

The export angle

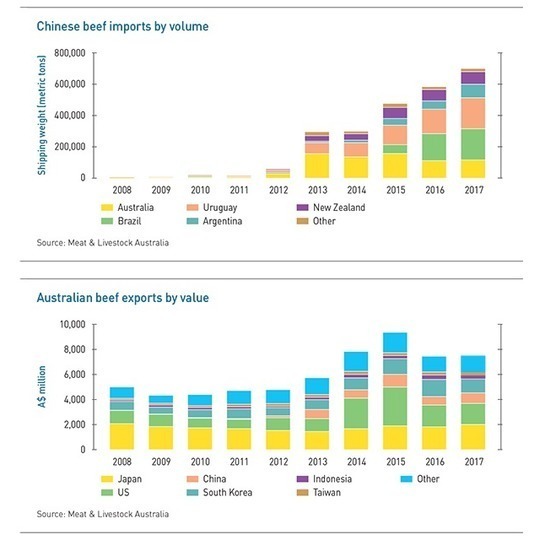

When QIC started to examine Australia's beef industry in 2015, all signs pointed to strong growth ahead – particularly in light of booming demand from China. Data from Meat & Livestock Australia show that imports of Australian beef had surged in 2013, rising to 155,000 metric tons from just 27,000 the year before. While demand eased slightly in 2014, Australian beef imports had climbed back to 156,000 metric tons in 2015.

"QIC was attracted to the broader theme around the growing demand for food globally, underpinned by a population of wealthier and more selective customers," says Crystal Russell, a principal at QIC and member of NAP's board. "Australia, with its clean reputation, arable land, world-class practices, and proximity to growing Asia, is well-placed to participate in this demand."

NAP offered a perfect opportunity to take part in this booming new market. The company had started in 1877 with a single cattle station in Australia's Northern Territory and grown to 13 stations and one feedlot by 2016, with 5.8 million hectares of pasture land and 178,000 head of cattle.

But the industry held little interest for several members of the shareholding Foster family, who were hoping to sell their stakes. QIC was an attractive partner. For the Fosters, selling to an Australian buyer meant the process could be greatly simplified with no need to involve the Foreign Investment Review Board. Management saw QIC as a source of capital to support needed upgrades and expansions to its facilities. The investor's industry connections could also help the company outsource certain operations, such as meat processing and meat marketing, that it lacked the expertise to manage properly.

"The business was not risk-averse, but we weren't comfortable taking on lots of debt, and the shareholding family was not able to allocate the capital that was needed," says Nigel Alexander, who was CEO of NAP at the time of the acquisition. "We had an opportunity to optimize our existing assets, and QIC had the deep pockets to help with that."

In the purchase of an 80% stake for A$400 million ($295 million) – the remaining 20% is held by two members of the Foster family – QIC saw a chance to leverage its unique strengths. First, its connections to foreign investors represented an opportunity to open new doors for the company's products. Second, as a government-backed investment manager, it was not beholden to either the short-term focus of the traditional private equity model or the passive approach of the typical agriculture investor.

"We wanted to go beyond the traditional land ownership strategy in agriculture and take an active, operational approach," says Russell. "We're applying a private equity mindset to the enterprise, but combining it with long-term capital appreciation from the real asset ownership."

The installation of Cummins as NAP's new CEO in 2017 was a mark of the hands-on role that QIC intends to play. As a principal at QIC, Cummins had helped with the investment, and after the takeover in January 2016 he stepped in as chairman of the board. Alexander had already been planning to retire as CEO but agreed to stay long enough to ensure a smooth transition.

A tweak in strategy

The biggest concern in the early stages was retaining the managers of NAP's far-flung cattle stations, most of whom had worked for the business for decades but owed their loyalty to the founding family rather than the company itself. Rather than risk losing these managers and their decades of experience, representatives visited each station to personally assure the staff that the new owners understood their importance to the company's health and that they would not be neglected.

After addressing this challenge Alexander left the company in August 2016. QIC initially appointed cattle industry veteran Stephen Thompson to succeed him, but ultimately decided that Cummins, who at this point had direct experience with both the investor and the company and knew the market intimately, was the best person to take NAP forward.

His appointment came as QIC reexamined its strategy for NAP amid unexpected developments in the Australian beef export market. After reaching their peak in 2015 following the 2014 slump, China's imports of Australian beef fell to 111,000 in 2016, recovering only slightly the following year. The country's rising appetite for foreign beef was being met by South American rather than Australian sources.

Along with the drop in Chinese enthusiasm, Australian exports over the past two years have been softer across the board after five years of sustained growth. The value of beef exports to all countries peaked at A$9.3 billion in 2015, and hovered around A$7.4 billion in each of 2016 and 2017, the last full year for which data is available.

This development had the potential to upend QIC's plans for NAP. However, the company has been able to pivot its strategy to capitalize on the growing interest in environmentally-friendly food production from the core consumers of Australian meat in developed countries such as Japan, South Korea, and the US.

In turning to this opportunity, QIC has been able to make use of NAP's long history of scientific innovation in the cattle space. The company was one of the first Australian cattle breeders to use genetics in its breeding process, and it continues to be a leader in this regard.

"In some ways NAP is the definition of sustainability – it's a company that's been continuously involved in red meat production for over 140 years, and that's only possible because we've been able to do it in a sustainable way," says Cummins. "So there's a wealth of knowledge in how to manage the existing assets and the properties we have today."

In recent years NAP has focused on reducing its animals' carbon footprint through measures that include accelerating the cows' growth so that they can be slaughtered faster and lower their lifetime carbon emissions. The company is also researching ways to make digestion more efficient in order to reduce methane output.

To play to the sustainable food movement, NAP plans to introduce its own meat brand. The Five Founders label will use QIC's industry relationships to develop its marketing and retail strategy, and will emphasize the company's long history of sustainable production methods.

"It's similar to what you've seen around beer production – 30 years ago there were just a handful of beer companies selling a very homogeneous product. But small, niche producers were able to disrupt that market by playing on various factors such as taste, production processes, and so on," says Cummins. "Beef has the same opportunity because it's a massively fragmented market, and you can play to your unique characteristics."

In addition to the beef itself, NAP is looking for ways to orient every aspect of its operations around ecologically friendly production. For instance, its pasture land represents a massive opportunity for carbon sequestration, and the company is working on assessing the benefits of this land use and improving its outcomes.

The long game

This focus on sustainability does not represent the abandonment of QIC's hopes for expanded exports to China. NAP sees the research it is conducting as the foundation of a more efficient breeding and rearing process that will enable it to respond quickly when interest in Australian beef rises again, which it sees as inevitable as the income of Chinese consumers, and their demand for protein, grows.

Moreover, the tastes of these increasingly affluent consumers are likely to become more discriminating with regards to meat production methods and their impact on the planet, just as their Western counterparts have. When that occurs, NAP will have a head start on other beef exporters that have not kept up with their investments in scientific production methods.

While the company's strengths lie in production and long-term research, QIC has aimed to fill management gaps with talent across the human resources, marketing, communications, and legal teams. The goal is to prepare NAP to thrive over the long term as an independent company.

"There is a lot of talent and industry expertise within NAP. We've sought to harness those ideas, passion and leadership, and help the company operate in a more coordinated and data driven environment, while being respectful of the nature of the operations and the culture," says Russell.

QIC has always seen NAP as an investment that will work over a longer holding period than the usual PE deal, with an exit expected 10-15 years after the initial acquisition. The ability to take on a longer holding period is a unique strength of QIC, allowing it to pursue deals that other firms would be unable to address.

Though almost three years into the investment, a time when many PE firms would have already started planning their exits, the extended holding period means that the relationship is still at a relatively early stage. But both parties anticipate a productive partnership going forward, with NAP serving as a template for future agriculture investments playing off the sustainability thesis.

"A lot of what we can do around sustainability will lead to better commercial outcomes," says Cummins. "It's about producing higher-quality, better-tasting animals in shorter periods of time. If we're able to achieve that in a cost-effective way, that's a great outcome not just from the commercial perspective but from an environmental perspective as well."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.