4Q analysis: Defined by uncertainty

Korea comes to the fore as investment in China slows; venture capital and pan-regional players remain preeminent in Asia fundraising; IPO weakness reflects investor wariness

1) Investment: Korea up, China down

Hahn & Company's $3.7 billion acquisition of SK Shipping is not only the first successful non-government led corporate restructuring in Korea's shipping industry. It is also the second-largest private equity deal ever seen in the country and – excluding one infrastructure privatization in Australia – Asia's biggest buyout of 2018.

PE investment in Korea reached $10.8 billion in the last three months of the year, a record quarterly total for the market. SK Shipping wasn't the only sizeable contributor. Korea accounted for an unprecedented six of the 25 largest deals announced in the region, including a $2 billion investment by SoftBank in e-commerce player Coupang and a $878 million commitment to retail group Shinsegae from Affinity Equity Partners and BRV Capital Management.

While the Shinsegae deal is classified as consumer-retail, the investment is for the e-commerce units of Shinsegae Department Store and E-mart, which are being spun off into a dedicated platform. It means that eight, rather than seven, of the 10 biggest deals in October-December are new economy plays. This is not unusual, but only two of the companies are Chinese, compared to between four and six in each of the three previous quarters.

Evidence of China's economic woes is mounting, from slowing GDP growth to weakening economic sentiment to job cuts in industries that were previously in expansion mode. It is tempting to add a decline in growth-stage tech investment – an area in which valuations were at eye-watering levels due to the amount of capital seeking deals – to the list.

Private equity investment in China for 2018 stands at $91.5 billion, according to AVCJ Research, only marginally down on the $100.5 billion deployed in 2017. However, activity slowed markedly in the second half, coinciding with the increasingly bleak macro picture. The fourth quarter figure is $13.2 billion, the lowest three-month total in nearly four years. Growth-stage tech peaked at $25.6 billion in April-June, before falling to $11.8 billion and then $7.9 billion in the third and fourth quarters.

This follows a more drawn-out decline in China's venture capital space (although it's worth noting that the line between venture and growth is blurred). About $2.9 billion was committed in the final three months of the year, up on the previous quarter but down on the two before that. In fact, VC investment peaked at $23.6 billion in 2016 before moderating to $18.1 billion and $13.6 billion in 2017 and 2018, respectively.

The statistics should be seen in their proper context, though. While fewer dollars are being put to work in this area than earlier in the year, $7.9 billion is still the fourth-highest quarterly total and 2018 is a record year for growth-stage transactions in China – $52.4 billion was invested, more than three-and-a-half times the 2017 figure. There were 21 deals of $500 million or above compared to five for previous year in full.

Although the slowdown is inextricably linked to successive quarterly falls in overall private equity investment in Asia – it reached $40.5 billion in October-December – growth-stage tech deals have been a key factor in the region achieving its second-highest annual total on record. According to AVCJ Research, $183.3 billion was deployed, trailing only the $207.3 billion from 2017.

Growth-stage tech activity across all of Asia accounted for just under one-third of investment, up from 7.7% in 2017. Meanwhile, the buyout share fell from 40% to 27%. There were 16 buyouts of $1 billion or more in 2017 – only two of them involved energy or infrastructure in Australia – and they were responsible for 28% of overall capital deployed. The statistics for 2018 are 11 deals and 10%.

Korea and Japan were the only major markets to see an increase in activity during the fourth quarter, both due to big buyouts. In Korea, SK Shipping and the rest turned a weak year into a record-breaking one. As for Japan, Baring Private Equity Asia's agreement to pump about $900 million into Pioneer Corporation did little to disguise the transition from a record-breaking year to an underwhelming one.

2) Fundraising: More of the same

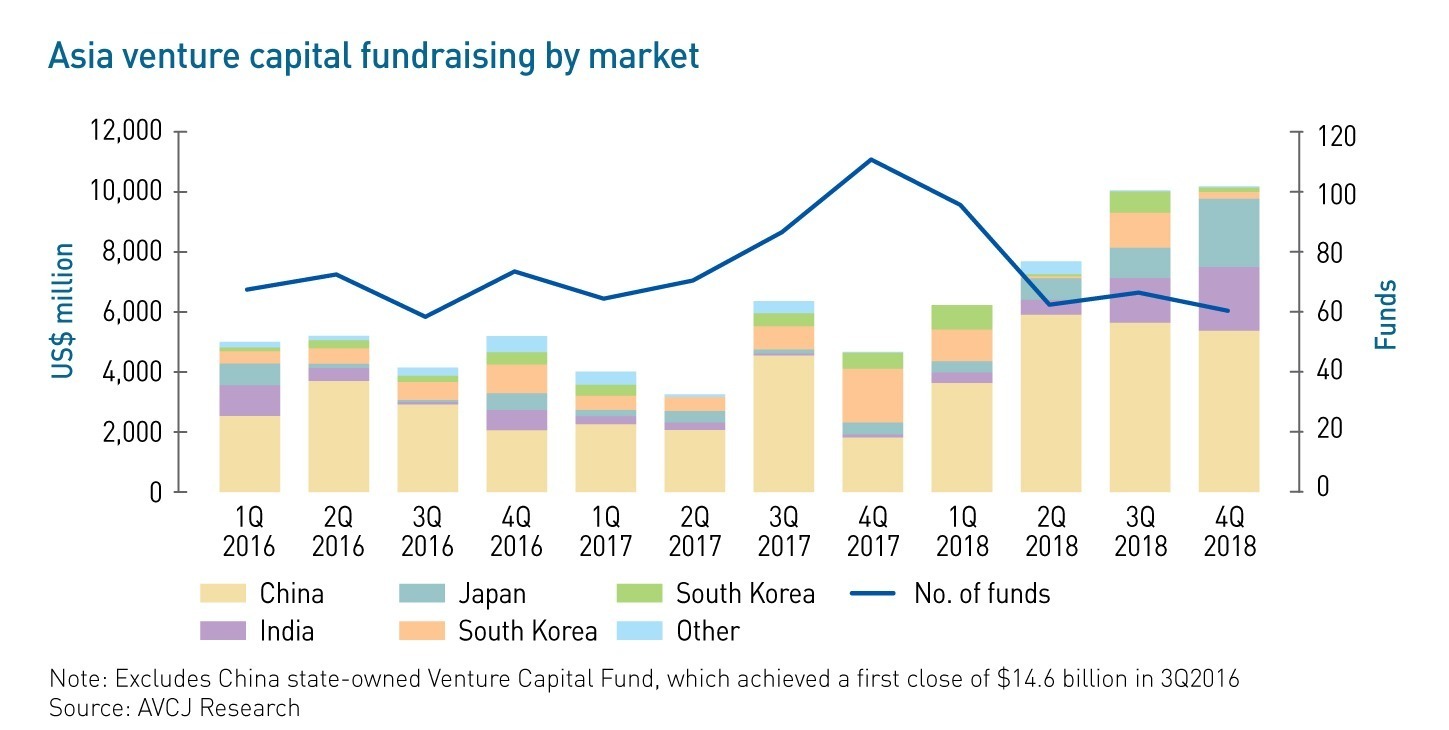

Asia venture capital fundraising reached $10.1 billion in the final three months of 2018, the first time it has surpassed $10 billion for a single quarter. Commitments became increasingly large over the year, with the fundraising record broken in three consecutive quarters. The $33.9 billion for 2018 in full is only $4 billion short of the combined totals for 2016 and 2017.

The dynamic environment is a testament to the continued interest in technology by investors. That said, the government role shouldn't be understated. The balance between commercial and policy objectives varies by market, making it hard to establish whether certain funds should not be considered or indeed whether there is any correlation between the figures announced and the amount of capital deployed.

Last year represents a new high because the China state-owned Venture Capital Fund, which achieved a first close of $14.6 billion in August 2016, is excluded as an outlier. But the total for the fourth quarter of 2018 includes $4 billion raised by government entities in Japan and India.

Nevertheless, the Asia VC fundraising story is still underpinned by China. Managers focused on this market received more than half of the capital committed in October-December and account for 60% of the annual total, including renminbi funds. A sizeable contribution came from GGV Capital, which raised $1.88 billion for multiple vehicles that cover seed through growth stages.

It is worth noting that in each of the three record-breaking quarters from 2018, only about 60 venture funds achieved incremental or final closes, compared to an average of 75 per quarter in 2016 and 2017. One theme highlighted in AVCJ's third-quarter analysis was capital flocking to brand names, which remains the case.

The same can be said of the private equity space. In the third quarter, the five largest funds accounted for nearly two-thirds of all capital raised. For the final three months of the year, only two funds – PAG Asia Capital and Bain Capital – attracted more than $2 billion and they contributed 30% of the $32.9 billion raised. Both were achieved in approximately five months.

In this way, the last quarter of 2018 saw a continuation of the trend that dominated the year: big managers raising ever larger sums, usually in double-quick time. A total of $139.4 billion was committed to the asset class, falling to $100.8 billion if renminbi-denominated activity is excluded. The top 10 non-renminbi funds raised were responsible for 48%. Eight are pan-Asian, seven were final closes and six had previous vintages. The average increase in fund size on the last vintage ranged from 33% to 152%.

The top 10 accounted for 50% in 2017, but they shared a much smaller pie of $62.1 billion. It is worth noting that if renminbi vehicles are included, Asia fundraising fell from $144.2 billion in 2017 to $139.4 billion in 2018 – which underlines how precipitous the falloff in China's local currency space has been.

Approximately 100 renminbi-denominated vehicles received $15.3 billion in the first three months of 2018. There were only 29 closes in the second quarter, with commitments reaching $13.2 billion. A loss of confidence among high net worth individuals and restrictions on participation by financial institutions contributed to a third-quarter collapse to $3.1 billion. A small rally in the final quarter – there were closes for 40 funds – saw fundraising hit $7 billion.

Renminbi funds bettered US dollar vehicles for capital commitments for 16 quarters in a row until the last half of 2018. With $38.6 billion in commitments for the year in full, the Chinese local currency share of Asia fundraising was 28%, down from 57% in 2017 and 63% in 2016.

The latter two years were buoyed by the launch of large government guidance funds, and questions are being asked as to how efficiently this capital has been deployed. A policy-driven revival in renminbi fundraising could still happen, but it would need to be accompanied by encouragement for independent operators and a relaxation of the curbs on domestic LPs. This might undermine efforts to clean up the domestic PE industry.

3) Exits: Stumbling to the finish

PAG Asia Capital's realized windfall on the IPO of Tencent Music was $57 million. Its ultimate gain will likely be far greater, with a 9.3% stake, currently worth about $2 billion, in China's dominant music streaming platform. Its initial investment, in what was then China Music Corporation, was below $100 million.

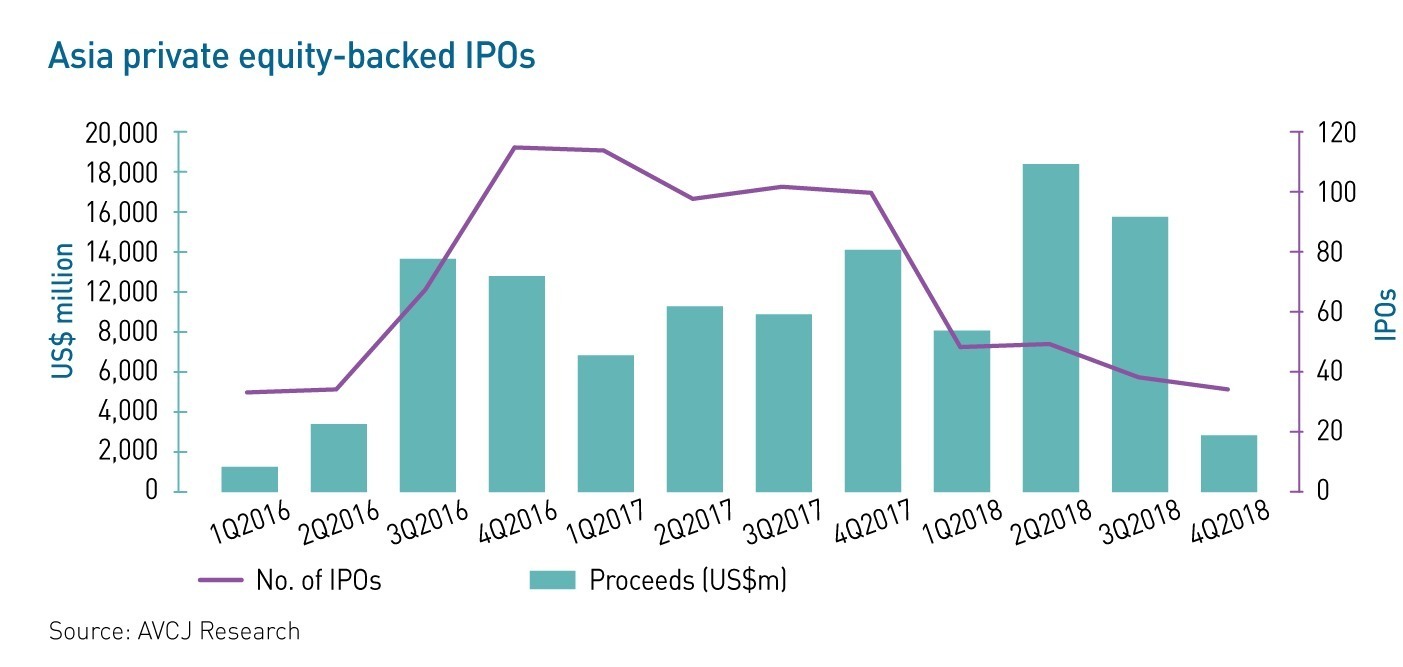

Tencent Music's $1.1 billion offering was one of few sizeable success stories from the fourth quarter of 2018 as proceeds from private equity-backed IPOs came to $3.1 billion. It is necessary to go back to the opening months of 2016 to find a lower total.

To a certain extent, Chinese companies have withstood volatility in global markets, if not at home. There were 19 IPOs featuring financial sponsors on mainland exchanges between April and June, followed by just one over the next two quarters. Hong Kong remained relatively active, going from six offerings in the third quarter to five in the fourth, while the US slipped from seven Chinese IPOs to four.

However, the drop in overall proceeds and generally conservative pricing suggest that it has become harder for companies to win public investor support. There was even some uncertainty over the timing of Tencent Music's offering. Plenty of other listings have been postponed or abandoned.

For 2018 in full, approximately 170 private equity-backed IPOs in Asia generated a combined $45.7 billion. It is the biggest year since 2014 by gross proceeds, thanks to large Chinese listings offshore, and the smallest since 2013 by number of offerings, thanks to reduced activity onshore.

Private equity exits in Asia follow a similar trajectory to IPOs: a peak in the second quarter followed by a gradual decline, with the October-December total of $17.1 billion the lowest in more than two years. More deals from the period may come to light, but the number of exits – about 70 – is the least since the aftermath of the global financial crisis. Notably, trade sale volume fell by nearly half on the previous three months.

Nevertheless, exits still surpassed $100 billion for the first time in 2018, ending the year at $117.1 billion. The number of transactions slipped below 500, compared to at least 600 in each of the previous two years, but a handful of large trade sales in the technology space shored up the overall dollar value.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.