China tech IPOs: Battle of the bourses

China has rolled out another proposal for a start-up friendly listing regime in Shanghai, this time with presidential imprimatur. PE investors are skeptical as to how quickly it could challenge Hong Kong

The five-day China International Import Expo kicked off on November 5 against the backdrop of a trade war with the US and a slowing domestic economy. For the Chinese government, it was an opportunity to showcase the country's globalization credentials and simultaneously boost sentiment at home. Based on the large numbers being bandied around, the event was a success: over $57.8 billion worth of deals signed by more than 80,000 participating Chinese and foreign companies, and 11 bilateral engagements between Chinese President Xi Jinping and foreign leaders.

For private markets investors, however, the biggest development had little to do with imports. It was Xi's announcement that the Shanghai Stock Exchange would launch a new independent board – the Ke Chuang Ban – specifically for listings by technology companies.

Notably, the proposed new board will adopt a registration-based application system, potentially marking a significant shift away from the current approval-based regime that is widely blamed for slowing the passage of companies to the public markets. The Ke Chuang Ban was soon being referred to as "China's Nasdaq 2.0," reflecting investors' hopes that it will serve as an updated version of Shenzhen's ChiNext. Launched in 2009, ChiNext was positioned as a NASDAQ-style board with flexible listing standards, but the trading volume of its 700 member companies is still less than 7% that of Shenzhen's main board.

"The proposed registration system will speed up China's capital market reforms and create a more streamlined process for the primary listing of unicorns and potential transfers of ChiNext-listed companies," says Yingfei Yang, a partner at law firm FenXun Partners.

It was not mere happenstance that Xi's announcement came at the import expo. Just as that event was in part designed to stimulate China at a time when sliding public markets capture a deterioration in the public mood, the Ke Chuang Ban serves as a promotional tool. China wants domestic investors to share in the success of homegrown technology giants. Snatching an IPO by a company like Ant Financial from the Hong Kong or US bourses would be viewed as a win for policymakers, brokerages, and retail investors.

The ambition is bold, but many investors do not anticipate rapid delivery. Ian Zhu, a managing partner at Nio Capital – an investment firm established by Chinese electric carmaker Nio, which listed in the US this year – points to the National Equities Exchange & Quotation (NEEQ), or New Third Board, when asked to explain his wariness. Starting from 2015, it became a credible and well-used listing channel for PE-backed companies, but liquidity has since dried up.

"We are closely monitoring the development of this new board and we hope the policies make it suitable for innovative companies, but as investors, we are not banking on those [initiatives]," Zhu says.

Liquidity lags

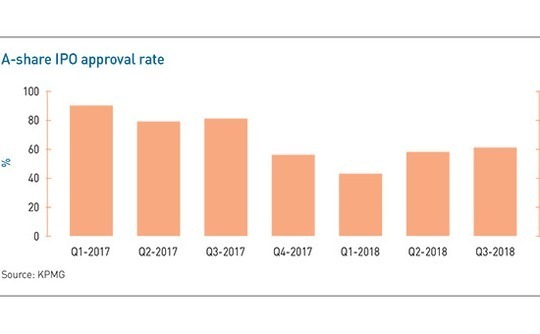

No implementation timetable for the new system has been put in place, but PE and VC investors might argue the sooner the better. China's IPO process is notoriously complicated and moves at a glacial pace, but frustration has steadily mounted this year as the securities regulator responded to increasing market volatility by further slowing approvals.

The Shanghai and Shenzhen bourses recorded 89 new listings with a combined value of RMB122.7 billion in the first three quarters of 2018, a 30% drop in number of the new share offerings from the same period last year, according to data from KPMG. Moreover, the number of active listing applicants has decreased significantly since the start of the year from 511 to 252 as of mid-September.

As a result, there have been just 42 IPOs by PE and VC-backed companies in mainland China, compared to 256 and 116 for the full 12 months of 2017 and 2016, respectively. "The current exit environment for domestic VCs is terrible. IPOs have experienced several cycles and now seem to be in a down cycle," says Zhenming Li, a managing partner at Insight Capital. "Rolling out the new board would be a huge boost for early-stage investment firms, especially those engaged in high technology industries."

Of the $78.6 billion deployed in China during the first 10 months of 2018, 57% went into growth-stage technology deals, compared to 25% in 2017 and 14% in 2016. The total includes bumper rounds for the likes of Ant Financial, news aggregation platform Jinri Toutiao, technology-enabled trucking logistics platform Manbang, and humanoid robot manufacturer Ubtech. Which ones would jump at the chance of a domestic listing if given the opportunity?

"I think the new board is going to be very helpful for PE investors. There is a natural demand of Chinese investors to invest in those new economy companies," says Victor Ai, a managing director at Hong Kong-listed China Everbright, who oversees renminbi and US dollar denominated funds, including the technology-focused CEL New Economy Fund. "CEL has 10 companies that could list in the next 18 months. We are working closely with the companies to see if they could qualify to list on the new board. With the launch of this new board, it's time for us to reap our rewards."

At present, most tech start-ups are a world away from being able to list on the domestic main boards. First, their valuations are too high; the consensus view is that a qualified company could not have a price-to-earnings multiple of more than 23x. Second, candidates must submit financial statements indicating at least three consecutive years of profitability – a challenge for tech start-ups that offer heavy subsidies to users as a means of building up market share.

None of online-to-offline local services platform Meituan-Dianping, video streaming site iQiyi or Nio would qualify under the existing regulations. The first went public in Hong Kong this year while the other two listed in the US, raising nearly $7.5 billion between them and generating liquidity events for CEL.

Regulators have hinted that the new board in Shanghai will have lower thresholds, including flexibility on past profitability, shareholding structure, and jurisdiction of incorporation. The implication is that companies based overseas would be welcomed. At the same time, limitations are likely to be imposed in other areas. For example, only qualified investors might be permitted to trade shares and applicants from certain sectors might be barred from entry.

"The new board is more likely to be developed to initially host the listings of well-known large-cap companies in the sectors such as artificial intelligence (AI), big data and technology, industries that are in line with the Chinese government's push to better develop its economy," says Paul Lau, head of capital markets at KPMG China.

A new rivalry

Focusing on this new economy agenda, the logical question is what happens to the Hong Kong Stock Exchange (HKEx), which has also amended its protocols to attract Chinese tech giants. Smart phone maker Xiaomi and Meituan-Dianping were the first to list with a weighted voting rights (WVR) structure – intended to let founders retain control despite dilution of their shareholdings – while four companies have gone public under provisions allowing IPOs by zero-revenue biotech businesses.

Suggestions that mainland regulators were concerned about Hong Kong's agenda clashing with its own increased earlier this year when WVR companies were excluded from Stock Connect schemes in Shanghai and Shenzhen through which Chinese investors can more easily buy Hong Kong stocks. "I think there could be direct competition between the new board and HKEx, even though the intention of the board is not to undermine Hong Kong as an IPO hub for Chinese companies," says Kevin Leung, an executive director responsible for investment strategy at Haitong International Securities.

The stakes are indeed high. HKEx has generated $12.9 billion in proceeds from PE-backed IPOs so far this year, with Xiaomi and Meituan accounting for more than two-thirds of the total. Meanwhile, US bourses have seen 27 PE-backed Chinese companies raise $19.6 billion, with the tech sector players responsible for 10 of the offerings and $5.1 billion of the proceeds.

The frenzy of Chinese listings – not all of them tech-related – has helped HKEx become the top-ranking bourse globally by IPO proceeds for 2018 to date, according to KPMG. Shanghai, which overtook the HKEx for the first time to claim second place in the rankings last year, had only one tech company among its three largest offerings – Apple supplier Foxconn Industrial Internet's RMB27.1 billion ($3.9 billion) flotation.

Despite talk of an intensifying rivalry, there are pros and cons to listing in each place. For instance, mainland bourses can usually be relied upon to give better valuations than Hong Kong because the investor base – which is still dominated by retail players – is familiar with the companies and high-quality tech companies are in short supply, according to Leung. Meanwhile, Hong Kong's registration-based IPO system offers greater speed and transparency. It is also easier to move capital overseas – a key consideration for many PE and VC investors – due to the absence of currency controls.

"We still see Hong Kong as the preferred venue for listings because it's more market-driven with clearer rules and fewer changes," says Xiaodong Jiang, a managing partner at Long Hill Capital. "So, for us, over the next three years, we are probably still going to choose Hong Kong. Of course, things are changing in the mainland. While moves by the Chinese government to further liberalize the capital markets and set up alternative venues for tech listings are welcome, it will take time for these things to change."

See it all before

Given the paucity of detail in the announcements made so far, an assortment of key issues remain unresolved. The most important of these is whether the initiative has staying power. This is not the first time the Chinese government has tried to bring technology listings onshore and some investors are worried there might be another false start.

In 2015, the State Council proposed a "strategic emerging industries board" for the Shanghai Stock Exchange to facilitate listings of technology companies, including pre-revenue internet firms. Following endorsements from Premier Li Keqiang and the securities regulator, a launch was expected in early 2016.

"When this proposal was made, regulators from the Shanghai Stock Exchange visited some of our portfolio companies to seek their opinions on the board, and some firms removed their VIE [variable interest entity] structures in preparation for domestic listings," says Li of Insight Capital. However, in March of that year, all mention of the board was removed China's 13th Five Year Plan, a blueprint for broad policy goals through 2020.

This abrupt removal was linked to a stock market rout in mid-2015 that wiped more than $3 trillion off the value of mainland shares in the space of three weeks. "It seriously shook the confidence of the regulators that they could push through this initiative, as they were worried that it would only end up as another disaster," one Beijing-based GP observes.

Another attempt to lure large technology companies to Chinese bourses came earlier this year with the publication of guidelines for China Depository Receipts (CDRs). This system is intended to allow overseas listed firms – including those with VIE structures through which overseas investors can get exposure to industries where foreign participation is forbidden – to sell shares domestically. The likes of Alibaba Group and JD.com responding favorably to the proposals, but traction has since been lost. Xiaomi was expected to be the test case, but it pulled out after failing to agree pricing terms with the regulator.

The failed strategic emerging industries board and the as yet unrealized CDR scheme underline how quickly the regulatory environment can change in China. This more than anything is responsible for muted expectations regarding the Ke Chuang Ban.

"It's easy to be skeptical about the idea because we have seen similar initiatives before, while the authorities have been talking about a registration-based process for years," says one Shanghai-based financial advisor. "The regulators need to clarify who will be the appropriate investors and the underlying fundamentals of the board."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.