Japan PE outlook: Slow and steady

GPs have built strong ties with corporate Japan by demonstrating value-add capabilities. These networks should serve them well as the market becomes more active

For many private equity investors, the sale of Toshiba Memory Corporation (TMC) is confirmation that the industry has come into its own in Japan. The JPY2 trillion ($17.8 billion) carve-out – announced in 2017 and closed this year – by a consortium led by Bain Capital Private Equity represents Asia's biggest PE-backed deal ever by enterprise value. It also helped save a venerable Japanese brand from bankruptcy.

Yet market participants are also quick to point out that this transaction is far from representative of Japan's PE space, where low to mid-cap buyouts are the dominant source of deal flow. Functioning as a source of both capital and high-quality business guidance, smaller GPs make themselves useful to the sellers of these assets, which range from large conglomerates looking to divest non-core assets to founders of smaller companies whose families have little interest in carrying on the business after they retire.

The strong networks formed over more than two decades of pursuing these deals mean that PE investors are largely confident in the industry's ability to weather any potential downturn. However, as growing competition in the middle market puts upward pressure on enterprise valuations and clouds gather around the global economy, Japan-focused GPs are reviewing their investment strategies with an eye to differentiating themselves from their peers.

"Staying focused on the fundamentals and the alpha of operational value creation, and generally expanding the underlying value of the portfolio company, are very important, because we can expect a volatile ride in markets, and potentially in valuations, given the obvious global macro uncertainties," says Mark Chiba, group chairman and partner at The Longreach Group.

Japan's private equity scene since the global financial crisis has rarely been flashy, though in recent years a growing number of large deals – in most cases, corporate divestments – have ballooned headline investment numbers. The TMC deal alone accounted for nearly two-thirds of last year's total capital committed. KKR's 2017 acquisition of auto parts maker Calsonic Kansei (announced in 2016 and valued at $4.5 billion) boosted the overall 2016 figure to $11.4 billion.

For many, the successful completion of these deals – especially TMC, which involved a consortium with several corporate and financial partners and overcame a number of challenges, such as regulatory review by Chinese authorities and a legal dispute by a competitor – signals that the last remnants of the stigma attached to PE in Japan has lifted.

"Corporate Japan increasingly sees PE as a partner that can sit shoulder to shoulder with them to solve problems around performance improvement, optimizing capital strategy, and refreshing managerial talent," says Paul Ford, a partner at KPMG in Japan. "That's exemplified by the great work and types of transactions funds like KKR and Bain have been doing."

Middle-market matters

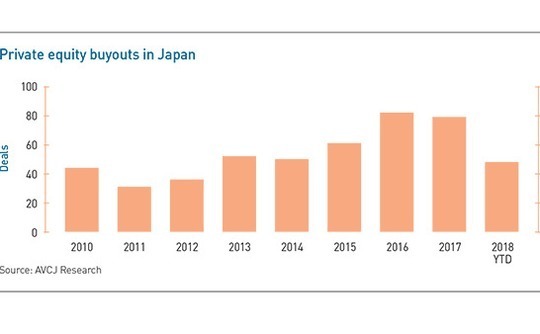

Beyond mega-deals such as these, the story of Japanese private equity has above all been one of consistent growth in deal volume at lower valuations. Excluding venture capital, a record 171 deals were announced in 2017, although this represented only a marginal increase on the previous year. At 79, the number of buyouts was twice the level from as recently as five years ago.

By far the majority of investment opportunities are in the lower middle market. Longreach's Chiba describes this area, where deal sizes typically fall between $10-100 million, as a "Goldilocks zone." Companies are scalable, can attract strong management, and have growth trajectories in Asia, but the deals can be done on a proprietary basis without involving an auction.

This dynamic may be changing as LPs, drawn by the headline deals, increasingly take notice of Japan and middle market fundraising picks up. Nine middle-market managers achieved final closes in 2017, some registering sizeable increases in fund size on the previous vintage. They raised $2.5 billion in aggregate, the most since the global financial crisis. These piles of dry powder, coupled with a decline in deal flow, mean that prices have started to rise to meet investor appetites. Fewer than 50 buyouts have been announced so far this year, which means the 2017 total is unlikely to be surpassed.

"In the last 24 months the deal flow that's come to market has slightly slowed down, and if we encounter one interesting deal the other private equity funds will try to compete with each other to take it," says Taisuke Sasanuma, a representative partner at Advantage Partners. "More importantly, a lot of the deals brought to the market have high growth potential, which will be reflected in the valuation multiple."

Quantifying the rise in the valuations is difficult, though one LP estimates that his GPs are currently willing to pay up to 9x EBITDA, as opposed to a standard multiple of 6x several years ago. The difference is relatively small, and some investors dismiss concerns about entry multiples, noting that the level of dry powder in the midcap space is still far below that of the large cap funds. Nevertheless, most market participants expect rising valuations to pose a challenge in the near term.

The possibility of a macroeconomic downturn is also weighing on Japanese investors' minds, amid developing disputes between some of the world's most significant economies. Navigating these uncertain seas effectively has become a primary topic of discussion among the community.

"Someone recently said at a conference I was at that this is the most highly anticipated recession in history," says TJ Kono, a partner at Unison Capital. "People have been talking about it for some time now, and I think some of the rhetoric about the trade conflicts and slowdown in certain large, influential markets, most notably China, are all a legitimate risk scenario. And of course, as risk grows, we have to be a little more conservative on entry valuation."

Conservatism has become the watchword of most of Japan's private equity investors, which are devoting a growing amount of effort to ensuring their portfolio companies are ready to weather whatever may unfold. This means both exercising discipline on future investments to make sure they are not exposed to global headwinds and communicating with their existing portfolio companies to see what dangers they might face.

"Generally speaking, Japanese domestic businesses should do okay. However, people are watching the tariff war between China and the US," says Kazushige Kobayashi, a managing director at Capital Dynamics. "Although it doesn't directly affect Japan, many Japanese companies export machinery to China, and Chinese manufactured goods are exported to the US."

Opportunity knocks?

This global uncertainty is considered both a challenge and an opportunity. A downturn could provide a platform to test the benefits of a firm's value-add strategy, along with driving out some of the opportunistic investors that are seen as responsible for the valuation issue. Valuations themselves are also considered likely to benefit Japan's PE community over the long term.

"For one thing, it forces funds to develop proprietary deals more and proactively create opportunities because the penalty of going to auction is higher," says KPMG's Ford. "Secondly, it forces them to be more creative with their value creation strategies, because you have to find new sources of value to justify some of the premiums being asked in the market."

KKR is cited as an example of a creative value-add strategy. The firm recently announced that Calsonic Kansei would acquire its European peer Magneti Marelli, creating a global auto components supplier. This follows a similar transaction involving Panasonic Healthcare and a division of Bayer.

Some Japanese GPs are also pursuing a platform-building strategies of their own. Longreach acquired Wendy's Japan in 2016 and subsequently bought domestic rival First Kitchen from Suntory Holdings to form a Japanese fast food business. The Wendy's deal is also an example of a GP leveraging an existing portfolio company for proprietary deal sourcing. Longreach's later purchase of coffee shop chain Kohikan was based on the supplier relationship between Kohikan's parent company UCC Holdings and First Kitchen, which bought coffee beans from UCC.

"It's a really good test of how you have constructed your portfolio up to that point, and how you've set up your ability to create value," says Unison's Kono. "Instead of just paying down debt, can you improve EBITDA? Can you improve the business model? What we have done is focus on certain areas that we think offer more consistent possibilities for value add, and approach it that way."

Despite the challenges posed by rising valuations and trade uncertainties, sentiment regarding Japanese PE remains strong overall. While high-profile deals will continue to draw headlines, the meat of the opportunity remains in the domestic companies and the alliances they have formed with private equity funds to drive their companies to the next stage.

"The size and scope of the opportunity is so big that the overall market profile doesn't need to change for private equity volume to grow significantly in Japan," KPMG's Ford says. "We'll see it more from accelerating trends within the existing market structure such as the increasing openness of sellers to dealing with private equity, the acceptance of divestitures as a valid corporate strategy, and the aging of the postwar entrepreneurial cohort."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.