China PE outlook: End of the party

Growth stage technology deals have retained a strong following in 2018, but elsewhere in Chinese private equity the mood is more somber

When Ant Financial, the financial services affiliate of Alibaba Group, closed its $14 billion Series C round in June at a valuation of more than $150 million, weakness in the broader Chinese economy was already evident. Public markets had peaked in January and were falling; government deleveraging efforts had led to tighter liquidity; capital was thinning out in the start-up space; and the US had started imposing tariffs on Chinese exports.

Over the ensuing five months, pessimism has intensified. The Shanghai Composite Index has now dropped 20% since the start of the year, while the Hang Seng Index has lost 15% in value. Trade relations with the US have worsened. Private markets investors have reason to be wary.

“There has been a fairly dramatic shift in views in the last six months. People have started to doubt the growth prospects of sectors that used to be red-hot,” says Yichen Zhang, chairman and CEO of CITIC Capital. “While the trade war hasn’t had a tangible impact on trade numbers, the effect lies more on the psychological side, making people question whether certain business models are sustainable and what might happen to companies if they cannot keep on raising money.”

Some analysts suggest it could take six to nine months for the full impact of the public equities decline to be felt in private markets, but this can hardly be described as the consensus view. A variety of factors could accelerate that timeline and deepen the trough – just as more forthright government intervention might temporarily alleviate the pain.

“A lot of companies that received investments this year could face enormous valuation pressure in 2019 amid the slowdown in economic growth. In addition, if there is a slowdown in China’s consumer sector as well, this would affect a large number of companies,” says William Shen, CEO of CRE Alliance, a private equity joint venture between China Resources Enterprise (CRE) and Great Wall Asset Management.

For all the problems a downturn might present to PE investors that have money in the ground, those with capital to deploy are cheerful. They are looking forward to a period that is not characterized by an abundance of terms sheets for every company and founders continually increasing their asking prices.

“I’m happier than four months ago. When markets are going through a downcycle, such as in 2000 and 2008, and when others are hesitant to invest, it usually is a good investment opportunity for me,” says Jonathan Wang, a founding partner and senior managing director of OrbiMed Asia, a specialist healthcare investor.

A technology story

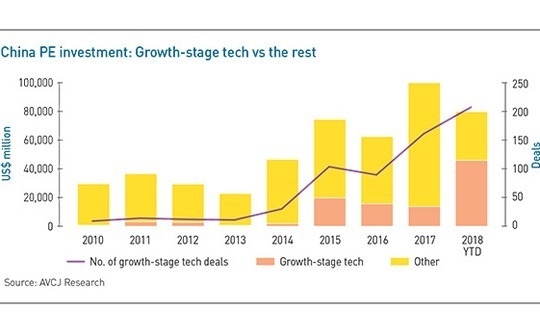

The fact that Ant Financial was able to command such strong interest in an uncertain environment says much about the recent dynamics of China private equity investment. Deal flow appears to have remained strong in 2018, with a total of $78.6 billion was committed during the first 10 months, compared to $99.2 billion for 2017 as a whole. However, 57% of this went into growth-stage technology deals. Even by China’s recent standards, that’s high: in 2016 and 2017, it was 14% and 25%, respectively.

Move to the earlier stages of the technology space and the picture is very different. A total of $10.9 billion was deployed across around 820 venture capital deals in the first 10 months of the year. In 2017, nearly 1,300 transactions were announced and the total invested was $18.1 billion. “The overzealousness in China’s VC space in the past three or four years was hard for me to digest. Now, things have become more rational,” says Wei Zhou, founder and CEO at China Creation Ventures.

Asked for examples of irrational behavior, he cites the speed at which companies went through funding rounds and the knock-on effect this had on valuations. There have been multiple cases of start-ups raising six rounds in the space of 12 months, while many would launch the process for a second round before they had closed their first. Another ploy was to raise four tranches of funding but group them together as a Series A.

A contributing factor to the market correction is likely a slump in renminbi-denominated fundraising that dates to the second quarter, following the imposition of restrictions on bank participation in private equity. According to the Asset Management Association of China (AMAC), as of August, a total of 24,191 registered managers had issued 70,000 fund products – several times the comparative figures for the US market. It remains to be seen how many survive.

“Some of the current players should not be engaging in any investment activity at all because they lack expertise and insights into certain sectors. They are just people who chased whatever concepts were hot at the time, looking flip their stakes and cash in quickly,” says one China-based fund-of-funds manager.

Technology, media and telecom (TMT) is just one of three sectors in which industry participants claim to see signs of an actual or impending correction – but it is where the patterns are most complex. The bifurcation between growth and early-stage deals reflected in the headline investment numbers is supported by anecdotal evidence.

On one hand, a Beijing-based GP observes that a not-so-well-known company he is tracking recently slashed the target amount for its Series B by 40% in response to changing market conditions. On the other, Kuaishou, a video streaming app backed by Tencent Holdings, is reportedly looking to raise new funding at a valuation of $25 billion.

It would appear investors are still comfortable backing market leaders in major technology verticals – and if these companies are aligned with an established industry player, all the better. A total of 32 deals of $500 million or more have been announced in China since the start of the year; 30 are expansion or pre-IPO rounds for technology companies; and 17 are for businesses that have some affiliation to Alibaba Group or Tencent.

“There seems to be various tiers of technology companies in China. Once a firm becomes incorporated in either the Alibaba or Tencent system, I think that valuations in that end of the spectrum remain very high. Which stages the companies are in don’t matter that much, in comparison,” says Marcia Ellis, a partner at Morrison & Foerster.

The bubbles deflate

The other two sectors are healthcare and education. The healthcare bubble is most apparent in drug development, which has seen $3.8 billion in PE and VC investment this year, up from $1.6 billion in 2017. This has facilitated the emergence numerous healthcare unicorns, such as Fosun Group’s $1.5 billion biotech arm Henlius Biotech, which is considering a $500 million Hong Kong IPO even though it hasn’t taken a single product to market.

The Hong Kong Stock Exchange’s move to allow listings by pre-revenue biotech companies helped spur investor interest in the space, but the first three companies to go public under the new regime have underperformed. This has weakening overall sentiment. “Even through the first half of 2018, China’s healthcare sector had strong momentum. But over the last four months, it has cooled down, due to the weak markets, the trade war, and reduced support from renminbi funds,” says Wang of OrbiMed.

As for education, asset-light players such as online tuition platforms can still raise capital at attractive valuations, provided they have sufficient scale, industry participants say. The outlook for companies that operate brick-and-mortar teaching facilities is not so positive. In August, the government issued new guidelines that drew a clear line between public and private education providers, potentially making it harder for the latter to sell services to the former. As a result, valuations have taken a hit.

“In education I’m seeing people agree to much lower prices than they would have a year ago, because of the draft regulations,” Ellis adds. “Although we don’t know whether the draft rules will come into force, or how exactly things will fall out, it will definitely impact the sector.”

How fund managers respond to the uncertain environment depends on their existing exposure, their investment mandate, and their general perception of the China market. Predictably, the most active sellers include renminbi funds, family offices and US hedge funds – groups typically known for coming into late-stage rounds for technology companies at elevated valuations.

Investors that have generally avoided the technology space feel differently. “China’s traditional consumer sector looks like it’s in a trough. It is a great opportunity for value investors who are disciplined in terms of the sectors they pick and who can do the heavy lifting to understand which companies will be the winners and losers,” says Stuart Schonberger, a managing director at CDH Investments.

If there is one point on which they all agree it’s that Chinese private equity stands to benefit from a period of rationality, assuming that is indeed what comes to pass. With less pressure to deploy, fund managers can be more selective and the companies that receive funding will use it more judiciously.

“This is because there will be less noise around companies. Before, when one firm got funded, six or seven of its rivals got funded as well, so the deployment efficiency was not so good,” says Jixun Foo, a managing partner at venture capital firm GGV Capital.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.