Australasia PE outlook: Return of the take-private

Large-cap GPs are setting their sights on listed companies, with healthcare, education and technology top of the list

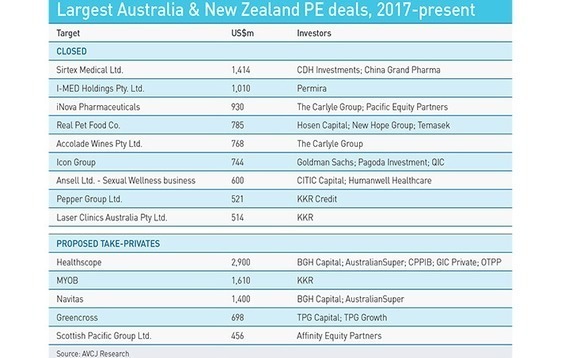

Public-to-private transactions are back in vogue in Australia. Over the past six months, BGH Capital has made offers for Healthscope and Navitas, TPG Capital and KKR have gone after Greencross and MYOB, respectively, Affinity Equity Partners has won board support for a Scottish Pacific bid, and CDH Investments has completed an acquisition of Sirtex Medical.

Four of those bids – plus BGH's latest approach to Healthscope, with an unchanged proposal – have come within the last two months, during which the ASX200 Index has dropped from a post-global financial crisis high to a 12-month low. That said, public markets are not cheap: companies are still trading a 12-month forward price-to-earnings (P/E) multiple of 15.5x.

While concerns about rising interest rates and geopolitical instability have hurt consumer and business confidence in recent months, the local economy remains stable. Even the recent public market volatility has been relatively modest in a global context, given the ramp up in prices over the last 18 months wasn't of the same magnitude as that seen in the US.

"As an economy based largely on domestic consumption, with high immigration rates and with mining and agricultural exports that remain attractive to overseas buyers in almost all economic conditions, we are quite well insulated. Now is a positive time for the national accounts, the federal budget and shareholders in mining companies, because the US dollar is strong and commodity prices remain high. Unless Australia is drawn into some specific element of the China-US trade conflict, we can expect to remain insulated," says Tim Sims, a managing director at Pacific Equity Partners (PEP).

The recent spate of attempted take-privates, even as valuations remain buoyant, reflects a keenness to take advantage of any perceived dislocation. David Willis, head of Australian private equity at KPMG, observes that the stream of dividend payments which had kept investors happy and share prices buoyant is coming to an end for many companies. The response to underperformance can be "quite savage," which in turn can encourage private equity.

At the same time, these investors are looking for opportunities in a market where large-cap deals are scarce and there is plenty of capital available for deployment.

"Deal activity across private equity generally is moderate and the gestation period for investments is lengthening. Company owners have seen property prices going up, stock prices going up, and overvaluation in other asset classes. They don't want to sell unless they are offered a ridiculous amount of money," Willis adds. "With the market moderating a bit and share prices coming off, people at the large end of town are looking at public-to-privates again."

Target identification

AVCJ Research has records of approximately 75 buyout transactions with enterprise valuations of $300 million or more in Australia and New Zealand since 2010 and 18 since the start of 2017. In each period, about one-third of the deals are energy, infrastructure, transportation and distribution, and therefore fall beyond the remits of most mainstream private equity firms.

Infrastructure distorts headline investment numbers as well. Of the $16.2 billion deployed so far this year, A$9.3 billion ($6.7 billion) went into the acquisition of a 51% stake in Sydney's WestConnex highway system. Investment reached $15.3 billion in 2017 and a record $36.9 billion in 2016. The former saw no substantial infrastructure deals; the latter saw several.

The four companies currently subject to take-private offers have a combined enterprise valuation of around A$9 billion – a sizeable contribution to the overall PE total even after some existing shareholders roll over their positions into the acquisition vehicles. However, success is by no means guaranteed. In the last eight years, there have been only six successful privatizations of listed companies worth $300 million and above. Numerous other attempts have failed to win favor.

"The scars many PE sponsors wear from unsuccessful larger-scale take-private attempts in Australia are extensive," says Mark McNamara, a partner at King & Wood Mallesons (KWM). "Mid-market transactions in the public space have generally been easier and found success. It is the large-scale deals where sponsors have run into real and consistent resistance from boards."

However, the two ongoing situations involving BGH suggest that private equity may have found an edge. AustralianSuper is an LP in BGH's fund and an existing shareholder in each company. It said it would vote its shares in support of the take-privates. This change in approach from Australia's largest superannuation fund has stirred a moral debate.

"One argument is that super funds should be part of the corpus of public investment, providing liquidity as stable long-term shareholders in good companies. The other is that they should do the best for their investors, even if that means disadvantaging other investors in favor of their own position and acting more like corporate raiders," one local GP observes.

Paying a premium for a public company – and forgoing potentially more lucrative take-private offers for the business by siding with a particular consortium early on in a process – also represents a very different risk-return proposition. However, multiple industry participants expect other superannuation funds to follow AustralianSuper's lead.

"AustralianSuper is the first super fund in this market to proactively support a sponsor as part of its initial bid approach and to do so on an exclusive basis that," adds KWM's McNamara. "It is seemingly happy to continue investing but would rather do so in a private state with a sponsor as a significant owner. It's not something we have seen before, a super fund actively supporting a private equity player, but I think we will probably see more of it. This is a new dynamic in my mind."

It is no coincidence that healthcare, education and technology feature prominently in the latest cluster of deals. Sims of PEP observes that large GPs typically gravitate to sectors that offer economies of scale and companies that are asset-rich and often listed. If these happen to be sectors with regulated reimbursements and volumes, they may be able grow at a faster pace than GDP, supporting the high entry and exit multiples required from public market transactions. Healthcare and education fit this model, but their appeal stretches across the private markets spectrum.

Of the 10 largest private equity deals announced in Australia and New Zealand since the start of 2017, excluding energy and infrastructure, five involved healthcare assets: Sirtex Medical (CDH), I-Med Holdings (Permira), iNova Pharmaceuticals (PEP and The Carlyle Group), Icon Group (Goldman Sachs, QIC, and Pagoda Investment), Laser Clinics Australia (KKR), and Novotech (TPG Capital). The EBITDA-to-enterprise value multiples paid for I-Med, Laser Clinics, and Novotech are said to have been in the 11-15x range – the three-year average EBITDA multiple for mid-market deals is 8.4x – but the buyers were willing to pay up because of the strong growth profiles.

"There are a few demographic trends that help," says Alex Emery, partner and head of Asia at Permira, in reference to diagnostic imaging specialist I-Med. "Australia's population is growing and aging, and people need more imaging services as they get older. There is also an increasing realization that preventative medicine costs the state a lot less. By using MRIs to catch conditions earlier, survival rates improve, and it saves the country a lot of money."

In addition, I-Med appealed because its business is sticky – the company signs multi-year contracts with hospital groups and there is little incentive to change provided the pricing and level of service are acceptable – and its industry is fragmented. Several smaller independent diagnostic imaging providers have already been acquired as part of a consolidation effort.

More recently, KKR bought back into cancer and cardiac services provider GenesisCare because it recognized the potential for continued growth at home and overseas. Having sold its 45% stake in the company to China Resources Group and Macquarie in July 2016, the private equity firm has agreed to return with a 20% holding. The enterprise valuation on reentry is A$2 billion, compared to A$1.7 billion on exit.

Small is beautiful

If take-private transactions come in intermittent bursts, the consistent sources of private equity deal flow in Australia and New Zealand remain corporate carve-outs, founder succession situations, and growth funding opportunities. There is also a healthy stream of assets passing from mid-cap to large-cap GPs, typically as what was initially a succession deal becomes a scale-up opportunity, perhaps with an element of cross-border expansion. Icon, Laser Clinics, and Novotech all fit this profile.

"Large GPs have a limited market of prospects in Australia – we estimate 200 to 300 – so they naturally find the corporatized businesses in the portfolios of mid-market and lower mid-market GPs attractive," says Robert Radcliffe-Smith, a managing partner at Advent Partners. The lower mid-market firm sold Junior Adventures Group, an outside school care provider primed an industry consolidation play, to Quadrant Private Equity earlier this year.

In contrast to the large-cap space, managers operating in the mid and lower tiers of the private equity market in Australia and New Zealand face relatively little competition for deals. Radcliffe-Smith notes that Advent seldom finds itself in competitive situations, and even when it does, the other parties tend to be trade buyers. However, valuation is just part of the equation.

"For business owners, price is one of many factors. They want a fair price, understandably, but more importantly, they want a partner that will be a good custodian of the business and help get the company to the next level," says Jeremy Samuel, a managing director at Anacacia Capital, another lower middle market GP. "We are also choosy in who we work with. There are a lot of opportunities in the lower mid-market, but you must take care in picking the right ones."

In Australia specifically, the GP community has been shaped by the preferences of domestic investors that traditionally accounted for the bulk of LP commitments. Some groups have diversified their portfolios to include more international PE exposure at the expense of domestic coverage, while others have withdrawn completely due to fee concerns. Pressure from local LPs over fees is still cited by GPs as one of the major challenges presented by the industry.

The volume of capital available is largely the same, but there has been some change in the identities of those deploying it. Upper middle market stalwarts like Archer Capital and CHAMP Private Equity have retrenched – the future of the former is undecided; the latter has downsized – while Quadrant, Crescent Capital, The Growth Fund, and Mercury Capital are raising larger funds. This has created space in the lower middle market.

"When I came back to Australia from London in 2006 I found that A$200-275 million fund size area was very competitive. Now, though, there is more activity in the A$600 million to A$1 billion area," says Willis of KPMG. "When I talk to managers at the lower end, with funds below A$330 million, they are very happy down there because there is less competition. But the upper mid-market has become the more competitive area, there are auctions now."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.