Portfolio: Advent International and King Koil China

Looking to apply its US mattress retail expertise in China’s fragmented market, Advent International bought King Koil China two years ago. It is now in the process of boosting online and offline sales growth

Sleeping on a soft, well-crafted mattress might have been denounced as corrupt bourgeois behavior during China's Cultural Revolution years. Five decades on, premium bedding is an increasingly popular status symbol among a swelling middle class that aspires to more comfortable lifestyles – and wants others to know it.

Advent International first recognized the potential for mattress retail in China six years ago when it acquired a controlling stake in AOT Bedding Super Holdings, the parent of Serta Simmons Bedding, which accounts for about 40% of the US mattress market. The deal was worth around $3 billion and came from the firm's seventh global fund, which closed at $10.8 billion in 2012.

"Through this deal, we better familiarized ourselves with the industry and it was then that we started to notice the huge opportunity China holds, partly thanks to the many discussions we had with the teams at Serta Simmons." says Andrew Li, a managing director and co-head of Greater China at Advent.

The Chinese market is in many respects the mirror image of the US. In the former, the top 10 players account for less than 10% of sales; in the latter, it is 85%. This contrast – and the high level of fragmentation it implied – underlined China's growth potential if a leading operator could be secured and set on the right development track.

Second time lucky

It didn't take long for Advent to identify King Koil China as an acquisition target. The company supplies around 35% of the mattresses used in China's high-end hotels – when assessing whether something is premium, Chinese people tend to use such establishments as a reference point – and also has a large retail presence covering online and offline channels. Its overall share of the country's premium mattress market is 6%.

However, another GP moved quicker. CITIC Capital bought a controlling stake in King Koil China in June 2014, saying that it would help the company expand its retail presence. The number of offline stores increased nearly fivefold to 330, while online sales rose tenfold. Previously a mattress manufacturer that relied on hotels for most of its revenue, by 2016 the company had fully embraced a B2C model with retail sales contributing about two-thirds of revenue. CITIC duly decided to sell.

"When we saw that CITIC Capital had acquired King Koil China we thought we had missed the opportunity. Then in 2016 when CITIC proposed to exit, we were already fully prepared and jumped at the chance quickly," says Li. Advent picked up the business for an undisclosed sum, via its eighth fund, which closed earlier that year at $13 billion; CITIC is said to have secured a 4x multiple on the investment. King Koi's management retained its minority ownership stake.

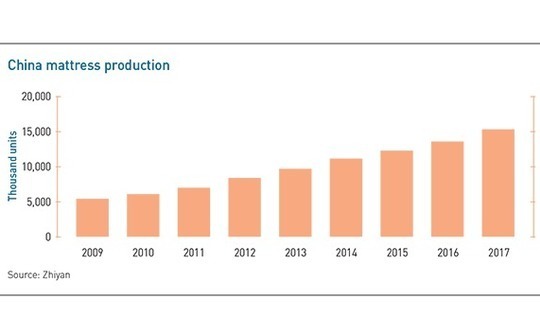

The Chinese mattress market is projected to be worth RMB125 billion ($19.8 billion) by 2022, up from RMB86 billion last year, according to Advent. King Koil China says the premium segment – defined as products priced at RMB6,000 and above – currently makes up 20% of sales. It has been growing at a rate of 20-25% a year, compared to approximately 10% for the mattress market as a whole. The key driving factors are the expanding middle class and rising property sales prompting greater demand for furniture over the last two decades.

Advent's research indicates that China is the world's largest mattress market by volume and second-largest by value, following the US. There are more than 1,000 different brands competing for customers.

While the premium segment is dominated by imported international labels such as US-based Sealy, with King Koil China leading the local contingent, the middle to low-end bracket remains the preserve of domestic brands like Sleemon, a Shanghai-listed mattress maker that has a 3% market share. In recent years, Sleemon has sought to expand into the premium segment because the margins are higher.

As such, King Koil needs to scale up over the next three to five years if it is to leapfrog the domestic and international competition. Advent has promised to support these efforts through a combination of organic growth and M&A. "We want to grab the opportunity presented by the fast-developing Chinese mattress industry and so the main purpose for our business is to get scale quickly. The industry is already going through a period of consolidation and we would like to be in the first echelon," says Wang.

Retail penetration

Founded in 2000, King Koil China is the exclusive licensee of several international brands including King Koil, Aireloom and Life Balance. US-based King Koil is the master licensor, receiving an annual fee from the Chinese company for the right to use the brand name. It has no equity interest in King Koil China.

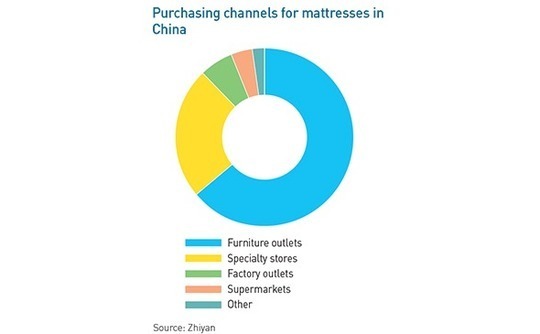

While sales to high-end hotels still account for a significant part of the company's business, the shift from B2B to B2C that began during CITIC's holding period has continued under Advent. This has been supported by growth in the retail network, with King Koil now operating around 500 stores nationwide. Nevertheless, the company still trails its major competitors, some of which have over 1,000 outlets.

One of Advent's initiatives aimed at boosting retail penetration is partnerships with other leading players in China. The GP recently provided financial support for a joint venture between King Koil China and Serta China, the exclusive local licensee of Serta-branded products. Serta Simmons has a minority equity interest in the company – it is controlled by Airland Group, a Hong Kong bedding provider – and also receives royalty payments.

The joint venture will see the two companies combine their internal resources and distribution channels. However, they will still operate independently branded retail entities.

Advent's plans do not end there, though. The GP has offered to buy Serta China outright, according to a statement published by China's anti-monopoly bureau in September. In the meantime, Serta Simmons Bedding has bought a minority stake in the joint venture and granted the entity a new, perpetual exclusive license for Chinese distribution of Serta products.

"The merger could help both us and Serta China have a bigger sales platform in China. In addition, we could complement each other's distribution channels. King Koil China has the best penetration rate in terms of online sales of premium mattresses, while Serta China has a strong offline presence, spanning 300-400 cities. We could help each other have better penetration in each channel," says Wang.

There are more than 1,400 Serta outlets in China that sell eight major mattress brands, ranging from AvantGarde to iContour to Perfect Sleeper. Li admits that King Koil China could do more in terms of developing its offline operations, especially in second and third-tier cities.

Another aspect of Advent's value-add efforts is bringing international expertise into China. The firm has a 70-strong operating partner team, comprising experienced senior executives from different industries who act as independent advisers to portfolio companies. In addition, people from Serta Simmons were invited to King Koil China. They visited factories in Shanghai and Chengdu, which have a combined capacity of 500,000-700,000 mattresses a year, and offered advice on improving operational efficiency.

"Advent's expert resources have been extremely helpful for us. When there are difficulties in our daily operations, we can reach out to Advent, which is quick to offer assistance through Chinese and foreign experts," says Wang.

Other areas in which the private equity firm has driven change at King Koil China is supply chain management. New talent was recruited to lead these operations, resulting in the on-time delivery rate for products rising from 60% to 90%.

Structural growth

The question for all retail-oriented companies in China is how they will fair in the face of weakening consumer sentiment. The economy expanded 6.5% in the third quarter, the slowest pace of growth, since the global financial crisis, while most major industrial, investment and consumer indicators have weakened. Meanwhile, the Shanghai Composite Index is down more than 20% on a one-year basis.

For all the talk of a consumption upgrade in China, the combination of slowing growth, trade tensions with the US, and plummeting public markets have prompted concerns about the willingness to spend. Retail sales growth has been volatile, but certain segments are experiencing a clear downward trend. Car sales – a key indicator of consumer sentiment – are slowed for three consecutive months, with some analysts predicting the first contraction in this segment since the 1990s. Luxury goods have also been hit. For example, distiller Kweichow Moutai recently posted its slowest earnings growth in three years.

Asked whether he fears a consumption downgrade as shoppers turn their backs on premium products like King Koil China mattresses, Wang argues that people are not necessarily spending less, just becoming more rational. "It's not a downgrade, in my opinion, consumers are putting money in places that they deem more appropriate. They want things that are high quality but also offer value for money, such as our products," says Wang.

The company is also identifying new sources of growth that are structural rather than cyclical in nature. A decade ago, a mattress was a subsistence product – consumers bought the cheapest product, paying little attention to brand. Now health is a more important consideration, which is driving demand for premium mattresses that protect the spine and offer a better night's sleep.

King Koil has responded to this trend by emphasizing spinal health in its marketing efforts. It teamed up with the International Chiropractors Association to launch a "spine protection for all" campaign, attracting participation from consumers in 60 Chinese cities. Advent is keen to see more initiatives that target the priorities of the modern Chinese consumer.

"We will help the company build up a marketing team as well, so it can better increase brand awareness and educate consumers on the importance of choosing the right mattress," says Li.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.