3Q analysis: Favoring the few

Brand names dominate Asia fundraising to an unprecedented degree; China IPOs continue despite weakening markets; Taiwan, Australia and Singapore deliver an unlikely investment boost

1) Fundraising: The concentration effect

The phenomenon of a large amount of capital ending up in the hands of a relatively small number of managers is well established in Asian private equity. Preliminary data from AVCJ Research suggests the third quarter of 2018 conforms to this trend – but is unusual in both the level of concentration in fundraising activity and the nature of the managers involved.

With renminbi-denominated fundraising in retreat, Chinese government guidance funds can no longer be relied upon to serve as the big beasts in Asia's private equity space. At it happens, a cluster of large pan-regional players have emerged to fill the void.

Hillhouse Capital's $10.6 billion fundraise is extraordinary for any number of reasons: the largest pool of private equity capital raised for deployment in the region; a manager with a somewhat sparse track record in buyouts winning endorsement for an investment strategy that is in part control-oriented; and an investment firm founded as recently as 13 years ago confirming its place among the global elite. It also accounted for nearly one-third of all capital raised during the quarter.

If anything, this statistic – which could change as previously unannounced activity comes to light – points to weakness in the broader fundraising environment. Aggregate commitments came to $32.7 billion, a third consecutive three-monthly decline, and while the number of funds achieving a partial or final close actually increased, it is still far short of the average for the previous eight quarters.

With Baring Private Equity Asia hitting a $4.5 billion first close on its seventh pan-regional offering, India's National Investment Infrastructure Fund (NIIF) attracting commitments of $2.5 billion, and Yunfeng Capital and CITIC Private Equity raising $2.5 billion and $2.2 billion for their latest China vehicles, the five largest funds were responsible for two-thirds of the regional total.

A similar trend runs through the venture capital stratum. Fundraising reached $7.1 billion for the April-June period, the largest quarterly total in seven years, if the state-linked China Venture Capital Fund-of-Funds is excluded. This hot streak continued into the most recent three months, with $7.6 billion in commitments. However, there were only about 50 closes in each of second and third quarters – the lowest since early 2014 – as large players attracted most of the available capital.

Sequoia Capital is the most egregious example of this. The firm's China franchise took in $2.5 billion, including $150 million for its debut seed fund, $550 million for a seventh venture vehicle, and $1.8 billion for a growth fund. While the amount of capital raised for the venture strategy was roughly in line with the previous vintage, the growth fund is nearly twice the size of its predecessor, underlining the popularity of products that back companies across multiple funding rounds as they scale up. It is worth noting that Hillhouse has enough flexibility in its mandate to address this opportunity as well.

With Sequoia India achieving a final close of $695 million on its sixth vehicle, a single brand drew in more than 40% of the money committed to VC managers during the third quarter. This flight to quality suggests that raising early-stage technology vehicles is not as straightforward as it was three or four years ago, but the 10 largest final closes comprise a mixture of old and new names.

Sequoia, GSR Ventures and Matrix Partners India fall into the former category, whereas the likes of Long Hill Capital Management and China Creation Ventures (CCV) represent the latter. Long Hill, a China spin-out from New Enterprise Associates, found its second fund was oversubscribed, facilitating a final close of $265 million within three months. CCV, which was founded by former KPCB executive Wei Zhou, took about nine months to raise $200 million for its debut vehicle.

The concentration effect within Asia fundraising is partly a function of which GPs are in the market at any given time, so the third quarter may in hindsight be described as the extreme manifestation of an accepted trend. However, the shift in the center of gravity from renminbi to US dollar funds appears set for the time being.

In the final three months of 2017, renminbi funds received 54% of the aggregate capital committed to Asian managers. This share fell to 41% and then 38% over the next two quarters, before collapsing into single-digit territory for July-September 2018. A fresh policy initiative could drive a turnaround, but this is unlikely given the steps taken this year to remove bad actors from the market – restricting bank participation in funds, taking a tougher line on custodian arrangements, and bringing new registrations near to a halt.

Eighteen months ago, established US dollar fund managers were busy adding renminbi vehicles, so they could tap the liquidity boom. Now local GPs are trying to leverage their track records in the renminbi space to raise US dollar capital.

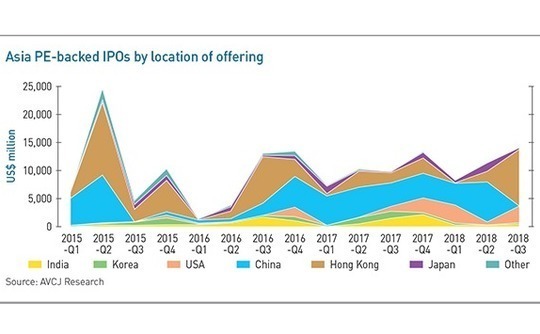

Volatility doesn't help public market exits. The recent global sell-off that started in the US and has since spread to jurisdictions across Asia is barely a week old. But a more gradual slide on the mainland China and Hong Kong bourses began in June and this likely made private equity investors reluctant to realize their liquid positions. Public market sales duly plummeted to $1.8 billion for July through September, the third-lowest quarterly total in seven years.

Overall exits reached $24.7 billion, on par with the average for the previous eight quarters, though trailing the $46.2 billion April-June, which included bumper trade sales involving Flipkart, Ele.me and Mobike. However, the IPO market did offer encouragement, even though the basic statistics – $14 billion raised in the third quarter, compared to $11.3 billion three months earlier – don't tell the whole story.

A year ago, Xiaomi and Meituan-Dianping might have been sitting on top of the quarterly PE-backed IPO table as US listings. But the introduction of weighted voting rights (WVR) in Hong Kong, enabling founders to retain control even after their equity is diluted below 50%, meant these companies could go public closer to home. They raised $4.7 billion and $4.2 billion, respectively, with underwriters fully exercising the overallotment option for Xiaomi and allowing Morningside Venture Capital to make a partial exit.

Hong Kong accounted for five of the eight largest offerings, although none of the others opted for WVR. Seven of the top 20 were listings by Chinese technology companies in the US, led by Pinduoduo, Nio, and Qutoutiao, using the equivalent dual-class share structure. It is unclear how many could have met the requirements to list in Hong Kong, but this trend suggests there will be continued robust interest in the New York Stock Exchange.

Meanwhile, Shenzhen and Shanghai IPOs were conspicuous by their absence. These bourses saw 45 private equity-backed listings in the final three months of 2017, but amid weaker markets and a decline in listing approvals from a regulator wary of dragging down market quality, the number of offerings slumped to the low 20s and then the high teens in the next two quarters. During the July-September period, there was just one IPO supported by a financial sponsor.

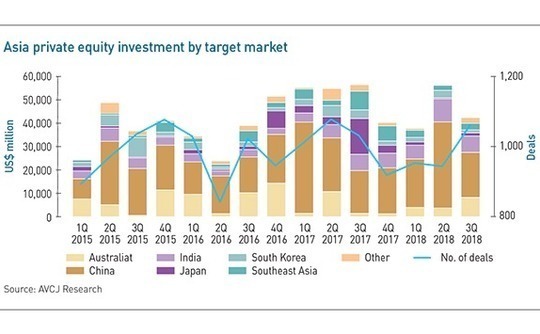

Over the 12 months from November 2016 to October 2017, six private equity deals of $1 billion or more were announced in Japan. Since then, only one transaction has crossed the $500 million threshold as Baring Private Equity Asia agreed to invest up to $538 million in Pioneer Corp. in September. This contributed to a quarter-on-quarter uptick in Japanese deal flow but $3.2 billion posted for the first nine months is less than half the total for same period in 2017, even if Toshiba Memory Corp. is excluded.

If Japan is a market from which investors expect everything but have got close to nothing, Taiwan is its mirror-image. Yet in the third quarter of 2018, more capital was committed to Taiwan than in the 14 preceding quarters combined. One deal made the difference: KKR's agreed $1.56 billion privatization of LCY Chemical Corp. It is the PE firm's first announced investment in Taiwan since the acquisition of Yageo Corp. was blocked in 2011 – a development that made all GPs wary of doing business in the market, contributing to a protracted period of minimal buyout activity.

It was always unlikely that Asia private equity investment would match the $55.9 billion deployed in the second quarter, of which Ant Financial was responsible for $14 billion on its own. However, the July-September total of $42.1 billion compares favorably with the two quarters before that. As investment in China and India fell back after a bumper second quarter and South Korea posted its lowest three-month total in two years, markets known for lumpy deal flow – Australia and Singapore, as well as Taiwan – came to the fore.

It should come as little surprise that a large-scale infrastructure deal moved the needle in Australia. The structure is a familiar one: toll road operator Transurban brought in AustralianSuper, Canada Pension Plan Investment Board, and Abu Dhabi Investment Authority to support the A$9.3 billion ($6.7 billion) purchase of part of Sydney's WestConnex highway system. Brownfield with some greenfield, it is one of those yield-generating assets that have become so popular among institutional investors.

Meanwhile, AVCJ Research has records of 11 private equity deals of $500 million and above since the beginning of 2015. Four were growth rounds for emerging technology companies and four involved hard assets (transportation, logistics, infrastructure). One of the three from the second quarter of 2018 falls firmly within the former category: Southeast Asia-focused ride-hailing platform Grab closed its latest funding round with $2 billion in commitments.

Another could be categorized as both. AirTrunk, a Singapore-based data center provider at present mainly focused on Australia, received $620 million in senior debt financing and capital from Goldman Sachs and TPG Capital. It reflects a blurring of the lines within the infrastructure space as data and industrial-scale digitization increasingly become the driving force behind investments.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.