China-Europe: A sense of uncertainty

Chinese interest in European assets – from industrial technology to consumer brands – is undimmed, but certain governments, as well as the EU itself, are taking steps to protect their crown jewels

Louisville Slugger is an iconic US brand. The official bat of Major League Baseball, it has been part of the sport since 1884, helping deliver home runs for everyone from Babe Ruth to Barry Bonds. Should Anta Sports and FountainVest Partners succeed in their EUR4.6 billion ($5.3 billion) buyout of Amer Sports, Louisville Slugger would effectively become Chinese property.

Amer is not a US company but it makes a lot of money there. Headquartered in Finland, the sporting goods manufacturer has a portfolio of brands that includes the likes of Wilson and Salomon. Louisville Slugger was added to the list three years ago. Of Amer's EUR2.68 billion in sales for 2017, the Americas accounted for 43%, the same as Europe, the Middle East, and Africa.

Amidst Sino-US trade tensions and moves to curtail Chinese investment in certain parts of the US economy, there is much talk about a pivot towards Europe. "At the moment we don't have much on our table in terms of the US," says Gian-Marc Widmer, head of international M&A at CITIC Securities. "You can see the patterns in how Chinese investment banks are expanding internationally. They are beefing up their operations in Europe and Asia, whereas in the US, not a lot is happening."

But Amer is not only an example of how Chinese investors can get exposure to the US via Europe. It also reflects what some M&A advisors see as a push into central and eastern Europe where regulation is lighter than in the region's western nations. Chinese appetite for assets in Germany, Italy, France, and the UK is undiminished, but there is also a recognition that investment in these countries is becoming more challenging.

The ambiguous mood is best captured by the fact that there appears to be no real consensus as to whether Chinese investment in Europe is holding steady or starting to tail off. Thomas Gilles, a partner with Baker McKenzie in Frankfurt and chairman of the EMEA-China group, observes a general slowdown in investment. He gives three reasons for this: greater regulatory scrutiny in Europe; fierce competition for deals in the region, which means even the keenest of Chinese buyers might lose out; and various impediments in China when it comes to financing and implementing offshore deals.

While others attest that the pivot towards Europe is real, they are quick to add caveats. "We have not seen a reduction in activity, but we do see a reluctance on the part of German sellers," says Christian Cornett, a partner with King & Wood Mallesons (KWM) who is also based in Frankfurt. "The uncertainty has caused a somewhat bearish sentiment which may result in a decrease in the number of transactions."

Putting up barriers

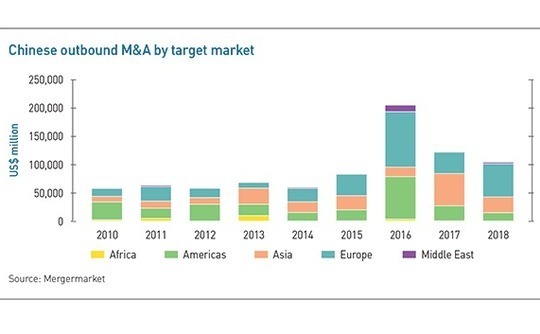

Europe accounts for 56% of the $103.8 billion Chinese investors have committed in overseas markets so far in 2018, according to Mergermarket. This compares to 30% and 48% in the two preceding years. It helps that the Americas share has plummeted seven percentage points to 14%, but there is a longer trend on display. Europe trailed the Americas in three out of four years between 2010 and 2013. Since 2014, the region has consistently outperformed its neighbor. The phenomenon is more or less the same in terms of deal count.

It's no secret what Chinese investors want from Europe: industrial technology, healthcare and biotech assets, and consumer brands. However, several governments in the region want to curtail the shopping spree. Beijing's "Made in China 2025" policy, launched in 2015, detailed ambitious plans to establish global leadership positions in areas such as advanced IT, robotics, aerospace, new energy vehicles, power equipment, new materials, and biotech. Questions were asked as to the economic and national security implications for Europe of China's state-sponsored technology grab.

Fast forward to 2018 and Germany is more willing to intervene. When State Grid Corp. of China began negotiations to buy a 20% stake in 50Hertz Transmission – below the 25% threshold required to trigger an investigation – KfW, a German state-owned bank, was mobilized to buy the position instead. This was followed by the government taking the unprecedented step of vetoing Yantai Taihai Group's proposed acquisition of Leifeld Metal Spinning, a manufacturer of high-strength metals for the aerospace and nuclear industries. Yantai Taihai duly withdrew its offer.

"This year we've seen two deals abandoned due to regulatory resistance and one where the government couldn't exercise its proper authority but circumvented that by pushing a state bank to help fend off a Chinese bidder," says Matthias Weissinger, a partner at Shearman & Sterling. "We will see a tighter regulatory regime but it is not a reflection of a more protectionist Germany and it most likely will not be as tough as the US. For the time being, the regulatory hurdles are much lower and political relations are more predictable."

Indeed, 100 Chinese acquisitions have been approved by the German authorities since the start of 2016 and a further 60 are pending. One of the deals that went through was Yantai Taihui's purchase of Duisburg Tubes, another components supplier to the nuclear industry. It is expected that Germany will lower the regulatory review threshold for transactions involving non-EU buyers, but this will be irrelevant for most private M&A transactions.

Procedural problems

The damaging aspects are more around procedure and perception. According to Gilles of Baker McKenzie, in order to gain certainty that there will be no regulatory intervention in Germany, in most cases a foreign buyer must wait for two months for a certificate of non-objection. For standard mid-market deals, this implies an extension of one month compared to the situation before the most recent regulatory change in 2017. This has an impact on dealmaking, especially auction processes.

"If you look at the big picture, a European government preventing a transaction based on an explicit decision will likely remain the exception rather than the rule. The real issue is that foreign investment review procedures have a practical impact on a broad spectrum of non-sensitive M&A transactions as well. European sellers and foreign buyers are debating issues concerning foreign investment very broadly, in particular in the context of China-related deals. This creates uncertainty," Gilles adds.

The same applies to the EU investment screening mechanism, which was approved by the European Council in June. It amounts to an information-sharing agreement among the 12 members that have foreign investment control regimes, but the system envisages a seven-step process with plenty of back and forth between the member states and the Commission. The criteria being discussed – for example, not just whether a deal involves a state-owned entity but whether it is state-financed – are also detailed and potentially cumbersome for investors.

The mechanism is likely to be introduced by the end of the year, and then the question is what comes next. Several countries have pushed for a more comprehensive investment control regime and market watchers believe the pressure for tougher measures will only increase. However, KWM's Cornett suggests pan-EU oversight could turn out to be a somewhat blunt sword, given the amount of compromise that would be required to pass legislation. "The status of European economies is so different – some want to impose controls and others just want the money to go in," he says.

There is also a school of thought that more robust oversight won't be that disruptive at all. "My feeling is that European countries are more rational and long-term in their outlook when handling such issues," says Eddie Chen, China head of France-based GP Eurazeo. He notes that Chinese activity in Germany remains on par with France and the UK, despite the recent concerns.

Should sentiment on Europe cool, it remains to be seen where China looks next. Mark Webster, a managing director with BDA Partners in Shanghai, notes there has also been a pivot towards Asia as well as Europe, with Southeast Asia and Japan attracting more attention. One way or another, Chinese capital will continue to flow overseas.

"China has a secular need to make acquisitions, from the perspective of both a consumer upgrade and industrial technology moving up the value chain – that's not going away," Webster adds. "A lot of the time the default was the US, but now they are having to look harder elsewhere."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.