US regulation: Cold shoulder

New trade legislation in the US is set to have important ramifications for Chinese private equity deal making in a range of data-related technology segments. Macro effects, however, may be muted

Tariffs are the bombs of a trade war, blunt, easily deployed, and in their knock-on effects, almost random instruments of disruption. Foreign investment review legislation, by comparison, is a long, tedious chess move with more nuanced pitfalls for stakeholders.

This notion came to the fore in August when the Foreign Investment Risk Review Modernization Act (FIRRMA), passed into US law with rare bipartisan zeal amid some of the thorniest Chinese trade tensions in memory. Private equity investors will be impacted globally by FIRRMA's expansions, which include new jurisdiction over minority and indirect interests. But China will take most of the heat.

The legislation was largely informed by a report last year from the Defense Innovation Unit essentially declaring that a massive transfer of technology knowhow from the US to China was a national security threat that needed to be addressed by the Committee on Foreign Investment in the United States (CFIUS). FIRRMA is consequently peppered with thinly veiled blocks against China in the form of malleable language about scrutinizing countries with demonstrated tech acquisition agendas.

More directly, FIRRMA requires the secretary of commerce to produce a biennial report on Chinese foreign direct investment from 2020 to 2026. No other country is subject to this review but the China effect will ripple across many seemingly unrelated deals. The US offered a dramatic case in point last year when it blocked Singapore-based Broadcom from acquiring Qualcomm on security grounds roundly considered a China-US affair.

"China is definitely in the crosshairs here, and you can see it in the deals involving Chinese entities because whether or not there's a clear government player, those deals take longer. Not all of them get blocked, but they all get a longer review," says Mark Ostrau, a partner at Fenwick & West. "The first question that comes up in every Chinese deal now is how to structure the investment so that it doesn't trigger CFIUS and what to do if it does."

Time to digest

FIRRMA passed almost two months ago but no shockwave has been felt yet. In part, this is because it will take 12-18 months for the implementation regulations to be rolled out and for precise definitions of some key terms to be established. In the meantime, CFIUS is empowered to run pilot programs to implement certain aspects of the law, but much of the overall machinery of the act will remain deferred.

Another reason for the lack of alarm is the idea that FIRRMA is merely a formalization of rules by which CFIUS has already been playing for some time. The agency has always interpreted its controls freely, especially with China, so the vagaries and long timeframes around shoring up the new rules are apparently a continuation of the status quo.

"Depending on how the implementation rules are written, the effect on foreign investments in technology is potentially quite significant," says Stephen Heifetz, a former CFIUS official and current partner at Wilson Sonsini, who represents the National Venture Capital Association (NVCA) in CFIUS reform talks. "It's probably underappreciated just how cumbersome things may become from an investor and company perspective."

Historically, only control transactions from foreign investors would trigger CFIUS jurisdiction. Control was broadly defined, but generally, anything less than a 10% interest was considered passive. FIRRMA eliminates this safe harbor by making it possible for all minority transactions in the targeted industries to be subject to CFIUS review, even if the foreign investor in question is deemed an "observer" with no voting rights.

Targeted industries encompass a widening range of "critical" technologies, including data. Companies with data on US citizens have been flagged in particular. Other covered areas include real estate in close proximity to military sites, airports and seaports. This rule applies to non-technology deals and could result in retroactive reviews for past greenfield investments that have since developed into CFIUS-covered assets. Like much of the vocabulary in FIRRMA, "close proximity" has yet to be defined.

Perhaps most concerning for private equity, FIRRMA can extend CFIUS jurisdiction to deals pursued by US-based fund managers with foreign LPs. This will apply in any situation where the LPs are seen as having access to non-public technical information in the targeted industries. Precedent for such a review was set last year when Canyon Bridge Capital Partners, a US GP backed almost entirely by Chinese money, was blocked from buying Lattice Semiconductor.

It is expected, however, that in the wake of FIRRMA, US funds with foreign LPs will be subject to CFIUS review in much less egregious circumstances. Co-investments made by foreign LPs alongside US managers in domestic technology companies may well be part of this enhanced coverage, although the rules remain unclear to date.

More red tape

Meanwhile, CFIUS will transition from a voluntary filing regime to one with significant mandatory obligations depending on the rights of the foreign investors. Parameters are yet to be set, but required filing is likely to be applied in all cases involving critical technology or an investor substantially backed by a government. To date, this rule has not been interpreted to include foreign LPs in US funds but industry observers are bracing for it to be more of a sticking point for deals with any Chinese participation.

CFIUS usually only has the bandwidth to chase up a smattering of un-filed investments in any given year, but this is going to change. FIRRMA authorizes at least $20 million for CFIUS operations, requires a major increase in political involvement, and instructs the assembly of a team mandated specifically to patrol for transactions that haven't been filed.

Resilience of sentiment in light of these changes has been rooted in the idea that although FIRRMA increases strictness and bureaucracy, it also increases procedural transparency for a decidedly opaque organization and leaves the door open for creative workarounds. FIRRMA includes clear rules about evasion and attempts to circumvent its intentions, but CFIUS has traditionally been willing to consider innovative deal structures using tools such as proxy boards and voting trusts.

"We've had the committee tell us that there was no way to mitigate the risk in some deals, but we were able to come back with mitigation techniques unlike anything they'd seen before, and they were eager to consider them," says Jennifer Huber, a partner at Fluet, Huber & Hoang (FH&H). "Over the next several years, I think new mitigation measures like that will become almost routine, but companies are going to have to start budgeting for them, both from a timing and financial perspective."

During this period, there will be a chilling effect on Chinese investment into the US, exacerbated by the recently finalized Export Control Reform Act, which also tightens restrictions on technology transfers. A rebound in confidence is expected to play out over about a five-year period, however, as industry players adapt to the new environment. Smaller companies with greater agility and risk appetite will naturally figure at the top of this curve.

"In our experience, it's really been the big industry players that have had trouble competing in changing regulatory landscapes, while the mid-market has actually been well placed to take advantage of these situations and get in a better position to compete," Huber adds.

The idea that the mid-market will lead the recovery in the wake of FIRRMA is encouraging for at least two reasons. First, the mid-market is the most active domain for much of the innovation and data technology segments being addressed. Second, it is the primary playing field for private equity, which appears to be particularly vulnerable to the new rules.

Although not as conspicuously targeted as China, private equity as an asset class was clearly in the minds of FIRRMA's creators. This is particularly evident in venture capital since many of the new rules focus on minority stakes and access to technological secrets by direct and indirect investors. Indeed, NVCA lobbied – with marginal success – to explain to policymakers before FIRRMA's ratification that LPs had no ability to garner portfolio company information other than at the discretion of the GP.

"We've frequently heard in past years that US private equity doesn't have to worry because foreign LPs are passive by definition, but that conventional understanding no longer matches up with what CFIUS is thinking," says Wilson Sonsini's Heifetz. "US funds need to think carefully about whether or not they have foreign LPs, and if they do, whether they need to insulate them so that they don't have access to material non-public technical information. It has to be made very clear in the formation and subscription documents that there isn't any CFIUS jurisdiction."

Competitive angst

However, as with any legislation that has macro overtones, the deepest concerns are not at the fund, deal, or company level. Vis-a-vis China, the US is losing global market share in venture and start-up spheres, but it is not necessarily declining in innovation capacity or prestige. There is a fear that this could change as a result of protectionist policy.

Martin Chorzempa, a research fellow at Peterson Institute for International Economics, says the committee should focus on areas where US firms are unique in order to maximize national security benefits while minimizing the possibility of falling behind global competition. "The risk is that if a similar company or technology is available from a company based elsewhere, American start-ups and established companies in these areas might be at a disadvantage as an investment target due to the delay, costs, and risks of rejection in the CFIUS process that other countries do not have," he says.

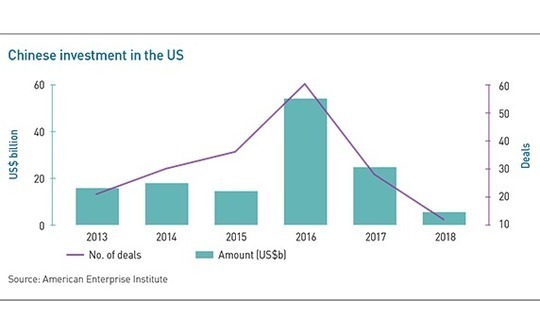

Still, Derek Scissors, an economist at the American Enterprise Institute (AEI), sees no evidence that China is contributing to US innovation on a net basis. He flags data from AEI that charts total Chinese investment in the US in relatively insignificant sums of less than $25 billion a year. In this view, even an anomalous spike like the $54 billion deployed by China in 2016 is framed as loose change for a $19 trillion economy.

"You cannot find a year where Chinese inbound investment in technology was ever very large," says Scissors. "The only way you could imagine FIRRMA being important in a macro sense is if you had a story in your head that 2016 was the wave of the future and we were going to have an intense technological relationship that has now been cut off. But that didn't happen, and that's an unlikely level of US-China cooperation."

Chinese investors may do well to keep this brand of realism in mind as they plot US M&A programs with a view to forging strategic partnerships. To date, most transactions subject to CFIUS have ended up in mitigation agreements rather than being blocked. And if the deals are purely financial in nature, there's usually no material impact for investors. The problem is when investors seek exposure for more politically sensitive reasons – such as the strategic appropriation of intellectual property – because the ensuing mitigation measures will likely interfere with those goals.

To complicate matters, all these factors tend to falsely suggest that FIRRMA will only be relevant in deals involving inbound US investment. Joseph Falcone, a partner at Herbert Smith Freehills, notes that investors should take CFIUS requirements into account even in acquisitions between non-US deal parties where the target company has US subsidiaries.

"Potential considerations for parties include, for example, whether potential non-US acquirers are willing to put in place, as deal terms, restrictions to their access to US technology, data and sensitive facilities, where applicable," says Falcone. "Moreover, in a cross-border deal involving several jurisdictions, deal parties will need to ensure a coordinated approach across the relevant foreign direct investment regimes."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.