Tech investment case study: True North and Seedworks

True North aimed to set Indian seed maker Seedworks apart from its competitors by leveraging digital technology. Two years into its investment the private equity firm is seeing its initiatives pay off

At first glance, India's agriculture industry may seem a surprising place to worry about digital disruption. The basic ingredients for growing crops – sunshine, water, and soil – have never changed. And while there is no shortage of scientific research focused on agriculture, these scientists mainly focus on areas that are directly related to boosting yields, such as plant breeding and fertilizer chemistry.

But farming is far from the simple life depicted in popular imagination. Successful growers must master a staggering array of variables spanning multiple scientific disciplines, from chemistry to meteorology, and misjudging even a single factor can lead to a ruined harvest.

For all the data that Indian agriculture requires, the industry still relies to an overwhelming extent on old-fashioned collection techniques. Even a well-established research company like Seedworks International, which has been developing hybrid seeds in India for 20 years, employs an army of crop inspectors who visit the fields where its seeds are used and inspect everything personally.

"They have to note data about how tall the plants are, what is the distance between the plants, how much fertilizer they've been given, how much nitrogen is in the soil, and so on," says Anand Narayan, chief digital officer at True North. "And it is all done manually – someone has to go out physically with pen and paper and note down these data in a register, then come back to document them and send them in."

True North – then named India Value Fund Advisors – saw a better way forward when it acquired Seedworks from Wand Capital in 2016. The firm knew Seedworks had impressive R&D capabilities and a trove of data on seed performance that it had built up over the years, but the company lacked the capacity to put this information to work properly.

Upgrading Seedworks' digital infrastructure would not only give the company a competitive advantage over domestic rivals, but also endow it with capabilities to rival global peers such as Monsanto and Bayer. Accordingly, True North has made such improvements a priority through a series of initiatives undertaken with the company's management. While many of these projects are still in the early stages of implementation, the firm is confident that Seedworks has embraced the potential of digital transformation and is set to take a leading role in its industry.

"We've done a lot of applications of newer methodologies for trying to solve older problems," says Hindol Basu, CEO of True North's data-focused subsidiary Actify Data Labs. "Seedworks is a very interesting organization, because they were very keen to absorb many of these lessons internally."

Growth potential

True North recognized the raw materials for success in Seedworks from the beginning. The company had built up a portfolio of hybrid seed varieties, mostly in rice and cotton, and the GP believed the market for both was primed to take off as Indian farmers turned to new strains that offered faster maturity, higher yields or resistance to pests.

However, Seedworks needed help setting itself apart from myriad competitors in the hybrid seed industry, which is characterized by short product life cycles and rapid churn in the corporate pecking order. Market leaders tend to be deposed quickly and have major problems maintaining a level of scientific innovation that can retain customers over a long term.

These market issues reflected, in part, and industry bottleneck: While many players had advanced research credentials, they were forced to plan their future seed developments based on field data collected and processed using methods that were fundamentally slow and imprecise. A company that could find more efficient ways to collect and analyze agricultural data would gain a major competitive advantage.

"Before 2016 not enough data was available in the organization," says Seedworks CEO Venkatram Vasantavada. "True North pushed us to adopt a framework we call 3A – analytics, algorithms, and artificial intelligence – which has helped Seedworks drive toward data-based decision making as a cultural change."

In pushing for investment in data processing capabilities, True North was echoing multiple industry observers at the time who were calling for Indian corporate players across the agricultural spectrum to improve their digital infrastructure and data analytics. Such upgrades were seen as increasingly urgent, particularly in developing markets like India, due to the projected effects of climate change on growing seasons that would require rapid adaptations from industry participants.

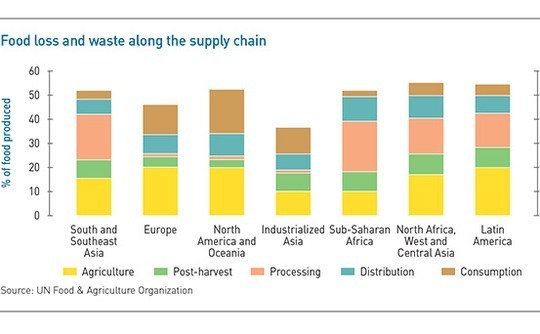

Big data is also considered a valuable resource for fighting food waste, which in South and Southeast Asia occurs predominantly in the growing, post-harvest, and processing phases, according to the UN Food & Agriculture Organization. Improper storage and transportation, as well as plants grown in unsuitable soil, are the key contributing factors. Data that can indicate the root cause of such crop spoilage can help companies such as Seedworks develop strains of plants that are more robust.

Convincing Seedworks' management to overhaul its approach to digital data collection and processing was therefore relatively easy, despite the fact that it was so far outside of the traditional focus. Working with True North's team, the company quickly identified areas where it could improve data practices.

One of the first changes implemented was in the crop inspection system, which the company has aimed both to standardize and streamline. This was accomplished using a mobile app through which the field inspector submits his results in real time to the central monitoring office. It has already provided real benefits to the company.

"It effectively means two things: one, data is recent – it's collected almost as the event occurs, so if you detect a problem you can immediately react to it, rather than figuring it out days or weeks later," says Narayan. "Two, data is captured at source and only once. There are no issues of omission or correction of data, which is a huge problem in large data science projects."

Seedworks' crop inspectors are also the subject of some more ambitious projects. One that the company is particularly excited about makes use of image analytics technology to provide independent assessment of a plant's health. Currently in the development phase, the initiative will allow an inspector to upload a photo of the plant to a central database from his smart phone. Once uploaded, the system will examine the plant for signs of disease or growth issues.

The Actify angle

Actify, which True North established earlier this year with a $10 million investment, has been crucial to pushing this and other far-reaching initiatives at Seedworks. The subsidiary is intended to provide an independent source of information technology expertise, both for True North's portfolio companies and for businesses outside of the portfolio.

While some of this assistance could have been provided by True North directly, the firm felt that a separate entity could be more flexible than an internal team. As a subsidiary Actify has both the freedom to work with companies not related to its parent, and to build a full team with a focus solely on technological value-add rather than having to fit into the larger organization.

"These fields require some specialist expertise that the deal teams and True North's other teams may not have access to," says Basu. "You may feel that applications of image analytics or sensor data will add value to a portfolio company, but to implement it, even as a proof of concept, and show it to the customer, requires specific knowledge."

In addition to Basu, who has led digital transformation strategies for companies including Tata Industries, Citigroup, and TransUnion, Actify's team includes 10 digital professionals, each with a master's degree or higher and at least eight years' experience working with data science. While relatively small, the collective expertise of the team members means it can provide clients with plenty of support as they explore technology applications in their businesses.

Another area in which Seedworks has been supported by Actify is the incorporation of data science into genomics research. For this project the team has taken a hands-off approach, deferring to Seedworks' superior knowledge of genetics and breeding. However, it has provided significant input in terms of computing expertise and set up workshops where both teams can exchange ideas.

Seedworks' leadership with this and other projects – such as a database of farmers that use its seeds and an ongoing survey of its competitors – is seen as a positive sign by Actify and True North. The GP and its subsidiary hope to help the company build up its internal capabilities so that it can eventually operate with greater independence, particularly after True North has ended its ownership and is no longer directly involved in the company.

One way of encouraging this development is through the hiring of Seedworks' chief digital officer. This hiring was intended to bring the company a zeal to experiment with the latest technology and see what benefits it could bring to an industry that has been held back by traditional business models.

True North and Actify have subsequently helped build out Seedworks' internal digital team. Currently there are two data scientists on the team, and they frequently connect with their counterparts at Actify informally to bounce ideas off them as well as partner on formal projects.

"Seedworks has a well-crafted digital strategy in place and given the range of initiatives planned by the organization, Actify is one of the prospective strategic partners in our digital journey," Vasantavada says. "For example, Seedworks can use Actify's services to reduce lead time in quality testing using artificial intelligence."

Actify does take the lead on more advanced initiatives. For instance, the firm recently created a proof of concept for software that models the results of specific genetic tweaks to a plant's real-world performance. However, even in this case Actify limited itself to demonstrating the capabilities of the software, and once the showcase was over the firm turned the project over to the company to develop further due to its greater familiarity with genetics.

Competitive edge

Seedworks' rapidly developing internal digital capabilities have put it on track to fulfill True North's goal of surpassing its domestic peers, most of which have made no such investments in upgrading their technology. The GP believes that in coming years, as rapidly altering weather patterns disrupt agriculture, the company's real-time monitoring capability will let it register changes more efficiently than other providers and quickly develop new crop strains in response.

As the digital initiatives continue to develop, they will also add to the perceived value of Seedworks, making it more attractive to potential buyers when the time comes for True North to exit. From the beginning the firm has seen its investment in Seedworks as a bet on the company's courage and forward-thinking even more than its research skills, and it hopes the technology projects will help more investors to share that view.

"We evaluate companies now on their profit and loss and balance sheet, but I think very soon we'll also be evaluating businesses on their intellectual capital," says Narayan. "Everyone accepts that in any business changes are bound to come, but the ability to handle change is what differentiates one from the other. That ability is fundamentally driven by the quality of thinking behind putting these technology systems and processes in place."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.