China-US tech: The innovation game

The emergence of domestically-developed tech business models in China that can be exported overseas has VC investors hoping the country can become known as an innovator rather than a copycat

China's technology space has always been largely seen as the domain of copycats, with entrepreneurs adapting business models from overseas for the local market. While the likes of Alibaba Group and Didi Chuxing, often billed as the Amazon-eBay and Uber of China, have overcome the domestic challenge of their overseas counterparts, they would never be considered innovators based on their initial business models.

But for the country's venture capital investors this image is fading fast as a growing number of Chinese technology-enabled businesses emerge that are not obviously derivatives of foreign models. The poster child for this phenomenon is the bike-sharing industry, which in just over three years has exploded across China. Domestic leaders Mobike and Ofo are both now entering global markets, where they have encountered copycats of their own.

"We always try to find comparables in the US, Europe or Israel, but in the last few years there have been more and more companies for which we can't find comparables anywhere in the world," says Peter Mao, a partner at early stage VC firm Panda Capital, which invested in Mobike in 2016 and exited when Meituan-Dianping acquired the company in April. "And they are quite driven – in the case of Mobike, from day one they told us they wanted to be global and deploy bikes all over the world."

With Mobike, Ofo and other China-based technology developers providing inspiration to local entrepreneurs, VC investors expect to see even more Chinese companies, both start-ups and established players, help set the technology agenda worldwide. Many of these players will find global success a daunting task, but in the end the addition of more voices can only help the world's tech conversation.

Urban petri dish

Several unique factors have facilitated the development of start-ups in China that provide original services, not least the size of its cities and the tech-savviness of its citizens. "The country has a huge population and mobile user base, and what's happening in China now is like a giant experimental lab," says Jay Zhao, a partner at TCL Venture Capital. "A lot of things are being tried, the big cities in China are not afraid of experimenting, and capital is there for those that want to try out new business models."

According to iResearch Consulting, China has 156 cities with over a million residents, as opposed to just 10 in the US. These urban centers are also far denser than their American counterparts, with over 2,400 people per square kilometer in China versus 333 in the US. By 2023, 940 million people in China are projected to live in cities, up from 731 million in 2013.

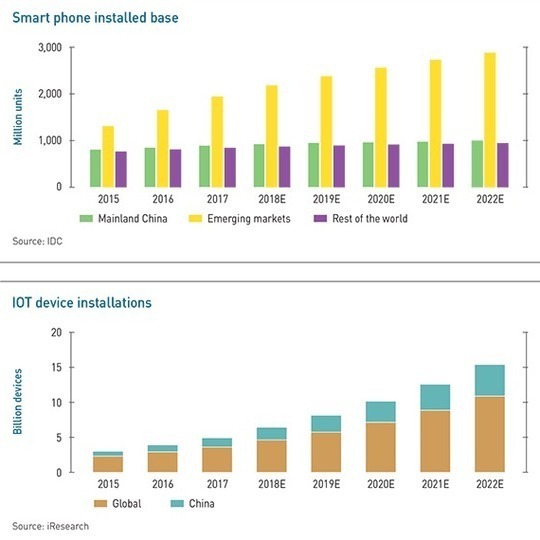

These urban dwellers are increasingly online, with IDC reporting that China's installed smart phone based reaching 892 million last year. This represents more than the entire developed world, defined as Australia, Canada, Japan, Korea, the US and Western Europe. China is expected to maintain this lead at least through 2022. Even then there will still be room for growth, with smart phone penetration projected to hit 71% by 2022 compared to 91% for developed countries.

In addition, China is an increasingly significant part of the global market for internet of things (IOT) devices, with installations set to reach 4.5 billion by 2022 out of the global total of 15.3 billion.

With massive populations increasingly crowded into limited spaces, where they compete for goods and services, there is a clear opportunity for companies that can use technology to enable wider access and more efficient distribution. Bike-sharing, which connects users with last-mile transportation efficiently through their phones, is one business model that has evolved to meet this need. It is worth noting that Ofo started as a student project on the campus of Peking University.

Another example is the so-called new retail segment, arguably best represented by Alibaba Group-backed supermarket chain Hema, where shoppers use an app to scan products, log purchases, and settle the bill through the company's Alipay service. Customers can pick out fresh food and have chefs cook it for them immediately in the store, or order products online for home delivery within 30 minutes, provided they live within 30 kilometers of the store.

Some of the new retail concepts are not unique to China, but Alibaba is considered to have implemented ideas more effectively than US-based peers such as Amazon, which promises delivery times of up to two hours. Alibaba's control of every aspect of the grocery experience is seen as key to its success.

"Amazon bought Whole Foods and tried to do on-demand grocery, but Hema did it in a much better fashion," says James Mi, founding partner of Lightspeed China Partners. "It really has a significant impact on improving ordinary people's lives, and that is also enabled by a lot of the technology pieces such as mobile payments and the infrastructure for delivery."

Hema is seen as evidence that new business models can be developed by established Chinese companies as well as by start-ups. This includes internet giants Baidu, Alibaba and Tencent Holdings (collectively known as the BAT) that were previously seen as strictly adopters of overseas business models rather than innovators.

The BAT bandwaggon

Investors acknowledge the perception is somewhat unfair, because the tech expertise available in previous years was an obstacle to innovation. Now the talent pool is deeper, enabling the BAT to apply their vast resources to businesses that can benefit from their expertise. Moreover, Alibaba and Tencent each control a sizeable proprietary payment platform and are therefore responsible for a crucial part of China's technological infrastructure.

The BAT companies are also playing an increasingly active role in supporting their up-and-coming peers, rather than trying to replicate innovative business models with in-house resources.

"The BAT created the first couple of alumni classes of well-trained internet executives, several of which have now started new companies or are acting as angel investors and advisors," says Chris Evdemon, a US-based partner at Sinovation Ventures. "They're also investors and potential acquirers for most rapidly growing start-ups that appear to be headed for success. There is no technology segment that is not of interest to them."

Companies that have benefited from this investment activity include Mobike, which Tencent first backed in 2016; its acquirer, Meituan-Dianping, is also backed by Tencent. Panda's Mao recalls that when Tencent joined Mobike's investor roster it made few demands on the company, requesting only that the company list Tencent's payment platform WeChat Pay first on the payment screen.

Tencent has helped spread Chinese technology concepts to the US as well. For example, US-listed communications platform Snap rolled out a redesign of its signature social media app Snapchat last year following an investment by the Chinese giant. CEO Evan Spiegel cited WeChat and other Chinese messaging apps as an inspiration for the new look, which aimed to provide more personalized content.

At the same time, Snapchat is a cautionary tale for China's technology sector because the redesign met with a backlash from users who found the new format difficult to use. Cultural and regulatory issues have troubled Ofo and Mobike as well during their cross-border expansion push. The two companies, along with US-based competitors Limebike and Bird, have found it hard to get traction given their bikes are often abandoned in public spaces and regarded as a nuisance.

These obstacles underscore the fact that many Chinese companies believe their optimal target market is elsewhere. "Chinese companies don't always think of the US or Europe as their go-to markets when they are considering international expansion," says Sinovation's Evdemon. "They tend to target markets such as India, Southeast Asia and South America, where the demographics and consumer spending power resemble those of the early days of the Chinese internet a lot more."

Investors generally agree that emerging markets offer more opportunities for products and services originally developed for the Chinese consumer, though the strong US following of video social networking platform Musical.ly – acquired last year by Chinese news aggregator Toutiao – does demonstrate that Chinese-developed apps can appeal to a Western audience.

There is an additional nuance in the divide between hardware and software. Hardware-focused start-ups, such as drone-maker DJI and InnoLight Technology, a manufacturer of cloud computing components backed by Lightspeed and CapitalG, may want to go directly to developed countries where there is a larger market for their products.

"For mobile applications and services, especially consumer-facing services, the huge domestic market and population density really do make it easier," says Lightspeed's Mi. "But for hardware-focused companies like DJI and InnoLight, that's less important. An innovative hardware product can be immediately applicable in the global market."

Plugging the gaps

At the same time, the scope of Chinese innovation is not universal, due to a shortage of researchers in some key areas. One VC investor active in the country identifies artificial intelligence, robotics and biotech as areas in which domestic players have lagged, though there is pressure for this shortfall to be addressed too.

"Chinese companies have already leapfrogged their foreign counterparts in terms of the consumer internet, but some of the best Chinese researchers in these deep tech areas still live and work abroad," says the investor. "However, given the domestic China market size, its appetite for these technologies, and the push from the Chinese government in this respect, we should expect China to reach parity very soon across the board."

GPs are generally optimistic about the future of Chinese technology. The growing number of unique business models is seen as evidence that the sector is coming into its own, and that the relationship between the US and China in this area will come to be based on mutual learning rather than dependence.

Nevertheless, identifying Chinese companies that are likely to do well in the US will continue to be a challenge. Zhao of TCL VC observes that conventional wisdom would seem to dictate that a bike-sharing start-up could not gain traction in the US due to the widely different levels of population density. But the launch of Limebike and Bird suggests there is at least some appetite for the model, even though success is still far from assured.

"If you looked at it from that perspective, you might feel like you shouldn't make that investment," Zhao says. "At the same time, you can't assume that what worked in China will work in the US, because the market base and customer behavior are quite different. You need to go deeper."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.