China-US trade: Balance of power

A long-smoldering trade dispute between the US and China has begun to reverberate globally across a range of sectors. Private equity must not ignore the potential impacts

Last month, new legislation was overwhelmingly passed to expand the scope of the Committee on Foreign Investment in the United States (CFIUS). Two versions are currently being hashed out, but whatever the outcome, it will impact private equity through stricter oversight of cross-border investment, probably including at least some new restrictions on the transfer of minority interests. At present, the committee only considers buyouts.

An early hardline draft that would have blocked several tech industries outright has been scratched for the moment, but its very proposal suggests that no matter which rules are eventually put in place, they will be subject to aggressive interpretations. Although CFIUS has been a significant obstacle for PE in a Chinese context for the past several years, the latest policy developments hint that a hardening tone is now set to be adopted globally.

For example, the carve-out of Japan's Toshiba Memory Corporation this year – the biggest Asian PE deal ever – was not publicly viewed as a gambit in US-China trade tensions. But the deal was seen by China as a potential threat to its massive chip market, and industry participants note that authorities likely delayed granting approval at least partly due to the significant US presence in the buying consortium.

While intellectual property (IP) is the main focus in this instance, the standoffs have not only been a matter of trade secrets. Even relatively innocuous digital assets such as customer behavior data are now being regarded as security-critical resources as artificial intelligence and other computing-related industries gain prominence. The result is that US-China trade complications are increasingly bleeding into marginally related deals as the world's two largest economies bring more red tape to various industrial ecosystems.

"It's directly relatable to private equity internationally because a lot of US portfolio companies sell into China and utilize China as a critical part of their supply chains, while many PE-backed Chinese companies rely on the US as a market and source of strategic partnerships, investment and M&A," says David Lam, a general partner at Atlantic Bridge. "We are already seeing cross-border Chinese investment and M&A shifting to Europe, which may be the near-term winner, but in the end, everyone loses when the free flow of markets, capital and people are disrupted."

Macro to micro

For Asian private equity, the highest profile elements of global trade tensions in recent months have rumbled like distant thunder. The US imposed $50 billion of tariffs on Chinese goods in March, prompting a measured $3 billion retaliation from Beijing in April. Equity markets have been shaken, but so far not sent into freefall, and PE firms remained generally upbeat, seeing little direct exposure to targeted industries.

More recently, rhetoric from Washington has put some $400 billion of Chinese imports at risk of increased tariffs. To some extent, GPs have dismissed the warnings as protectionist politicking ahead of the US mid-term elections. But the impact that even a fraction of this expansion could have on global supply chains is now making the issue impossible to ignore in any industrial sector or jurisdiction.

"There are global concerns about Chinese industrial policy and the divergence of China from market-driven norms," says Logan Wright, a director at Rhodium Group. "And it's not clear what kinds of concessions China can put on the table to placate those concerns absent reworking significant policy preferences, which would be difficult. We're not going back to the status quo of a few years ago. It's going to be a very different relationship going forward, not only bilaterally, but between China and the rest of the world."

Private equity firms looking for both openings or safeguards in this context are advised to understand the drivers at the sovereign level. The US has prioritized IP protection and the reduction of an expanding trade deficit with China, as well as reciprocal access to China's massive but comparatively closed markets. A number of European countries have indicated parallel concerns, with Germany notably expanding the powers of its Foreign Trade & Payments Ordinance.

China, meanwhile, is looking to diversify trade partnerships away from a heavy reliance on cheap exports to the West, vent excess industrial capacity in higher value product categories, and maintain the speed and scope of its unprecedented modernization process.

"As a private equity firm, we need to be on the right side of this by using our money to accelerate the transformation of the Chinese economy from manufacturing to services and from exports to domestic consumption," says Eric Xin, a senior managing director at CITIC Capital. "If you're exposing yourself to those trends, then you'll probably benefit from the trade disputes."

CITIC has participated in carve-outs of China businesses from four multinationals in the past year and it expects the opportunity set to increase as the economic ramifications of recent trade friction comes into focus. This approach includes a strong preference for consumer and B2B service segments over manufacturing and export goods – a tactic echoed by some of the region's most diversified players.

"Export-oriented sectors have experienced headwinds for the past 10 years, with double-digit increases in labor costs every year and with the renminbi appreciating 27% since WTO [World Trade Organization] accession," says Weijian Shan, group chairman and CEO of PAG Asia Capital. "No PE should have invested in this sector."

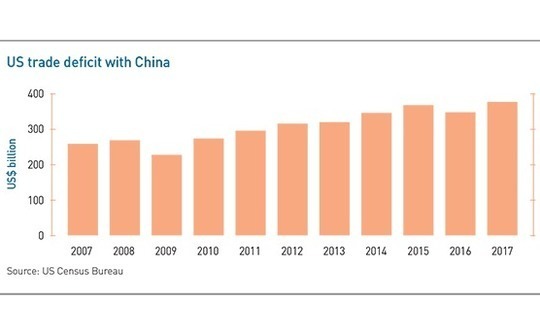

Consistent depreciation of the Chinese currency versus the dollar has aggravated worries about an exacerbation of the US-China trade deficit, which hit $376 billion in 2017. This trend is also seen as sending deflationary signals to other emerging markets in the region that almost put the problem beyond the practical reach of diplomacy.

Supply chain bottleneck

A tit-for-tat escalation of current trade tensions is almost universally seen as an illogical lose-lose scenario, yet one that is foreseeable and difficult to reverse once it gains momentum. This represents an important risk factor for interconnected global supply chains. As such, it is expected to intersect even relatively insulated sectors such as consumer, which has overtaken low-cost exports as the investment focus in Asia during the past two decades.

Alvarez & Marsal (A&M), a group that helps PE firms drive operational and financial performance, is now hiring additional staff to handle an expected increase in supply chain-related efficiency problems. This work includes identifying where intermediary products are sourced for portfolio companies and how they will be affected by various trade policies, with acknowledgment that critical links can be buried several layers down in the supply chain.

"Even in very well-run companies, CEOs and even heads of supply chain don't necessarily have a complete picture of their own supply chains, especially if it's driven by a purchasing department as opposed to a whole-company initiative," says James Dubow, a managing director at A&M. "You have to map it out, and you won't get the information on suppliers of suppliers from a phone call. You have to visit them to understand what they're doing."

H&Q Asia Pacific, however, sees opportunity in areas with glaring supply chain vulnerabilities such as automobiles, where it backed Efficient Drivetrains, a US and China-based components company that was acquired by a US strategic this week. The GP, which is also exposed to IP sensitivities via an investment in a Chinese semiconductor fund manager, notes that recent trade tensions have actually improved investment conditions in China by promoting leniency around foreign control stakes.

"The US is putting a lot of pressure on China and of course China will fight back, but in the meantime, we are seeing the Chinese government making the market more open," says Benson He, a managing director at H&Q. "That's a fact we've already seen, and as long as it benefits people's lives, I think it's good."

In the US, Chinese investors are nevertheless expected to face increased scrutiny in the years to come and will consequently be compelled to target less sensitive industries. This pressure will be heightened for government-connected initiatives such as a recent fund launched by sovereign investor China Investment Corporation and Goldman Sachs.

The China-US Industrial Cooperation Partnership was announced last year with a view to raising $5 billion for investments in US companies looking to enter China in the manufacturing, consumer, and healthcare sectors. It has positioned itself as part of a long-term fix for the US-China trade imbalance, albeit uninvolved in the digital economy being rattled by the current IP and market access disputes.

"This fund is not just a way for Chinese money to get around CFIUS because it's actually going to be focused on traditional, low-tech industries," says a person familiar with the vehicle. "Of course, the current environment is not helpful, but this fund, with a private equity time horizon, is looking beyond the political rhetoric."

While a lack of security concerns means low-tech industries are unlikely to be directly targeted by protectionist trade policies, they remain at risk due to the sheer scope of their cross-border flows. Soybeans, for example, are the top US export to China with about $15 billion worth of shipments made a year. It was among the first categories to get hit with Chinese tariffs this year.

CDIB Capital, the PE arm of Taiwan's China Development Financial, suspects that companies in non-sensitive consumables sectors could see an increase in operational dislocations if the US-China dispute grinds on, with Southeast Asia a likely destination for Chinese companies to move production. This is a potential issue for an investment by the firm in the furniture space, where China currently has a trade surplus with the US of about $35 billion a year.

Moving targets

Furniture is not in the CFIUS crosshairs at the moment but mixed signals from the US in recent months have made it difficult to predict where restrictions might hit next. CDIB recently pulled back from a potential investment in a US logistics company because it had access to standard customer data and the authorities indicated that Chinese investment would not be welcome. In a sign of the tangled ramifications of US-China tensions, such episodes have inspired caution even in Asia-focused deal flow.

"Right now, we're somewhat slowing down the pace of investment in the region, because we've entered very choppy waters and it could have a major impact on valuations," says Lionel de Saint-Exupery, chairman and CEO of CDIB. "There are ways to work around it in the medium term, but if there is a sudden acceleration of trade discussion in a negative way, it could be a catalyst for a macro recession that would be much more difficult to overcome."

CITIC Capital, similarly, has been reviewing a consumer brand company in China that exports to the US and has had to calculate around the possibility that another manufacturing facility outside the country could be required. Pressure on the economics and valuations of most companies, however, is more likely to come from reduced access to Chinese growth capital, the impact of tariffs on purchasing power at the customer level, and weaker IPO and M&A options as buyers hesitate in an environment of macro uncertainty.

The US-China trade dispute has so far generated far more talk than action, but it is too deeply rooted to be dismissed entirely as short-term political posturing. In the end, tighter markets will create costs for every party involved. Private equity investors may therefore do well to contemplate taking on new risk mitigation expenses as an insurance policy for a world where the two largest economic powers are likely to keep trying to outmaneuver each other indefinitely.

"It comes up in every conversation when I'm speaking with people in PE because it has an impact on almost all businesses, either on the top line, supply chain, overall investment thesis, enterprise values, or future growth plan," says Eric Wang, a managing director at A&M. "US tariffs are against China now, but they might go other places next. This is not going away in a few months – it's going to continue like this for years, so you have to look at it with a holistic view."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.