Japanese LPs: Stirring giants

Japan’s LP landscape is in a state of flux as several large-scale investors ramp up their alternatives programs. The industry must prepare itself, in terms of personnel, structures, and expectations

Tokihiko Shimizu first spoke to AVCJ in 2013, a few months after Japan's Government Pension Investment Fund (GPIF) had launched a feasibility study into whether alternatives should feature in its portfolio. Was the world's largest pool of retirement savings prepared to ease its dependence on government bonds in favor of higher-risk assets like private equity?

"There is a lot of debate in Japan as to whether public pension schemes should start investing in alternatives," said Shimizu, who was then director-general of GPIF's research department. "Some government ministers say we should be able to invest in private schemes such as infrastructure in India and China; others say the priority should be safety. It is very controversial."

Five years on, that debate is over. GPIF is in the process of awarding managed accounts across real estate, infrastructure and PE as it prepares to formally enter these asset classes. Shimizu, meanwhile, moved on to Japan Post Bank (JPB), helping establish what has fast become the country's most dynamic alternatives program. He is now CEO of direct investment unit Japan Post Investment Corporation (JPIC).

The transition has been rapid, by Japanese standards, and its implications will be wide-ranging: the actions of these large groups are likely to trigger similar responses throughout the LP community. It has also prompted a hiring spree as JPB, Japan Post Insurance (JPI), and GPIF raid insurance companies and asset managers for people to execute their plans. This raises the question as to whether there is enough talent in Japan to deploy the wave of capital expected to enter alternatives.

"Everybody in this industry – not just Japan Post and GPIF, but also trust banks, asset managers, and gatekeepers – is very active in terms of hiring people," says Reijiro Samura, president and CEO of asset manager Alternative Investment Capital (AIC). "It is very difficult to recruit experienced people."

The mother lode

The numbers being thrown around are eyewatering. Based on GPIF's JPY162.7 trillion ($1.49 trillion) in assets as of December 2017, as much as JPY8 trillion – equivalent to the entire Oregon Public Employees Retirement Fund – could enter the asset class if the 5% alternatives allocation target is hit. JPB wants to increase the size of its alternatives portfolio from JPY1.5 trillion to JPY8.5 trillion in the next three years, while JPI is looking to commit approximately JPY1.1 trillion over the same period.

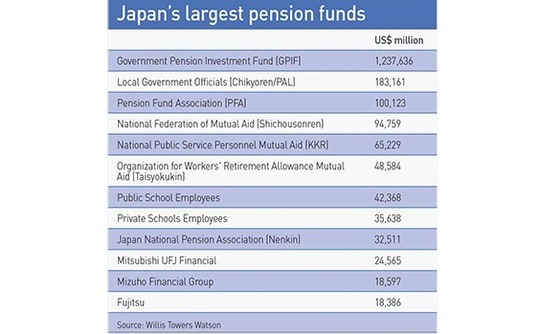

The top eight government pension funds after GPIF, currently not active in alternatives, had more than $600 billion under management between them at the end of 2016, according to Willis Towers Watson. The largest of these, the $183 billion Pension Fund Association for Local Government Officials (Chikyoren), now has an alternatives team and an advisor, and is taking meetings with managers.

Meanwhile, Tuck Furuya, CEO of placement agent Ark Totan Alternative, estimates that of 10,000 corporate pension funds nationwide, over 100 have at least $200 million under management and can commit $5 million or more to a fund. Many want to increase their alternatives exposure. Denso Pension Fund, for example, has $5 billion in assets and a 10% allocation to private equity, real estate, credit, and infrastructure. The goal is to reach 20% within eight years.

"If you had asked me three years ago whether we were expecting to raise huge sums out of Japan, I would have said you have to be kidding me," says a partner with a global PE firm. "It feels like Korea 10 years ago. NPS [National Pension Service] and KIC [Korea Investment Corporation] kicked it off and then the floodgates opened, with the banks, insurance companies, and asset management groups all coming in."

This manager's most recent fund has about a dozen Japanese LPs, including insurers, banks, endowments, and pension plans. There are now expectations of bigger checks to come, especially if the other government pension funds follow GPIF's lead and establish alternatives programs. Should this happen, Japan will become a permanent fixture on the fundraising trail for international GPs.

The budding potential of Japan stands in stark contrast to the situation 15 years ago when the call sheet was largely limited to Nippon Life, Sony Life, Mitsubishi Corporation, Tokio Fire & Marine Insurance, and Norinchukin Bank. Some of these investors are still active in the market, but the personnel aren't the same, and there isn't always a deep pool of talent below the senior layer.

"When investment professionals move to other organizations it creates a big hole. Private equity is a networking business. If one guy leaves an insurance company after 15 years he takes his network with him," says Ark Totan's Furuya. "Groups that lose people need to build up their teams again or rely more on gatekeepers, otherwise their investment budgets will be reduced."

This dynamic is exacerbated by growing interest in Japan among international managers. A few GPs are hiring local staff, so they can build relations with investors, recognizing that marketing to Japanese LPs requires a licensed local representative to be present at meetings. Meanwhile, the fund-of-funds – aware that an office in Tokyo is often a prerequisite when competing for separate account mandates – are also adding manpower. Adams Street Partners established a local presence in 2014 and has been expanding ever since.

In the post

For both Japan Post entities, the journey into alternatives began in November 2015 with the IPO of their parent group. They had to start generating dividends for shareholders, which meant seeking higher returns than those available on government bonds. JPB launched its alternatives program in early 2016 and hiring more than 20 investment professionals.

The bank not only moved faster than its peers, it aggressively pursued reform. Katsunori Sago, the Goldman Sachs hire who became JPB's CIO, made two crucial changes early in his tenure. First, JPB decided to pay market rates to recruit talent from outside the organization, ensuring it had "the pick of the litter," as one industry participant puts it. People have come in from groups such as Nissay Asset Management, Sumitomo Mitsui Trust Bank, Daido Life, and AIC.

Second, the practice of rotating staff through different jobs every 3-5 years – a characteristic of Japanese corporate culture – was abandoned in the investment division. It amounts to an acknowledgement of the fact that private markets require specialization and apprenticeship. "JPB clearly transformed its culture and maybe other domestic institutions can follow," says JPIC's Shimizu. "This will bring Japan closer to global standards."

It is worth noting that JPB's path appears less cluttered with bureaucratic obstacles than those of JPI and GPIF. With JPY76.8 trillion in assets, JPI is just over one-third the size of JPB and it entered the alternatives space a year later. There are eight investment professionals on staff with two more set to join next month. Individuals have been hired from reputable groups, but JPI has not introduced a separate salary scheme for the alternatives unit and its rotation policy officially remains in place.

There are also differences in how the two groups work with advisors. JPB initially appointed four local gatekeepers and has since entered into partnerships with several international fund-of-funds as well. But coverage of Japanese private equity and some Asian funds is said to have been taken in-house. JPI, on the other hand, is still highly dependent on its gatekeepers.

Tadasu Matsuo, head of alternative investment at JPI, expects this approach to evolve, but it will take time – and this in part due to team size and availability of talent. "For the next two or three years, we will work with gatekeepers and advisors. By the second stage, I hope our staff is large enough and our experience deep enough that one-third our new commitments can be made by ourselves," he says.

Descriptions of investor-advisor relationships in Japan vary considerably. Government and corporate pension funds are required by law to operate through gatekeepers but discretion often comes with a high degree of oversight. "Legally speaking, these are discretionary mandates, but practically speaking we work very closely with the gatekeepers," explains one LP.

Much rests on the type of clients a gatekeeper is handling. For example, Development Bank of Japan tends to the needs of the country's regional banks, which have different needs and capabilities to AIC's mixture of financial institutions and corporate pensions. But perhaps a more pertinent question for these advisors is how they will manage the additional work generated by rising alternatives allocations, particularly given clients' in-house teams tend to be relatively small.

Samura of AIC observes that business has been busy lately because existing corporate pension clients are investing at a faster than anticipated pace. The firm has not brought a significant new investor online, but the government pension funds would be just that. It represents a huge opportunity for advisors, but also a challenge to their resources.

"When selecting gatekeepers, we look at the quality of the company, as well as the quality of the individuals who make up the gatekeeper team," says Masanori Asawaka, CIO of Denso Pension Fund. "In the past, many gatekeepers were passive or suggested products they wanted to sell. However recently, we see some gatekeepers who listen to their clients' needs and show their commitment to fiduciary duty to the clients."

Local complexities

The caveat is whether the check is large enough to justify the effort. According to Kazushige Kobayashi, a managing director at Capital Dynamics, investors are willing to take on more risk – for example, an insurer that used to commit $10-20 million is now entering $20-50 million territory. It tallies with accounts of asset managers are servicing LPs interested in creating customized mandates for specific asset classes rather than making one-off commitments to funds.

At the same time, though, some advisors are still aggregating $5 million commitments from multiple investors to achieve critical mass. If an investor wants exposure to a product or strategy but it is unable to make a substantial commitment and other LPs are showing little interest, there is often a reluctance to devote time and resources to due diligence.

These contrasting tales speak volumes for the structural complexities of Japan's LP community – and offer context to the challenges foreign alternatives managers have historically encountered when trying to raise capital from it.

While there are common themes in terms of what LPs want exposure to, the division of assets is so skewed that the market cannot move as one. Until relatively recently, most of the money was beyond the reach of alternatives managers, held by government-linked entities. This left a long tail of financial institutions and corporate pensions often characterized by their conservatism and preference for diversification.

Japan gained a reputation as a place where countless meetings with institutional investors delivered relatively small commitments. "A lot of GPs suffer brain damage in Japan. You spend eight years with some of these pension plans before they say they are ready to make their first commitment. You're expecting $25 million but they only want to put in $5 million," says one pan-regional manager. "But we must keep plugging away to open up the market, it's such a big savings pool."

Despite expressing frustration at their slow decision-making, the manager still had seven Japanese LP in his latest fund, which was oversubscribed. The rationale was that these investors are sticky: the effort required to get commitments to the current fund will be worthwhile if they end up writing larger checks in later vintages. Their willingness to re-up may also stimulate demand from other Japanese LPs.

This scenario offers a snapshot of how GPs are positioning themselves to tap the large pools of capital now emerging in Japan, but some industry participants warn against expecting too much too soon. For private equity specifically, Hong Kong Monetary Authority writes $300 million checks for funds, China Investment Corporation is comfortable with $200-300 million, and Korea's NPS and KIC start at $100 million. Japan's LPs have yet to enter this territory.

GPIF will need to make large commitments given the size of its asset base, but its plans are unclear. JPB is certainly able to invest $100 million into a fund but is thought to be averaging around $50 million, while JPI's current range is $20-30 million. Norinchukin aside, it remains to be seen how quickly the remaining financial institutions, insurance companies and corporate pension funds – individually or aggregated – become fixtures in the larger-ticket categories.

Not every organization will be able to replicate the JPB model, but they still need time to put in place the people and systems to accommodate more comprehensive participation in alternatives. Even then, fundraisers will have to adapt to local conditions as they do in any other market.

"There is money to be raised out of Japan, but in many cases the amounts won't be huge and you need to do a lot of meetings with a lot of LPs," says Kay Sano, Japan representative director at Monument Group. "And you need someone on the ground who speaks Japanese – the language barrier is higher than people expect."

SIDEBAR: The direct route

Japan Post Investment Corporation (JPIC) doesn't want to compete with PE firms for deals, preferring to co-invest with GPs. This hands-off arrangement does not extend to staff. Since its establishment in February, JPIC has hired professionals whose resumes include CVC Capital Partners, TPG Capital, and Unison Capital. More appointments will follow as it fills out the junior ranks.

"If a co-investor doesn't have enough skill in direct investment it is very hard to execute deals," says Tokihiko Shimizu, CEO of JPIC. "If we have that experience and skill, private equity firms are more comfortable working with us. We can execute deals within two to three weeks of an opportunity being presented to us by a GP."

JPIC was formed by Japan Post Bank (JPB) and Japan Post Insurance (JPI) as a standalone unit because the two groups – both of which have launched alternatives programs in the last three years – were being offered co-investments but found it difficult to act on them. It has raised $900 million for its first fund, with JPB contributing two thirds and JPI one third. There are plans to raise another $300 million from outside investors by March of next year.

Most deals are expected to come through private equity funds in which JPB or JPI is an LP; two investment decisions have been made so far but the transactions have yet to close. In addition to participating in buyouts, JPIC will also make growth investments in technology-oriented companies and target special situations opportunities.

There are currently 11 investment professionals on the payroll and the intent is to hire around 10 more. Compensation packages are said to be market rate and structured much like those of private equity firms. Management has a 25% stake in the GP – the rest is held by JPB and JPI – and will receive carried interest on successful investments made by the fund.

Shimizu adds that investment professionals are likely also attracted by the model being pursued by JPIC, which he sees as the best way for a large LP to achieve scale in its deployments. The idea – inspired by the likes of Canada Pension Plan Investment Board or GIC Private – is to have the fund and direct investment teams leveraging one another's information flows to drive returns.

"In joining our team, they can learn more about different GPs' approaches to investment," Shimizu adds. "Someone who joins from Unison is probably only familiar with Unison's practices, while someone from CVC only knows CVC's investment practices and philosophies. At JPIC, we want to draw on everything and create a balanced approach, a best practice GP model."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.