Portfolio: Cathay Capital and Shopal

Shopal’s cross-border marketing ambitions and Cathay Capital’s Sino-French investment history have proven to be a strong match for tackling the expanding Chinese high-end consumer market

China's economic boom has sparked a rush by global brands to cater to its growing middle-class consumer market. The inflow of overseas companies has, in turn, created an active support ecosystem to help these newcomers create branding strategies for China, with e-commerce marketers in particularly high demand. But as the commercial environment continues to evolve some observers have noticed a small but growing gap.

"The legacy businesses looked at the big brands with big volumes, and worked with big platforms, and they captured the first generation of consumers in China," says Nicolas du Cray, a partner at Cathay Capital. "But the new generation of consumers is much pickier – they want higher end, niche, differentiated products."

The problem from Cathay's perspective is that none of the established marketing consultancies in China seem interested in going after this emerging consumer segment. While newer-generation consumers might be willing to pay more for higher-end brands, the share of the market that they represent is relatively small. Moreover, marketing to their more discriminating tastes requires shifting strategies, which might not seem worth the effort to move resources from a model that has already paid off.

Shopal stepped into this gap in 2015 with a plan not only to include these higher-end consumers, but to make them the center of its technology-enabled strategy. The company would find niche brands overseas that are likely to appeal to Chinese consumers, craft strategies for them to enter the China market, and execute those strategies through its own well-developed online marketing network.

Cathay had been looking for innovative takes on the Chinese consumer branding market and immediately recognized Shopal's potential. As the company's earliest investor, it the private equity firm been instrumental in helping to shape the strategy and grow the business over the last two years. Both sides believe the partnership will continue to be one of Shopal's greatest assets as it aims to become the leading marketer for luxury products in China.

Product of its time

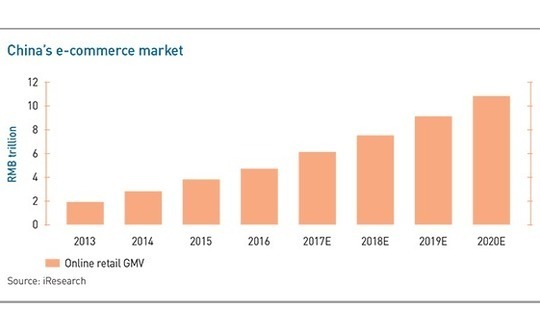

In some ways a player like Shopal was an inevitable result of the inexorable growth in the country's consumer sector. In the year of the company's founding Chinese e-commerce gross merchandise value (GMV) came to RMB3.5 trillion ($547 million), according to iResearch Consulting, representing 12.6% of overall retail sales of consumer goods.

E-commerce GMV is predicted to rise to RMB10.8 trillion by 2020, when it will account for 21.9% of consumer retail sales. Since online retail consumers tend to skew younger than overall retail, it clearly pays for overseas brands looking to build a lasting presence in China to create an online strategy early.

Shopal founder Guo Lu had a front row seat to these developments, having served since 2012 as director of strategy for Asia Pacific at apparel and footwear giant VF Corporation. Guo's team helped create China marketing strategies for the company's portfolio of consumer brands including Vans, Timberland and The North Face. From the apparel industry she moved to Johnson & Johnson in 2015, where she had the insight that led to the creation of Shopal.

"I realized that in the health, beauty, and mother and baby space, the majority of brands still operated as a small counter, or 100% wholesale model, and the go-to-market capability was much less agile," says Guo. "At the same time, Chinese consumers are going through an upward trend in these sectors. They're looking for brands with higher quality and heritage backing them, rather than general mass brands."

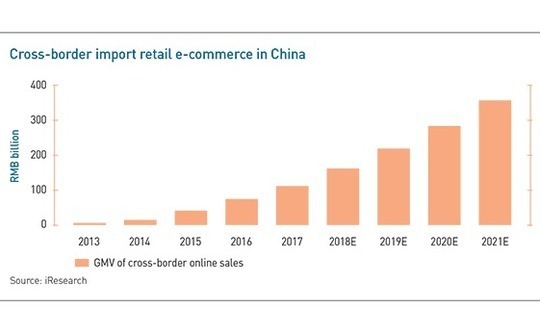

This developing appetite for higher-end products was already being reflected in online retail data at the time. The GMV of products entering China through retail e-commerce had risen from RMB6 billion in 2013 to RMB41.2 billion in 2015. IResearch expected it to reach RMB356 billion by 2021.

The GP's cross-border strengths have allowed it to exercise a level of influence over Shopal disproportionate to its relatively small investment size: Cathay has committed $10-20 million across three funding rounds, taking an initial stake of 10% and increasing it to 20%. The close relationship stems from the private equity firm's ability to straddle the Chinese and French markets and provide valuable insights relating to each one.

A wider reach

Cathay entered the scene at a critical time for Shopal, when the company was searching for overseas clients that could benefit from its marketing services in China. The GP emphasized that its presence in Europe could provide a valuation source of introductions for Shopal, and this pitch registered with Guo.

"Cathay Capital is unique, because we have a very strong ecosystem in France and Europe, as well as in China," says du Cray. "What we bring to Chinese companies in general is access to the European market. The vision from day one was that we would be able to bring a lot of potential clients to the company."

The firm has since delivered on this promise, connecting Shopal to a range of French luxury brands. In addition to Cathay's own portfolio, the firm leveraged its existing relationship with French investment bank Bpifrance, which has a unit dedicated to investments in French cosmetic and beauty brands. Tapping this portfolio has given Shopal a rich enough pipeline that the company has already reached the point where it feels it can afford to turn down clients.

Relationships established through Cathay include skincare brands Aveeno and Caudalie, for which Shopal took over the exclusive online marketing rights in China in early 2017. Both brands have seen their market share grow under the company's management, with Caudalie rising in Taobao's beauty brands ranking from below 200 to enter the top 50 by the end of last year.

Building an online presence for this type of company requires a different approach to that pursued by China's established e-commerce marketing players, known as Taobao partners or "TPs" after Alibaba Group's online marketplace. These groups' strategy typically focuses on aggressive discounting to build up sales volumes, an approach which is not always viable for small brands that cannot afford to sell at a loss.

Instead of blitzing the most heavily trafficked platforms with discounts and promotions, Shopal emphasizes a holistic approach to brand building that leverages data relating to all aspects of the market and the client's internal operations. This was a central element of the company as originally conceived by Guo and it played a major role in attracting Cathay's investment.

"Cathay really understood the requirement of being not just a media player, a TP player, or a data and logistics player, but that all those core qualities are needed from the beginning to go into this market," Guo says.

Shopal's data-centric approach makes up for its clients' relatively smaller buying power by providing them with the information needed to put their resources where they will do the most good. In product promotion, for example, it constantly analyzes data from China's myriad livestreaming platforms and video sites. By determining what products are viewed and which sites deliver the most purchases, the company can then direct its network of 1,000 online opinion leaders and influencers to effective platforms for their products.

This data analytics expertise also allows Shopal to set prices more efficiently in online and offline retail channels and see how consumers respond in real time. The company even reviews data relating to the efficiency of China's logistics network in order to recommend where its partners should position inventory and when to prepare for shipping delays.

"You need to be able to go end to end, basically, all the way from upstream – brand recognition, brand building, KOL [key opinion leader] activation, and so on – all the way to the downstream, the logistics and warehousing aspect," says du Cray. "All that data is needed to build a platform that lets you operate efficiently."

Competitive edge

These efforts are not unique to Shopal, and the major e-commerce platforms have offered various forms of analytics to sellers for years. But the company believes it brings clients advantages that are hard for others to duplicate.

For one thing, Shopal has been built from the beginning around optimizing its service offering for smaller players. Marketers that deal with larger brands may have a hard time building up their expertise in this area, since their existing clients probably don't see the need for it. Shopal also has the advantage of selectivity. It actively identifies and contacts brands that might do well in China, whereas other marketing firms typically rely on customers to come to them.

Furthermore, while e-commerce sites offer data analytics to customers directly, Shopal can claim a more comprehensive view of the market due to its dealings with a broad range of providers. The company believes this gives it an edge over the Taobao partners, which as their name implies tend to deal with the largest sites where large volumes can be moved quickly, and lack experience with smaller platforms.

Shopal is still in its early stages of development, but it already claims to have run a profit starting in March 2017, and management has partnered with Cathay to draw up a growth strategy. In the near term, the company is focused on expanding its client list from six to 15 within the next two years. Cathay will assist in this respect, as well as helping Shopal scale its team to handle the intensive data collection needed for these new customers.

The longer-term goals are even more ambitious. Shopal is planning to open its first offline store by the end of the year where it can showcase overseas clients' products directly to Chinese consumers. This could provide a way for the company to build brand awareness in the local market. Shopal has also begun to acquire equity stakes in its brand partners, giving it greater control as it develops its own online and offline retail channels.

"This is the vision that Cathay has cultivated together with Shopal to decide where the company's going," says Guo. "They've been a very good partner on these areas, and I think that one of the key benefits of this relationship is that it's opened up my eyes about how such an institution can pursue portfolio management."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.