China online-to-offline: Retail reorientation

As technology brings the buyer closer to the seller, some investors are put off by the uncertainty while others see opportunities in finding ways to digitize – or further disrupt – traditional retailers

Chinese retail has lost its shine in the eyes of most PE investors. The industry has been so disrupted by technology that its very ethos is being called into question. A traditional retail platform was the most efficient means of bringing together consumer and brand. Now data-enabled marketing, browsing, payments and logistics threaten to remove this platform from the equation, with brands developing the capacity to reach out to consumers directly.

In this context of uncertainty, until April 2017, there hadn't been a meaningful investment in an independent brick-and-mortar retailer by a mainstream PE player in about four years. Then CDH Investments and Hillhouse Capital agreed to privatize Belle International, the largest women's shoe retailer in China with more than 20,000 stores nationwide, at a valuation of $6.8 billion.

The company's financial performance and stock price had both suffered in recent years. Belle admitted there was a need to integrate its traditional retail business model with the digital economy, and that triage under the veil of private ownership was the best way of achieving this. The PE investors believe they got in at an attractive valuation, but they also see potential in threading technology into the DNA of a company that controls its entire process, from product design to retail.

"The global capital markets look at the disruption taking place in traditional retail and discount the valuations of typical old-line players," says Stuart Schonberger, a managing director at CDH. "Our view is that in China, established players are uniquely positioned to outperform app-based start-ups because they have mastered the hardest parts of retail – the product, the channels and the clients. If they successfully improve their technology, they should be more valuable than pure technology companies."

Predicting the future

Technology has turned retail into a melting pot of different interests and strategies. The future will involve the fusion of offline and online capabilities from factory floor to home delivery, but it is subject to a variety of interpretations. Traditional retailers must establish plans based on their resources, and then decide how they want to work with the likes of Alibaba Group, Tencent Holdings, and JD.com. On top of that, the disruption patterns could be redrawn by new technological advances.

"I think it's still a work in progress," says J.P. Gan, a managing partner at Qiming Venture Partners, which has invested in retail start-ups ranging from unmanned convenience stores to B2B e-commerce platforms. "Traditional companies haven't been completely disrupted yet, but gradually more new players will come through with better products and business models. That will cause more disruption."

AVCJ Research has records of 51 private investments in China retail in 2017, a couple short of the combined total for the previous four years. However, three-quarters of the deals were in the venture capital space and several growth transactions involved companies with technology-oriented businesses. A similar proportion of the deals announced so far this year are also VC.

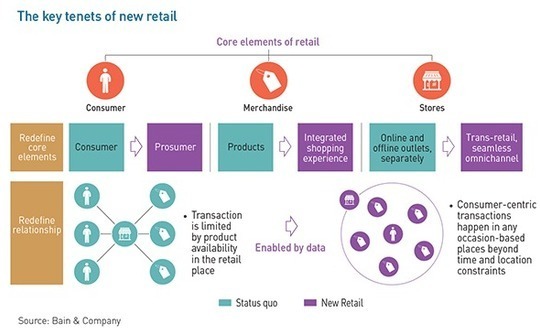

Online-to-offline (O2O), omni-channel retail, and disruption have featured in early-stage investor parlance for several years. The key driver for the latest wave of activity is the amount of data available and the emergence of technologies that claim to put it to effective use. This, in turn, provides companies with more guidance on what they must do to sell more. Welcome to new retail.

"It is about using data to drive deeper insight about consumer needs, digitizing the ways consumers interact with products and services, and deciding how to build a different physical and digital asset to support that interaction. In short, it is the digitization of three key elements: the consumer; the product or service; and the location of the transaction," says Jason Ding, a partner with Bain & Company. "Earlier attempts at O2O were part of that overall scheme but not as complete or fundamental."

Alibaba arguably has the most coherent vision of new retail. Central to its thesis is Hema, a supermarket chain that is intended to unify online and offline to create a "seamless shopping experience." Consumers use an app to navigate the store, scanning product barcodes to get more information, logging purchases, and settling the bill through a link to their Alipay account.

Hema reinforces its consumer-centric approach by allowing shoppers to pick out fresh food, such as seafood, have chefs cook it immediately, and then eat in the store. Meanwhile, on the logistics side, each of the 25 outlets across seven cities doubles as a fulfilment center, so registered users can place orders through the app for delivery in 30 minutes, provided they live within a three-kilometer radius.

"They are basically using the offline experience and offline retail insights to generate traffic and turn it into online traffic," says one consumer-focused private equity investor. "The per-square-meter activity and sales are going to be higher than a typical supermarket because they aren't just selling to offline customers. There are online members making purchases for delivery as well."

It is a powerful concept. Apparently powerful enough to convince Howard Schulz, executive chairman of Starbucks, that rather than just work with Tencent on in-store payments, it should collaborate with Alibaba as well. When Starbucks launches its first roastery outside of Seattle in Shanghai this year, Alibaba's mobile Taobao app will use location-based technology to recognize users as they arrive and offer store information as well as customized services.

Hema also serves to address Alibaba's broader need to increase its exposure to offline retail, as evidenced by its strategic investments in the likes of hypermarket operator Sun Art Retail and department store chain Intime Retail. Online consumer acquisition is more expensive and difficult than before as the total number of internet users and the amount of time spent online begins to plateau. Reaching more people and realizing more value is dependent on a multi-strategy approach.

But for how long can Alibaba reconcile Hema's role as a new retail showcase with the fact that it's a loss leader? Moreover, how applicable is this vision of the future to companies that are responding to digital disruption in the here and now?

"With the flashier things, we're not there yet. When a solution is straightforward it's much easier to react in terms of operations," says James Dubow, head of Asia at Alvarez & Marsal (A&M), who works with retailers in China. "If someone goes into a changing room to try something on, they are close to a buying decision and staff are trained to say the right things. If there's data showing the hit rate, you can respond to that. With other data, it's not yet clear how you adjust your operations to capitalize on it."

This doesn't mean A&M advises clients to avoid Alibaba. In one instance, a retailer relies on the Tmall and Cainiao axis – the former is Alibaba's B2C e-commerce site, the latter is a logistics system that brings together multiple third-party providers – for 60% of its logistics needs.

The enablers

The next step in Alibaba's offering is consistent with its desire to move from online to offline: integrated supply chain management based on a single pool of information. If the in-store inventory is running low, take it from the stocks for online customers; if an order is placed online and the item is not immediately available, check the offline stores. "They say they can do full integration. We haven't tested it yet, but we are looking into it," adds Dubow. "While it sounds obvious, making it work in practice isn't easy."

Brands and retailers have been working with Alibaba for years, establishing stores within Tmall to capture online traffic. One of the tenets of Alibaba's new retail is enabling brands to do more.

If Hema represents the future built from the ground up, other services are essentially a digital wrapper for existing brick-and-mortar players. Through a variety of different platforms, Alibaba is promising to: help companies develop products for the China market and test the response on Tmall before formal launch; and manage consumer engagement, sharing data and providing guidance on pricing and distribution.

Meanwhile, convenience stores can get a digital makeover, complete with apps that provide store analytics – enabling retailers to identify products that sell well – and bulk sourcing solutions. At the other end of the spectrum, department stores can be equipped with virtual shelves that connect with Tmall and deliver products to shoppers' homes if the right size or color is not in stock.

"Data assets are the most important thing that Alibaba wants to enable. Many traditional retailers don't have transactional data. They might have membership programs, but they are capturing a very small amount of information," says Bain's Ding. "Alibaba, with its own ecosystem and partnerships, has accumulated a vast portfolio of user data. This can help retailers make better decisions about product selection, dynamic price, store location, and other services."

It is not the only Chinese technology company making entreaties towards digitization. JD.com is also making a pitch for integrated logistics based on its model as an online retailer. The approach includes control over inventory and delivery versus the Alibaba approach of marketplace plus outsourced logistics.

Tencent typically focuses on the upstream part of the consumer journey, attracting users through games and social networking with a view to assembling a target market for its downstream retail partners. More recently, the company has also made forays into the offline space – it acquired a minority stake in Yonghui Superstores at the end of last year and then teamed up with Yonghui to invest in Carrefour China with a view to driving demand for internet-enabled services.

However, Tencent's most powerful tool is messaging app WeChat and the notion of a decentralized platform. WeChat is fast becoming an operating system in its own right, complete with mini-apps embedded into it so consumers can access products and services from inside WeChat and pay for them using WeChat Pay. It is a focal point for communication and data collection, but brands and retailers make their own decisions about how to leverage the information and develop services.

"People are talking about ‘WeChat traffic' – WeChat by itself is becoming kind of walled garden," observes Qiming's Gan. "Many companies are using WeChat traffic to get users and to provide decentralized products and services, which means they are selling more through WeChat."

The question for traditional retailers is whether they want a relationship with technology companies, and if so, how it functions. As part of the Alibaba-Sun Art Retail tie-up, RT-Mart is installing new point-of-sale systems that connect with the Alibaba backbone, allowing the retailer to develop a more comprehensive understanding of its customers. Can others, including multinationals that may have their own global systems, afford not to do the same?

Belle is working with the likes of Tencent and Alibaba on certain projects, but the move towards digitization comes from within. Hillhouse seconded one of its founding partners, Luke Li, to the company as head of a division of more than 1,000 engineers and executives dedicated to this effort. Initiatives include cloud-based inventory management, which facilitates faster home delivery, and the use of big data and artificial intelligence (AI) to harmonize online-offline merchandizing and pricing.

The general idea is to make technology drive efficiency in a way that brings the consumer closer to the designer. CDH's Schonberger uses the example of large-size women's shoes, a product line that distributors are reluctant to stock because there is little demand. Under a data-driven system, designers and manufacturers can respond swiftly to demand patterns and provide large-size shoes while minimizing inventories.

"Stores can become showrooms for a fully integrated just-in-time delivery system from design to manufacturing to client," he explains. "A salesperson measures your foot and takes a picture of it, you look at products in the store and online, and say, ‘I like this shoe, but do you have it as an eight-wide in green?' With digitization, the shoe is delivered to your home within days. The hard part is managing relationships between manufacturers, distributors, warehouses, and stores. Companies like Belle already have these."

Implementation issues

A key caveat is that these strategies can't just be bolted on; the scale of change is so significant that support from senior management is essential. For example, the unification of online and offline functions must be threaded into a company's operations. If supply chains are not geared to respond to customer demand – using data to work with suppliers on smaller, more targeted orders – then efficiencies cannot be realized. If incentives systems for in-store sales staff are not modified to reflect the fact that transactions are taking place across multiple channels, integration efforts will be stymied.

One of the takeaways from Hillhouse's past retail investments, and something the firm is prioritizing in its work with Belle, is the role of sales staff in consumer engagement and ensuring they have digital tools to maximize impact. A&M has also focused on this area with retail clients in China, equipping staff with iPads so they can listen to customer feedback on products and feed it into the system.

"On a weekly basis, you review the best and worst sellers and you aggregate all the information you hear from the source app about those pieces. In the past, if something wasn't selling, you would have to guess why: fit, color, style or quality. Now you understand specifically why things aren't selling because you hear the same things over and over," says A&M's Dubow. "You integrate what you learn offline into your approach. The worst thing is having data but not doing anything with it to generate sales."

That is the fundamental challenge for all retailers. From video counters that track movement throughout a store – recording the age and gender of each consumer as well as where they went and what they bought – to camera systems that monitor eyeball movement, technology is generating more customer information than ever before. This might already be influencing highly practical issues such as store layout, but it remains to be seen how quickly more complex datasets filter into retail strategy.

Making the most of data involves asking pointed questions and seeing if the analytics produce deeper consumer insights that can be acted upon. In this context, many systems are still unproven. "A lot needs to happen in the next 6-12 months for us to see who can demonstrate the benefits of all these data," says Bain's Ding. "Integration is far from complete and it will take a lot of effort to connect all the dots."

At the same time, technology is not standing still. This, in turn, explains the hesitancy of private equity to participate in retail as well as the willingness of venture capital players to back internet-enabled solutions. For both sets of investors, Alibaba, JD.com and Tencent are either partners or rivals on the journey towards digitization.

Lightspeed China Partners, for instance, supported Hanshow, the developer of an electronic shelf labelling system that allows retailers to synchronize online and offline pricing and special offers. Customers include traditional retailers like Wumart as well as Alibaba's Hema. Lightspeed is also an investor in Xingbianli, one of numerous Chinese start-ups that sell fresh food through cashier-free convenience stores where access and payment is controlled via an app.

All these companies are pursuing business models that directly or indirectly improve the user experience or reduce the cost of providing that experience. The ways in which they engage with the consumer vary based on the nature of the product or service, but they essentially rely on systems that optimize the use of online and offline infrastructure – and can respond to changes in demand.

"You are getting close to the end-users and offering them convenience. The physical touch point might be a vending machine around the corner or a supermarket further away," says Jixun Foo, a managing partner with GGV Capital. "But new retail is a supply chain play, you have to be vertically integrated. It's not just about putting in a machine."

SIDEBAR: Beyond the box

For the past 12 months, Amazon employees have been trialing a new store concept in Seattle that has no checkout desks or cashiers. A smart phone app gives shoppers access to the premises, hundreds of cameras track their every move and purchase, and machine learning-enabled analytics systems calculate the final bill and charge the credit card linked to the app. In January, Amazon Go opened to the public.

Alibaba has a similar initiative on its Beijing campus: entry is controlled and bills are settled using a combination of an app, facial recognition technology, and radio-frequency identification (RFID). There are also a host of VC-backed start-ups across China pursuing variations on the same theme: the likes of Bingobox, Citybox, Xingbianli, and Guoxiaomei have rolled out thousands of unstaffed convenience stores and smart vending machines.

"Where there is a big market opportunity, the capital will follow," says James Mi, co-founder and managing director of Lightspeed China Partners, which invested in Xingbianli. "It happened before with group-buying. There were 1,000 companies and eventually those with the best teams, best execution, and the most funding won. And now there is only one company, Meituan-Dianping."

There are already signs of fatigue, with some consolidation in the segment and plenty of anecdotal evidence that activity is slowing down. J.P. Gan, a managing partner at Bingobox investor Qiming Venture Partners, observes that a lot of money was raised based on ideas or business plans. Now investors are focusing on execution – they want companies to continue pursuing expansion plans but also start delivering revenue from these store networks.

Still, cashier-less convenience stores fit the new retail profile: they resolve a customer pain point by enabling people to shop in places, such as residential complexes, where they previously could not; they should be cost-effective because no permanent labor is required, and outlets can simply be dropped into low-rent locations; and they capture data, which can be used to devise better marketing, procurement and logistics strategies.

If these start-ups are basically volume plays, the longer-term question is about value. As new retail practitioners become more sophisticated in how they collect consumer information – moving more towards the Amazon Go model, for example – who owns the technology that interprets all the data? "Facial and image recognition is important, whether it's used in finance or retail," Gan says. "In the next few years, there will be a lot of competition in the technology space itself as well as in retail."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.