1Q analysis: The inevitable slow start

Traditional buyouts slip into the shade, allowing education and technology to shine; China IPOs and secondary buyouts stay strong in a weak exit market; fundraising suffers an early-year blip

1) Investment: Services stand out in a weak market

PE investment in education ended 2017 with a flourish as Affinity Equity Partners agreed to buy the Malaysia assets of global player Laureate Education for $180 million. It took commitments to the sector to a record $6.7 billion for the year, helped in no small part by the $4.3 billion privatization of Nord Anglia Education. But the number of deals, from venture to buyout, rose as well, surpassing 100 for the first time.

This momentum continued into the first quarter of 2018 with 35 transactions announced worth a combined $640 million, according to preliminary data from AVCJ Research. They included two buyouts of brick-and-mortar businesses in Southeast Asia – KV Asia bought Malaysia's APIIT Education Group for $180 million and ICG paid around $100 million for Singapore-based PSB Academy – as well as the standard collection of Chinese online-only operators.

These investments are all presaged on the willingness of Asian parents to invest in their children's education. They also represent a relatively small but growing portion of an investment landscape that is increasingly geared towards services – with China, India and Southeast Asia the most prominent geographies.

The significance of internet-enabled technology to regional PE deal flow is well-established. Even as investment activity reached a record high last year on the back of traditional buyouts, venture and growth deals for start-ups still accounted for over 20% of capital committed. This rose to 32% in the final three months of 2017 and 35% in the first quarter of 2018.

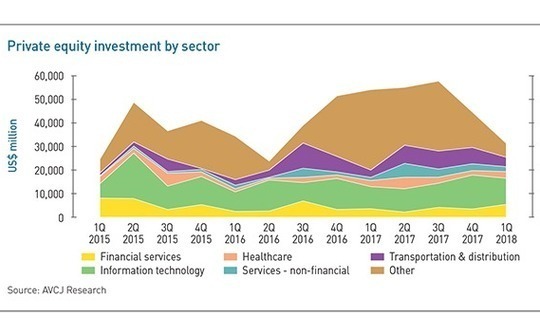

The proportion of investment going into financial services, healthcare, and non-financial services such as education also increased, while transportation and distribution saw a marginal retraction. Together they enjoyed a 46% share, a level surpassed on only one other occasion in recent years.

The trend is so stark in part because big buyouts have fallen off a cliff. The $12.7 billion posted for the final quarter of 2017 was less than half the total for the preceding three months. For January-March 2018, it plummeted further to $7.1 billion, the third-lowest quarterly total in more than four years. Only two buyouts feature in the top 10 transactions, with tech growth deals occupying seven slots. The largest was Chinese online retailer JD.com's spin-out of its logistics unit, which raised $2.5 billion. A separate private investment in the company's finance unit took third place.

Overall PE investment in Asia for the quarter came to $31.2 billion, down from $44.3 billion in the preceding three months. It is likely additional activity from the period will be announced in the coming weeks, but not enough to close the gap. It is the lowest quarterly total since April-June 2016, suggesting an end to the heady behavior of the last 12 months. Or maybe not.

It should be remembered that the first quarter is a historical weak spot, with the Lunar New Year festival reducing the number of work days in certain markets. A tendency to cram deals in before the end of the calendar year is also sometimes blamed for creating a lag.

We made this observation in response to a similarly weak opening to 2015. The first quarters of 2009, 2010, 2011 and 2013 were the smallest of their respective years, and the first quarters of 2012 and 2014 were the second-smallest. January-March 2015 did indeed turn out to be the weakest three months of that year; the same periods in 2016 and 2017 were the second-weakest. Given the amount of dry powder in the market, the is every reason to believe that 2018 will pick up the pace.

2) Exits: China IPOs, secondaries offer encouragement

While the early-year blues that blight investment are not as pronounced in the exit numbers, the trend is still there. But for about $300 million, 2017 would have made it three years in a row that the first quarter was also the weakest. Given the $14.2 billion in exit proceeds from January-March 2018 represents the lowest three-month total since the same period in 2015 – and it is also the first time the number of exits has slipped below 100 in eight years – Asia is likely returning to the norm.

The steady run-up in public market valuations that saw most indexes hit record highs during 2017 was bound to falter at some point and this happened towards the end of January. Block trades by PE investors slowed: Asia went from $5.45 billion in the final three months of 2017 to $1.53 billion in the first three of 2018, the second-lowest quarterly return in seven years.

At $9.45 billion, trade sales were roughly in line with October-December 2017, but still below the quarterly average for the past three years. And in terms of exit events, public market sales and trade sales haven't been this weak since the post-global financial crisis adjustment period in 2009.

There are, however, a couple of encouraging developments worth noting. First, despite private equity-backed IPOs failing to maintain the level of activity seen in 2017 – 43 offerings generated proceeds of $7.8 billion, compared to $13.4 billion from 99 in the previous quarter – there still appears to be demand for Chinese companies listing in the US. There were seven in the final three months of 2017, taking the annual total to 12. Five more listed in February and March.

The amount raised by these companies came to $3.17 billion, the highest quarterly figure since Alibaba Group went public in 2014. However, online video platform iQiyi accounted for two-thirds of the total. The company raised $1.53 billion in early 2017 from a group of private investors, but it is controlled by Baidu. In taking the business public, Baidu is continuing a trend of large internet players spinning out subsidiaries, although the likes of Tencent Holdings and Bitauto – which listed China Literature and Yixin – opted for Hong Kong over New York.

IQiyi was not the only video platform to complete an offering with Bilibili also debuting on NASDAQ. However, the more compelling pattern involves education. Post-secondary specialist Sunlands Online Education and K-12 after-school services provider OneSmart Education became the fourth and fifth private equity-backed companies from this sector to achieve public listings in the last six months.

The second development is the continued robustness of the secondary buyout market. Transaction values for secondary exits overall have dropped off substantially from the total posted in the final quarter of 2017 – $2.34 billion versus $8.38 billion – but there has been nothing of the scale of Global Infrastructure Partners' $5 billion acquisition of Equis Energy. And the number of secondary deals only fell marginally to 14, while the buyout tally rose from seven to nine.

Five of these feature in the 15 largest exits in the first quarter, an unusually high proportion. The geographical spread is also broad: I-Med Holdings in Australia (EQT Partners to Permira), Trimco in Hong Kong (Partners Group to Affinity Equity Partners), MFS Technology in Singapore (Navis Capital Partners to DCP Capital Partners), Woojin Electric Machinery in Korea (Skylake to ACE Equity Partners), and APIIT Education Group in Malaysia (Ekuinas to KV Asia Capital).

The Trimco deal is also notable for Affinity becoming the third consecutive private equity owner, with Partners Group having acquired the asset from Navis in 2012. The increasing prevalence of transactions of this nature are not only a characteristic of a maturing market, but also one in which pan-regional buyout players are battling to put their capital to work.

3) Fundraising: Buoyed by a 2017 overhang

The first and final closes of the latest funds raised by Affinity Equity Partners and Orchid Asia were classified by AVCJ Research as taking place in early 2018 rather than late 2017. They contributed a combined $7.3 billion to the regional fundraising total for the first quarter. But with or without Affinity and Orchid, the preliminary statistics indicate it was the slowest three months for fundraising since 2013.

Total commitments to Asia-focused managers came to $17.5 billion, down from $22 billion in the previous quarter. The number of funds achieving a partial or a final close also fell from more than 150 to around 60. The only quarter-on-quarter increase in a major market was for venture capital in China – and with several blue-chip managers preparing new funds, this is likely to become a more prominent theme over the course of the year.

Pan-regional activity should also continue thick and fast, with The Blackstone Group poised to join the ranks of global managers with Asia-dedicated funds. The firm has achieved a $1.5 billion first close and is expected to reach its $3 billion target with relative ease and a relatively concentrated LP base. With the global fund set to add ballast for larger deals, the top end of the market will become even more competitive.

Of the single country managers, Japan is well-represented, particularly given most of the active firms closed their latest funds last year. Nevertheless, Japan Industrial Partners weighed in with $1.1 billion towards a total pool of $1.4 billion, including a co-investment vehicle, and there was a final close of $282 million for Rising Japan Equity. Meanwhile, The Longreach Group, a North Asia-focused GP with strong Japan coverage, is inching towards its $650 million target.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.