Asia education: School's in

Education has emerged as the latest hot sector for private equity in Asia on the back of opportunities created by rising incomes and regulatory change. But higher valuations mean more pressure to deliver

When it comes to investing in a child's education, Asian parents are the world's biggest spenders. The region accounts for eight of the top 15 countries and territories based on the amount spent on education from primary school through university, according to a recent HSBC global survey. Hong Kong leads the list, with average spending of $130,000, and Singapore and Taiwan also appear in the top five.

China ranks sixth with $42,892, ahead of Australia, Malaysia and the UK – a remarkable statistic given the IMF places the country 76th globally in terms of per capita GDP. Chinese parents were also the best prepared financially among those surveyed, expressing a willingness to fund their children's education from whatever they have: savings, investments, insurance, or even specific education saving plans.

The importance of providing children with the best education possible to maximize their career opportunities in an increasingly competitive job market is rooted in the minds of Asian parents. Moreover, as incomes rise among the nascent middle classes of China and Southeast Asia, they are in a position to pay a premium for quality rather than rely on the state system. In China, about 44% of overall education expenditure comes from parents' pockets, compared to 16% in the US.

Against this backdrop, the scale of the education opportunity in China and markets like Vietnam and Malaysia is clear. And private equity investors are responding with gusto. The rationale is simple: education is a cash-generative and sticky business. Once parents are convinced they have found the right provider, they are unlikely to switch and often happy to pay upfront.

"Five years ago, education was one of a handful sectors we covered. It is now one of the most important sectors with a dedicated investment team looking at it. Private equity investors have recognized education is a huge market, with strong growth prospects driven by increasing educational expenditure in Asian and Chinese households. It's also a defensive industry that can withstand a possible economic slowdown," says Dejun Luo, a managing director at CITIC Capital Partners.

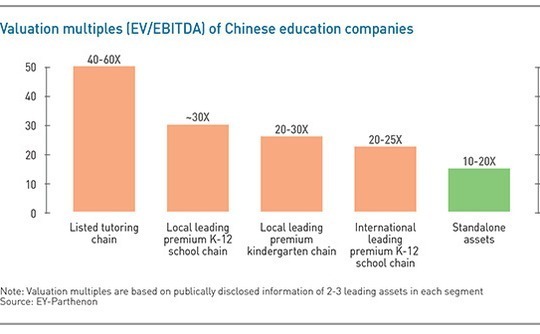

With demand outstripping the supply of high-quality assets, valuations have risen dramatically, prompting concerns as to whether the sector can deliver the anticipated returns. The onus is therefore on private equity players to strike a balance between the rapid expansion that often underpins their investment theses and maintaining service quality. In a sector that has powerful stakeholders – regulators more so than parents – financial performance is only part of the equation.

Heading Nord

If there is one deal credited with driving enthusiasm for education it is the privatization of US-listed Nord Anglia Education by Baring Private Equity Asia (BPEA) and Canada Pension Investment Board (CPPIB). The investors were bullish enough about the company's growth prospects in China, that they were comfortable with an enterprise valuation of $4.3 billion, or 20x adjusted EBITDA for 2016.

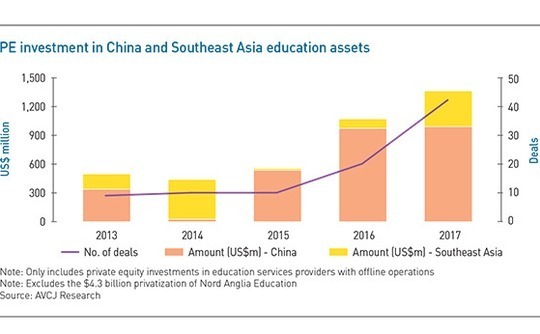

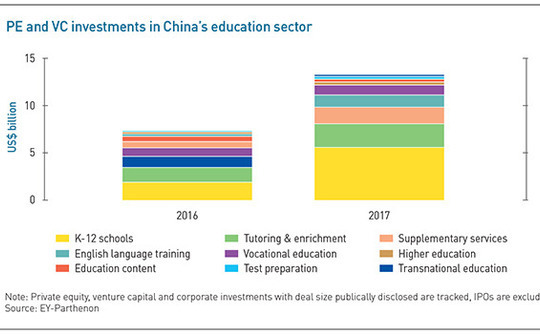

The Nord Anglia transaction was announced in April of 2017. As a global company, it does not feature in AVCJ Research's records of private equity and venture capital investment in China's education sector. Nevertheless, capital deployed across online and offline businesses reached a record high of $1.6 billion last year. This compares to $1.25 billion in 2016 and $802 million in 2015. Offline education services providers – some of which have varying degrees of online coverage – led the way, attracting $984 million, up from $966 million and $533 million in the previous two years.

This robust investment activity is correlated to a favorable exit environment, as well as the sector's attractive fundamentals. Over the past six months, four private equity-backed Chinese education businesses – Rise Education, RYB Education, Four Seasons Education, and Sunlands Online Education – have completed IPOs in the US. China Everbright-backed Hope Education, the second-largest privately-owned higher education provider in the country, is currently seeking a listing in Hong Kong.

Rise and Four Seasons, which provide after-school tuition in English and mathematics, respectively, are currently trading at price-to-earnings (P/E) multiples of 40x or more. Their larger listed counterparts, TAL Education and New Oriental Education, are two of the most valuable education businesses globally, with market capitalizations in excess of $14 billion and P/E multiples of 129x and 50x, respectively. This has translated into higher private market valuations. Large education assets – high-profit margin businesses such as kindergarten chains and K-12 schools – command EBITDA multiples of 20-30x.

"In the education space, large assets are scarce. Despite significant capital available in the market, PE investors – together with Chinese corporates – are competing for a few high-quality assets in China and globally," says Claudia Wang, a vice president at consulting firm Parthenon-EY. "Before 2015, there were only a few high-value education deals in China. With recent government and legal changes to promote private education taking effect, together with clear comparative advantages with other industries, we are seeing more quality and high-value deals."

Investment in Southeast Asia's education sector – predominantly in offline players – is also on the rise. Vietnam accounted for three out of five transactions worth a combined $370 million last year, compared to $98 million in 2016 and $19 million in 2015. The valuation trend is the same as China, with the days of single-digit multiples have long gone. For example, a sale process is currently underway for a large-scale, cash-generative education asset in Vietnam. It is expected to command a valuation multiple of 12-14x, with at least 20 regional and global private equity firms in the hunt.

"From an investment point of view, there are very few truly scaled assets and even fewer at the premium level. If you want to find assets with more than $50 million in EBITDA, there aren't many of them," says Kosmo Kalliarekos, a managing director at BPEA. "This is a highly fragmented and highly regulated area, but we're beginning to see the emergence of scale education providers in Asia. It's becoming more of a sophisticated consumer sector."

Macro to micro

Demographic change and regulation – and their relationship to scale – are arguably the most significant drivers of investment opportunities, but they can vary considerably by market. In China, for example, the switch from a one-child to a two-child policy is expected to trigger a baby boom. There were 2-3 million births last year, up from 1.3 million in 2016, and these children will become key consumers of pre-school education over the next five years. Parents intend to enroll children in pre-kindergarten institutions, after-school tutoring clubs and premium private schools from a young age.

Between 2017 and 2022, education segments such as premium K-12 schools, after-school training, and English language training are expected to see annual revenue expansion of 15-25%. Study abroad services – whereby kids attend summer camps in overseas schools during the K-12 phase – are also on a roll, with more than 40% year-on-year growth over the past five years.

This was the context for China-focused Primavera Capital's participation in the buyout of US-based WorldStrides last year, which was led by Paris-based investor Eurazeo. The study-abroad programs organizer offers student academic, professional, performing arts and sports programs through partnerships with K-12 schools and universities in 100 countries. Primavera plans to help the company expand in China through cooperation with local education institutions.

On the regulatory front, the most significant recent development has been the move to promote private education. As of September 2017, education institutions – especially private schools – were able to choose whether they wanted to be non-profit and profit-seeking entities. Previously, all private schools had to be non-profit. Now that they have the flexibility to increase tuition fees, private equity investors are keen to participate.

One requirement that remains very much in place is that all groups offering compulsory education services in China to student aged 6-15 should teach the Chinese national curriculum. As a result, introducing national curriculum programs at international schools is seen as way of boosting scale. This was one of the drivers behind EQT Partners' investment in private education services provider Long-Spring Education.

"Most PE firms have focused on international curriculum education for Chinese students. However, there is an even larger market in China by providing private education for Chinese students under the national curriculum. This is sometimes overlooked," says Jerry He, a partner and head of China in EQT. "It has a huge demand because all Chinese citizens are required to complete the national curriculum and pass a general exam. And parents want to have an alternative for their kids outside of public schools even they still choose the national curriculum."

Integrating the national curriculum into existing syllabuses involves adding a language as well as adding teaching modules. Furthermore, international players like Nord Anglia are looking to differentiate themselves from the local competition by offering a wider range of foreign language options as well as courses that focus on humanities and arts.

Although international schools are in some respects becoming more local, the rules on ownership are not so malleable. Foreign investors are still prohibited from investing directly in compulsory education in China, which means the variable interest entity (VIE) structure – often used to allow offshore participation in restricted areas – remains a fixture in the sector.

Scale models

While Southeast Asia does not present the same level of regulatory challenges as China, achieving scale is a more nuanced process. Vietnam has been the most active market in the region on the back of interest in the K-12 private schools and English language-learning institutes, but rapid expansion is not necessarily part of the investment thesis.

"Investing in Vietnamese schools is not about expanding them regionally, it doesn't make sense. However, it's still nice to grow those schools organically in the country because the industry fundamentals are strong," says Chris Freund, a partner at Mekong Capital, which in the past year has exited K-12 provider Vietnam Australia International School to TPG Capital and invested in English specialist Yola. "I haven't seen domestic M&A in Vietnam's education space either. In many other sectors, M&A happens when companies want to scale, but it's not exactly the case with education."

Measured organic growth is also the priority for EQT following its acquisition of ILA from HPEF Capital Partners last year. The private equity firm recognized that ILA was already a strong brand in the English learning space and decided to focus on product development. The company is now moving into new product categories, implementing teaching methodologies imported from developed markets, and introducing online platforms, as well as considering organic expansion opportunities.

"Valuations generally have gone up a lot. When we looked at the business, we were really thinking about whether private equity could add value. We formulated a value-creation plan early on, trying to look at what else we could do for one particular asset," says Tak Wai Chung, a partner and head of Southeast Asia at EQT.

Other markets, by contrast, do present viable cross-border expansion opportunities. Affinity Equity Partners acquired Malaysia-based higher education institution INTI University & Colleges a few months ago in part because it sees the country as a regional hub for reasonably-priced English-speaking tertiary education. The plan is to attract more students from China and elsewhere in Southeast Asia, and eventually turn INTI into a platform for consolidating other high-quality assets in the region.

There are similar examples in the K-12 space. Advent International purchased The Learning Lab, a Singapore-based business, in 2014 and recently completed the bolt-on acquisition of Best Learning in China. The private equity firm wants to create a leading regional player, but given the variation in competitive dynamics, regulation and curriculums between jurisdictions, it opted for inorganic rather than organic expansion to avoid new market entrant risk.

"Education is a sector at the lower end of the risk spectrum. If a business is operated professionally, then you'll see the result. The key consideration for parents is the track record of the schools. For example, for after-school education, parents will look at what kind of results the services provider can deliver in terms of improving their children's academic grades," says Kiki Yang, a partner at consulting firm Bain & Company.

In this sense, brand cannot be compromised at the expense of scale, which means the mode of expansion becomes incredibly important. While the franchise model works for restaurant chains, it is not always appropriate for a high-touch services like education where the aim is to achieve consistent quality standards across every facility.

Franchise risk was most visibly illustrated last November when private equity-backed Chinese kindergarten operator RYB Education, saw its stock price collapse in response to accusations of child abuse. An investigation found there had been illegal conduct by an individual teacher – contrary to claims of widespread misbehavior – but the episode highlights the difficulties managing 250 kindergartens across 130 cities, of which 175 are franchised. RYB also has 853 play-and-learn centers aimed at pre-kindergarten age children and most of these are franchised out.

The financial structure of education businesses is seen by some as potentially exacerbating these problems. If parents are paying upfront for tuition, irresponsible franchisees might not be fully committed to providing high-quality services for the duration of the agreement.

"There are many new entrants in Asian education overall, not just in China, jumping in without spending enough time to understand what they're investing in or the true nature of this market," says BPEA's Kalliarekos. "They may think that investing in education is just like investing in any other consumer product or service. But if they just go for growth and are not sufficiently mindful about how they are able to manage that growth, without the necessary discipline, focus and patience, failure and disappointment will be the inevitable result."

Sub-standard outcomes also present a significant risk to the industry at large because governments tend to react quite decisively against the entire competitive set, rather than just blaming one or two players. This sobering reality reinforces the notion that, even in markets like China where steps have been taken to liberalize the sector, regulation is never far away.

Rising tide

Despite these risks, private equity interest in education is unlikely to abate – the fundamentals are too attractive – and so high-quality businesses will continue to attract lofty valuations. However, investors may find that the competitive environment does change as the companies they have helped scale become more acquisitive with a view to sustaining growth. Whether it is global players like Nord Anglia and GEM Education or listed Chinese companies, education companies could prove to be just as aggressive as PE firms in the pursuit of assets.

"Many Chinese education companies listed in Hong Kong are higher education institutions, with a few more in the pipeline for listings. We foresee these Chinese listed companies will be key competitors for PE and VC investors – along with other non-education listed companies – for high-quality assets in the education space," says Parthenon-EY's Wang.

"Such companies have set up corporate M&A teams to diversify into strong growth segments like K-12 schools and non-degree education. At the same time, any private equity firm looking to sell a strong education business can expect to see a long line of prospective buyers. The overall passion for education and capital flowing into this space are tremendous," Wang adds.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.