Traditional Chinese medicine: Innovating antiquity

As the time-honored but largely unprofessional industry of traditional Chinese medicine reinvents itself for the 21st century, private equity could play a role in a massive healthcare overhaul

When foreign analysts contemplate the latest policy push behind traditional Chinese medicine (TCM), the kneejerk reaction is often to evoke an ominous brand of culturally charged geopolitics. Clearly the archaic alchemy of it all inspires the imagination.

The Chinese government's TCM drive is most logically interpreted as an attempt to rally existing resources – even if they're pseudoscientific – to fill a huge gap in the world's most heavily burdened healthcare sector. Even more prosaically, the soft power plays around TCM are probably less about stoking nationalism than drumming up the substantial amount of private capital that the healthcare plan will require.

This effort is starting to work. Recent private equity investment in TCM has revealed the segment's graduation from a venture-oriented niche to an industry that can support nationwide business empires. Notable activity includes a RMB1 billion ($157.5 million) Series D round for Gu Sheng Tang (GST) that confirmed the clinic chain's evolutionary path from VC darling to strategic gambit for state-owned heavyweights the likes of China Life Insurance and Shanghai International Group.

Despite the trail of government money in such deals, they do reflect a returns-focused story. GST's latest round, for example, built on a $70 million Series C led by US insurer Starr Companies and Ping An Insurance. Early-stage TCM investors further clarify the crossover between capitalist and public agendas with long-term plans to plug new business models into a service vacuum at the family doctor level.

"Our motivation for the GST deal was to use TCM as an entry point that would help us really jumpstart our investment activities in primary care," says Xiaodong Jiang, a managing partner at Long Hill Capital. "If China wants to have a healthy society without going bankrupt, this has to be part of the solution. In fact, TCM could be one of the fundamental building blocks of an entirely new, privately-driven primary care system."

A services story

Jiang led a Series A investment in GST for New Enterprise Associates (NEA) in 2014 at a time when government support for new primary care business models was starting to gel. When Long Hill spun out of NEA in 2016, both firms remained investors in GST, with Jiang serving on the board. NEA and Long Hill combined are still the largest institutional stakeholders in the company.

The investment plan revolved around a belief that primary care could be delivered in an outpatient setting by leveraging China's 40,000 TCM doctor's offices and the holistic, wellness-based medicine they represent. This would relieve pressure on China's overcrowded inpatient hospitals and reinforce a widespread but underutilized bedrock of small, government-run health centers for day-to-day services.

Company building strategies benefit from a diffuse and fragmented landscape in this space. More than 90% of TCM companies are said to generate less than RMB10 million of revenue a year. Offices are typically staffed by only one or two doctors, with the best and brightest tending to gravitate toward positions at large TCM hospitals.

China's healthcare sector, however, is no place for consolidation. The TCM and government-run primary care offices that do exist are usually considered unattractive bolt-on candidates and rarely up for sale in any case. As a result, companies tend to grow from scratch, acquiring existing clinics only to absorb their licensing paperwork and expedite organic expansion. Under NEA and Long Hill, GST grew from three clinics to more than 40, with annual revenue increasing from $3-4 million to over $150 million.

"We like this business model because it's not capital intensive," says William Hu, a managing partner at Qiming Venture Partners responsible for healthcare investments. "If you invest just a few million renminbi, you can start a TCM clinic without needing to buy too much equipment – and generate quite interesting revenue. That's a key advantage compared to Western medicine, but I'm not worried about it resulting in too much competition because the market in China is so big."

Qiming entered the TCM space in 2013 with Junhetang Chinese Medicine, a Shanghai-area clinic operator with 10 locations that received a RMB100 million Series C last month led by a VC platform of Meinian Onehealth, China's largest private provider of preventative healthcare check-up services. Value-add initiatives have focused on improving customer experience through careful hiring and technological integrations. The company now employs an online portal for video communication between doctors and patients.

Recent investments following similar strategies include Jiande Hexu Enterprise Management, which received RMB483 million from a medical industry buyout platform under Hony Capital, and Xiaolu Clinic, which raised a RMB100 million Series B led by Sinovation Ventures and Redpoint Ventures. Notably, most deals are struck in this services end of the market, which encompasses preventative prescriptions, acupuncture and physical therapy.

The services segment provides an intuitive avenue for private equity players to make the most of their strengths in customer engagement and back-end optimization. It may also be the most direct beneficiary of the strongest government policy pillars, including a plan to establish TCM programs in every community-level health service institution in the country.

Supply side issues

On TCM's supply side, products range from patent medicines to untreated herbs and processed boiling materials known as decoctions that are said to be experiencing the fastest growing demand. The ingredients category will benefit from new policies around the protection and industrialization of certain plants, but by comparison, private investors consider it a more delicate proposition.

Although unethical sourcing of endangered or illegal species and toxic contaminants are the highest profile pitfalls for TCM suppliers, investor trepidation is more closely related to increasingly strict efficacy standards set by the China Food & Drug Administration (CFDA). Official prioritization of TCM in recent years has attempted to put the industry on a roughly even footing with science-based medicine, but the treatments have more difficulty meeting drug registration and compliance requirements as regulations get tightened across the pharmaceutical spectrum.

Nevertheless, for investors able to enter this side of the market, the rewards can be substantial. In perhaps the largest TCM deal to date, Hong Kong-listed China Traditional Chinese Medicine acquired an 81% stake in herbal extracts producer Jiangyin Tianjiang Pharmaceutical for RMB8.3 billion in 2015, facilitating an exit for two PE funds managed by China International Capital Corporation (CICC). As a result, those crunching numbers on the transaction were offered a peek at the potential market size.

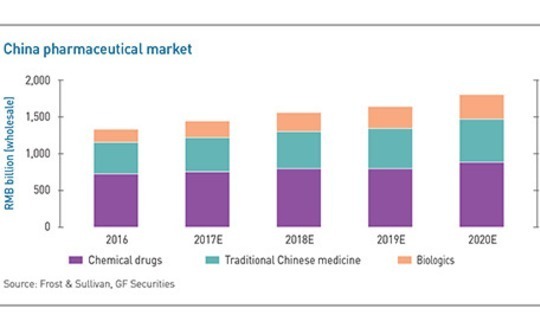

China's state-owned media outlets tout industry valuations in excess of $120 billion, but the fragmented nature of TCM makes good numbers hard to nail down. UK-based consultancy Future Market Insights said the market was worth $84.4 billion in 2017 and growing at 8.4% a year. Data from GF Securities and Frost & Sullivan have tracked a comparable growth trajectory, predicting trends around aging and urbanization with lift the TCM market to about RMB96.1 billion by 2020.

Still, the case for accessing this opportunity via TCM's relatively loosely regulated services segment does have its limitations, especially among dedicated healthcare investors with a harder bioscience bent. Chinese cross-border specialist Lyfe Capital, for example, is attracted to the market, but sees most of the credible inroads as cultural plays that are difficult to square with its investment mandate.

"Whether a healthcare company is lifestyle driven or innovation driven, the most important thing we look at is the efficacy of the treatment," says James Zhao, a founding partner at Lyfe Capital. "However, it's really challenging for a TCM company to find a strong angle in the US market, which is a critical part of our strategy. If a China-US company has innovative technology and strong trial evidence for its treatment, then we're willing to take a look because it's a sizeable market."

Wariness around TCM drugs and their regulatory hurdles is most pointed in injectables. TCM shots, although once seen as the fastest growing category, are now stalling due to a lack of trialing evidence, quality control issues in the manufacturing process, and stricter rules around proof of efficacy from the CFDA. This is no doubt exacerbated by incidents such as the reported death of a 37-year-old farmer last November after his doctor administered intravenous TCM.

Solid dose tablets, while less overtly controversial, are inhibited by the same scientific hurdles, which in turn create insurance coverage disadvantages. As a result, investors with broad-based healthcare agendas are not particularly distracted by stronger sentiment for TCM. Qiming has invested in more than 70 healthcare companies but only one TCM player – and the firm has expressed little interest in any further exposure.

If this trend holds, it could discourage the process of confirming scientific credentials in TCM products. In an apparent countermeasure, government incentives behind TCM have put a strong emphasis on connecting with educational institutions. Under China's latest Five-Year Plan – a policy document that outlines broad economic objectives – the country will construct 70 schools and 30 cultural centers focused on TCM.

Overseas interest

As this program rolls out, many international markets are charting increased interest in holistic alternative medicines and lifestyles. Last month, Netherlands-based medical publisher Elsevier partnered with Beijing University of Chinese Medicine (BUCM) to build a taxonomy that will examine TCM practices from a scientific perspective.

"By enabling this discovery and analysis of integrated health and medical research, we can provide customers with more successful outcomes and deeper understanding of the evidence behind how TCM complements conventional medicine to improve prospects for patients," Cameron Ross, managing director of life science solutions at Elsevier, said at the time of the agreement.

Meanwhile, Elsevier notes World Health Organization data that estimates more than 100 million Europeans are currently using traditional and complementary medicines. The Chinese government has been keen to highlight this traction, praising the creation of new TCM centers in Germany and the Czech Republic. But to date, private equity activity appears limited to geographies with large Chinese minorities.

In 2016, Tower Capital, a vehicle controlled by former 3i and Actis Capital Partners executive Danny Koh, partnered with Temasek Holdings in a S$269 million ($204 million) takeover bid for Singapore's Eu Yan Sang International, a Chinese natural health supplements business. Other global investors in the TCM space have included IDG Capital, Aberdeen Asset Management Asia, and Fidelity International.

Ultimately, any traction in markets outside of China could do more for the industry than a domestic build-up since it would contribute to the standardization of terms, which is considered essential to the industry's modernization. Indeed, one of the key goals of the Elsevier-BUCM partnership is to streamline historical TCM databases that suffer from an opaque lexicon of interchangeable spellings, synonyms, translations, and symbols. These efforts are expected to support growth in both the service and ingredient-supply facets of the industry.

"Owing to the wide-ranging benefits of TCM, integrating traditional medicine with modern medicine is a practical attempt to introduce primary care to the domestic healthcare space thus providing healthcare facilities at a lower price as well as creating more employment and training opportunities," explains Nandini Roy Choudhury, a researcher at Future Market Insights. "Also, as the popularity of TCM is increasing worldwide, the Chinese government is becoming successful in realizing its aim of promoting and bringing proprietary Chinese medicine products into the market."

Internationalization could also play a role in dispelling ongoing skepticism in China since overseas TCM use is almost exclusively relegated to preventative wellness regimens rather than for treatment of acute sicknesses. Within China, many patients continue to rely on TCM for acute conditions where more rigorously scientific therapies are typically advised.

There has been some backlash to modernization progress as a result, with TCM innovations around telemedicine occasionally decried on social media platforms as an attempt to mask a lack of science with technological bells and whistles. But as the demographic and political tailwinds currently driving the market continue to blend with social inclinations toward alternative medicine, stakeholders are likely to remain upbeat.

"As an investor, I don't think personal bias is that important here because, at the end of the day, if the customer has decided they're happy and they want to come back, that speaks for itself," says Long Hill's Jiang. "Whatever the market tells us, we respect it, and the market has been telling us about this opportunity for a few thousand years."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.