Japan mid-market: Realignment issues

Competition is intensifying in certain segments of Japan’s middle market, driving up valuations. Private equity firms must consider how they position themselves to maximize deal flow

Judging by the share prices of Nihon M&A Center and M&A Capital Partners, succession-planning deal flow in Japan has never been stronger. These companies are the country's largest listed M&A brokers – intermediaries who identify small business owners who are looking to sell, often due to the lack of an heir, and match them with buyers. Since the start of 2014, they have posted gains of 1,661% and 418%, respectively.

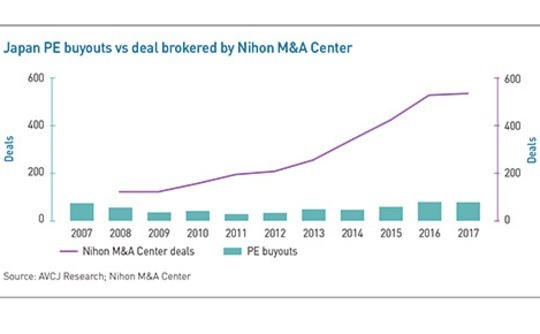

This performance is underpinned by rising transaction volumes. Nihon M&A closed 524 deals in the 12 months ended March 2017, more than twice the 2014 figure. In December, with three months to go in the 2018 financial year, its tally stood at 531. M&A Capital Partners worked on 111 transactions for the year ended September 2017, a threefold increase on 2014. Both companies receive fees from the sell-side and the buy-side.

"I went to a conference held by one of these brokers and 3,000 people were in attendance – it seems like there is a bubble in the market," says one Japan-based LP. "On top of the main intermediaries focusing on succession deals, investment banks and regional banks are trying to generate more deal flow."

Private equity accounts for a small portion of these transactions, with fewer than 100 buyouts of any size each year. Yet the blossoming in middle-market activity – driven by an increasing willingness among company founders to do business with PE players – that was anticipated for 2017 does not appear to have materialized.

Industry participants are not disappointed, describing the year as steady rather than spectacular, and they remain focused on longer-term trends that are expected to work in their favor. Nevertheless, concerns about competition and its impact on valuations are real. This inevitably draws attention to how much capital has been raised in recent years and what it means for how private equity firms position themselves in the market.

Shifting sweet spot?

AVCJ Research has records of 80 buyouts in Japan in 2017, just shy of the record of 81 set the previous year. Meanwhile, Japan-focused buyout funds received more than $2.5 billion in commitments – the most since before the global financial crisis, as nine middle-market managers achieved final closes.

This segment of the market won its reputation as Japan's sweet spot for three reasons: relatively low entry valuations of 5-7x EBITDA; the availability of leveraged financing, with GPs able to buy at 7x EBITDA and get 4x of debt; and operational improvement. Even though returns may have been driven predominantly by operational improvement, anecdotal evidence suggests some GPs are being squeezed by higher entry multiples.

The deal that has attracted most attention is Polaris Capital Group's carve-out of LB, a division of Japanese beverage maker Asahi Group Holdings, which was announced last November. The transaction price was not disclosed, but the private equity firm is said to have paid 15x EBITDA, supported by around 6x in senior debt and another turn of mezzanine.

Polaris is described by industry participants as exceptional among Japanese middle-market GPs. It is known for bidding aggressively for underperforming assets where there is the potential for revitalization, and LPs clearly still believe in the strategy: Polaris' fourth fund closed at the hard cap of JPY75 billion ($665 million), more than 40% larger than its predecessor.

However, several sources say they have seen multiple investors chase deals with valuations of 10-12x EBITDA. Pricing becomes elevated in full auctions launched by corporations that are divesting assets and have a duty to their shareholders to realize the highest possible valuation. But these are not the only situations in which activity is heating up.

"It is happening with family-owned businesses as well. If a company is famous, it will be popular," says Koji Sasaki, a partner at Tokio Marine Capital. "In the past such processes were handled cautiously with a limited number of candidates. What we have seen happen in the past year is families getting accustomed to employing financial advisors and soliciting a wider variety of PE firms to join auctions. We focus on getting exclusive mandates, but this is becoming more difficult."

More intermediation and past PE success stories are expected to generate increased deal flow. A byproduct of this trend is better educated vendors who are finding out information from counterparts in the market – either directly or through advisors – and adjusting their valuation expectations accordingly.

The varying accounts among private equity firms of their exposure to this dynamic points to a segmentation of the middle market, based largely but not wholly on fund size. To some, the traditional approach of entirely proprietary transactions or limited auction processes still holds true. It is worth noting that listed M&A brokers aren't necessarily the primary source of this deal flow, with GPs using their own networks of lawyers, tax advisors, and banks.

"Founders have other objectives they want to accomplish that are not just about price," says Jun Tsusaka, founding member and managing partner of NSSK, which claims to have done seven deals since inception – all proprietary and six involving business succession. "Therein lies the arbitrage opportunity for buyers that can bring operational value added to the table."

Tsuyoshi Yamazaki, a director at Integral Corporation, adds that participation in smaller corporate carve-out processes also tends to be restricted to a select number of bidders because sellers don't want to disseminate business information widely or upset employees. Integral usually completes up to three deals a year, three-quarters of which are proprietary. In 2017, there were two – a bolt-on acquisition and a secondary buyout – and the number of carve-outs in the pipeline is increasing.

Size matters

While the latest vehicles raised by Polaris and Integral have been above JPY70 billion, with the latter moving from JPY44.2 billion in Fund II to JPY73 billion in Fund III, others have sought to remain towards the lower end of the middle market. CLSA Capital Partners' (CLSA CP) latest Japan fund was substantially oversubscribed but the GP stuck to its hard cap of $400 million (JPY42 billion) to stay focused of transactions in the sub-$150 million enterprise value range.

"Most of the intermediaries in the lower-end mid-cap space are independent M&A boutiques run by a couple of professionals. They don't want to run full auctions, so they try to find the best possible buyer for their client. The clients are also selecting PE firms as partners based on chemistry or capability rather than pricing," says Megumi Kiyozuka, a managing director with the firm. "At the higher end there is more efficiency, which makes it harder to buy companies at a discounted price."

CLSA CP completed one new deal in 2017 but Kiyozuka believes there could be five new deals and two bolt-ons in the first quarter of this year alone. The expectation is that nearly half the fund will be deployed in 2018, meaning the timeline to the next fundraise is likely to be contracted. Similarly, J-Star closed its third fund at JPY32.5 billion in 2017 and deployed about 40% of the capital in the first year.

Of the middle-market managers that raised money last year, Tokio Marine Capital saw the biggest increase in fund size, with its fourth vehicle coming in at JPY51.7 billion, more than twice as large as its predecessor. Sasaki admits this has required some adjustment, with the typical investment target also doubling in size.

"Last year, several of our peers raised funds of a similar size, but there is still a lot of untouched space or blue ocean in business succession and carve-outs," Sasaki says. He adds that Tokio Marine is looking at doing more platform-style deals where smaller businesses can be acquired and aggregated, as well as broadening its scope to consider opportunities outside major cities.

Should Sasaki be proved correct and Japan's middle market continue to deliver the kind of performance that drew LP interest in the most recent fundraising cycle, competition would likely increase, and this blue ocean might eventually contract.

"There is more capital to deploy, and pricing is creeping up, but there are enough deals in the market and we are being opportunistic," says NSSK's Tsusaka. "I wouldn't be surprised if the 2016-2018 vintages turn out to be quite good and as a result more money will flow into Japan. That's how it developed in the US and Europe, and Japan is primed to take the next leap as a PE market."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.