Australia consumer: Attitude adjustment

Demographic shifts are prompting Australian GPs to reevaluate domestic consumer plays with an eye toward processes rather than goods. Overseas markets are an increasingly important part of the equation

Quadrant Private Equity's purchase of Fitness First in October 2016 capped an intense few months of deal-making. Having already closed deals for Goodlife Health Clubs and Jetts Fitness earlier in the year, the Australian GP had the makings of a platform to lead the country's fragmented fitness space.

But for Quadrant, dominating domestic fitness was just a first step. The firm sees Fitness & Lifestyle Group, formed from merging the three chains, as a springboard for entering other countries around the region, leveraging the insights it has gained from Australia's consumers to better target potential customers in those markets just waking up to the benefits of fitness.

"We've got 450 gyms in Australia. That's a huge number. And so we've got all of that data and profiling on how people use gyms and health, fitness, and wellness," says Chris Hadley, executive chairman of Quadrant. "We can deploy that into other countries – for example, we're rolling out gyms in Bangkok as we speak. It's not a sophisticated market for gym membership, so we can bring that information to bear there."

Quadrant's strategy with Fitness & Lifestyle Group speaks to several trends among middle-market GPs in Australia. The cohort continues to see Australian consumers as a reliable bet, bolstered by continued strong economic performance but with a growing appetite for services in addition to consumer goods.

At the same time, this market is being remade by demographic shifts such as an aging population and strong immigration. Australia's neighboring countries in Asia also constitute an enticing space for portfolio companies toughened by the competitive landscape at home. GPs seeking opportunities in the consumer sector must be able to help their portfolio companies tackle these trends.

Steady spenders

Consumer spending has always been reliable in Australia. Data from the Australian Bureau of Statistics show that after a brief dip to just under AUD200 billion ($157 million) in the last quarter of 2008 consumer spending grew at a more or less steady rate over the following decade, reaching A$251 billion in the third quarter of 2017. This solid performance has made local consumers and their disposable incomes an enticing target for international retailers.

"Australia didn't have a recession when the global financial crisis arrived, and is now in its 27th year of continuous growth, a feat unmatched by any other OECD economy," says Paul Bloxham, chief economist for Australia and New Zealand at HSBC. "So we've been an attractive market for global retailers to enter, and we've seen quite a few new entrants. That's adding competition at the same time that it's compressing retail margins and putting some downward pressure on retail inflation."

With household incomes expected to see a significant boost as a result of the commodity price recovery, economists predict consumer spending should continue to climb as well. But strong macro performance is only part of the story, and GPs considering the space must keep the country's idiosyncrasies in mind when planning their investments.

While Australia's steady consumer spending growth might be reassuring, there is also a downside in the degree to which this measure resists the impact of traditional economic factors. For example, some economists predicted the rise in home prices nationwide in recent years would accelerate consumer spending, but growth continued at the same rate. This is not to say that Australian consumers are inattentive to economic factors. Rather, they respond to different inputs than residents of other markets might.

"A significant portion of Australian consumers are homeowners with mortgages, so the consuming public is very sensitive to macroeconomic circumstance and international interest rates," says Tim Sims, a co-founder and managing director at Pacific Equity Partners. "When you put that together you have a sophisticated and wary consumer population who are sensitive about how they spend their discretionary income when the cycle is negative."

Demographic changes also play a role in the consumer story. Australia is in the midst of a generational shift, with the share of the population over 65 projected to grow from 15% in 2014 to 23% by 2055 and life expectancy at age 70 expected to increase over the same period from 17 years to 21 years for men and from 19 years to 23 years for women.

These changes are offset somewhat by population growth, which at 1.6% for the year ended March 2017 is unusually strong for a developed nation: by comparison, the US and UK grew by 0.7% and 0.8% respectively, according to the World Bank. Of this figure, the majority of growth came from immigration, with nearly 232,000 inbound settlers compared to natural population growth (deaths subtracted from births) of 157,000.

"After 65, we know they're not going to be buying huge amounts of product, but they will be buying services," Quadrant's Hadley says. "On the other hand, millennials are very good early adopters of IT, fast fashion and similar types of products. So it's about segmentation as much as anything else."

Hadley is joined by other market participants in identifying services as an attractive investment prospect with considerable potential for targeting the disposable incomes of Australia's aging citizens. The services opportunity ranges from medical and aged care facilities to financial services, education and even fitness.

The appeal of aged care and medical services is obvious – older citizens need more frequent care, and may eventually want to move to homes with services intended for their special needs. But fitness, tourism and financial services all play into the same theme. People who believe they will live longer than previous generations are more likely to want to keep themselves in shape, leading to interest in fitness programs. Tourism plays can also benefit from retirees looking for ways to enjoy themselves.

Meanwhile, financial services can profit from a population with a longer-term perspective, preparing for their own elderly years and looking to make sure their insurance and retirement accounts are in order and that they do not impose a burden on their families. Even education can be a concern for elderly citizens whose grandchildren attend Australia's increasingly expensive private schools and who see their own children struggling to pay the bill.

"That cost is putting a huge burden on parents, along with the cost of housing," says Patrick Verlaine, a partner at Crescent Capital Partners. "That means that grandparents are now often funding their grandchildren's school fees, which means they're retiring later, or they've already retired but they actually have less disposable income, and the kids are moving out of the home later as well."

Amazon arrives

Younger Australians are still considered more likely than their elders to spend their money on consumer goods. But here too the future of the consumer thesis is in question and the most attractive investment plays are not clear – though in this case, thanks to the advent of Amazon the question is not what the consumers buy, but how they buy it.

Australia's traditional retailers watched the arrival of Amazon in the country last December with a certain amount of trepidation. E-commerce was not unknown in Australia, but due to the country's size and small population, it had proven difficult to build up a truly national service offering.

"The geography of Australia means that you've got five major centers that are all far enough apart that if you want to operate in any of them you've got to have a full distribution chain," says HSBC's Bloxham. "That makes it quite different to the US, where you've got an enormous market but you don't have to have supply chains in each city, because you can provide goods to many other places from a hub."

This logistical difficulty has had important consequences for the development of Australian retail, notably the relative lack of customer insights among the country's leading retailers. While Amazon and other leading global e-commerce companies can collect data on their shoppers at a highly granular level, the major Australian retailers still mainly collect customer information from more old-fashioned methods such as loyalty programs and surveys, limiting the level of knowledge they can attain.

This limitation was never a major setback as long as every retail player followed a similar playbook, but once it became clear Amazon would enter the market the major retailers began to realize the disadvantage they would be operating under.

What growth Australia has seen on the domestic e-commerce front has mainly come from established offline retailers. While these players have seen some success, this comes with its own drawbacks.

"At the moment you've got some retailers who've had good growth overall and good growth online, but they're somewhat cannibalizing footfall from their own stores," says Ronan Gilhawley, head of retail for KPMG Australia. "So retailers are having to rethink the role of the store in their portfolio, because customers are clearly shifting the channels through which they investigate or acquire goods."

The story of Australian e-commerce is not yet set. Amazon's performance in the country since its entry last year has been somewhat mixed as it struggles to adapt to the geographical issues faced by other online retailers. Local media has carried a number of reports of Amazon shipments arriving significantly late.

The company will overcome these teething issues in due course, but in the meantime, local players with an understanding of the domestic market have an opportunity to stake their claim. For many observers, the US giant's struggles show that no matter one's resources, there is no substitute for local expertise.

"If you want to operate in Canada and you're in the US already, really all you're doing is adding another branch just north of the border. Most of the population's along the border anyway, so it's just a marginal addition," says Bloxham. "But if you're a big US player and you want to operate in Australia, that's a very different proposition."

Offshore demand

While Australian GPs are deemphasizing consumer goods from the domestic perspective, the sector is by no means neglected. In addition to the reliable demand for consumer goods within Australia, investors see considerable untapped opportunity for the country's products offshore, and particularly in Asia.

"Traditionally Australian consumer goods organizations have underplayed their strengths in Asia," says KPMG's Gilhawley. "In part, it's an availability bias – if you have very few people in your management team with Asian experience you tend not to play in Asia. But in the last few years, a range of organizations have gained experience penetrating the Southeast Asian and Chinese markets."

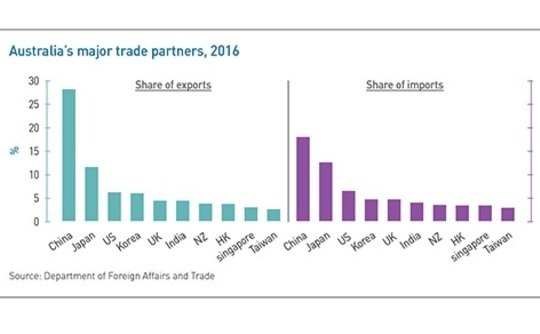

When it comes to marketing into Asia, Australian firms have several advantages over other developed markets such as the US and UK. The ease of shipping to the region is one, while another is the relatively sparse population of just 25 million in a country comparable in size to the continental US. This means domestic manufacturers can easily satisfy the local market, with plenty of capacity left over to sell overseas: out of the top 10 recipients of Australian exports in 2016, seven were based in Asia.

From the perspective of an overseas buyer, Australian brands are seen as providing an appealing level of quality assurance, particularly in processed food. Anacacia Capital pursued this theme with two of its portfolio companies, baby food maker Rafferty's Garden, exited in 2013, and snack producer Yumi's Quality Foods. It took over both companies when they were pursuing a strictly domestic strategy, and set them up for expansion into Southeast Asia, where each has now established a strong presence.

Crescent targeted another angle last year with its acquisition of swimwear brand Tigerlily from Billabong. It saw a chance to leverage Australia's image as an outdoor culture in Asian and global markets. "When people think of Australia, there's a lot of association with the beach and the sun – good weather, with lots of open space," says Crescent's Verlaine. "So the angle with Tigerlily is that it's a brand that's well-recognized in Australia that hadn't actually been taken overseas, and with a strong affiliation with what Australia represents to the rest of the world."

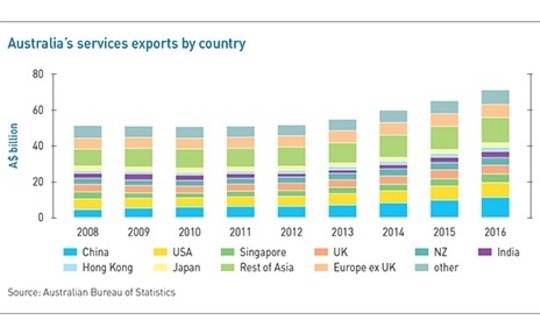

For many GPs, though, the most exciting market segment, for the Asian opportunities it can provide, is actually services. Asian consumers are increasingly eager for education, healthcare and tourism services from Australian providers, and thanks to their growing incomes are willing to pay for them – China's share of Australian services exports alone grew from almost nothing in 2000 to more than A$10 billion in 2016.

As a result, market watchers see considerable opportunity in often overlooked areas. Education services, primarily teaching and training provided overseas by Australian companies, represented Australia's third biggest export in 2016, and even education investments in Australia can have an overseas angle, since the institutions often recruit foreign students or immigrants.

Medical care is also seen as presenting a major overseas opportunity, as evidenced by Icon Group, a cancer care chain. Quadrant acquired a majority stake in the company in 2014 and started a regional expansion plan that saw centers established in Singapore and mainland China, before selling the business to a consortium including Chinese and Australian investors for A$1 billion.

Icon's medical expertise was a major draw for the buyers, but what made the business irresistible was its ability to use technology to leverage the knowledge base of the home office. No matter where they were, patients felt as if the Australia team was in the office with them.

"You've got this highly skilled, highly focused company that's a leader in its field, in this case medical oncology as well as radio oncology, and can actually transfer those skills with technology in a very efficient way," says Quadrant's Hadley. "That's why they paid A$1 billion for it. It wasn't necessarily for the Australian opportunity, it was for what it can become in an Asian context."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.