Technology: The unavoidable angle

Technology is directly or indirectly redefining business models across Asia. Private equity investors must embrace change or risk seeing returns damaged as portfolio companies are disrupted

China's travel and tourism industry represents a unique combination of traditional and new economy interests. The hotels and resorts people travel to, and the planes, trains and automobiles that get them there, are asset-heavy, but the channels they use to research where to go and make reservations are asset-light. Around 50% of bookings are currently made online and almost all the growth is online.

"For us, naturally, that is a space we have to capture and invest in," Tony Jiang, co-founder and partner at Ocean Link, told the AVCJ Forum in November. "The real challenge is in the valuation. The key to that is how do we look beyond the valuation multiples and really understand the growth trajectory behind them, the risk-reward associated with the business models, and then assess and price them correctly."

Ocean Link was established in 2016 as China's first private equity firm dedicated to investing in travel and tourism. It received $400 million in seed capital from the likes of General Atlantic and Ctrip and now has $500 million in assets under management across renminbi and US dollar-denominated vehicles. The GP considers a range of verticals from hotels and transportation to travel agencies and IT solutions.

The breadth of this coverage within a single industry, and the way in which the different parts of the value chain connect, emphasizes a dilemma facing the entire private equity industry. Given technology is directly or indirectly redefining business models to the point that it is impossible to make an investment without a full internet strategy, how does one engage with these trends?

"We are seeing all the private equity firms trying to get involved in technology companies. And we are seeing both the impact of that and in some cases the cultural mismatch between how a technology company wants to be run and private equity disciplines," said Michelle Deaker, a managing partner at Australia-based OneVentures. "Technology is definitely the unavoidable angle. I think every PE firm in Australia thinks somehow they should be getting involved with technology companies and they are trying to work out how to do that."

Stick or twist

For Ocean Link's Jiang, the answer to this question came during his decade with The Carlyle Group. The firm made its first internet-related investments in Asia in 2014, backing online reading business China Literature and classifieds site Ganji. Both were difficult to get past the investment committee: the valuations were high, only one board seat was available with few shareholder rights, and there was minimal visibility as to how the commercial environment would play out for these companies.

The conclusion was that Carlyle couldn't afford to pass up on the opportunities: every future consumer investment would be impacted by companies like these and investing in them was the best way to understand broader industry dynamics. Both deals worked out well as Ganji merged with listed rival 58.com in 2015 and China Literature completed a Hong Kong IPO last year.

Nevertheless, Jiang is wary. "Some of these deals are driven by temptation and some are driven by must-have requirements. You get the sense that half the deals being done are tech deals and 95% of the carry comes from them, so there is a temptation, not only among private equity firms but also hedge funds. On the other hand, if you look at the management and entrepreneurs we back, even in traditional industries, you have to think about the internet strategies for those companies."

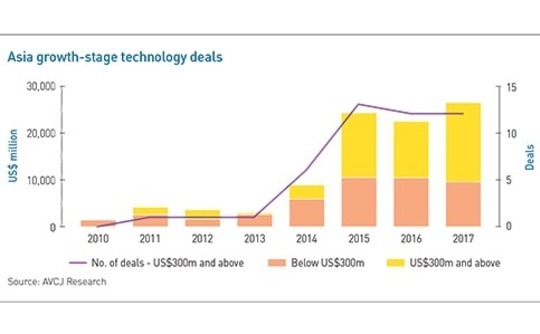

Indeed, temptation has driven valuations of growth-stage technology deals to eye-watering highs, particularly in China. Anecdotal evidence abounds of company founders seeking valuations of several hundred million dollars despite having sparse performance metrics and seeing the valuation double within months of launching the process. Similarly, investors whose strategy is to access market leaders have been known to submit blank term sheets and instruct bankers to fill in any value below a certain threshold.

Sun previously spent 20 years at Warburg Pincus and oversaw investments in pre-revenue companies like 58.com, where a commitment of $85 million turned into a return of $800 million within five years. His conclusion: "If it's a large enough space and the growth potential is phenomenal and you are number one in market share with no one else in sight, you probably should have a leap of faith, throw away your traditional valuation metrics and make a bet."

PAG Asia Capital went through much the same thought process. The private equity firm nearly passed on China Music Corporation (CMC) because the check size was below its usual minimum deployment requirement. But the bet paid off last year when Tencent purchased a majority stake in the company at a reported valuation of $2.7 billion, far higher than that PAG paid on entry. The GP remains an investment in the business, which is said to be targeting a Hong Kong IPO.

"We decided that the technology space in China is just too important to ignore even for a buyout firm," said Weijian Shan, chairman and CEO of PAG. More recently, the firm has backed financial technology business Dashu Finance and acquired a controlling interest in Zhenai, an online matchmaking and dating service provider.

Corporate considerations

This decision is not only being made by private equity firms. Corporations across the spectrum of traditional industries are establishing captive venture capital units and pursuing strategic acquisitions intended to offset the impact of disruption. Initiatives range from establishing incubators that offer exposure to ideas to a substantial restructuring of operations, creating new industry silos that leverage existing customer bases.

In China, for example, home appliance retailer Suning Commerce Group has not only sought to update its core business by introducing online-to-offline (O2O) capabilities but also added real estate, financial services, media and entertainment, and sports verticals. Rather than just sell devices to consumers, the company wants to use the strength of its brand to lend money and provide content to these people, while serving as landlord and service provider to other retailers.

Furthermore, in 2016, Suning formed an investment division with a view to reaching RMB50 billion ($7.7 billion) in assets under management. It pursues equity investments and acquisitions in "forward-looking industries" that support Suning's long-term development, including consumer retail, technology, media and telecom, entertainment, financial services and healthcare.

The importance of keeping tabs on how and where innovation is moving was integral to Ayala Corporation's decision to invest in the Philippines business of online fashion retailer Zalora. Last year, Ayala acquired a 43.3% stake in the business, with its subsidiary Ayala Land taking 1.9% and two other Ayala-controlled companies – Globe Telecom's VC subsidiary Kickstart Ventures and a unit of Bank of the Philippine Islands (BPI) – taking 3.8%.

"When that deal came onto our radar we didn't really know what to make of our e-commerce strategy. We were really a brick-and-mortar type company and this was very new," Michael Montelibano, head of business development at Ayala, told the Forum. "We saw it wasn't profitable yet but what got us over the hump was this was a business that was going to disrupt Ayala Land. They were drawing traffic that would potentially come to our shopping malls but would instead buy products through the e-commerce platform."

The company was also attracted by the synergies it could bring to the partnership through the marketing reach of Globe, the payments competencies of BPI, and the brand relationships of Ayala Land. "Ask me in three years' time if we hit our profit targets," Montelibano added. "But that's a top of mind example for us when we think of technology and in particular disruptive technology."

Not everyone is comfortable with this kind of investment risk, but they are still looking for ways to track innovation. While Jean Eric Salata, CEO and founding partner of Baring Private Equity Asia, is convinced that China's tech sector is experiencing a valuation bubble, the strategies pursued by companies in the space are factored into decision-making. The firm assesses the technology and disruption risk – positive or negative – for every investment.

"You could be trying to avoid all the hype by investing in a business that you can buy at a reasonable price, with good profitability and growth, and suddenly its whole business model has the rug pulled out from under it by these new entrants," Salata said. "And many of these new entrants are not necessarily operating rationally at this stage; they are looking to scale and undermining the margin of the whole industry. It's very hard to compete in that environment if you are not one of those well-funded players."

Most private equity firms are now cautious about investments in traditional retail, having witnessed the impact of e-commerce on brick-and-mortar players. The question they now have to answer – as part of due diligence and also during the holding period – is what will be disrupted next. Venture capitalists in Asia are more or less unified in their excitement about education, healthcare and financial services, so any PE deals in these sectors would require a thorough technology audit.

Be prepared

In saying that buyout investors can no longer afford to ignore technology investments, even if only minority stakes are available, PAG's Shan added an important caveat: the sector is so dynamic that private equity firms require deep knowledge to take advantage of it.

How a GP responds to this challenge depends on its internal resources. Global firms are layering functional expertise – with professionals that can address issues such as digital marketing and IT systems – on top of their existing sector-focused teams. Consultants are also being called in to review the direct and indirect impact of e-commerce or online payment on entire portfolios. Smaller players are coming up with other solutions.

"We are seeing venture capital starting to work with private equity because we bring different things to the table. We understand the new trends in technology, they have got the larger checks and the PE discipline," said Deaker of OneVentures. She added that venture capital is now also losing out on deals to private equity. OneVentures was set to invest in an Australian medical devices company that had a US roll-out plan ready to go only for KKR to do the deal off its balance sheet.

Meanwhile, cultural mismatches between relatively youthful technology companies and private equity investors are not insurmountable. When Samena Capital participated in a Series B round for Southeast Asian grocery on-demand service HappyFresh in 2016, it did so on the precondition that the company exit two of its five markets in order to reduce the burn rate. According to Vincent Chan, head of Asia at Samena, this more disciplined approach has helped HappyFresh move from negative economics to making $3 per order. It is expected to break even within three months.

This notion of a learning process can benefit both sides. As technology companies move through the institutional funding rounds, commercialization, revenue generation and ultimately profitability become more important. PE firms might be well-positioned to help businesses through these later stages – and in doing so they can develop their own understanding of the sector.

Whether private equity players make direct investments or not, the knowledge has to come from somewhere. Failing to provide adequate coverage in this area amounts to a denial of the prevailing commercial reality, and it could come back to haunt GPs in ways they are unable to foresee.

"We don't look at businesses as tech versus non-tech. We want to find good management teams and great business models," said Paul Yang, head of Greater China at KKR, which has backed the likes of O2O services provider 58 Daojia in China and ride-hailing business Go-Jek in Indonesia.

"If you look at today's economy, technology accounts for a larger share of GDP globally and probably a much greater proportion of growth. In order to be successful as a private equity firm we have to move with the market. It is only natural that more of our portfolio has that tech split to it."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.