China autos: Wheeling and dealing

A nascent, fragmented and digitally savvy industry of traditional car services is set for expansion as China’s booming car market matures. Private equity investors are piling in enthusiastically

New, often exotic business models around connected cars, electric driving and ride-hailing continue to make headlines in China as the country's massive automotive market gets in gear. But private equity investors still see opportunities in comparatively pedestrian aspects of the industry.

Investor interest in the rise of the Chinese driver tends to be directed at traditional car-related services and retail technology. The most recent activity in this space includes a RMB1.5 billion ($227 million) round led by Warburg Pincus for Chinese carpark management company Sunsea Parking Industry Group.

The deal notably included participation from furniture retailer Red Star Macalline, a Warburg Pincus portfolio company with a swath of parking spaces ready to be upgraded. Sunsea will subsequently see its management portfolio expand to about 500,000 bays – a minor threshold by US standards but enough to claim market-leading status in China.

The plan enjoys a sturdy macro foundation: China has emerged as the largest auto market in the world, now selling roughly twice as many new cars as the US at some 24 million units a year. About 200 million vehicles are said to be on Chinese roads, some 10 times as many as during the 1990s. Meanwhile, a lack of urban planning foresight has meant parking availability is only one-third of the average in the developed world, equating to less than a half a bay per car.

"We think that carparks will probably amount to one of the fastest growing asset classes in China, driven by the increase of car owners," says Qiqi Zhang, a principal at Warburg Pincus and a director at Red Star. "Over the last five years, car ownership in China has grown by more than 10% a year, and we expect that will continue, increasing demand for carparks in every city."

The Sunsea deal says much about China's car services investment potential in that it overlaps a number of social and technological modernization trends. Political will is an important factor. De-regulation in carpark pricing rules and more enforcement around illegal parking are helping to professionalize the industry. At the same time, mobile parking reservation apps and big data tracking systems inside garages, for example, reflect a capacity for innovation in the most low-tech corners of the car industry

Digitization drive

Warburg Pincus is no stranger to this space. Recent investments by the GP also include designated driver service eDaijia, car rental players Ucar and China Auto Rental, and Baturu Technology, an online auto parts trading service. It has also been active with second-hand car trading platforms, including Uxin and Souche, the latter of which it backed last month as part of a $335 million round.

Adjacent business models have angled to bring the mechanical side of the business online as well. After-sale maintenance platform Tuhu raised $100 million at a valuation of $500 million from investors including Qiming Venture Partners. Meanwhile, Grand Flight Investment led a $44 million round for Lechebang, a company that connects drivers with spare parts stores among other support services. Earlier this week, Lechebang backer Cathay Capital Private Equity launched a RMB1.5 billion automotive fund that it said would focus in part on similar aftermarket plays.

Opportunities around the belated digitization of familiar services are tipped to be amplified by base market growth related to China's rising middle-class ambitions. The consumer instinct to kick the tires in person with big-ticket items like cars ensures that online-to-offline crossover will continue to proliferate, especially as car leasing and financing models develop against an increasingly sophisticated financial technology backdrop.

Recent car-related financial services deals include a $29 million round for valuation specialist Che300 led by SAIC Motor and a $52 million investment in financing platform Chedai led by You Jin Capital and Addor Capital. Earlier this year, a number of Chinese GPs backed Atzuche, a Shanghai-based company that helps drivers gradually monetize their cars by renting them out to pre-screened customers.

"For the foreseeable future, there will be coexistence between the pure offline players and the emerging online competitors because the market is so huge, and it's very local," says David Yuan, a partner and head of China at Redpoint Ventures. "In the long run, we think combining online and offline will be a core competency and competitive advantage for companies. The barriers to entry are about being able to build both a strong online brand and keep up a large offline services component."

Redpoint was among the earlier PE movers in this category, having invested peer-to-peer used car trading platform Renrenche in 2014 as part of a $25 million round. Renrenche raised a $200 million round in September from a group of investors include ride-hailing giant Didi Chuxing, which will integrate the service into its mobile app.

Other corporate heavyweights backing the used car space include Alibaba Group, JD.com and Baidu, lending credence to industry expectations that strategic acquisitions could be a viable exit option as the market matures. At the same time, stakeholders appear increasingly convinced that new fintech-related services will eventually help translate a bumper crop of new cars in Beijing and Shanghai into a second-hand boom for markets in less affluent cities.

"While the auto industry in China has always had significant potential given the size of the market, it has just recently reached the tipping point to become an economically viable industry with the introduction of financial leasing models," explains William Chen, a managing partner at Clearvue Partners, which invested Souche in April. "Consumer credit has only started to evolve recently with the development of the financial industry and consumer data generated from new models like peer-to-peer lending and digital payment platforms like Alipay and WeChat Pay."

In addition to Renrenche and Souche, used car platforms attracting PE investment in the past 12 months alone include Uxin, Tiantian Paiche, Guazi, and Maihaoche.

Underpenetrated market

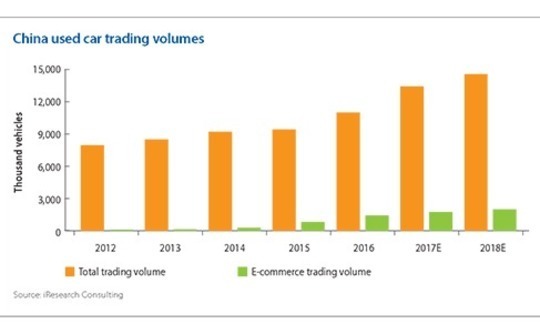

According to iResearch Consulting, internet-facilitated trading will account for 12.8% of China's used car transactions in 2017, and this figure is set to inch up to 13.4% next year as total trading volumes grow 8.5% to about 14.6 million vehicles. This footprint for online business models compares to penetration rates of only 2.8% and 8.4% in 2014 and 2015, respectively.

"The market is strong and growing, especially in second-hand cars," says James Ieong, chairman and managing partner at Pagoda Investment. "We're investing in the opportunities in value-add services and the entire ecosystem around cars as an information platform. Eventually, information of used cars will become more and more transparent, and transactions will be more frequent given better user experience offered by service providers like Tiantian Paiche. "

Pagoda led a $100 million round for Tiantian late last year, which was extended in October by a $80 million commitment from investors including Industrial Bank of China. The GP said it was attracted to the company due to its consumer-to-business (C2B) trading strengths. Used car dealers in China don't benefit from the various car sourcing channels available in more developed markets, resulting in strong upside for C2B facilitators.

"As the used car market matures, online-to-offline trading models will grow, but the capability to offer scalable and standard offline services will be a key success factor in the digitalization process," says Aminta Xiong, a director at Pagoda and the deal leader for the Tiantian investment. "At the same time, valuations of first-tier players are already very high, so you have to consider if the prices are reasonable, if a company is in a market-leading position, and then how to balance that."

Xiong adds that while M&A consolidation is likely to re-shape the market and create exit opportunities in the future, it remains uncertain how or when this will happen. More caution can be seen in the likes of Gobi Partners, an early investor in Mychebao that sees the used car space not as a winner-take-all scenario, but a diffuse playing field where a steady process of professionalization will eventually culminate in a kind of commercial oligarchy.

"There may be some consolidation in the future, but for now, we don't see it as a big opportunity, even though the market is very fragmented," says Don Jiang, a managing partner at Gobi. "That's because a lot of the mom-and-pop shops are so inefficient and don't have enough value – it's more about who can take the biggest market share through better customer experiences. In the next few years, it will boil down to about five $1 billion companies that can do that."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.