Indian family offices: Family matters

The shift from blind pool funds to direct investments doesn’t reflect the preferences of all Indian family offices, but exposure to fast-growing technology start-ups is an increasingly powerful draw

Munish Randev, CIO of Indian multi-family office Waterfield Advisors, is hiring. Two senior associates are expected to join in the next six months, creating a stand-alone team of three whose sole task will be to assess direct investment opportunities. Unhappy with the performance of funds they backed in the past and unwilling to pay PE fees, clients increasingly want to participate in funding rounds for companies – chiefly those with exposure to India's technology boom.

"Of the 36 families we manage, five have given us a clear mandate to create a direct investment system, almost a segregated entity within their family office. Five out of 36 isn't huge, but they represent $1 billion. If 10% of that is allocated to direct deals, a large amount of money must be invested," says Randev. "In the last 18 months we have seen a huge shift in demand towards direct deals."

Waterfield's clients are by no means representative of India's family office space as a whole, a sprawling collection of pockets of wealth that vary hugely in size and sophistication. The evolutionary curve has high net worth individuals (HNWIs) with no existing PE exposure – who are therefore more likely to back funds – at one end and fully staffed and institutionalized family offices at the other. But no one is standing still on this curve.

The Indian Angel Network (IAN), for example, has grown from a collection of 30-40 individuals that co-invested in start-ups to a 450-member organization that includes various family offices. Pratik Bose, who was previously with Cisco's captive PE unit, joined as managing partner this year with a brief to work on IAN's debut fund. While this reflects broader demand for exposure to the technology start-ups, there is also a subset of more advanced investors willing to write bigger checks.

"The earlier trend was they would put capital into seed or pre-Series A rounds. Even Series A was rare for family offices, apart from a handful of large ones. The ticket sizes were small, tens of thousands of dollars to hundreds of thousands of dollars," Bose says. "Given the growth in the number of start-ups in India, as well as some exits, the ticket sizes have increased. Over the last couple of years we have started to see $1 million commitments from a single family office."

This tallies with reports from other parts of the industry. George Mitra, CEO of Avendus Wealth Management, which has about $3 billion under management, notes that the number of family offices willing and able to write checks of $5 million and above for early-stage deals is growing. Nevertheless, he estimates that this bracket only holds about 250 and stresses that the shift from blind pool to direct investing is still largely limited to ultra HNWIs.

Mixed market

Private equity remains a relatively new phenomenon for Indian family offices, particularly among those that have limited access to offshore managers. Funds focused on real estate and gold were the first to attract attention, but their appeal has dropped off relative to technology. Meanwhile, regulatory reform – notably the introduction of the alternative investment fund (AIF) regime – has led to an increase in the number of products launched by quality GPs.

"The market has only really taken shape in the last four or five years as the industry has become larger," says Randev. "Once the AIF platform was introduced it became much easier to launch funds, and family offices started gravitating towards this space."

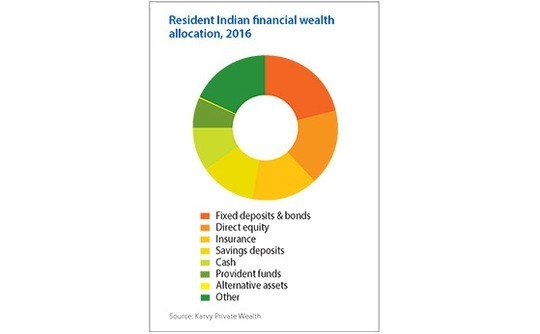

Individual domestically held wealth in India amounted to INR304 trillion ($4.7 trillion) at the end of the 2016 financial year, up from INR280 trillion the previous year, according to Karvy Private Wealth. Of this total, INR172 trillion was in financial assets, two thirds of it in fixed income, direct equities, and savings accounts or with insurance companies.

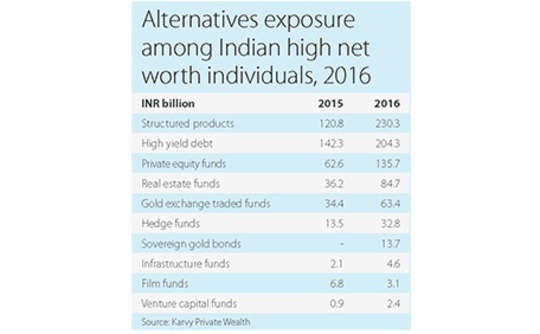

The alternatives share is tiny – just 0.45% – although it rose sharply over the course of the year from INR420 billion to INR775 billion. Private equity and venture capital exposure both more than doubled, coming to INR135.7 billion and INR2.4 billion, respectively, but they trail structured products and high yield debt within a broadly defined asset class that also includes real estate funds, gold exchange-traded funds, and hedge funds.

Even among those that are able to invest offshore, views on private equity are divided. Paragon Partners recently closed its debut India fund at $120 million with 20% of the corpus coming from Indian and overseas family offices. Siddharth Parekh, a senior partner with the firm, estimates they met with 40 India-based groups. While some were open to the portfolio diversification offered by private equity, others said no because they were uncomfortable with the fees or the illiquidity.

"And then the bigger and more sophisticated groups are transitioning to doing it themselves, whether it is early-stage angel investing or later-stage direct deals because they have the expertise and the professional teams to do it," Parekh adds.

The first movers among the family offices chasing direct deals inevitably include several titans of Indian industry, such as Wipro chairman Azim Premji, Tata Group's Ratan Tata and Infosys co-founder Narayana Murthy who now invest their personal fortunes through PremjiInvest, RNT Associates, and Catamaran Ventures, respectively. Each family office is notoriously publicity shy.

Other groups have turned to investment after exiting their core businesses. The Patni family formed Nirvana Venture Advisors once it had sold Patni Computers to iGate Corporation in 2011, while Ronnie Screwvala set up Unilazer Ventures following the sale of UTV to the Walt Disney Company in 2012. T.V. Mohandas Pai, an Infosys alumnus turned angel investor, has various initiatives, including Aarin Capital, which is described as a proprietary venture capital fund.

The behavior of these family offices is by no means uniform. While PremjiInvest is said to favor larger public and private investments – it committed INR7 billion to Aditya Birla Capital earlier this year – RNT targets smaller deals, particularly in the technology space. The portfolio includes sizeable start-ups like Ola and Paytm, but the firm will also invest earlier, leveraging Tata's role as a special advisor to Kalaari Capital, Jungle Ventures and IDG Ventures.

RNT will take LP stakes in funds raised by these GPs and also co-invest in deals that appeal to it, although the firm is understood to have completed even more deals sourced independently of these relationships. "One third of [Tata's] time is spent on this area, one third on the family trust, and one third on social causes," says one industry participant familiar with RNT. "It's a big piece of his life and there is a strategic aspect to that. I haven't seen this from a lot of other so-called family offices."

Increasingly institutional

Other market watchers assert that the likes of RNT are no longer the exception to the rule in India. More family offices are becoming institutionalized by introducing professional teams and formal investment programs. Bose of IAN notes that these teams often include a younger-generation member of the founding family who has been educated overseas. However, the key differentiating factor concerns the ability and autonomy of these internal resources.

Samena Capital is in the process of raising a private debt fund under an AIF structure and has already received commitments from approximately five family offices. The firm was recently in contact with a family group that has around $600 million to deploy and is in the process of meeting with managers before deciding how to allocate it. A private equity professional was hired to provide guidance but the principals are attending all the meetings and making the decisions.

"They have used someone to formalize the structure and get to grips with the opportunity set but there isn't a professional team running the show," says Pavan Gupte, a managing director at Samena. He sees family offices with $100-300 million as an attractive target market; they are becoming increasingly sophisticated but don't necessarily have the resources to warrant hiring a dedicated team for direct deals.

Another option is to outsource this function to a third party, which is why Waterfield is looking to build out its direct investment team. Randev explains that these individuals will be tasked with deal sourcing as well as fulfilling the deeper due diligence requirements. This involves establishing relationships not only with investment banks but also within the VC ecosystem through incubators, accelerators and entrepreneurs, and through referrals from the Waterfield client base.

"Promoters who are reaching out for capital will check in the industry as to who are the major players in the fund space and the family office space. Previously, they would only have checked the fund space. We are gatekeepers for lots of these families and people need to realize they can reach out to us and make sure we do an assessment of their product," says Randev.

In addition to wealth management, Avendus has an investment banking arm that syndicates early-stage and growth investments to private equity firms. Mitra admits that some of the larger family offices want to look at these deals, but the chances of participation are relatively slim, in part because the institutional investors who lead these rounds don't like to see too many lines on the capitalization table.

In this sense, September's $250 million Series D round for online hospitality platform Oyo, led by the SoftBank Vision Fund, was unusual. Several existing venture capital backers re-upped and Hero Enterprise – an entity set up by Sunil Munjal, who separated from Hero Group, which is led by his elder brother, last year – came in as a new investor.

"You need to have expertise and financial resources to do these deals, but whether family offices have access is a different question," Mitra says.

Unique selling points

However, family offices do have an edge when targeting areas in which they can bring domain expertise to bear. Technology entrepreneurs, for example, could get access to popular start-ups by virtue of their own networks and the experience they can offer to less seasoned founders. The formalization of what start out as fairly opportunistic portfolios is apparent in Flipkart founders Sachin and Binny Bansal working with multi-family office Tsai Shen Capital.

"They are very knowledgeable about technology trends and they attract talent to their family office that has a similar background," says IAN's Bose. "You are seeing professionals who have been part of India's current wave of start-ups coming into venture capital, and there will be many more names."

These forces become especially powerful when family offices take another step in the institutionalization process and raise third-party capital. This has become an established trend in China's technology space, resulting in a new generation of investment groups created by successful internet entrepreneurs as well as professionals who have spun out from established VC firms. There are early signs that India will follow suit.

Last year, G.S.K. Velu, who sold his stake in Metropolis Healthcare in 2015, set up a family office and also launched Stakeboat Capital, an alternative investment firm that is looking to raise $100 million from family offices and institutional investors. Meanwhile, Kanwaljit Singh formed Fireside Ventures as a family office in 2014 after departing Helion Venture Partners and this year raised an early-stage consumer-focused fund. LPs include other family offices with interests in the consumer space.

"The first round has been fund managers who have worked with other firms venturing out on their own," says Mitra of Avendus. "While we have seen entrepreneurs form funds, they haven't taken any third-party money, which is partly to do with regulation and what structures are possible. But I believe we will see this in the next round."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.