Portfolio: CITIC Capital and Oriental Cambridge Education Group

Oriental Cambridge Education Group was already a leader in China’s early childcare market when CITIC Capital acquired it in 2014. The GP has strengthened the company to tackle new challenges

Dejun Luo, a managing director at CITIC Capital Partners, is often asked what separates the firm's portfolio company Oriental Cambridge Education Group from its competitors in China's childcare market. He found the best analogy outside the industry altogether.

"I say, think about this business as Uniqlo. Uniqlo provides basic things with a good quality at a very reasonable price," Luo explains. "We don't position ourselves as something like Zara, continuously chasing trends. We focus on the fundamentals, and finding the price point that can make the business financially sustainable."

Oriental Cambridge's commitment to elevating its competence across the board has made it a leader in the early education space, and CITIC has taken an active role in its expansion. In addition to backing the company with financial and professional support, the GP has led initiatives to strengthen areas such as curriculum development.

CITIC sees its three-year investment in Oriental Cambridge as an example of the firm at its best, forming a partnership with a management team in which each party reinforces the other's best qualities. As the company moves to the next stage of its development the GP will continue to support its existing strengths while leading new value creation efforts aimed at long-term growth.

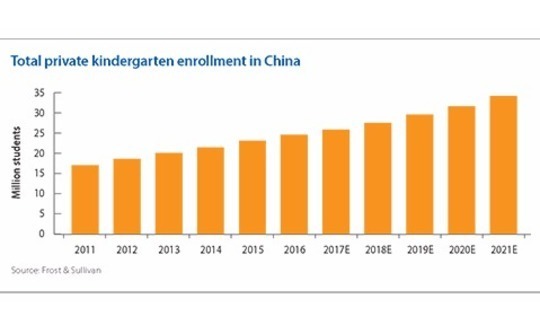

CITIC's investment in Oriental Cambridge in early 2014 came amid expansion across China's private kindergarten industry. According to report by Frost & Sullivan last year, total enrollment in private kindergartens grew from 16.9 million students in 2011 to 21.3 million in 2014 on the back of factors such as urbanization and rising disposable middle-class incomes.

Along with these drivers, the relaxation of the one-child policy – which began in 2011 and continued in 2015 with the implementation of the two-child maximum – meant the share of China's population under six years old was expected to rise from 99 million in 2011 to 112 million by 2021. Population growth and the need of Chinese professionals for childcare are projected to push private kindergarten enrollment to 34 million by 2021.

Scale proposition

In light of these statistics, CITIC saw an investment in private kindergartens as a good bet, and it began looking for an opening. In Oriental Cambridge it found what it sought: a company that had managed to achieve significant national presence in a highly fragmented industry.

"To build a business that can operate kindergartens in over 30 different cities is a huge undertaking," says Luo. "For most kindergartens, even if they operate multiple campuses, they only operate in one or two cities. But Oriental Cambridge had managed to expand its business to over 30 cities. That clearly distinguished them from other players."

In its examination of the industry, CITIC had seen that kindergarten operators tended to share certain characteristics that made them self-limiting in terms of size. For one thing, most companies were predominantly run by educators, who understood education and childcare but were unable to add the layer of institutionalization needed for significant expansion. In addition, success in the kindergarten business is highly driven by word of mouth, and companies that have succeeded in one market find others dominated by local players with their own solid reputation in the community.

Oriental Cambridge, which opened its first kindergarten in 1986, made itself an exception to these rules through years of effort. While it was also founded by an educator, former Harbin University professor Songling Yu, from the beginning the company understood that creating a strong corporate structure would be key to realizing its ambitions of a nationwide network of facilities focusing on children aged 3-6.

"Oriental Cambridge has been able to manage national expansion with strong leadership teams built at the group, regional and school levels," says Yu. "The management team is supported by regional management teams who contribute valuable educational, commercial and financial know-how based on regional industry knowledge. At the school level, the principal manages the school together with the school's leadership team."

Seeing Oriental Cambridge as an ideal entry into the kindergarten space, CITIC proposed to acquire the business for an undisclosed sum. The company's management accepted, viewing the GP as a partner that could provide needed financial support for expansion and assist with further refinements to the corporate structure and strategy.

One of CITIC's first initiatives was to reform the company's human resources structure to give the head office a greater voice in hiring and talent retention. While the firm didn't want to take staffing decisions out of the hands of local headmasters, it believed the central office could take a stronger role in providing consistent standards and a positive working environment.

"It's a people business, so it's very important to hire good employees and keep the teachers and headmasters happy," says Luo. "So we hired a very professional HR director who used to work for a Chinese budget hotel chain. He did a fantastic job laying the foundation of a very solid HR system, in terms of retaining talent and career development, training, salary and performance management."

Pricing problems

Another area for improvement that CITIC identified was pricing. Prior to the acquisition, individual kindergartens were responsible for setting their own tuition fees, and in its due diligence the team had discovered that more than half of the company's kindergartens had not raised their prices in the past three years.

Looking for the sources of this problem, the GP found that performance assessments for local managers focused almost entirely on enrollment, with almost no attention paid to financial performance. This meant that headmasters were incentivized to grow their student bodies, which they often accomplished by keeping fees low. CITIC saw this approach as unsustainable.

"If you measure the headmaster by the kindergarten's enrollment, they are reluctant to increase the price. But if you don't increase the price properly in line with your cost increases, then your profitability goes down," Luo says.

To address this imbalance the private equity firm implemented a new system of key performance indicators (KPIs) that elevate revenue and profitability to the same level as enrollment. The goal is not to punish headmasters but to show them it is in their interest to balance student recruitment with the financial health of the business and make them feel more like partners in the company.

With its connections at government level and within regulatory agencies, the GP has also strengthened Oriental Cambridge's relationship with key players in these areas. This assistance has come in several forms: while CITIC has helped the company build ties with figures in local government and obtain operating licenses, it has also created structures to ensure that the company is always operating within the law.

"Since CITIC Capital's investment, Oriental Cambridge has refined its procedures. Kindergartens are required to be compliant with industry standards and are inspected at regular periods by the designated team," Yu says. "Compliance is driven centrally through finance and project management functions. It is a key operating tenet that all businesses comply fully with the appropriate legislation and regulatory framework."

While these improvements have done their part to improve Oriental Cambridge's internal structure, CITIC sees its greatest achievement as the new curriculum it is helping the company to implement. The GP believes that unlike its other measures, which could apply to companies in nearly any industry, the new curriculum will be key to establishing Oriental Cambridge as a leader in the childcare space.

When planning the curriculum, CITIC and Oriental Cambridge took the age of their student base into account. Managers believed the toddler years were not the right time for challenging concepts like English or math instruction; instead, the school's materials would start at a more basic level, helping students build the skills to understand and participate in the world around them.

"Kids don't always have a good environment to develop what we call keystone habits, whether it's hygiene, sports, reading, or the habits of thinking or interacting with other people," says Luo. "Age three to six is a critical stage for kids to develop these habits."

An educational expert from New Zealand was hired to develop the new curriculum in partnership with Oriental Cambridge over 18 months, and the company began rolling it out to its facilities last year. So far the results have been promising.

"The feedback from the parents and teachers is very positive, because the parents can clearly see after taking these classes that their kids' behavior has changed quite noticeably," Luo says. "So this is also a keystone pillar for us to build a brand that can eventually differentiate us from other players."

Premium products

CITIC's more recent efforts have focused on extending Oriental Cambridge's product offering past its current focus on middle-market customers. Last year the company partnered with global early education provider Busy Bees to launch a line of kindergartens that target the high-end market, with the first already open in Harbin and the second planned to open soon.

While Oriental Cambridge kindergartens typically charge around $300 per month, the Busy Bee facilities will charge $1,000 or more. The companies are developing a new curriculum and design to deliver a premium feel to clients.

In another new venture, Oriental Cambridge opened its first corporate daycare center earlier this year at the Beijing headquarters of e-commerce giant JD.com. This is regarded as a potentially lucrative new product line leveraging both the success of China's corporate giants and the country's growing pool of young urban professionals.

"The company is very happy and the parents are very happy, because they can take their kids to work, and they don't have to leave the kids at home with nannies," says Luo. "They can have kids and their professional careers at the same time, and it fits their lifestyle."

Oriental Cambridge would like to see the joint venture with Busy Bee and the corporate daycare project as form the second and third legs of a tripod with the core kindergarten business. The company believes its established strength in the budget childcare market provides a solid base from which to grow its reach into the premium and professional market sectors. It also sees potential for expanding and deepening its current business model.

"Our main plan for the future is to widen the age range of kindergartens to start younger, running from age zero to 6," says Yu. "We will also focus on extending our education by integrating family with the preschool and children."

Oriental Cambridge expects CITIC to continue to play a crucial role in its growth plans, due to its industry connections, investment experience and industry insights. The private equity firm can help to evaluate new markets for expansion while supporting company management through assistance with strategic planning, financing and regulatory compliance.

CITIC is in the fourth year of its investment but claims ambivalence as to whether the exit route is an IPO or a trade sale: the response is that it's premature to consider exiting Oriental Cambridge. With strong growth likely to continue in China's early childcare market, the GP believes it is more important for now to follow through on the operational improvements it has already put in place over the next several years.

"We are continually fine-tuning these products and improving the operating standard and the training," says Luo. "We'll continue to focus on these three platforms, and make sure that they can generate strong growth momentum."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.