Sector funds: Special forces

The proliferation of fund managers targeting relatively focused investment segments signals a new maturity in Asian private equity. The trend will evolve in step with regional markets

When a private equity firm starts out by restricting its mandate to an economy half the size of Thailand, few observers would expect the strategy to become even more specialized over time. Such stories are coming to light, however, as versatility becomes an increasingly equivocal virtue in private equity.

The firm in question, Mekong Capital, was set up in 2001 with a tight focus on Vietnam and a broad sector strategy. This led to deals in areas such as energy and real estate, where difficulties related to typical frontier market business cycles dented fund performance. By the time of Vietnam's 2011-2012 economic downturn, it became clear that consumer-facing industries were the only reliable way forward. As a result, Mekong logically embraced a consumer-only tact, which in time has proven a decisive renaissance.

The recent sale of portfolio company Vietnam Australia International School (VAS) to TPG Capital helps illustrate this point. Although financial details have not been disclosed, Mekong's consumer strategy contemplates turnarounds of no less than 5x, and the firm has described the exit as "very successful." This assessment is flavored by non-tangible winnings as well, including education industry experience that doubtlessly informed an English learning platform investment only five months later.

The VAS deal therefore exemplifies much of the experience snowballing effect enjoyed by sector-focused GPs, but from a macro perspective, it also offers insight into the forces behind the gradual acceptance of private equity in Asia. That's because specialization does more than just help investors better exploit various deal environments – it utterly redefines their role in the surrounding economy.

"If you rewind 10 years to when Mekong was investing across many sectors and our deal leaders would go to a board meeting and confront the company about something that was off-track, the CEO would say, ‘What do you guys know about this sector – you're just private equity investors,'" says Chad Ovel, a partner at Mekong. "But now that we're so focused, we're perceived in the boardroom as experts. It's a complete turnaround."

Credibility and respect in industrial circles, like many aspects of specialization, has knock-on effects across the asset class. For example, the reputation for having an elevated understanding of a sector gives fund managers leverage in pushing for more favorable investment terms. They are also seen as better able to execute tangible value-add proposals and better positioned to bring outside help to bear thanks to widespread industry contacts.

These networking strengths in turn improve access to talent and technology as well as facilitate exits through more connections with buyers. Meanwhile, specialized funds typically boast higher-than-average numbers of strategic players in their LP bases. This expands potential for lasting operational synergies and even deeper industry insights.

Hype vs reality

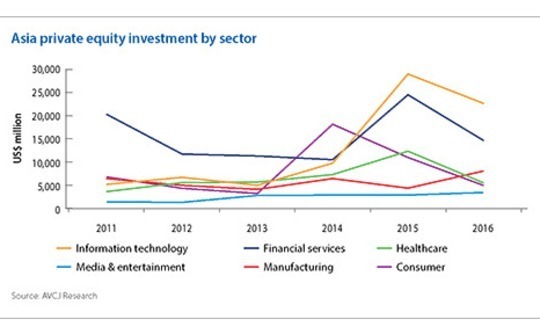

Faith in such advantages is well established in the US and a tenant of major international GPs' existing playbooks. In Asia, the strategy is less entrenched but growing. Investors in the region do not yet pursue specializations at the sub-sector level in large numbers, but firms like Mekong that flag a broad sector preference are increasingly common.

Although anecdotes about specialization success are plentiful, hard numbers are not. Doug Coulter, a partner at LGT Capital Partners, says it may still be too early for specialist funds in Asia, noting that evidence of strong outperformance remains lacking. "We've backed one sector-specific fund in Asia, a healthcare fund in China," he says. "We also like education, for example, but whether you'd want to build an entire fund around education is questionable because you're basically looking at a bunch of really expensive deals at the present time."

Hesitancy about the merits of specialization also strikes at one of the strategy's core selling points: the ability to source deals with a greater acumen than less informed generalists. In this view, specialized funds in any particular sector could simply be a symptom of the hype cycle.

The most common example used to illustrate this point is the Chinese renewable energy space in 2006-2009. A groundswell of sector interest saw the emergence of several specialized clean energy investment vehicles, but the larger generalist firms had already acquired the sector's best assets – represented by a number of local wind turbine manufacturers.

"The concept of a specialist fund is a very good one, but by the time a fund like that is formed, it's usually too late," says Edmond Ng, a managing partner at fund-of-funds Axiom Asia. "The game is not necessarily over, but you'll be paying sky-high valuations for assets because the sector has already become so hot, and you won't be able to make very good returns. That pattern repeats itself all the time."

Skepticism around specialization can therefore have an impact on fundraising, especially for younger teams floating a debut vehicle that may feel obliged to target unique domains in order to differentiate themselves. As a result, specialization has at times suffered from a reputation of being more about branding than investment strategy.

"A lot of investors will talk about a certain strategy for fundraising purposes, and then may or may not execute on that strategy," says Kyle Shaw, founder and managing partner at Shaw Kwei & Partners. "So there are firms that are truly specialist in certain areas and execute on that strategy and then some that are just telling people what they want to hear. More than a few private equity firms tend to focus on whatever is the flavor of the month."

Like many of the more established sector specialists in private equity, Shaw Kwei developed its focus on manufacturing and industrial businesses by following up an early success. Once introductions are made and reputations begin to form, GPs find themselves part of a network that deepens with each relevant deal. In this way, specialization is a natural, even inevitable process.

Perhaps more importantly, though, Shaw Kwei – along with number of resources-focused GPs – represents a philosophy of specialization detached from the hype cycles that drive occasional flourishes of niche fundraising. Investors in this camp stick with their sector during the cold spells, using their operational knowledge to carve out returns.

In many cyclic investment cases, the businesses in question tend to be older, and work during the holding period means succession planning or modernizing teams that are reluctant to embrace modernization. The strategy therefore often requires a controlling stake and a concentration on markets without excessive competition.

"We want to fish in the biggest pool of opportunity with the fewest competitors trying to access it," says Shaw. "That's what manufacturing and industrial deals represent in Asia. Our focus is on advanced manufactured parts like radar systems and sensors for electric vehicles because the growth potential is huge."

Employing expertise

The idea that a sector needs to be deep and wide enough for investors to find a sufficient range of opportunities is central to the specialization concept. Large markets are less prone to rollercoaster valuations, affording GPs enough scope to execute a thesis over a reasonably long timeframe.

Interestingly, sector growth not only allows for specialization, it breeds it. Large markets offer more complexity because increased competition stimulates changes in methodology, which in turn require operators to adopt specialized skills.

However, there is a tendency in private equity, even among specialized firms, for teams to have a predominantly financial background as opposed to industry-specific skill sets. Large firms have coped with this phenomenon by introducing more operational professionals to positions traditionally dominated by staff with only transactional experience. This has resulted in multiple layers of specialized management in their deal teams.

Smaller firms have imitated this blueprint through hybrid strategies involving third-party contractors. The main challenge is finding industry-specialized tacticians who also have a sufficient level of local savvy in the targeted geography. GPs adopting this approach must be sure that betting on expertise will achieve superior returns because operating expenses related to the hired help have been known to exceed management fees.

Despite reservations about valuation volatility, many LPs see a sector-focused game plan as indispensable to keeping a competitive edge. Indeed, there appears to be a growing industry consensus that LPs are beginning to lean more toward strategies of multi-geography and single-sector in favor of single-geography and multi-sector. Hints of this sea change can be seen in GP vocabularies, where the word "generalist" is being phased out by the vaguely more targeted connotation of the term "sector-agnostic."

Mounir Guen, CEO of placement agent MVision, sees a direct connection between the increasing size of global PE funds and the proliferation of specialized managers. This causality is supported by LP demand for performance enhancement through strategic focus, but it is limited by geography and demographic factors.

"The question is: Does the region in which the GP operates lend itself to being micro-defined or not?" says Guen. "The US does. Other areas of the world do not. In Asia, you have to pick a few themes as priorities and systematically manage those. De-emphasizing sectors can be done quickly, but when emphasizing new sectors it takes time to build the knowledge."

Private equity investors in the US are widely seen as having much more precisely defined strategies than their Asian counterparts due to the deal targeting advantages of the country's large, homogenous population and more developed M&A environment. Although much of the US ecosystem remains generalized, it is seen as being at the vanguard of experimentation in specialization, as evidenced by emerging hyper-niche plays such as single-asset fund structures.

It is doubtful if Asia will be able to replicate this kind of activity as its economies mature. The tightly bound marketplace required for US-style sub-specializations would need to be built on international organizations like ASEAN, which have so far proven only marginally effective at stoking economic cooperation. China appears on track to become more specialized, but instability tied to its massive cultural and economic transitions could be a mitigating factor.

"Sometimes when a GP is marketing a fund, there is a particular sub-sector that is very interesting, but China is fast-growing with a continually evolving investment landscape. By the time a fund closes, another sub-sector may have become even more interesting," says Jireh Li, chief representative for Asia at Commonfund Capital.

Some more experienced GPs have responded to this dynamic by marketing their strategy as broadly defined IT or technology, media and telecom (TMT). If a detailed sub-sector focus adjusts along the way, it does not appear as a change in strategy, rather an example of tactful investment management.

For the moment, the specialization on show in Chinese PE may not pass the definition test in the US. While healthcare and financial technology have emerged in the country as reasonably specific areas of focus, most sector-focused GPs maintain broad mandates across categories such as consumer and technology.

The tech angle

Indeed, part of the difficulty in tracking the proliferation of specialized private equity is a lack of agreement on what constitutes a specialty. For Tsing Capital, a GP that focuses on environmental technology, specialization is less about niche technical interests and more about knowing how to respond to various macro drivers.

"We never claim to be technology specialists, but rather specialists of certain markets and industries. In our philosophy, evolutions in technology will happen faster than the change in market demands," says Fang Yuan, a partner at Tsing. "Specialized GPs are better at knowing when to introduce a new technology to their focus industries, how might the market accept it, and what business strategies should the portfolio company take in order to succeed."

It is expected that as sub-sector deal flows in the region multiply, more specialized technology managers will come to the fore. In this view, Asia's diversified IT funds today may eventually splinter into specialists targeting areas such as software-as-a-service or social networking platforms. That said, while niche specialization within the technology space has proven ravenously popular with US investors, uptake in Asia is likely to be more nuanced.

"PE firms will continue to look at traditional industries, but I don't think they will start to be specialized in tech because tech is disrupting those industries," says Jenny Lee, managing partner at GGV Capital. "PE investors need to fully understand how technology is bringing changes to those industries. The old way of doing due diligence in areas like manufacturing, restaurants and transportation is not the same as how you do due diligence on a mobile app."

So far, international private equity firms are taking on these sorts of due diligence issues through operational hires and team segmentation. Meanwhile, strategic preparations around the disruptive effects of technology on traditional industries have appeared akin to pre-emptive crisis management.

"One of the biggest challenges facing our firm today is the impact of e-commerce," says the Asia head of a global buyout firm. "Our US business hired a consulting firm to review all their portfolio companies and do an assessment as to whether they were e-commerce ready, and we're getting the same consulting firm to come to Asia. If you aren't part of a global organization, it's hard to get this kind of learning."

Although the rise of e-commerce globally has inspired more specialized investment strategies, it coincides perhaps more significantly with the emergence of Asia as a key consumer market. A number of PE themes have demonstrated this trend – such as the popularity of fast food consolidation plays – but a general prevalence of family-owned businesses in the region has been linked to a lack of consumer buyout opportunity.

This scenario has underpinned the strategies of DSG Consumer Partners and ClearVue Partners, which both focus on a new generation of technology-enabled consumer companies. Verlinvest, a family-owned holding company that sparingly makes LP commitments, has backed two funds under ClearVue and is an anchor investor in DSG.

"What's interesting about ClearVue and DSG is that they're really looking at what the key consumer trends in China, India and Southeast Asia will be in the next 10 years and how to find companies that are positioning themselves to benefit from these trends," says Nicholas Cator, an executive director at Verlinvest. "These GPs are identifying and narrowing their scope of investment to a few consumer sectors they believe will flourish in the next years."

Consumers count

Few sectors offer more scope to narrow focus than consumer, which can touch on industries as disparate as pharmaceuticals and retail-connected logistics. However, consumer specialists such as L Catterton have signaled that an all-encompassing approach could also be attractive to LPs. The firm is the product of a merger last year between Catterton Partners, a US-based consumer investor, and L Capital, a GP affiliated with luxury goods conglomerate LVMH that had operations in Asia and Europe.

"Our approach globally is to focus on those categories and sub-categories that are growing faster than the overall market," says Sanjay Gujral, regional managing director at L Catterton Asia. "We achieve this by spending vast sums of money on conducting proprietary research, retained arrangements with consulting firms, as well as ongoing dialogue with LVMH executives across the world."

The LVMH connection is a critical part of L Catterton's strategy, not just as a private equity firm, but as a specialist in particular. Affiliation with an industry giant in the targeted area of focus is a recurring hallmark of private equity's more resilient specialists.

This is especially true for independent GPs operating in the broad but intensely competitive China market, which is also inhabited by deal-hungry corporates and a plethora of renminbi-denominated funds offering quick and easy access to capital. Chinese specialists taking this approach include entertainment-focused CMC Capital Partners, which maintains an affiliation with Shanghai Media Group, and Yao Capital, a sports investor that banks much of its reputation on the popularity of co-founder and former NBA star Yao Ming.

"Sponsor relationships are a special characteristic of Chinese private equity that we don't see that much of in other markets," says Chris Lerner, partner and head of Asia at placement agent Eaton Partners. "This is a top-down driven market where brand, platform and resources are important components of a competitive advantage. So when GPs try to differentiate themselves and compete for deals, those things probably matter a bit more in China than they do in a mature PE market like in the US."

Hosen Capital, a China-based food sector specialist, also follows this pattern through a close sponsorship relationship with agribusiness conglomerate New Hope Group. The private equity firm sees a future in Asia's food sector based on a number of consumer demand trends related to increasing regional wealth.

The long-term plan envisions a market where the overall growth of China will contribute to a wave of domestic consolidation and the creation of the country's first generation of truly global food companies. Fittingly, this outlook blurs the lines between one of the world's most inclusive economic trends and a relatively exclusive opportunity set. As private equity becomes a more integral part of Asia's various investment ecosystems, the open-ended concept of specialization may do the same.

"If you ask me where Hosen will be 10 years down the road, we will probably evolve from a mostly growth capital and food sector specialization to doing more buyouts and more general consumption," says Alex Zhang, a co-founder and managing partner at Hosen. "Specialization is a sign of maturity in private equity and we are a specialist fund, but that doesn't mean we won't evolve into more generalist consumption because there are other structural trends in the growth of the market."

CASE STUDY: Yao Capital - Sporting chance

NBA Hall of Fame basketball player Yao Ming gives his name to China-based private equity firm Yao Capital, while David Han, formerly of The Carlyle Group and domestic conglomerate Wanda Group, brings the industry expertise. Their objective is to build a select portfolio of sports assets with a view to exploiting business synergies – and creating addition value – between the portfolio companies.

"I was a generalist 10 years ago. We invested in every sector and we did well because the Chinese economy in general was booming. Now China has become the world's second-largest economy, expansion has plateaued in some sectors. That means GPs must be more selective, picking fast-growing segments to be their investment focus," says Han.

Yao Capital also has government policy on its side. In 2014, the State Council announced plans to accelerate the development of the domestic sports industry, including the elimination of regulatory barriers and measures to stimulate private investment. The State General Administration of Sports followed up last year with a detailed five-year blueprint that has the stated aim of creating a RMB5 trillion ($750 million) industry by 2025.

"The sports industry is at the beginning of a 10-year growth cycle. Right now, it only accounts for 0.6% of GDP, compared to about 3% in mature economies. But the sports business is part of the entertainment business, which means it also benefits from rising consumption," says Han.

Yao Capital targets investments inside and outside China across 20 segments within the sports industry, ranging from technology to healthcare services. It has already backed eight companies, including sports ticketing platform Weisai, kickboxing tournament organizer Glory Sports International, and electric car-racing championship Formula E. The firm also acquired a controlling interest in Canadian nutrition supplements manufacturer Lovate Health Sciences International.

"The industry is large and relatively new, and we are the first mover. A lot of private equity firms don't have the industry know-how and connections or the track record to invest in this area," says Han. "There are only a few active sector-focused players. We haven't run into a single generalist fund when making investments over the past two years."

Yao Capital has received commitments from Tencent Holdings as well as domestic institutional LPs such as Tsinghua University Education Foundation, Qianhai FoF and CICC FoF. Relevant past investment and operational experience, as well as the brand awareness offered by Yao Ming, were among are among the reasons given for backing the GP.

"Our brand equity is strong. I can knock on the door of almost any sports company and they will welcome us because of we are a recognizable name," Han says. "A well-known brand like Yao Capital and the value-add capabilities it represents is important for young companies. When we come in, we can help them lift their brand awareness as well as provide strategic assistance."

CASE STUDY: Ocean Link - Tapping the travel boom

China's travel and tourism industry generated RMB6.6 trillion ($1 trillion) in revenue last year, equal to 9% of national GDP, according to the World Travel & Tourism Council (WTTC). Already the second-largest market globally, it is expected to grow 7.2% a year over the next decade to reach RMB14.3 trillion.

The possibilities conjured up by these statistics convinced Tony Jiang and Alex Zhang to create tourism-dedicated private equity firm Ocean Link. Relying on Jiang's investment experience at The Carlyle Group and the Zhang's operational knowhow as co-founder of Plateno Hotels Group, they will dig deep in search of high-quality companies and then deliver more meaningful value-add.

Ocean Link received $400 million in seed capital from the likes of General Atlantic and domestic online travel business Ctrip and now as $500 million in assets under management across renminbi and US dollar-denominated vehicles. "LPs generally have two concerns about sector-focused funds: whether there are enough opportunities to generate sustainable deal flow; and what impact a systemic slowdown in an industry would have on a GP's deal-making capabilities. We can address some of these concerns," says Jiang.

Ocean Link looks at a broad spectrum of verticals within travel and tourism, including hotels and resorts, attractions, travel agencies, transportation services, and IT solutions. Initial activities have involved supporting Ctrip's industry consolidation efforts. The GP participated in a $4.4 billion take-private of US-listed Qunar – which later merged with Ctrip – and also joined Ctrip and Tencent Holdings in a $622 million privatization of hotel-booking site eLong.

It expects to have closed 10 deals by the end of this year, split equally between online and offline plays. Targets in traditional market segments should be able to demonstrate offline-to-online strategies. For example, Ocean Link backed Germany-based Ruby Hotels and Chinese student camp organizer Mind Education, both of which manage offline assets but want to attract customers through online platforms.

While investments in early-stage companies – defined as those with annual revenue below RMB100 million and no profit – are also considered, the GP claims a differentiated approach. "We look at these deals as though we're looking at growth equity or even control transactions.," says Jiang. "Since we know the competitive landscape so well, even it's a very early-stage opportunity, we can take a view on whether or not it will lose money. It's a different mentality to generalist VCs, where they say ‘We bet on 10 deals, two will be 20x so we don't care about the rest,'" says Jiang.

Ocean Link has adopted a similar approach to global PE firms by building a separate operating team to work with portfolio companies during the holding period. This is especially important for overseas businesses that want to form local partnerships in China or other Asian markets. As for exits, Ocean Link believes its sector focus can make managing trade sale processes easier.

"When we look at the industry landscape, we look at the companies not only as potential candidates for investments but also as potential buyers of our existing portfolio companies," says Jiang. "If I want to sell a company today through trade sale, I know exactly who the real strategic buyers are and what their financial performance is like because some of them are backed by us."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.