3Q analysis: More about Japan

Toshiba sends Japan into top spot for investment amid corporate carve-out excitement; fundraising plummets in the absence of Chinese state-backed vehicles; the IPO window opens as public markets boom

1) Investment: Big buyout central

During the six years to September 2016, Japan delivered six PE deals worth $1 billion or more. In the last 10 months it has matched this total, including five corporate carve-outs. The late-stage rounds for Chinese tech players and Australian infrastructure privatizations that account for most of Asia’s extra large-cap deal flow now appear to have a bedfellow.

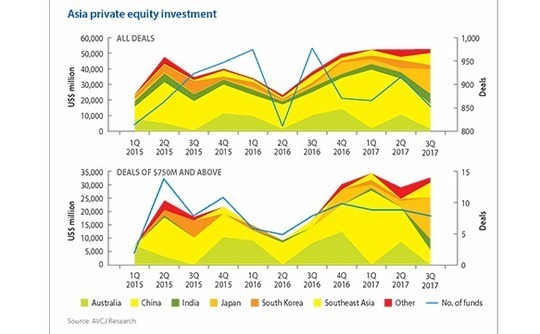

This is the context for a third quarter in which Japan became the largest market for private equity investment in Asia, a status it has not enjoyed since the last three months of 2007, if the government-backed rescue of Japan Airlines in 2010 is excluded. Japan and China contributed $16.2 billion and $15.8 billion, respectively, as a record $52.5 billion was committed, according to preliminary data from AVCJ Research. It just eclipses the total for the previous quarter.

Nine months into 2017 and investors have already deployed more than they did across the full 12 months of 2015 and 2016. The industry seems healthy, almost dangerously so, but the impact of unusually large deals cannot be overstated. In September it was the widely anticipated acquisition of Toshiba Memory Corporation (TMC) by a Bain Capital-led consortium. The deal was worth JPY2 trillion ($17.8 billion), although AVCJ Research deducts the capital that Toshiba is reinvesting in the asset and puts the total at $14.7 billion.

TMC represents Asia’s largest-ever private equity buyout and grounds for vindication among those who have spent years trying to persuade Japanese companies to divest their most prized assets. At the same time, it goes against trend because Toshiba is offloading a very large business that in other circumstances would never have been put on the block. Most divestments are made by non-desperate sellers and involve non-core assets.

For a truer example of the corporate carve-out, look to GSR Capital’s acquisition of Nissan Motor and NEC’s electric battery manufacturing business, which was announced in August and is said to be worth $1 billion. It is closer to the profile of the other three deals, although in each of those cases KKR prevailed in processes for listed subsidiaries of Nissan and Hitachi.

There are likely to be more large cap divestments: governance reforms and an emphasis on return on equity and maintaining competitiveness are forcing conglomerates to prioritize efficiency over size. But the deals are complex, typically expensive, and there is a lot of competition – from the corporates that continue to dominate Japanese M&A as well as from rival PE buyers. It remains to be seen if six transactions in 10 months will be the exception or the norm.

The other two major contributors to the third quarter’s record deal flow both involve China. The first was a long-running, somewhat contentious and well publicized process that ultimately saw Singapore-listed Global Logistic Properties (GLP) accept an offer from a consortium including Hopu Investment, Hillhouse Capital, and the company’s co-founder. At S$15.9 billion ($11.5 billion) it is now Asia’s second-largest PE buyout.

The pursuit of GLP is a natural consequence of more private capital entering China’s logistics sector, but it is also an unusually large target. More than half of the facilities the company has in operation or under development are based in China, where its market share is several times that of the number two player. GLP is also participating in global consolidation, positioning itself as a nexus for goods entering and leaving China. It is difficult to see anything else quite like it coming to market in the near term.

The second significant transaction from the quarter was China Unicom raising RMB78 billion ($12 billion) from a group of private and state investors, including Qianhai FoF and China Structural Reform Fund AVCJ Research puts the private equity portion of this deal at approximately $5.6 billion.

It is an example of mixed ownership reform whereby state-owned enterprises (SOEs) are encouraged to bring in private investors to improve efficiency but without ceding government control. The quarter ended with Hony Capital committing RMB1.8 billion to a similar deal involving a unit of COFCO Group. While there have been numerous false dawns regarding PE participation in SOE restructuring, this initiative appears to have some momentum – although it is unclear how meaningful the investor-investee relationship can become.

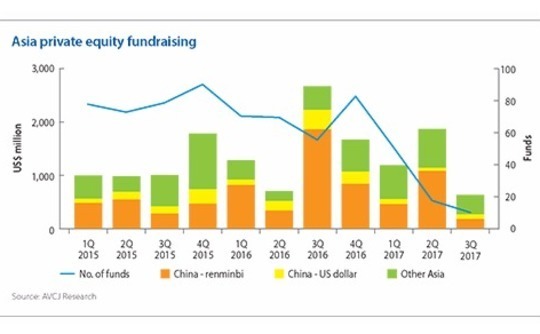

Twelve months ago, the arrival of large state-sponsored Chinese funds took private equity fundraising to new highs. At least one of these vehicles has made an appearance in every quarter since then – until July-September 2017. A total of $12.6 billion went towards partial or final closes of Asia-focused PE funds, the least in nearly four years, although previously undisclosed activity may yet enter the public domain.

China fundraising came to $5.3 billion, down from $22.8 billion in the previous quarter as commitments to renminbi-denominated vehicles dropped more than 80% to $3.5 billion. This was only slightly offset by an increase on the US dollar side. Notably, 15 local currency funds raised capital compared to 13 in the preceding three months, which underlines how much government-linked vehicles move the needle.

India was one of few bright spots in the Asian landscape, with $1.9 billion committed to new funds, compared to just $483 million in the previous three months. Behind it are two of the fastest India fundraises of recent times – further evidence of the improved sentiment around the market being channeled into demand for a select group of managers.

First, SAIF India closed its third fund raised since the team spun out from SAIF Partners at $350 million, rigidly sticking to the same size corpus as the previous two vehicles. Then Kedaara Capital completed the fundraising process for its second vehicle after just six months in the market, ending up at the hard cap of $750 million. All the existing LPs re-upped as the GP raised 66% more than for its debut fund in 2013.

With the Dow Jones Industrial Average and the NASDAQ Composite Index reaching previously unseen levels, the Hang Seng Index at a post-global financial crisis high, and Sensex breaking new ground, GPs are unsurprisingly looking for liquidity via the public markets. However, private equity-backed IPOs in the third quarter merely offered a taste of what is expected to come.

There were 93 offerings during the period and they generated proceeds of $9.3 billion – both of these represent a decrease on the previous quarter. But buried in the statistics are three US IPOs by Chinese companies, perhaps the most significant burst of activity in two years.

The market is still selective when it comes to Chinese companies. Best Inc, a logistics operator backed by Alibaba Group, came out aggressively, seeking up to $1 billion in an offering that would have facilitated partial exits for several GPs. It was ultimately cut back to $450 million and the partial exits were abandoned. This could be linked to memories of how the bullishness around the ZTO Express IPO last November quickly went flat when the stock started trading.

Zai Lab and RYB Education, on the other hand, have performed strongly. Zai Lab, a drug developer that completed its Series A round – led by Qiming Venture Partners – as recently as 2014, raised $150 million after increasing the size of its offering and pricing at the top end of the indicative range. It gained 55% on debut, and as of October 16, was trading at a 78% premium to the IPO price.

Kindergarten operator RYB is up 67%, having raised $144.3 million in its offering, through which Ascendent Capital Partners made a partial exit. The private equity firm, which invested $51.8 million in late 2015, generated a cash return of $52 million and an IRR of more than 100%. Its remaining 26% stake in RYB was worth $160 million based on the IPO price.

Qudian, a micro-lending services provider backed by BlueRun Ventures and Source Code Capital, among others, and Bain Capital-owned Rise Education will both set pricing for US IPOs this week. Peer-to-peer lending platform PPDai will follow suit later in the fourth quarter. While Chinese companies account for the bulk of Asian activity in the US, they aren’t alone in trying to tap the market. Southeast Asia-focused Sea – formerly known as Garena – is looking to raise as much as $800 million.

The largest offering of the quarter was Zhong An Insurance, which raised $1.5 billion in Hong Kong, but two of the top five were Indian companies. Au Small Finance Bank’s IPO is one of India’s most successful, coming in heavily oversubscribed and enabling the company to raise INR19.1 billion ($296 million). Warburg Pincus, the International Finance Corporation, ChrysCapital and Kedaara Capital all made partial exits. It is trading at a 68% premium to the IPO price.

Warburg Pincus secured another liquidity event, although no partial exit, with ICICI Lombard General Insurance’s INR57 billion offering in September. SIS Group Enterprises, Dixon Technologies, Matrimony.com, SBI Life Insurance and Prataap Snacks were the other PE-backed Indian companies to go public in the third quarter, while at least six more have made filings, including CMS Info Systems and Newgen.

PE exits for July-September came to $22.2 billion, the most in three years. GIC Private selling its stake of Global Logistic Properties as part of a Chinese consortium’s S$15.9 billion ($11.5 billion) buyout is the single biggest reason for this, but special mention should go to Carver Korea.

Bain Capital and Goldman Sachs paid about $380 million for a majority stake in the Korean cosmetics supplier in June 2016 and then exited to Unilever in September at a valuation of EUR2.27 billion ($2.7 billion). The IRR and money multiples have yet to be disclosed, but it appears to be one of the fastest – and among the most lucrative – large cap exits in Asian private equity.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.