PE and AI: The machinists

After decades of tantalizing but patchy progress, artificial intelligence is finally seen as ready for mass commercialization. Investors must now weigh an unmissable opportunity with a world of uncertainty

Artificial intelligence (AI) milestones have always had a dramatic, even surreal flavor, such as in 1997 when a black refrigerator-sized box named Deep Blue beat world champion Garry Kasparov in chess. Since the 1950s, these breakthroughs have fueled a number of hype cycles, but one step-change has remained elusive: economically meaningful integration into the business world.

Recent private equity activity in this space, however, has demonstrated that widely marketable applications are indeed beginning to be delivered, suggesting that the latest ramp-up of interest reflects a materially different AI landscape. Standout deals include a $13 million round for Australian business analytics start-up Hyper Anna by Sequoia Capital, IAG Ventures, Reinventure and Airtree Ventures.

Within its first eight months of operation, Hyper Anna took up big data duties for corporate clients including Australia's top two insurance companies and three of the five largest banks. This level of enthusiasm from blue-chip businesses is relatively new for AI and highlights a number of risks that result from rapid scaling in a poorly understood field.

"You have to look deeply into the adoption curve and make a call on whether a company has a chance of being worth it or not because there will be a few winners but a lot of road kill," says Daniel Petre, co-founder at Airtree. "It's a difficult space to play and requires a level of diligence that some VC firms aren't used to."

Hype and nuance

Demand for exposure in AI is often boiled down to a few key technical areas, including machine learning, natural language processing (NLP) and image or voice recognition. Crossover between these silos is typical. Hyper Anna, for example, uses NLP to take user requests and then generates unprompted feedback through machine learning. Sense Time, a Chinese start-up that received a $60 million Series C round this year, brings together a suite of object scanning and data analysis technologies.

Runaway growth among companies leveraging such combinations has piqued concerns around valuation accuracy, but specialist investors are seeing something convincing in the latest flurry of excitement. The fusion of multiple AI disciplines means that the tools now being developed are no longer seen as one-trick ponies like Deep Blue.

"There are a lot of start-ups right now that are beginning to make money, but they've not run off the valuation curve," says Manish Singhal, founding partner at AI-focused investor Pi Ventures. "We're in the early stages of the valuation cycle so it's a good time to look at the AI space. Companies are hungry for more automation and more insight."

Investors are nevertheless emphasizing the importance of diligence rigor, especially since a good AI engine can be hard to spot by the untrained eye. IDG Ventures India has backed a number of start-ups under this thesis, including banking services provider Active AI and SigTuple Technologies, a company that automates blood sample screening for disease identification.

"There's absolutely a lot of hype, but it's less about the AI start-ups themselves being overvalued and more about the companies that say they have AI when they actually don't," says Sanat Rao, a partner at IDG. "Unless you actually look at the code, it's very had to tell who has it and who doesn't."

Pi, which has also backed SigTuple, recommends investors prioritize clarifying the parameters of a company's datasets. "We look deeply at companies' data strategies because that forms the fundamental basis on which AI can work," Singhal says. "We want to find out if the core is solid in the companies we're investing in. We want to know what value their data brings and what kinds of costs it incurs."

Both Pi and IDG have recently illustrated LP appetite for this space. Pi reached a first close of $13 million on its debut vehicle with participation from the International Finance Corporation, while IDG has reportedly closed its third fund at $200 million. About 10% of this corpus will go toward the Frontier Tech Innovators Program (FTIP) and Rao expects up to three-quarters of the capital to be deployed in AI.

Open source angle

Much of IDG's deal flow will involve companies that operate via open source software services. The idea is that major players including Google and Microsoft will eventually commoditize the technology's essential algorithms and validation architecture, leaving start-ups with few options for horizontal plays but myriad opportunities to perfect strategies in specific verticals.

"We aim to make intelligent capability available as a set of APIs [application programing interface] to every developer to leverage the same building blocks into their applications that we use internally to build our own," says Darren Hubert, chief technology officer at Microsoft Asia. "We are aggressively building one of the world's most powerful AI supercomputers and making it publicly available to enable people to harness its power and tackle AI challenges, both large and small."

Hubert adds that his company's efforts to provide outside users with machine learning infrastructure include access to systems that have been tailored for use in specific business areas. This is expected to precipitate more ambitious offerings in the future, including AI-enabled pattern recognition tools known as classifiers that can be run on mobile phones in disconnected environments.

Piggybacking on the infrastructure and services of companies such as Microsoft, however, has to be done with care. Datasets provided by services like Google Maps, for example, are typically unstructured and commercially unreliable. Companies are therefore advised to curate custom datasets using both publicly and privately retrieved information, while finding the right balance between machine learning, sensory recognition and language understanding technologies.

"When you're building AI capability, you're taking various subsets of expertise and putting them together in your technology stack," explains Brijesh Pande, managing partner of Tembusu Partners' Southeast Asia-focused ICT Fund I. "If you're an open source player, you don't need to recreate everything, but the secret to making it work is knowing how to take the various disciplines within AI and then build a broader solution around it."

Tembusu put this thesis into action last month with participation in a $6 million round for Singapore's Taiger, a company that rationalizes unstructured data for government and corporate clients across a range of industries. As with Hyper Anna, this is realized through a synergy of computational semantics, NLP and an advanced strain of machine learning based on human neural frameworks known as deep learning.

The difference between machine learning and deep learning is often described through jargon such as narrow intelligence, weak AI and sentient versus non-sentient cognition. Adding to the complexity are fields such as "machine reasoning," which is considered distinct from machine learning since it follows a seemingly less linear computing approach related to conceptual associations.

The algorithms that drive these systems, also known as perceptrons, each have their own case-specific pros and cons, and are applied through a number of varyingly appropriate techniques such as clustering and random forest. The esoteric nature of this terminology befits the technical rabbit hole of AI research, and arguably represents the primary challenge for interested investors.

"There's a lot of confusion and varied opinions about what AI is, and that comes into play where companies are already on the right path with AI capabilities but they don't realize it because they feel that AI is something different," says Aditya Kaul, research director at technology market intelligence firm Tractica. "It will take a few years for people to really get educated and discover what AI means to them – it's really one of the biggest problems facing AI today, especially when it comes to the enterprise space."

As a result, conventional wisdom in the AI space has shown a preference for pursuing tightly targeted strategies with specific business goals in view. VC investors, meanwhile, are advised to keep start-ups from getting distracted by clients outside of their core area of focus. Too much diversification is expected to be the main strategic hazard as competition intensifies.

"If you are a start-up or a VC, there is a higher chance that you will succeed if you target a niche area, but at the same time, there is some opportunity around the platform space if you are very careful about what you're building and designing," Kaul adds. "It makes a lot of sense to build a platform for healthcare because there are multiple use-cases to target, but a platform that goes across everything would take a lot of resources and VCs would have a hard time understanding that."

Sectors of interest

Healthcare is roundly considered the most prospective development area for AI disruption in the foreseeable future due to a combination of marketing scope, a need to reverse entrenched operational inefficiencies, and severe labor shortages. The global shortfall of healthcare workers will reach 13 million by 2035, with Asia expected to be the hardest hit.

According to the World Health Organization, healthcare groups spent about $600 million on AI in 2014, and this figure will multiply tenfold by 2021. Only 5% of healthcare groups are not preparing an AI program. Predictive analytics are already in use, but due to a risk averse culture based on the industry's inherently high cost of failure, the more ambitious AI applications such as automatic diagnosis are expected to remain in the lab for another few years.

Other categories seeing significant activity include financial services, customer services and digital marketing. The latter of these has been the focus of Taiwan-based Appier, which has received backing from Sequoia, Temasek Holdings, UOB Venture Management, Jafco Asia, WI Harper and EDBI, a privately owned arm of Singapore's Economic Development Board.

"EDBI prefers to focus on AI's business use-cases and how it can be leveraged to better address market needs and create higher returns for their clients," says an EDBI spokesperson. "Adaptability and scalability of these companies' AI solutions to target specific customer needs in different industries are also key."

Government support for AI in Singapore also highlights development potential related to smart city technologies in Asia, especially around transportation. Earlier this year, Singapore's National Research Foundation agreed to invest about $107 million over five years in AI Singapore, a program established in part by the Smart Nation & Digital Government office.

"AI researchers in academic and research institutions in Singapore are world renowned, and we are capable of producing top-notched as well as new AI methodologies, algorithms and frameworks," says Leong Tze Yun, director of AI technology at AI Singapore. "The greatest potential will be in companies that can effectively further develop deep technologies, apply them to improve current business processes or create new business models, and deploy the applications at scale."

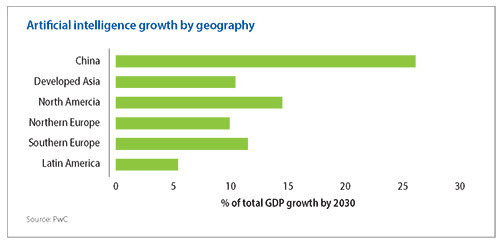

Strong momentum in Southeast Asia and India notwithstanding, China has emerged as the region's AI leader, with the government having recently earmarked about $80 billion for R&D investment in the space by 2025. According to PwC, about 26% of the country's GDP growth up to 2030 will be driven by AI implementations – almost doubling the global average.

Chinese activity in AI is expected to benefit from a number of unique overlaps, including a massive, increasingly affluent population base, robust IT infrastructure and plentiful logistical inefficiencies to iron out across several growth industries. In contrast to other large markets such as India, China also benefits from an established e-commerce market. It is said to account for some 40% of online retail globally.

However, the planned inflow of capital from Beijing has raised concerns that VC players will be susceptible to tagging along with government investments in uncompetitive companies. A relative lack of accessible public sector data makes it harder to sort the wheat from the chaff, and it could limit innovation and ecosystem creation.

More broadly, China's AI outlook is seen as a continuation of Asia's economic modernization story. Although "leapfrogging" technology integration trends are likely to reshuffle predictions about regional AI hotspots in the near term, broader forces associated with the sector appear to be setting up a cultural metamorphosis on par with the rapid proliferation of the internet in the early 2000s.

"Fifteen years ago, our experience with new technology adoption was predominantly transactional but AI is proving to be less about transactions and more about true experiences," says Pierre Legrand, Asia Pacific technology consulting leader at PwC. "Consumerization is now the thing that is driving the democratization of technology and it is fundamentally shifting the corporate approach to providing technology services to both customers and colleagues."

Corporate hesitance

Despite this enterprise angle, uptake by the business world so far has been muted, with a survey by PwC finding that 75% of CEOs have not taken action on AI. Of that group, less than one-third said they had even evaluated the technology. Deciding factors are believed to include hesitancy about job losses and unpredictable governance issues as well as a tendency to contemplate the technology itself rather than the operational objectives being addressed.

"AI is a very hot topic among CEOs but the majority don't really understand what to do with it," says James Larmer, PwC's head of data and analytics for Southeast Asia. "They either don't trust the technology or have concerns that it's going to take away some control. That's why we try to put the technical questions to the side in order to focus on the core business problems and the outcomes that AI can give."

Meanwhile, the social debate around AI has been amplified by a number of recent developments that make Deep Blue's chess victory seem quaint. In July, Facebook was forced to shut down two dialogue machines that were instructed to practice negotiation skills after they spontaneously started communicating with each other in their own secret language. This month, a facial recognition experiment at Stanford University claimed to be able to determine a person's sexual orientation with 80% accuracy – stoking Orwellian fears about systematized discrimination that, in some countries, could be a matter of life and death.

The impact of privacy and safety concerns on AI investment, however, is expected to be negligible. McKinsey & Company has estimated digital companies including Google and Baidu spent up to $30 billion on AI last year, with 90% of that going into R&D. Global private equity and venture capital investment is thought to have tripled in the three years to 2016 at $1-3 billion and $4-5 billion, respectively.

"There will be a lot of debate around ethics and the boundaries for AI experimentation, but it won't necessarily be curtailed," says Jeongmin Seong, a senior fellow at McKinsey's technology-focused MGI research unit. "Stem cells, for example, involve a lot of ethical debates, and therefore experimentation is not allowed in some countries. I think a similar feedback loop will happen in these social debates around the development and commercial applications of AI. And instead of just blind development, that will point it in different directions."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.