Portfolio: ChrysCapital and LiquidHub

Despite coming in as a minority investor, ChrysCapital has been key to the overseas expansion of US-based LiquidHub. The firm credits its active collaboration and unique connections

India's ChrysCapital has never regarded a majority stake as a requirement for a GP to play a significant guiding role for a portfolio company. To Sanjay Kukreja, a partner with the firm, ownership power exists mainly on paper: the real measure of a GP's abilities is its capacity for building relationships with company leaders.

"Our philosophy is never one of exerting control on the basis of rights, or on the basis of our ownership," he says. "Instead we believe in partnering with management teams and collaborating with partners who are very amenable to jointly working with us."

Kukreja sees US-based digital engagement services provider LiquidHub as a vindication of this philosophy. Over the more than three years of its investment, ChrysCapital has played a decisive role in the company's overall growth and in its development in India. The GP attributes LiquidHub's success in overcoming the challenges facing a US company expanding in India to the strength of its management team and to ChrysCapital's assistance with recruitment and forging industry relationships.

LiquidHub was far from a newcomer when ChrysCapital initially took an interest. Founded in 2001, the Pennsylvania-based company had quickly established itself as the preferred provider of prominent brands including Comcast, Subaru and Vanguard Group, helping its customers improve customer engagement through digital means.

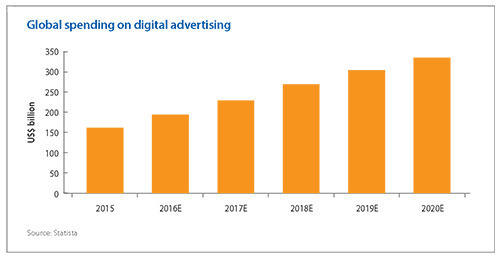

By 2015 LiquidHub had established five offices around the US and grown its annual revenue to $100 million, but with global spending on digital advertising projected to rise from $162 billion at the time to $336 billion by 2020, the company knew there was still plenty of room to grow. To move to the next level, it would need a global network of technically skilled support staff capable of providing the service to which its international customers had grown accustomed.

With its large pool of English-speaking IT talent, India was the natural spot to look for support, and LiquidHub had established a small office there several years earlier. But the recognized that a local partner was required who could adapt the business to the local market and bringing along its own contacts. This was where ChrysCapital entered the picture.

"Our proposition to them was, you've got a nice front-end, you've got people who understand consulting, business needs and technology very well," says Kukreja. "What you don't have is a whole engine back offshore in India that can leverage offshore economies of scale and help improve margins and things like that."

Experience counts

Though LiquidHub was reaching out to various potential investors at the time, ChrysCapital stood out for several reasons. The firm's India connection was an obvious recommendation, but even more important was its understanding of the digital engagement sphere, built through investments in IT companies such as Hexaware Technologies and HCL Technologies. With a track record in that space comprising 18 investments and 13 exits, ChrysCapital combined industry knowledge and capital base in a way that few other investors could match.

"Our main concern was not necessarily where they were based, it was their knowledge of helping portfolio companies scale in technology services," says Jonathan Brassington, founder and CEO of LiquidHub. "ChrysCapital had that track record along with knowledge of how the India component of scaling a global delivery model would work."

With both parties seeing clear potential for a mutually beneficial relationship, they shook hands on a deal that would see ChrysCapital lead a $53 million Series B round for the company with additional participants including PPM American Capital and Credit Suisse.

ChrysCapital took a stake of more than 40% in the deal; while short of a majority this did make it the single largest shareholder in the company and signaled the confidence with which LiquidHub's management team viewed its new investor. The GP wasted no time offering the company its guidance. ChrysCapital holds three of the seven board seats and it appointed Sudip Nandy – a managing director who formerly headed the technology, media and telecom vertical at India's Wipro Technologies – to one of them.

Nandy has been the most visible sign of ChrysCapital's presence at LiquidHub. In a typical month he spends a week to 10 days at the company's headquarters in Philadelphia, providing input on a range of matters from hiring to M&A. The GP has worked with management to emphasize the company's strength with both technology and market analytics, thereby setting itself apart from more specialized competitors like Deloitte Digital and Accenture Digital.

"That multidisciplinary capability is what differentiates this new type of digital transformation specialist against the traditional systems integration companies that are just pure software developers, or against pure marketing agency firms that lack deep technology capabilities," says Brassington. "This convergence means we've been able to build out this multidisciplinary team and delivery model and integrate it into a blended project outcome."

While ChrysCapital has played a key role in several major hiring decisions – such as chief delivery officer and head of sales – LiquidHub's growth in India has obviously benefited from the firm's experience and network in the country. The close relationship with management has allowed a degree of engagement not typically seen between the US and India offices of a software company, with the GP seeking to grant the India team equal status to the US branch.

"Nobody wants to work in an outpost," Kukreja observes. "You need to create an environment where it is run as a dual-shore company, because otherwise you're not able to attract the best talent in either situation. And maintaining that balance is not easy."

ChrysCapital's argument received early validation when the Philadelphia team – at the prompting of Sandip Gupta, a former deputy CFO of HCL brought in by ChrysCapital as a consultant – agreed to move the shared services functions to India. Along with cutting costs, this move signaled that the India team played a unique and indispensable role within the company beyond supporting US operations. The confidence created has been crucial in expanding LiquidHub's offshore headcount from 600 at the time of ChrysCapital's investment to 2,000 today.

Another early priority was streamlining LiquidHub's internal operations. Soon after its investment, ChrysCapital initiated a deep-dive analysis to identify drags on the company's profit margin and formulate the appropriate response. Following the analysis LiquidHub implemented the suggested measures, intended to reduce the lead-time for new hires, improve the pricing procedures and optimize margins for low-earning business lines.

Revenue enhancement

However, as important as internal cost-cutting is, ChrysCapital sees its most significant contribution as helping to grow LiquidHub's revenue. The GP has done this through a variety of means, including networking with its current and former portfolio companies for business opportunities: for example, the firm paired LiquidHub with another of its investees to handle a project for a large international customer which neither company could handle on its own.

Finding partners with complementary skill sets is only a temporary solution, however: more important to both ChrysCapital and LiquidHub is adding the required skills to the company directly. Management has sought to develop some talents internally, but typically expects to handle major skill expansions through M&A.

These inorganic growth opportunities have proved an essential part of boosting revenue. The firm has led three major acquisitions since its investment, with two targets based in the US and one in India, playing various roles in the process.

In the case of the US companies – digital design firm Foundry9 and customer relationship management portal developer Red Kite – LiquidHub sourced the opportunities, with ChrysCapital identifying boutique investment banks to finance the transactions and helping negotiate the deals, handle due diligence and structure the acquisitions. For the Indian company, analytics firm Annik, the GP was even more hands-on, sourcing the company itself and handling every aspect of the deal process.

"It was a relationship they'd had as a part of their pipeline development, but they thought it would be a good fit within LiquidHub," Brassington says. "So they touted it and led the whole process, through deal structuring, due diligence, and then close."

All three acquisitions were funded through internal accruals and leverage, with no need for further equity dilution. ChrysCapital's Nandy continued to play a major role following the end of the purchase process, helping to formulate the 100-day plan for each company and identify growth opportunities for the combined business.

"Sudip was essentially the go-to guy for managing the integrations, while the management was essentially let loose to focus on organic growth and build that out," Kukreja explains. "We had one person from Annik, for example, who was responsible for integration, and one person from LiquidHub, but he coordinated the overall integration process."

While ChrysCapital believes these deals have put LiquidHub in a strong position for further growth, the firm continues to look for additional M&A opportunities. Future acquisitions will likely follow a similar rationale to the three so far, with the company looking to buy companies that add to its existing skills rather than pursuing growth. The GP is likely to continue playing a key role in identifying targets and executing buyouts.

Growth trajectory

LiquidHub's revenue has more than doubled over the last three years from $100 million to $250 million, while EBITDA is expected to end this year at $30 million, up from $10 million in 2015. Kukreja attributes this growth to the heavy lifting by his firm and management. The team-building initiatives spearheaded by ChrysCapital have helped strengthen the company at all levels, and the division of labor worked out at the start of the investment has let each party play to its strengths, with Brassington and the other senior management focused on broader strategy and the GP helping to put their ideas into practice.

As demand for digital customer engagement continues to grow, the company expects to maintain its ambitious expansion targets during the foreseeable future. Key to its plans are the new skill sets to be gained by further inorganic growth, additional strengthening of its management team, and forging industry connections that can bring future collaboration opportunities. ChrysCapital is well positioned to continue providing all three.

"We certainly believe that we have a chance to build a billion-dollar business over the next seven to 10 years," Brassington says. "Where we see firms like ChrysCapital specifically as one of our institutional partners, is to help us in terms of our growth strategy, provide additional capital as we look to complement organic growth with acquisitions, and help us bring talent in."

For its part, ChrysCapital is focused on ensuring that LiquidHub can continue building out its services and establish a formidable footprint in the global IT services market, which will help with an eventual exit to a strategic player or another financial investor. In either case the firm hopes future investors will take note of its success and see its carefully cultivated alignment with management as a model to be emulated.

"We were very much aligned toward the strategic end road, in terms of where they were taking the business, how we want to build this digital transformation business and what direction it needs to take," says Kukreja. "Building that chemistry and that understanding and finding the right management team and partnership is an approach that we've always had. Once you're aligned to that objective then it's bound to work."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.