Korea securities firms: Brokerage bonanza

Korean securities firms are building PE teams with a view to raising capital from third-party investors. There is government support for these efforts, but independent GPs aren’t worried about increased competition

Kiwoom Securities was established by Daou Kiwoom Group in 1999 as Korea's only online brokerage. The firm is now using the profits from its stock trading business to expand into private equity. A captive PE team has been hired and Kiwoom is looking to raise $100 million for its debut fund. Commitments have already been received from government-backed fund-of-funds and local financial institutions.

In addition, Daou Kiwoom set up an independent PE affiliate – Kiwoom Private Equity (Kiwoom PE) – earlier this year, in which Kiwoom Securities holds a 40% interest. With initial capital of about KRW50 billion ($44 million) provided by Kiwoom Securities and other companies in the group, Kiwoom PE recently sealed its first deal, buying a majority stake in Dongbu Express Bus.

"We focus on buyouts, typically in the middle-market space. In the first two years, we will raise money through project funds, and a blind fund will follow," says Sung Yong Yoon, Kiwoom PE's CEO and previously an executive at Kiwoom Investment, a VC arm under Daou Kiwoom. "Korean securities firms are doing more PE investments. One driver is that the government is deregulating the capital markets, allowing securities firms to operate different business lines in order to boost profitability."

Numerous large brokerages have responded to the regulatory changes similarly to Daou Kiwoom – hiring external PE professionals, putting more capital into existing PE teams, or setting up divisions to raise third-party capital. However, they should think carefully about which segments of the asset class they target so as to avoid coming up against large independent GPs.

Bullish sentiment

Korean securities firms started entering the private equity space in 2010, primarily through balance sheet investments executed by captive teams. Few were successful, with sub-par performance ascribed to poor organizational structure and a lack of experienced PE investment professionals.

Senior management at brokerage firms tended to focus on short-term gains, and they are said to have struggled to adopt the longer investment horizons that define traditional private equity. This led to team instability as staff did not feel incentivized to stick around. Some firms ended up shuttering their PE divisions, while others restructured internal teams.

For example, NH Investment & Securities (NH I&S) took over the Woori Investment & Securities PE portfolio – including fund commitments and direct investments – in 2014 after NH Financial Holdings acquired Woori. Last year, NH I&S absorbed the private equity team at NH Financial's banking subsidiary, Nonghyup Bank. It then hired Yong-Sig Yang, ex-head of investment strategy at the National Pension Service, to lead the PE business, which by then had more than KRW1 trillion in total assets.

"They have built a Chinese wall between the stock trading and private equity divisions. The PE team is properly incentivized and they have established a good track record," one industry participant observes.

Other securities firms are also exploring different strategies that give PE teams a high degree of autonomy. Daishin Private Equity was established in 2014 as a wholly-owned subsidiary of Daishin Securities, but it operates independently from the parent company in identifying and executing investments.

"We could cooperate with the private equity divisions of competing securities firms or participate in a blind pool or project fund as a member of a consortium alongside other PE firms. In certain cases, we can also work with Daishin Securities. But we are free from it in our investment decisions," an executive at Daishin Private Equity says.

The regulatory reforms that are in part driving these team-building initiatives cover several areas. First, the Financial Services Commission (FSC) has simplified its oversight. There were previously three types of private fund – hedge funds, general private equity funds, and financial stabilization PE funds such as distressed funds – and each category was subject to a different set of rules. This classification system has been abolished and only two types of fund – private equity funds and hedge funds – remain.

Second, it has become easier to form private investment vehicles to be raised from third-party investors. Traditionally, securities firms had great difficulty launching hedge funds due to the FSC's stringent approvals process. This has been replaced by a registration regime. Securities firms favor the change as hedge fund investments are more aligned with their trading business – short-term focused with little attention devoted to post-investment value creation.

There has been a rush to apply for the relevant business license. NH I&S was the first to obtain a license from FSC to operate private equity and hedge fund strategies under a single alternative investment unit. A handful of other players, including Samsung Securities and Shinhan Investment, are expected to follow suit.

Third, the government is committing capital to private equity funds launched by securities firms. For example, the captive PE team at Kiwoom Securities received about $20 million from the Korea Growth Ladder Fund, a vehicle that makes investments in accordance with themes that the government sees as strategically important. There is also more deal flow, particularly from divestments by Korean chaebols that are under pressure to pare back their operations and focus on core business segments.

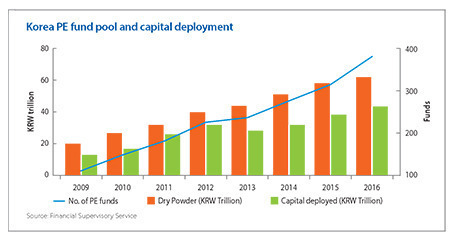

"The private equity industry is growing and many Korean LPs are increasing their allocations to the space. This is appealing to large players as they think private equity could help generate stable management fees for the wider group, especially when they are able to raise capital from pension funds," says Yi-Dong Kim, a partner at KPMG Korea. "Therefore, private equity is considered as a growth engine for securities firms as their trading businesses have been slowed."

Getting specific

NH I&S has said it will prioritize private equity investment as part of its core business. Earlier this year, local media reported that the firm intended to source an additional KRW500 billion from its sister subsidiaries to strengthen the internal PE operation. Once the unit has built up a significant track record, the brokerage is expected to consider spinning out the unit.

A source familiar with the situation tells AVCJ that although NH I&S is looking to become more active as a GP, it is largely focusing on co-investment opportunities alongside with independent private equity firms. Samsung Securities is taking a similar approach. Since early 2000, the firm has made LP commitments to Korea-focused funds launched by the likes of IMM Private Equity and VIG Partners, as well as regional vehicles raised by MBK Partners and KKR.

Samsung Securities has yet to build a dedicated private equity division to address direct investment opportunities, but it is planning to do so. The remit for the PE division is "to be a partner of independent GPs, rather than a competitor to them," according to an executive at Samsung Securities. For example, it would look to join in a private equity consortium led by MBK for a particular investment, but it would not participate on its own in auctions.

"These days, the focus for most securities firms is how to be a smart LP, or how to be a selective asset manager with a specific focus on private markets – such as growth capital, pre-IPO funds, mezzanine funds, or co-investments funds," says Jason Shin, a managing partner at VIG Partners.

Indeed, Kiwoom Securities' captive PE team is concentrating on investments in existing corporate clients on the brokerage side that want to raise capital to consolidate their industry positions, while the private equity unit at SK Securities is primarily interested in secondaries and mezzanine strategies. In this sense, Kiwoom PE's strategy is unusual compared to that of its industry peers because could result in the firm competing for assets against independent GPs. Industry participants believe this approach is less likely to become mainstream.

"I don't think the PE business will reach a critical mass within a securities firm because the industry dynamic doesn't allow that," adds VIG's Shin. "What Korean securities firms are doing right now probably is a good compromise. They run a PE arm as a GP, but they also realize that the PE team should have a very specific focus and keep it to a certain size. It is not necessary for these teams to compete for deals with other large independent GPs."

At the same time, PE is expected to be limited to the bigger brokerages. Korea's securities industry is set for a period of consolidation, with smaller firms merging of being acquired by larger competitors. Under the current rules, if a securities firm's total assets amount to less than KRW3 billion, diversification is restricted to areas such as lending. Private equity is not necessarily a priority or even a realistic objective.

"In my view, mid- to small-sized firms are now more focused on core business restructuring in order to survive, rather than spending time on non-core PE activities," says KPMG's Kim.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.