Korean middle market: Up the ladder

Interest from foreign LPs in Korea’s middle-market is rising, but the segment is still dominated by domestic institutional investors. Changes to this dynamic are unlikely to arrive soon

The Rohatyn Group (TRG) may have opened its first South Korea office last September, but the firm was far from a newcomer. Its exposure to the country's middle market included fast food franchise BHC, acquired through its subsidiary Citi Venture Capital International (CVCI) in 2013 and later expanded through the purchase of several more domestic restaurant chains.

TRG could have continued to grow the business and pursue other targets through its pan-Asia fund, but it believed Korea presented a unique opportunity to make its investments in the market self-sustaining. The GP's strategy involved taking a page from the playbook of local GPs by raising dedicated project funds from the country's active domestic institutional investor base.

"The LP market here is not only large, but also it is very experienced with the private equity asset class," says Gordon Cho, head of Korea for TRG. "So there is enough of a capital supply in Korea to feed these mid-market deals without having to go outside."

While the country's robust domestic LP community means GPs can draw on deep wells of support, many industry participants also describe it as a limiting factor to their growth. The presence of institutions with such deep pockets, so close by, means that firms inevitably mold their fundraising and investment strategies around the preferences of these backers. This leads to an insular market with mostly small fund sizes, and domestic GPs and foreign LPs largely disengaged from one another.

This is not to say Korea's middle market is unhealthy: observers describe a market teeming with investment opportunities. But with the dominance of local LPs likely to continue for the foreseeable future, foreign institutional capital will find it difficult to participate outside of a few select GPs.

Behind the numbers

Although industry participants differ as to what constitutes the middle market space in Korea, the generally accepted definition involves companies with an enterprise valuation of $100-500 million. Within this space a few domestic GPs, such as IMM Private Equity, VIG Partners (formerly Vogo Investment), Hahn & Co, and Anchor Equity Partners tend to attract the most attention, with most of the well-known deals in the country's PE industry being done by one among just a handful of firms.

However, appearances can be deceiving, and in the case of Korea investors say looking beyond the seemingly placid surface can reveal considerably more dynamic depths. "In terms of the number of deals getting done, Korea's M&A landscape is dominated by these transactions that are below $500 million in valuation. A lot of these deals are privately sourced and not widely publicized, so outside observers often don't notice them," says the head of Korea for one international LP.

The relatively low visibility of the middle market deal flow leads observers to underrate Korea's middle market fundraising space as well, since many privately sourced transactions are funded on a deal-by-deal basis by vehicles set up to hold a single asset. With deals underreported in the international press, these vehicles tend to go unnoticed as well.

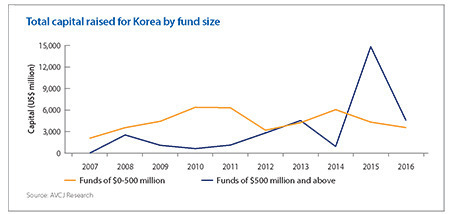

Those who discount these vehicles are leaving out an important part of the market: according to AVCJ Research, over the last 10 years funds below $500 million have accounted for nearly $44 billion in capital raised, over a third more than the total for funds valued above $500 million.

Moreover, in most vintages the sub-$500 million funds far outstripped the larger vehicles. The most prominent exception was four 2015-vintage funds above $500 million, which accounted for $14.8 billion in assets under management. However, one of these vehicles, the Korea Infrastructure Investment Platform, represents the vast majority of this figure with $12.7 billion.

One reason that smaller managers and project funds go under the radar is that they usually seek funding exclusively from domestic LPs such as the National Pension Service (NPS) – which according to AVCJ Research has made over 44 LP commitments to PE funds since 2003. Industry observers say the degree of support from such public institutions goes far beyond what is typically seen in the region and eliminates the need for PE firms to seek funding from outside the country.

"It's a market that's actually very well funded and well taken care of by the local players, and that's why it may seem to be a bit thinner than expected looking from the outside, but it's really not," says Hae-Joon Joseph Lee, a partner at IMM Private Equity. "It's a deep market and there are a lot of players in this space, they just don't have the recognition of international LPs yet."

While this arrangement largely works out to the benefit of local institutions and funds, some observers note that it does have its downsides as well. For instance, the dominance of Korea institutional LPs in the market is widely believed to depress fund sizes overall, since the institutions prefer to invest in vehicles with shorter tenures and in project funds that can help them keep better track of their capital.

In addition, foreign LPs are left out of the market to a greater degree than in other parts of Asia. Outside investors are not totally excluded from Korea – LPs can access the country's larger-cap market through global buyout funds such as KKR. But competition is high for the few domestic middle-market managers that can accept commitments from foreign investors.

"Compared to the US market, you have much fewer general partners that you can work with. The industry is still relatively in its early days, and those few GPs in the mid-market have regular domestic investors and fund structures," says Mounir Guen, CEO of placement firm MVision. "That leaves virtually no space for non-Korean investors to be able to invest capital there."

The foreign legion

This dynamic is most visible among relatively mature managers that have begun to expand their LP base beyond Korean investors. For example, in VIG Partners' most recent fund foreign LPs, including banks, family offices, fund-of-funds and pension funds, account for around a third of the $600 million total. NPS contributed $215 million, while other domestic institutional LPs committed the remainder.

The participation by foreign investors represented a vindication for VIG, which had attracted only a couple of institutional investors for its $350 million previous fund. In that vehicle, too, NPS accounted for about a third of the corpus. Raising a significant amount of capital from foreign investors signaled not only that the firm had graduated to a new level of investment success but that it had put in place the structures needed to manage investments from a wider array of sources.

"For a GP to be able to receive institutional money from outside of Korea, you need to exhibit a consistent strategy and record of creating value, and a lot of institutionalization," says Lee of IMM, which saw foreign participation account for 17% of commitments to its KRW1.25 trillion ($1.15 billion) third fund – a substantial increase from the previous vehicle.

This institutionalization, meaning the effort needed to broaden the fund structure to account for foreign LPs, represents another hurdle that many middle market managers may be unable or unwilling to climb. Behind the larger funds' successful outreach to non-Korean investors are organizations considerably more complicated than anything a strictly domestic fund has to deal with.

"Because they were able to create the access, they found themselves in quite a popular position," says MVision's Guen, who advised on VIG's most recent fundraise. "But it's a lot of work, because they need to have different structures running in parallel: they have to have everything in both languages, English and Korean; their reporting has to satisfy everybody, from the local regulator to all the different guidelines from where the investors come from."

So far few managers have managed to maintain this kind of double-tracked organization, and some observers suspect the current state of the market may persist for some time. Not all GPs have the appetite for investing in the internal structure necessary to attract non-Korean LPs, and the high levels of support from the country's public institutions mean that a manager can raise a fund of considerable size without going to investors based outside the country.

Under this logic, a GP's time and money would be better spent finding new investments with a moderately-sized fund than implementing a new internal structure, then searching for foreign investors to meet a much larger target and possibly falling short.

Not all market participants agree with this assessment, however: a Korea manager at one international LP notes that many Asian markets have been through this stage, and that with more than 100 PE investors estimated to be active in South Korea, chances are good that several will take the plunge and commit to the necessary improvements, broadening the opportunity for foreign investors. Korean institutions' prominence also need not represent a threat to the growth of the middle market, since while all managers will benefit from their support, talented managers will naturally benefit more.

In the end, Korean GPs may have no choice but to embrace foreign investors, as opportunities in the middle market continue to grow. A $300 million fund might be adequate today, but with valuations expected to continue rising, managers may find themselves priced out of the middle market quickly.

Growing opportunities

Market observers see divestments by chaebols and succession planning as the two main sources for middle market acquisitions in the future. However, succession deals are expected to account for the lion's share of deal flow as company founders become more comfortable selling to private equity. Chaebol transactions are seen as a source that is constant, but not dependable.

"Chaebol spin-offs will always be there, because they're constantly having to shed assets in order to be competitive in the global markets. However, the pace varies. Unless they need cash or they're being pressured by the government, chaebols are still not aggressive sellers of their assets," says TRG's Cho. "In addition, most of the time, these are very high-profile and competitive, and we prefer to deal on a bilateral basis."

In addition to buyouts, GPs see minority growth deals as an overlooked opportunity. Lee says growth capital investments in mid-market companies continue to be a significant part of the deal flow for IMM and other managers, though one whose potential is overlooked by LPs.

"You have a lot of good midcap founders who still have fire in their belly, and probably to some extent are more natural runners of the business than new managers you may be able to bring in," says Lee. "International LPs still have a very buyout-oriented view of Korea and private equity in general, but I think if they get to see more and more good-quality growth capital returns, then they may want to get exposure to that strategy as well."

But despite prospects for the middle market, managers don't expect change to arrive quickly. Domestic GPs will need time and effort to upgrade their internal structures, and even the most eager LPs have to satisfy their own standards before they make commitments.

"Our ideal scenario would be about half domestic, half foreign. We obviously plan on holding on to our existing Korean LPs, but we do still want to expand our international LP pool," says Jason Shin, a managing partner at VIG Partners. "But I feel that over the next 10 years only a few of us will be able to achieve that, because international LPs can be very exacting in choosing their GPs."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.