Portfolio: The Rohatyn Group and BHC

The Rohatyn Group bought Korean fried chicken franchise BHC in 2013 with a view to ironing out inefficiencies, broadening brand appeal, and pursuing bolt-on acquisitions. It has made progress in each area

Fried chicken is as much a staple of Korea's quick service restaurant (QSR) industry as kimchi is to traditional cuisine. The problem for BHC was that young people weren't eating it. "The older generations loved fried chicken but we found through our surveys that young people had different tastes. The perception was that fried chicken in unhealthy," says Hyun Jong Park, CEO of BHC.

One of the priorities for The Rohatyn Group (TRG) on acquiring the business in 2013 was reinvigorating this youth following. The subsequent evolution of BHC has tapped into a broader emergence of the gastropub phenomenon in Korea: a range of chicken dishes are now available – popular choices include recipes featuring cheese toppings, spices and garlic as well as the traditional offering – at restaurants designed to appeal to after-work drinkers and diners. A segment dominated by mom-and-pop establishments is now increasingly characterized by mood lighting and craft beers.

"The gastropub concept was there but it wasn't any different to the normal outlets. We changed it totally. The layout and design is very important – to give people the idea that it's there for drinking – and so we changed the lighting, displays, table arrangement, everything," says Park. He adds that where once menus were revised every two years and based on gut instinct, now they are launched in six-month cycles following detailed market analysis and customer feedback.

In 2013, BHC had 730 restaurants, of which 30% were ‘beer zone' establishments, although without the differentiation that Park's team introduced. Now the chain has approximately 1,400 outlets and just under half fall into the ‘beer zone' category. Where BHC has innovated, others have followed. Each one of the company's four main rivals has started changing up its menus and to varying degrees embraced the gastropub concept.

Logical appeal

The initial investment in BHC was made by Citi Venture Capital International (CVCI), a few months before the bank announced it would divest its private equity business to TRG for regulatory reasons. "Consumer has always been a focus for us. We like the QSR industry due to the strong and steady cash flow, and then chicken is a large and stable segment of QSR," says Gordon Cho, head of Korea at TRG. "BHC was one of those companies with great hardware – its own food factory, logistics network, and so on – but poor software. We felt we could take it to the next level."

In line with the increasing appetite for white meat globally, chicken consumption in Korea grew at a compound annual rate of 6.6% between 2008 and 2011, compared to 3.5% for beef and -7.8% for pork. There appeared to be room for further growth, given that the country's annual per capital chicken consumption of 11 kilograms trailed the likes of Hong Kong (36 kg) and Taiwan (27 kg).

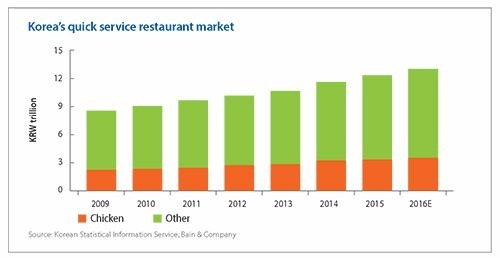

Dining out was also expected to benefit from an increase in the percentage of economically active women in Korea as well as the rising number of single-person households. The market was projected to be worth KRW79.7 trillion in 2016, a 36% increase on 2009. Over the same period, QSR spending rose from KRW8.6 trillion to KRW13.1 trillion, while chicken alone – the largest sub-segment – went from KRW2.2 trillion to KRW3.5 trillion.

Furthermore, TRG hoped to capitalize on a clear move towards consolidation in the QSR space as institutionalized players squeezed out mom-and-pop operators through a more sophisticated approach to menu development, marketing and branding, procurement, and franchisee management. Buy-and-build was very much part of the investment thesis.

This transition was already apparent in the chicken QSR segment and is has since become more pronounced. Between 2012 and 2015, per store revenue among small to mid-size companies posted a 2.8% decline in compound annual growth versus an increase of 19.4% for the top five players. By 2015, the big five – BHC, Kyochon, BBQ, Goobne, and Nene – represented 54% of the total chicken QSR market. When TRG acquired BHC, the company had yet to join this select group, ranking sixth and 12th by revenue and brand awareness, respectively.

While three of the big five were founder-owned and led, BHC and BBQ were both part of Genesis Group, which holds several Korean restaurant brands. The parent bought BHC out of restructuring in the early 2000s, but a decade later it was struggling financially, with a debt-to-equity ratio of more than 500%. When an IPO attempt failed, TRG came in with a buyout offer and ended up paying $100 million for the business.

By this point, Park had already been working for BBQ, Genesis' main chicken brand, for about a year. His route to the company was an unusual one, following a 25-year career with Samsung that included stints with the electronics division in R&D, human resources, and sales and marketing, and with the amusement park subsidiary in general management. Park was in charge of BBQ's global division when TRG hired him to run the newly independent BHC, recognizing the value in his marketing experience and execution abilities.

Heading up a strengthened senior management team, Park's initial efforts focused on addressing inefficiencies. "The first thing they did was to introduce forensic accounting and identify cost reductions," says Cho. "This included replacing of contracts because there was a lot of leakage and unattractive pricing, and replacing the archaic IT systems."

For example, different parts of BHC's business operated under standalone systems. Collating the accounts for a single month required an entire month of manual labor. Once the IT systems were consolidated, the process was reduced to three days. In addition to facilitating communication between departments, the systems enabled real-time monitoring of franchisees. It was also easier to set key performance indicators for each employee that incentivized them to meet certain targets.

On the procurement side, BHC signed long-term contracts with its major chicken suppliers on the condition that they invest in automated production machinery. And then, with a view to improving the company's bargaining power with counterparties across its supply chains, agreements were signed with multiple vendors.

Building trust

The changes made to menu development and the general positioning of the brand were essential to winning over franchisees. The clear majority of BHC franchisees are single-store operators, and reestablishing trust with these individuals – the company was previously losing franchisees because the menus weren't drawing in enough business – was one of Park's biggest challenges.

"They had no trust in headquarters, we had to build it from scratch," he explains. "Once we had done that by helping to improve their revenue and profitability, we started looking at in-store operations. A major part of this was simplifying the approach. For example, if there are 10 steps to selling one piece of chicken, we transferred seven to our suppliers. And in addition to the new store formats, we provided regular service training and did store visits."

BHC also introduced tighter franchise management across the business, from centralizing the production of key ingredients by establishing a food factory that allowed cost savings and standardized quality to creating a feedback channel between headquarters and the franchisees. Park notes that it became much easier to recruit new franchisees once these reforms were instituted. Indeed, the near doubling in the number of BHC restaurants is entirely down to organic growth.

The brand is now the second-largest by revenue and store numbers after Kyochon, with a 13% market share of the chicken QSR market in terms of sales. It ranks number four for brand awareness and number one in terms of profitability. EBITDA was around $12 million when TRC bought the business and it has since increased more than fivefold, while average revenue per store has doubled. Cho claims that BHC is the only one of the big five to deliver substantial store network growth in the past four years.

"It's a 10-stage process and we are now at stage seven," he says. "We have stabilized everything and added to store growth. Under the normal food and beverage model, first you look at the number of stores and then you try to increase revenue on a store-by-store basis. There is more upside in that area. The IT system was so important to us from day one because it means we can do more strategizing with the menus, ensuring we have the right target market, the right products, and minimal cannibalization."

Additional growth initiatives under consideration include providing ready meals through the existing franchise network and by supplying third parties, as well as overseas expansion. BHC has been approached by several prospective joint venture partners in foreign countries, with China the most likely initial target. TRG is exploring various options but remains cautious in its approach, conscious that able local management and a strong balance sheet are essential to overcoming the challenges that often emerge when going overseas.

For now, the priority remains domestic growth, and not only through BHC. The buy-and-build strategy has taken TRG into other QSR segments, where the firm can leverage its industry knowledge as well as the existing BHC infrastructure from procurement to logistics to franchisee management. Of the 15 food and beverage acquisitions completed in Korea over the past four years, TRG has accounted for five, including BHC. Its overall investment in the industry stands at $200 million.

There are around 2,100 restaurants under the BHC umbrella group. The first addition was Changgo 43, a Korean beef restaurant chain, in 2014. Seen as a business diversification opportunity for BHC, the company has 12 directly-owned outlets in Seoul. It was followed by Bullso, Korea's second-largest barbeque beef franchise operation with 110 stores, in 2015. Last year, TRG acquired two more subscale franchise brands to plug into the BHC infrastructure: beef restaurant chain Gram Gram and sausage soup business Keun Mom, which have 270 and 320 stores, respectively.

In addition to delivering platform synergies, these acquisitions open up more opportunities for the company's existing franchisees. "You have two levels of customers, your franchisees as well as your diners," explains Cho. "If a franchisee has done well with a fried chicken restaurant and wants to invest in something bigger, we can say, ‘We've got this great beef restaurant chain and the capex is around $100,000. You should look at it.' We have a full array of options in terms of offering franchisees different formats and food types."

Familiar territory

The objective is to build a diversified QSR operation that is large enough to appeal to a strategic buyer or the public markets. While SPC Group is arguably the leading exponent of this approach with predominantly Western cuisine – with Paris Croissant, Dunkin' Donuts and Baskin-Robbins – TRG sees more potential in local fare. Korea's dining out market is said to be worth KRW80 trillion a year and more than 60% of that is QSR. Traditional Korean food is the largest sub-segment of QSR and it is also the least penetrated by large-scale franchise operations.

However, in addition to leveraging the flight to size and quality within the industry, TRG's investment in BHC and those related food businesses represents a private equity firm sticking to what it knows. Cho sees that ability to dig deep as a key differentiating factor in a competitive domestic private equity market.

"QSR is not rocket science, it requires common sense and execution. But you would be surprised by how archaic the systems are in a lot of these companies, even the ones owned by chaebols. And when they bring in new systems they are often not local enough," he says. "You need to be very hands on and intensive on the detail, having constant conversations with management. If customer service is poor or you get bad feedback from franchisees or the menus must be changed, you need to act quickly. It's not about one piece of the puzzle, you have to concentrate on all of them."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.