Data centers: The information edge

Asia’s booming online economies have created unprecedented demand for data center services, but private equity investors still must determine the best way to approach the industry

When Epsilon Venture Partners looked at India's data center industry, it saw plenty of raw potential – but no way to take advantage of it. Despite watching the space for years, the firm had been disappointed in the local operators, who lacked the courage or the vision to take the leaps needed to gain parity with offshore providers like Amazon Web Services (AWS) and Microsoft Azure.

That changed late last year when Epsilon founder Sudheer Kuppam met Kalyan Muppaneni, founder and CEO of Pi Datacenters. Muppaneni impressed Kuppam and the firm with his knowledge of the data center business, gained through 15 years at Intel. It was the first data center Epsilon had seen that seemed capable of capturing a piece of India's booming digital economy from the foreign players.

"It was very clear that here we had a visionary," recalls Kuppam. "He had seen how things got built in the US, and now he wanted to set things in motion to provision the upcoming digital explosion in countries like India."

December's INR1.5 billion Series A round for Pi, led by Epsilon and joined by an unnamed Australian investor, marked the firm's entry into the data center space. But visionaries are hard to come by, and Muppaneni remains the exception to the rule. Despite Kuppam's enthusiasm for Pi, he expects the industry will continue to be a challenge in the foreseeable future.

Epsilon's reluctance mirrors the frustration of other investors toward investments in Asia-based data centers. Despite a clear opportunity in the region's growing army of internet developers, the overall inexperience of industry players coupled with pressure from foreign technology giants mean the possibility of achieving a suitable exit remains risky. While a number of investors are experimenting with investment strategies, devising a suitable approach will take some time.

Strong fundamentals

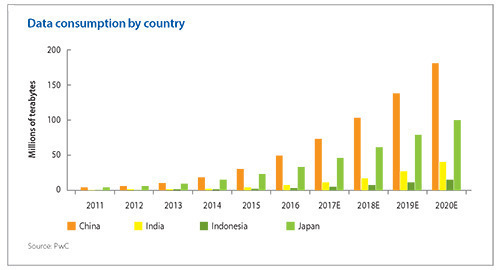

On the surface, investing in Asia's data centers would appear to be an easy sell. The growth in online media consumption and e-commerce across the region has caused an explosion in demand for digital data. A report earlier this year from PwC showed data consumption in Japan alone grew from four terabytes in 2011 to 33 last year, while China's consumption grew even more, from four to 49.

This kind of expansion is expected to continue over the next four years, with China consuming 181 TB in 2020 and Japan consuming 100 TB. India and Indonesia have grown more slowly, from zero TB in 2011 to seven and three last year, respectively. However, these economies too are expected to account for a collective 55 TB of consumption in 2020.

The consumer economy is only one factor in this projected growth: other drivers include businesses, which are expected to make greater use of data analytics to identify consumer behavior preferences and trends; and government programs such as Singapore's smart nation initiative and India's Aadhar and GST reforms, both of which rely on the internet to deliver their promised efficiency and service levels.

Given all of these considerations, the Asia Pacific data center market strikes many PE players as an enticing source of investments. Local data centers offer undeniable benefits in latency – the time it takes a signal to reach its destination and the response to come back – to homegrown internet businesses, such as those backed by Epsilon's Kuppam in his former position at Intel Capital. Most of those start-ups used AWS for their hosting needs, which created considerable inconvenience for customers.

"If the signal has to go to Singapore and come back, it's about 120 milliseconds, and if it has to go to Ireland or the US, the latency can be as bad as 200 to 400 milliseconds. But the average Indian consumer was living with that," Kuppam says. "But if you're in the same country, the typical latency that you can guarantee is 30 milliseconds."

Asia Pacific's data center industry lags behind that of Europe in size, with the former worth around $12 billion last year and the latter reaching $19 billion. The gap is even greater between Asia Pacific and North America, which was worth nearly $34 billion in 2016. It is expected to close this gap quickly, with a projected compound annual growth rate over the next five years more than double that of the other two markets.

While the numbers paint an encouraging picture, few investors have sought to gain exposure to the nascent data center ecosystem in Asia's developing markets. GPs that have invested are taking it slow for the moment, trying to find investees whose knowledge and vision match the resources that a private equity backer can bring.

"The challenge that I saw in South Asia and other emerging markets over the years was not about capital. There's a huge gulf in talent and leadership in these markets," says Rangu Salgame, a former head of the growth ventures and service providers group at India's Tata Communications and currently chairman and CEO of New York-based technology, media and telecom platform Princeton Growth Ventures. "Getting real estate and putting up a building is a relatively well-understood part of the industry. What's really important is understanding the evolving trends in the consumption of data."

Platform plays

Princeton represents one of the strongest PE bets in Asia's data center space, having received a $300 million investment in June from Warburg Pincus. The platform is intended to acquire either stand-alone businesses or corporate units in the data center and digital media services space in India, China, Southeast Asia, the Middle East and Latin America. There is a particular focus on underperforming and underinvested assets that can be improved by Warburg Pincus' capital and Princeton's operational expertise.

Warburg Pincus is intent on gaining a foothold in data centers, where it sees a relative lack of competition from other investors and considerable opportunities for established operators due to high barriers to entry. The partnership with Princeton follows the establishment of a similar platform with US-listed Chinese internet services provider 21Vianet last December. That platform, which focuses solely on China, was seeded with four of 21Vianet's existing assets and will develop new data center projects in addition to acquiring existing properties.

"The hard infrastructure sector in the US has established companies already that have access to REITs [real estate investment trusts] and public vehicles to raise capital, so there we've invested more in the applications layer," says Ellen Ng, a managing director with Warburg Pincus in Hong Kong. "When we turn to China, India, Latin America and elsewhere, opportunities in the underlying infrastructure facilities are still available."

The platform approach, which allows a PE firm to group complementary assets together into a single unit, may be the safest bet for those that can afford it. Investors choosing to forgo this strategy must be picky about the assets they pursue, and remain mindful about the peculiarities of the markets in which they operating. In India, for example, many existing data centers are not only small – no more than 1,000 racks – but are located within major cities. This makes it difficult for them to expand, and can also be an issue with obtaining adequate power and water for cooling.

Equipment is another issue with existing facilities, as the pace of technological progress means servers must be upgraded and replaced regularly. Data centers that attempt to economize by continuing to run legacy technology can quickly find themselves outclassed by operators with up-to-date equipment.

Smaller data centers can still be attractive investment targets if they are well-maintained. But in order to hold their own in the market they must position their appeal around technology by emphasizing the services they offer to their clients.

"The best assets that a PE investor could back are those that have a very high proportion of revenues coming from value-added services such as video surveillance, remote management, network integration, enterprise connectivity, and disaster management services," says Nitish Poddar, an India-based partner at KPMG. "The smaller players can thus compete with the larger players and justify their high real estate costs."

This approach can also pay off in developed markets, where data center operators that address a niche customer base rather than the general corporate market may benefit from private equity backing to help them meet their targets.

Australia's Quadrant Private Equity, for instance, made its first data center investment in 2014, buying a minority stake in Canberra Data Centres (CDC), which exclusively served Australia's federal government. The GP had avoided involvement in the mainstream data center space due to its lack of experience in this area. However, CDC provided an opportunity to get involved with a proven player with a stable client, help it grow through capital infusions for physical expansion and technology upgrades, and learn about the business from a position of safety.

"One of the biggest customers was the Department of Defense, and it's not like some commercial provider is going to be able get access to such sensitive data," says Justin Ryan, a managing partner at Quadrant. "It was effectively a monopoly because we were the ones prepared to put up the money, and very few people were able to provide the services that we could."

Quadrant's exit from CDC to infrastructure developer Infratil and Commonwealth Superannuation Corp. last year, which saw the GP secure a 3.4x multiple, is an encouraging sign for the industry, which has so far seen few exits. The most notable liquidity event was the NASDAQ IPO of GDS Holdings, the largest player in China's high-performance carrier-neutral data center space, last November. GDS raised $192.5 million in its offering, which was priced below the indicative range. Its backers, including SBCVC, retained their stakes.

Exit options

Private equity firms' strategies are as varied regarding exits as they are with investments. A trade sale to an infrastructure or technology player is one of the most likely scenarios. Especially in the case of a global technology firm, the idea of a local partner with already-built data center assets that can help it navigate an unfamiliar regulatory environment and cater to local consumers may be irresistible.

Other potential buyers include pension funds and insurance companies, which look for steady, long-term returns. Data centers can provide these players with a source of revenue in a stable, growing industry, particularly once they have gotten past the initial barriers to entry.

"Once we build a track record, we can introduce other investors who take comfort in the fact that there is an active PE investor in Warburg Pincus managing this portfolio," says Warburg Pincus' Ng. "Their risk appetite may be lower than us, and they're looking more for cash flow than for capital upside."

An IPO is also an option, as is spinning out the assets into a data center-focused REIT. This approach has been seen in developed markets, such as Singapore and Australia, where data center operator NextDC spun its data center assets into Asia Pacific Data Centre Trust, and is a natural fit given the importance of real estate to the data center sector.

However, for many investors real estate is no longer the best lens to use for the data center opportunity. The real value of the sector is in the technology and services that a skilled operator can bring to its clients, so they can in turn provide their users with the best possible experience.

"At that point it can feed on itself to ensure that the company is on a growth path," says Epsilon's Kuppam. "The customer can now be on the same level footing on a global basis, and can compete globally because they have one less thing to worry about, which is whether they have the right technology infrastructure when it comes to global competition."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.