Secondary buyouts: Peer to peer

Maligned by some investors, sponsor-to-sponsor deals are gradually becoming more prevalent in Asia as the private equity industry matures. What is the early verdict?

Private schooling is a PE-friendly business. Customers often pay up front on an annual basis and once they start they tend not to stop until graduation, which delivers strong cash flow and stable recurring revenue. Barriers to entry are also significant, given the capital needed to put in place the supporting infrastructure and the time it takes to establish a reputation.

Baring Private Equity Asia has mined this opportunity with Nord Anglia Education. Following a privatization in 2008, what was a primarily Asia-focused business has gone global. The company, which re-listed in 2014, educated over 37,000 K-12 students at 43 sites as of last year. Revenue came to $856 million, a more than sevenfold increase on 2008. Baring's third and fourth funds, which made the original investment and still hold a two thirds stake, are now poised to cash out as Nord Anglia is sold for $4.3 billion.

But the buyer is none other than Baring itself, investing through its sixth fund, and working in tandem with Canada Pension Plan Investment Board (CPPIB). Even at a 20x EBITDA multiple, they see the potential for further growth and consolidation in a premium school industry said to be worth $58 billion globally. Nord Anglia is set to become not only the largest secondary buyout undertaken by a PE firm based in Asia, but also the most unusual.

The compliance requirements when one fund is taking out another – and they answer to a single manager – are burdensome; approval is required from the LP advisory committees of each fund. According to sources familiar with the situation, Baring was diligent in addressing conflicts of interest and its communication with investors. When one LP asked the team to contribute carried interest from Funds III and IV back into the deal alongside Fund VI, steps were taken to make it happen.

Several LPs, when asked by AVCJ about the general notion of a PE firm acquiring an asset from itself, give skeptical responses. Such scenarios accentuate the fundamental discomfort some have with GPs buying from other financial sponsors: sub-optimal deal-sourcing, inflated valuations, minimal scope for extracting additional value, and frustration at having to pay fees on a transaction that sees an asset transferred between two funds in the same portfolio.

Another LP that has exposure to Baring says his investment committee's knee-jerk reaction to Nord Anglia was negative, but they were persuaded on further inspection of the deal. This suggests the stigma commonly attached to secondary buyouts, regardless of type, is painted in broad brushstrokes. Provided a PE firm can explain why it is pursuing a transaction, and how it expects to take the company forward, preconceived notions can be trumped by investment rationale.

"It is too general to say that a business being bought by private equity from private equity is a bad thing," says Peter Keehn, head of private equity at Allstate Investments. "Our default belief, especially in developed markets but also in developing markets like Asia, is that markets are so intermediated and efficient that a good agent is going to find the best price for any asset."

Asian nuances

Secondary buyouts are an established part of the private equity landscape in developed markets. Sales to other GPs accounted for 30% of all exits in Europe last year, just ahead of North America on 28%, according to Preqin. In both regions, that share has increased by several percentage points over the last six years.

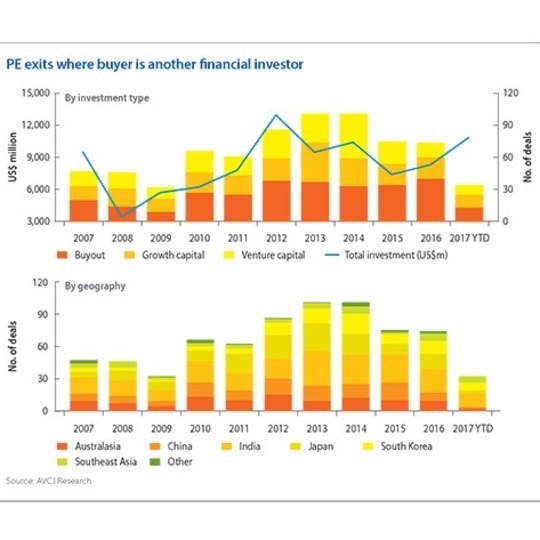

The significance of sponsor-to-sponsor deals in Asia is harder to quantify. AVCJ Research has records of 100 secondary sales out of approximately 800 exits in total in each of 2013 and 2014. This has fallen to the mid-70s in the last two years, but the picture is distorted by the number of minority positions, which have consistently made up at least half of annual secondary sales. They are solely responsible for the spike in 2013-2014, when later stage investors started flooding into start-ups.

Within these numbers, though, two trends are worth noting. The buyout share of secondary exits has gradually increased over the past six years, reaching 40 in 2016. And there is greater geographical variety. The bulk of deals have traditionally come from Australia and India, Asia's most developed buyout market and its preeminent PIPEs location (making it particularly suited to secondary exits), respectively. Now, the likes of China, Japan and Korea are becoming more active.

"It is part of the natural evolution of the market.As fund sizes and average deal size get larger, there will be fewer strategic buyers that can buy assets from PE funds. Since there are fewer large transactions out there, PE funds will have to bid on every large opportunity, regardless of the identity of the sellers," says Edmond Ng, a managing partner at Axiom Asia. "In times when the political environment is preventing the large strategics from buying assets, we will see more secondary buyouts. We will also continue to see medium-size managers selling to larger buyout managers."

Secondary exits fall into four main categories, all of which can be linked to the maturation of the industry in Asia. First, the transfer of assets from country-specific to pan-regional or global GPs, driven in part by the need to exit and in some cases by the fact that the original owner has taken the business as far as its resources and mandate permit. A stalwart of Australian private equity, these transactions are now also seen with greater frequency in Japan and Korea.

Two of the largest PE-backed IPOs seen in Tokyo over the last year started out as secondary deals. Sushi chain Sushiro Group and coffee shop business Komeda Holdings delivered returns of 7x or more for Unison Capital and Advantage Partners in 2012 and 2013. The new owners, Permira and MBK Partners, respectively, continued to support expansion and make operational improvements ahead of the public offerings.

"We brought experience of restaurants, branding, and pricing structures from around the world to Japan; we were able to help create further value despite the fact the company was previously owned by another private equity firm," says Alex Emery, head of Asia at Permira.

In Korea, VIG Partners more than doubled its money when selling the domestic Burger King franchise to Affinity Equity Partners last year. Jason Shin, a managing partner at VIG, observes that exits to regional and global private equity firms are a much more realistic prospect than five years ago, largely because the local GP community has deepened: managers have proven their ability to turn $100 million companies into $300 million companies, and so they are a natural target.

The second category features prominently in the rise of India. These happen when a planned IPO has failed to materialize, or it has happened but the minority PE investor still holds most of its shares. ChrysCapital Partners has secured several exits of this variety, with stakes in Hexaware Technologies, Intas Pharmaceuticals and Mankind Pharma going to financial investors. Hexaware was part of a larger deal that saw Baring Asia assume control by acquiring positions from other shareholders.

Selling points

Third are international deals, where an Asia-focused GP acquires an asset from a European or North American counterpart with a view to capitalizing on a previously unexploited expansion opportunity, while the final category comprises assets transferred between private equity firms of similar size. It is the latter that attract the most suspicion, although for now they are a rarity in Asia.

Comfort can be drawn from the level of intermediation in the market and what this means for price discovery, but only up to a point. "We wouldn't necessarily feel bad about these deals if everything is done properly and it is an arm's length transaction," says Axiom's Ng. "However, for transactions between GPs of similar size, investors who are LPs in both funds involved would likely feel aggrieved, as it is just money going from the left pocket to the right pocket. For investors who have to pay capital gains tax, they will just end up paying a lot of taxes."

Several industry participants point out that deeper considerations are present in these transactions than is immediately apparent. Nevertheless, when more detail is offered, it is difficult to escape the sense that one firm's gain represents another's loss.

A pan-Asian GP might justify a secondary buyout by saying that a lot of operational improvements have yet to be fully implemented. This wouldn't necessarily reflect well on the seller – a regional peer – if it opted for a shorter holding period in order to show some exits ahead of a new fundraise. On the flip side, a GP nearing the end of a fund investment period and under pressure to put capital to work might embark on a secondary spree, the implication being it is the easy and costly option.

Such concerns can be addressed by outlining the logic behind a decision to buy or sell, so that a deal can be assessed on its own merits. "At our AGMs I feel compelled to explain the alpha story," says Nick Bloy, a managing partner at Navis Capital Partners. "For a primary or a secondary, we ask what we can do that is transformative. If a portfolio company just keeps on doing the same thing, that's beta. The industry might grow at 10-12% and we generate a bit of cash, but it's not alpha."

In this way, the key consideration is less the source of the deal than the potential upside that can be generated from the investment. However, buying from private equity usually has its benefits: the books are in order, professional systems and processes have been introduced, and management teams strengthened. PE firms are also less emotional as sellers.

The importance of the "motivated seller" in Asia is frequently highlighted. Control deals are gaining traction across the region, but PE firms are often dealing with first generation founder-entrepreneurs who might neither want nor need to do business with a third-party financial investor. Assets within GP portfolios don't come with these strings attached. If the holding period is long or the people who did the original deal have departed the firm, a GP might be happy to trade.

"As the market becomes mature, secondary buyouts will be a larger source of deals. When buying from another sponsor – and the books are cleaner and the seller is less emotional – it will become easier to transact," says Yar-Ping Soo, a partner at Adams Street Partners. "It depends on the thesis the buyer has to bring additional value to the company. There have been good outcomes from secondary buyouts."

Within this dynamic, there are questions about supply and demand. In addition to more mid-cap GPs looking to sell $300 million assets in Asia, a larger number of players are willing to buy them. It is a function of increasing fund sizes enabling pan-regional and global PE firms to put more financial and human resources to work in individual markets.

Since the start of 2015, six GPs have closed large pan-Asian funds, with an average increase in fund size on the previous vintage of nearly 50%. It remains to be seen how prominently secondary buyouts feature in these portfolios, but fierce competition over a finite number of attractive, available and scalable assets would lead to higher valuations. This would likely lead to scrutiny of the extent to which PE firms say they can extract more value from these businesses.

Changing landscape?

That said, the negative perception of secondary buyouts is seldom tied to broad samples of evidence. A 2013 Boston Consulting Group study – based on more than 200 investments made in 2006-2012 – found that secondary buyouts delivered a median annual return of 24% compared to 20% for primary deals. Notably, secondaries that involved post-deal M&A performed better than those that did not, which explains the preference for sectors like education and IT services that offer consolidation opportunities and are conducive to platform-style investments.

As one LP observes, if the target business can be leveraged, generate stable cash flow and capture enough growth to generate a decent IRR over a five-year period, pass-the-parcel deals between GPs of similar size make sense to many investors. Indeed, another emerging category of secondary buyout is characterized by LP participation in these transactions.

Partners Group is a useful starting point. The firm made its first solo PE investment in Asia in 2012. Five more have followed – including several secondary buyouts – as well as three joint-lead investments. Scott Dingle, a senior vice president with Partners Group, says that relationships forged with GPs through primary fund commitments, secondary transactions and the firm's debt business are a rich source of deals.

"We take some comfort in having seen companies develop over time, seeing value-add strategies develop over time, and getting to know management teams," he explains. "Looking through the other areas of the Partners Group's business is a useful way to go hunting for deals, although it is certainly not the only way we do it."

Other institutional investors are now adopting the same strategy, notably those that want to build out their direct programs. These deals are not necessarily full buyouts. For example, a sovereign wealth fund or a pension fund becomes familiar with a GP's existing portfolio as an LP in one of its funds and offers to take a position in one of the companies, enabling a partial realization.

The Nord Anglia take-private could be seen as a variation on this theme. The company is listed, which means plenty of information is already in the public domain, and CPPIB is said to have been tracking the business for some time. But CPPIB is also an LP in Baring's last two funds, so it is not unreasonable to suggest that the pension fund's willingness to participate in the deal was in part based on a familiarity with the GP and its approach.

"We are seeing more situations where a major LP has exposure to an asset, albeit in a minority capacity by virtue of a fund, so they have a good understanding of it. They are starting to step in directly via their direct programs, seeing it as a means of directly owning the asset but with a lower risk profile," says Andrew Thompson, head of Asia Pacific private equity at KPMG.

These situations are the exception rather than the rule, and they are likely to remain that way given how few institutional players are able to pursue direct investments. Nevertheless, the phenomenon offers some pointers as to how the GP-LP relationship might develop – in terms of appreciating that more value can be squeezed out of a company and looking for ways in which that doesn't have to become someone else's alpha.

"A PE firm will often identify a couple of areas that are good for change and transformation and focus on those," says Allstate's Keehn. "But I think it's rare that in the space of five years a firm goes from one end of the spectrum to the other, doing everything that needs to be done."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.