China project funds: Cut to fit

Project funds have become popular in China on the back of increased demand for PE exposure from corporates and high net worth individuals. It remains to be seen if they have true staying power

When Feng Li and Ben Lin, formerly partners at China-focused IDG Capital, established Frees Fund in August 2015, they sought to raise RMB2 billion ($296 million) for their debut renminbi-denominated fund. One month later, China's stock market crashed due to concerns about an economic slowdown. Li and Lin, facing unforeseen challenges in its fundraising process, lowered the target to RMB1 billion.

This enforced change essentially opened up new segments of the LP community. The smaller target meant the minimum commitment for entry to the fund also dropped: investors such as high net worth individuals (HNWIs) could access China's early-stage technology space for as little as RMB1 million. Since then, Frees Fund has launched two project funds created for specific assets – ride-hailing app Uber and Chinese snack food brand Three Squirrels, which is an IDG existing portfolio company. The firm tapped similar LP types, principally HNWIs and corporates.

The project funds have provided management fees needed to support Frees Fund's 17-strong team and also presented the GP with an opportunity to build a track record that has helped with the main blind pool fundraise. A first close of RMB920 million came in October 2015, with contributions from eight Chinese-listed companies and institutions.

As of last August, Frees Fund had approximately RMB3.6 billion under management across multiple renminbi and US dollar funds, including four project vehicles worth RMB1.1 billion. The other two project funds participated in a $100 million round for Beijing-based mobile app developer Mobi Magic and a $181 million round for gaming platform Unity Technologies.

Project funds – which go by several names, including special purpose funds – have gained traction in China over the last three years, largely on the back of growing HNWI and corporate interest in private equity. Structured as a traditional PE funds with management fees and carried interest, they most commonly appear in two scenarios: take-privates and late-stage tech deals. But the popularity of project funds is a general reflection of certain investors' preference for a visible pipeline over a blind pool.

"The launch of project funds is driven by the fact that there is a lot of onshore capital chasing high-profile deals. Domestic LPs are typically reluctant to back traditional blind pool funds, where holding periods can be seven years or more; they feel there is less certainty in terms of investments and exits. Many GPs have sponsored so-called hot deals and structured them as project funds, because fundraising is much easier," says Dayi Sun, a managing director at China-focused fund-of-funds Jade Invest.

The beginning

Project funds have been used in moderation in Chinese private equity for some years. Numerous listed industrial companies have opted for these structures when pursuing domestic M&A. They identify an asset that is complementary to their existing business but recognize they don't have the skills required to close a transaction. A PE firm is drafted in as a partner, participating alongside the industrial company as an LP in a project fund.

"The best approach for this type of deal is to set up a fund structure. It's easy for two parties – the GP and the listed company – to manage the investment, as well as to share the returns. The GP also has the opportunity to syndicate the deal through raising capital from third-party investors," says Dali Qian, a partner at Llinks Law Offices.

However, the spate of privatizations of US-listed Chinese companies is generally held responsible for project funds going mainstream. The underlying rationale of these deals is often a swift relisting on a domestic exchange at a higher valuation, so they have become honeypots for non-traditional private equity investors looking for a quick flip rather than a long hold. But the project funds through which they participate vary in scope and scale.

For example, WuXi PharmaTech was taken-private in late 2015 in a $3.3 billion deal initiated by two private equity firms working in conjunction with the company founder and CEO, Ge Li. When the business relisted in Hong Kong last month – at a valuation of $4.4 billion – the filing revealed that a small portion of the company was held by a dedicated fund set up by Li. There are eight LPs, including ASEAN China Investment Fund III, which is managed by UOB.

At the other end of the spectrum, by the time the $9.3 billion privatization of Qihoo 360 Technology closed in July 2016, there were equity commitment letters from 36 different parties. They included five domestic insurers or their asset management arms; funds linked to four PE firms; a selection of bank asset management units; and a host of entities that could be corporate M&A funds or high net worth vehicles.

"Given there was huge demand for Qihoo 360's take-private deal, some of the 36 equity backers – particularly insurance and asset management firms – set up project funds or even project fund-of-funds to raise capital from HNWIs. Through such vehicles, they don't have to put their own money into the company but leverage external capital to finance the deal. In addition, they charge management fees on these project funds," Jade Invest's Sun says.

One participant in the Qihoo deal is an M&A fund set up by Huatai Securities that has received commitments from several Chinese corporates, while another is a project fund launched by Huarong Securities with the sole purpose of raising capital to support the deal.

"What has happened over the last few years is that there are more intermediaries – whether regular GPs or traditional financial advisors – trying to take advantage of specific investment opportunities, with a view to earning fees and carried interests through project funds," adds Teck-Yong Heng, a managing director at renminbi fund-of-funds Qianhai FoF.

However, as the capital-raising progressed, the amount of equity involved was beyond the means or mandate of some early-stage and even growth-stage funds. There was capacity for HNWIs to participate and so a means of access presented itself. "It's not surprising that some GPs, mostly financial intermediaries, have created project funds or single deal fund structures for investors to come into those deals," adds Heng.

Furthermore, an increasing number of spin-outs from large PE and VC firms – much like Frees Fund – are trying to use project funds as a stepping stone to blind pool vehicles. The reasons are twofold. First, foreign institutional investors are becoming more selective in working with new Chinese GPs; in most cases, they refrain from backing first-time managers unless they have previously built up strong track records in established franchises. Second, renminbi LPs are willing to support new managers, but they are uncomfortable making commitments to blind pool structures.

"Increasingly many investors want the freedom to invest on a deal-by-deal basis, rather than giving a capital commitment with little say as to whether to opt in or opt out of any particular investment opportunity, especially with fund managers with a shorter track record," says Maurice Hoo, a partner at law firm Morgan Lewis. "Some managers who strike out on their own the first time may use these vehicles to build a track record. These vehicles may be structured as partnerships with economics that are similar to PE funds generally."

GPs secure assets for project funds by leveraging relationships with entrepreneurs from their previous investments. Three Squirrels is a case in point. Li invested in the start-up from angel through Series C rounds while at IDG. When Frees Fund came calling, Three Squirrels founder Liaoyuan Zhang said he would accept a RMB100 million investment. However, Zhang ended up taking RMB300 million because he wanted to support Li in his new venture.

Channel business

For established GPs that already manage blind pool funds, project vehicles mean more fees, but there are strategic considerations as well. A venture capital player might have an investment quota for an existing portfolio company that is raising a new round, but the quota is larger than the maximum permitted commitment from the firm's fund. A project fund is therefore set up to take the excess, explains James Wang, a partner at Han Kun Law Offices.

For example, say a GP has lined up a $1 billion investment. Rather than provide the capital through its main fund, a project vehicle is formed and private equity firms and HNWIs are invited to put in money. The GP contributes $600 million and third parties commit $400 million. They serve as LPs in the project fund, with the GP acting as sponsor for the deal.

Under a similar logic – and essentially the same kind of vehicle – the GP may also set up sidecar funds to raise capital from existing LPs to pursue follow-on investments in companies that require more than the main fund can provide. However, sidecar vehicles differ from project funds in that they tend to make multiple follow-on investments across the portfolio rather than target a single deal.

Hillhouse Capital is said to have launched project funds to take investors into Uber, while Sequoia Capital China has used them in take-private transactions. The economics on these funds – which are usually $200-500 million in size – are often keenly negotiated.

"In terms of fees, it's highly dependent on the project itself – whether it's a popular asset that is known by LPs. Sometimes large GPs can get similar economics on a project fund to what they would get from a traditional blind pool fund," observes Lixing Wang, a managing director of Chinese boutique investment bank China Renaissance. "Fees tend to be lower if investors don't know much about the company in the market. And then retail investors in wealth management products tend to pay higher management fees than ultra HNWIs, because the latter have more bargaining power."

In this context, the line between PE fund managers, placement agents and financial advisors has become blurred in recent years. Some agents, which previously helped match projects and private equity investors, have become fund managers in their own right. On receiving an investment mandate for an in-demand company like Uber or being introduced to opportunities by GPs, they set up a vehicle around the deal. They get management fees and carried interest in addition to sales commissions.

Agents raise money either through their own LP networks or by asking wealth management firms to sell the products to retail clients. However, while a blind pool brings exposure to a diversified set of investments, effectively lowering the risk, project funds are concentrated on a single asset where the outcome can be highly uncertain. Several of these vehicles have been linked to scandals.

Gopher Asset Management, a subsidiary of wealth manager Noah Holdings, took its HNWI clients into Leshi Internet Information & Technology – also known as LeEco – through seven feeder vehicles that in turn participated as LPs in a project fund managed by a third-party GP. The company, which started out as a video streaming business, attracted a blaze of publicity with plans to produce electric vehicles for the international market, but it is now in severe financial difficulty.

As a result, Gopher's reputation has taken a hit. Earlier this month, the asset manager issued a statement saying that, given LeEco's current state, it had requested the project fund manager to "suspend new investment and seek to hasten our exit from invested projects."

There are concerns that another Chinese electric car maker, Nio, could meet a similar fate. The company, which is also known as NextEV, raised $600 million in March in a round led by Baidu Capital and Tencent Holdings. A handful of Chinese HNWIs participated through project funds. Indeed, institutional LPs have labeled GPs and agents as irresponsible for offering such high-risk and expensive investment opportunities to retail investors – especially when certain companies, for all their popularity, have yet to develop sustainable business models.

"It's very risky for HNWIs to channel their money into a few so-called ‘hot deals.' Often they believe these high-profile companies are too big to fail, but obviously that is not the case. Once they get burned from these high-risk investments, they will understand that it's important to ask professional managers to manage their assets," says Doris Guo, a partner at fund-of-funds Adams Street Partners.

Long-term loser?

Project funds are to some extent a function of China's relatively immature private equity market. In the absence of a critical mass of institutional LPs, corporates and individuals feature prominently in fundraising, and their inexperience can let them down. For example, an investor might consider itself suitably diversified by taking stakes in 10-20 project funds. It will take time for the mentality to change.

The large government-sponsored fund-of-funds that have been established in the last year or so are expected to play a key role in this evolution. Given their size and a lack of direct investment experience, they will inevitably back traditional blind pool funds rather than construct project fund-oriented portfolios. And where they go, others may follow.

"Chinese individual investors are already getting more institutionalized," says Jun Qian, head of China investment management at Adveq. "Project funds may have some short-term appeal, but in the longer term, they will become Western-style institutional LPs. They will understand that blind pool funds will be better suited to them than project funds where there is a high concentration risk."

Even so, there are other markets in Asia – notably Korea – where project funds continue to be used, so it is possible that China might find its own balance. While the extent to which investors get comfortable with blind pool funds, and how quickly this happens, is a key issue, the level of demand for exposure to hard-to-access assets is also a factor. The flood of capital into late-stage technology deals continues, and it has created a legion of spin-out managers that are leveraging their personal relationships with entrepreneurs to secure investment quotas. It is therefore easy for them to create bespoke structures.

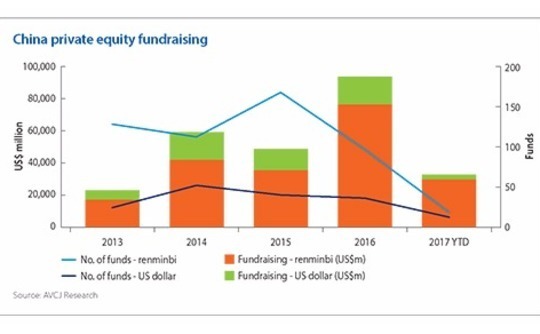

"Project funds were frequently seen between 2015 and 2016. As Chinese GPs and LPs mature, these vehicles might become less frequent than before, but it is hard to say how long it will take for them to be completely phased out of the market," China Renaissance's Wang says.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.