IoT in Asia: Things to come

A number of political factors have positioned Asia Pacific to be a global leader in internet-of-things development. Investors must now navigate an unwieldy field of technologies, markets and social drivers

When a large number venture capital firms pile into a young company's buzzword-tinged operational pivot, it's tempting to dismiss the enthusiasm as bandwagon behavior. But the more broadly encompassing the vision of the deal, the harder it becomes to maintain such cynicism.

This scenario played out recently in the internet-of-things (IoT) space, with Tokyo-based memory chip developer Floadia receiving JPY1.6 billion ($14.1 million) from nine US, Japanese and Taiwanese VCs, including Golden Asia Fund Ventures, a joint venture between Mitsubishi UFJ Capital and Taiwan ITIC. The support was aimed squarely at Floadia's plans to increase its IoT exposure in areas such as smart cars and mobile devices.

"The internet-of-things is expected to become more pervasive and, as a key component of IoT products, memory is indispensable," says C.J. Chang, executive vice president of Taiwan ITIC. "Customers who are aggressively going after the IoT market demand low cost, low power and ease of use."

Other investors in the round included SBI Investment, Chih-Hung Investment, Real Tech Fund, Daiwa Corporate Investment, Innovations & Future Creation, TEL Venture Capital, Innovation Network Corporation of Japan and Fortune Venture Capital, a division of Taiwan's UMC Capital. Perhaps the most signifying aspect of this diverse turnout is the notion that although all parties signed up for an IoT expansion, they were doubtlessly following a range of distinct end-market themes.

At this level of granulation, the technological inclusiveness of IoT and its practical use-cases prove instrumental in encouraging a variety of investment rationales. However, most investors tend to cite the long-term credibility of more conceptual virtues. Everything involved in the blurring of the lines between the physical and digital worlds can now be concisely marketed under one banner. For Asia Pacific investors, this overlap of focus and ambiguity portends rapid uptake and an uncertain future.

Favorable tailwinds

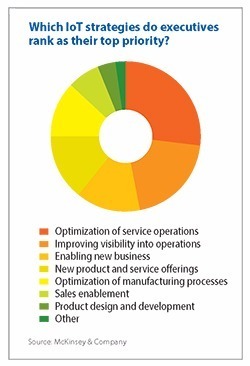

Thinking big is the norm in IoT. McKinsey & Company expects the market to be worth $11.1 trillion by 2025, while Cisco pegs it at about $14.4 trillion by 2022. But these forecasts do not necessarily trumpet the arrival of entirely new industries and economies – investors are interpreting them as merely carve-outs of overall IT spending in the future. In this view, excitement about IoT offers a reminder that it's not really a sector at all: it's a cross-sector trend in the application of existing technologies.

Asia Pacific appears well placed to benefit from this trend. Regional leadership in manufacturing is expected to drive the proliferation of smart factories, and relatively severe overcrowding in urban areas has so far inspired some of the most ambitious smart city initiatives globally.

Politics and long-term macroeconomic outlooks are also set to play an important role, especially considering that IoT's inherently interconnected nature tends to amplify investor needs around regime stability. In the early development stages of IoT data systems, control is believed to be more important than freedom – a perception that puts Asia's top-down governments at a distinct advantage.

Meanwhile, IoT investors contemplating the technology's generational social evolutions regard political leadership in Asia Pacific as more visionary and tactfully technocratic. Some 80% of China's top politicians are said to have engineering backgrounds. The Singapore government is similarly admired, with IoT professionals regularly namechecking Vivian Balakrishnan, the country's foreign affairs minister and head of its smart nation initiative, as a global thought leader on the subject.

The technical essentials of IoT entail sensors that collect data about the physical world and network the information in an online platform, usually a cloud. These data are either used for pattern recognition and predictive purposes or for the implementation of immediate action by associated equipment. The fundamental zones of application range from the human body to entire countries. As a result of this end-market flexibility and hardware-software crossover, VC openings have emerged across a number of components, computing and support service fields such as security.

"The interaction of artificial intelligence and analytics is where the vast majority of the economic value will be created," says Eitan Bienstock, founder of Australian start-up advisory Everything IoT and a managing partner at US and Australia-based Propeller Venture Capital. "What we see is that end-customers want the whole solution – they don't want to worry about getting the sensors from one supplier and the application from another."

The two major use-case areas VCs are currently targeting both address existing businesses: collecting data from the field to improve business operational metrics, as would be proposed at an assembly line; and enhancement of customer experience such as in driverless taxis or various healthcare applications.

Accel Partners aimed to expand on this playing field earlier this year with its investment in Borqs, an India and China focused company that develops novel IoT devices for corporate clients that are seeking establish new business models through new products. The GP joined a $10 million round for the company alongside Qualcomm Ventures.

"IoT use-cases are not necessarily about the commoditization of data and running analytics on top of that data," says Shekhar Kirani, a partner at Accel. "To enable these new use-cases, you have to be able to work at the design level, conceptualize from both the hardware and software perspectives, and create economically viable end-to-end products at scale. That's what Borqs does really well."

The investment also leverages expectations that China and India, as the largest overall consumer and production markets in the world, will dominate the IoT field in the years to come. China, for example, is tipped to account for 20% of connected devices globally as of 2020, by which time IDC Research estimates the country's annual IoT spend will approach $128 billion.

"One of the first use-cases in India will be in the availability of information on how much power is being consumed by area, because the costs of power in India are pretty high," Kirani adds. "There are not a lot of IoT devices that have been deployed for management of areas like this, so companies are seeing some interesting opportunities to push the envelope."

Niche advantages

While India may prove an attractive market for computational services and China is likely to take the lead in hardware, smaller jurisdictions will continue to represent interesting inroads for companies prioritizing differentiation. For example, Taiwan may ultimately be a secondary manufacturing market to Shenzhen in terms of sheer volume, but its advantages in intellectual property protection could result in a higher relative inflow of start-up talent.

Taiwan's technically proficient workforce and political momentum in the form of the IoT-focused Asian Silicon Valley industrial park project present a strong case for the country as future leader in connectivity innovation. Challenges remain, however, in a thin financial services environment, regulatory complications, a lack of local VCs and the fundamental notion that hardware may not be the most promising area for entrepreneurialism.

The nature of IoT investment success stories to come will be dictated as much by the needs of the local market as by that market's technical capacities. Australia is a case in point. It is expected to have a competitive advantage in connected agricultural technologies, with local investors, including Everything IoT's Bienstock, noting an uptick in activity across the paddock-to-plate supply chain.

Sydney-based Blackbird Ventures indirectly supported Australian farming last April with participation in a A$5 million ($3.7 million) round for domestic satellite technology company Fleet. The plan is to launch a network of small sensors in Earth orbit that allow IoT systems in remote areas to stay connected.

"From measuring how fast trees are growing to water temperatures of our most remote natural beauties, there are an infinite number of problems that can be better solved with data," says Niki Scevak, a managing director at Blackbird, adding that the Fleet investment was more about controlling costs than maximizing data collection. "If you can use a small number of satellites the size of loaves of bread, then it's many orders of magnitude cheaper than huge deployments of ground networks and towers."

While cost cutting efforts of this kind represent the industrial side of IoT opportunity, the consumer experience end of the spectrum remains a key area of expansion. In a typical technology hype curve, personal-use gadgets capture the public imagination first, then after a period of hot money rushing into the market, interest in the toys cools off and investors turn to less flashy applications around creating business efficiencies.

This scenario may not play out exactly the same way in IoT, given expectations that a time will come when nearly every object that one encounters in life will eventually be subject to at least some level of internet connectivity. Evidence for the resilience of gadgets in this context includes the enduring popularity of wearables, a sector IDC projects will ship 125.5 million devices this year, up 20% on 2016.

Darma Tech Labs, operator of Japanese hardware-focused accelerator Makers Boot Camp, sees a particularly strong future for wearables in Japan, where the current fad of dubiously scientific fitness trackers is set to lose market share to more serious medical monitors. The investor launched a JPY2 billion IoT venture fund in March that will focus largely on healthcare devices and services.

"In Japan, medical costs and an elderly society are big problems, so businesses that relate to these sectors will be attractive," says Makino Narimasa, co-founder and CEO of Makers. "There will be labor shortages in Japanese hospitals, so home medical will be a big market in the near future."

Approaching IoT investment from a geographic angle also helps emphasize the logic behind the mantra that it's not about the gear – it's about the data and the service. Although every IoT company will require physical sensors, supplying equipment that universally supports all data networks will likely be uneconomic. Specialization will therefore be needed even at the component level, meaning investors will have to double down on defining the end customer and the go-to-market strategy.

Industry consultants have pointed to a lack of business differentiation in the IoT space as an indicator that this kind of due diligence and attention to adaptive, tailored verticals remains in need. Charles Reed Anderson, an independent IoT commercialization advisor in Singapore and former IoT-focused analyst for IDC, recommends initially eschewing aggressive revenue generation in favor of proven cost cutting applications.

"When I'm vetting companies, I always look at who they're partnering with, are they solving a problem and do they know that customer demand is there?" says Anderson. "If they just have a widget and they're relying on someone else to find the value of that widget, that's where I get cautious because I want to make sure they actually understand why they're building it and the value they're going to add in that ecosystem and value chain."

Anderson confirms that Singapore's reputation as an IoT frontrunner is largely underpinned by the local government's venture support mechanisms such as SG Innovate and the Infocomm Media Development Authority. The country's lack of natural resources also casts its smart nation program as something of an existential imperative. Indeed, remaining competitive as a progressive hub of prosperity at the heart of a developing region is the city-state's only real economic play.

Layers of control

Paradoxically, one of the main challenges for Singapore is that the dawn of IoT-reliant smart cities in Asia may be more pronounced in less developed countries. The "leapfrogging" phenomenon that saw frontier countries skip over home computers into the mobile age is sometimes forecast as a likely and cost-effective way for struggling cities to shoot to the forefront of IoT innovation deployment.

For such developments to work in the long term, however, Asia would need to balance its governmental and policy advantages with the more open approach to data and infrastructure ownership in the West.

Rob Van Kranenburg, founder of the IoT Council in Belgium, sees IoT as a "winner-take-all" environment which will leave few pre-internet institutions standing and where multi-pronged data companies such as Japan's Line Corporation will leverage increasing control over society through their commercial ubiquity. In this view, the technocrats leading Asia's march toward full cybernetic immersion will need to relinquish some control lest they stifle the creative venture ecosystems that make IoT tick.

"If the trend continues and there are not a lot of strong public agencies like Singapore, then there will be more smart gated communities, which you're already seeing in Asia, South America and Africa," says Van Kranenburg. "These will gradually become more controlled, and there will be less investment for the rest. Top-down control is necessary for IoT at the moment, but it needs to be accompanied by a bottom-up innovative free-flow of data – and the human characteristics of bringing those together are rare."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.